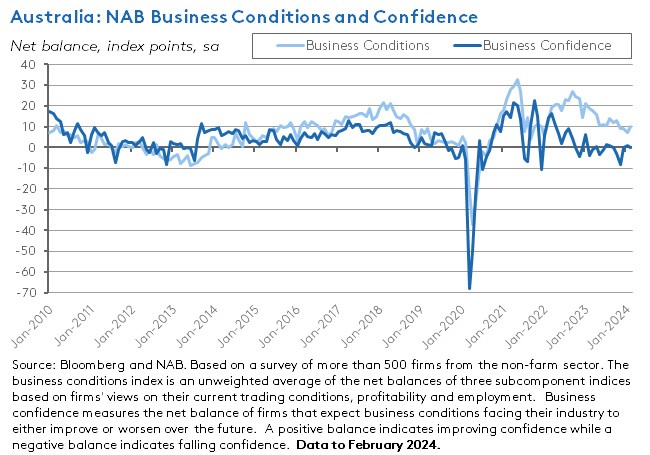

After last week’s big GDP-led data drop, this was a much quieter week for Australian economic releases. The NAB Monthly Business Survey reported a modest increase in business conditions in January 2024 alongside a small dip in business confidence. And last Friday’s Labour Account numbers confirmed that while the labour market continued to ease over the final quarter of last year, it nevertheless remained tight when compared to pre-pandemic conditions.

In the absence of any major data news, most macro attention was focused on next week’s RBA meeting. As discussed in more detail below, a review of the main economic releases over the period since the 5-6 February monetary policy meeting suggests that the RBA’s stance is unlikely to have moved significantly since then. That suggests that the Board will again leave the cash rate target unchanged. Meanwhile, the weakness in domestic private demand highlighted in last week’s release of the fourth quarter national accounts has prompted some shift in the public discussion around the balance of risks between growth (or recession) and inflation – seen for example in the comments this week from the Treasurer, also reported below.

Business conditions improved in February 2024, but confidence softened

The February 2024 NAB Monthly Business Survey reported that business conditions strengthened last month, with the index climbing three points to +10 index points. Of the three subindices, both trading conditions and profitability rose four points while employment conditions saw a small increase.

In contrast to the improvement in current conditions, the forward-looking business confidence index fell one point to a neutral level (0 index points). Consistent with that message, forward orders also eased last month, dropping from -2 points in January to -3 points in February. In parallel, there was also a modest decline in the capacity utilisation ratio, from 83.7 per cent to 83.4 per cent over the same period.

Those movements left business conditions above average and business confidence below average.

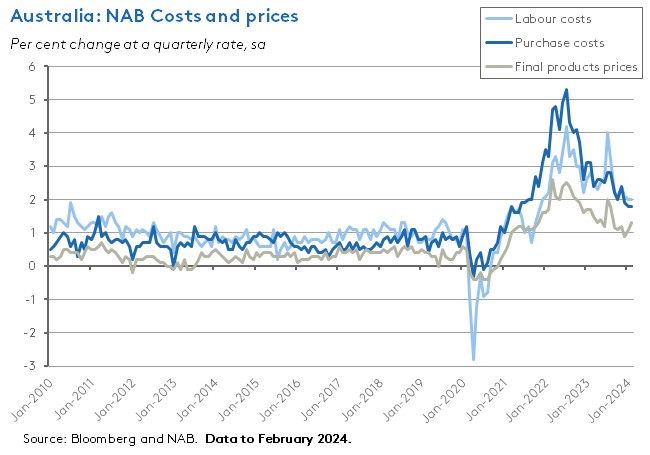

NAB also said that businesses continue to report elevated rates of cost growth in terms of both labour and materials inputs: labour costs rose two per cent at a quarterly rate while purchase costs were up 1.8 per cent, with both rates unchanged from January. At the same time, the rate of growth in final products prices rose from 1.1 per cent in January to 1.3 per cent in February while retail price growth jumped from 0.9 per cent to 1.4 per cent.

Those readings indicate that there are ongoing domestic price pressures in the economy and that firms retain some pricing power so they can continue to pass higher costs on to consumers.

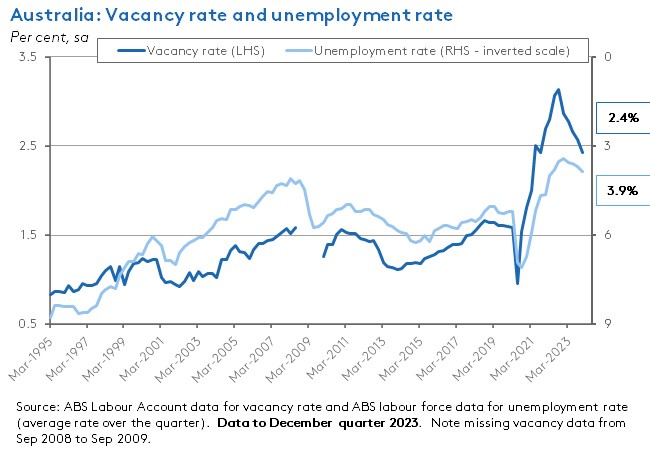

Labour market update: Vacancies rate and hours worked both fell again last quarter

Last Friday, the ABS published the Labour Account Australia for the December quarter 2023. The Bureau said that total jobs increased 0.2 per cent over the quarter (seasonally adjusted) and 2.4 per cent over the year to 16 million, with filled jobs up 0.4 per cent quarter-on-quarter and 2.8 per cent year-on-year to 15.6 million. The number of job vacancies fell 5.6 per cent over the quarter to 387,900, which is down 13.4 per cent compared to the December quarter 2022.

Hours worked were down 0.3 per cent over the quarter to 5.9 billion hours, although that was still two per cent higher in annual terms. According to the ABS, this is the first time in almost a decade that hours worked have fallen for two consecutive quarters, excluding the disruption associated with the pandemic. Hours worked are now one per cent below their series high – set in the June quarter of last year.

The share of vacant jobs fell to 2.4 per cent last quarter. That marked a fifth consecutive fall in the vacancy rate from its high of 3.1 per cent reached in the September quarter 2022. The vacancy rate is now at its lowest since the September quarter 2021 although still well above the pre-pandemic rate of 1.6 per cent.

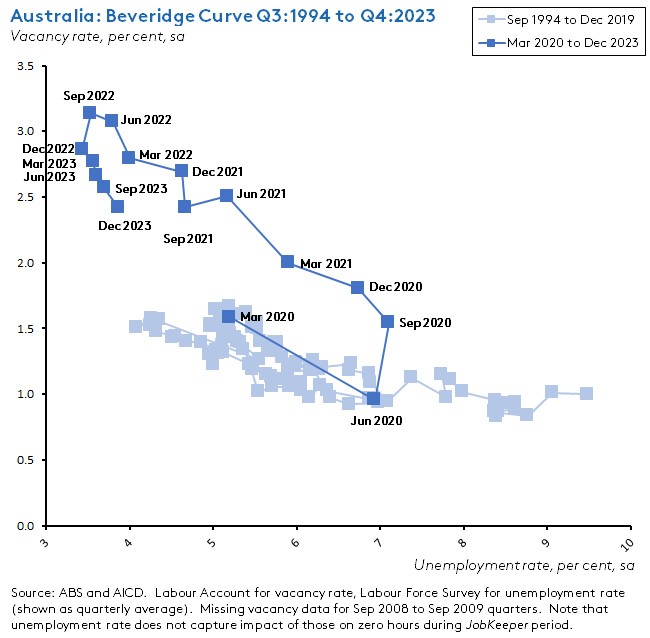

Since the second half of 2022, the process of labour market adjustment has involved a relatively steeper fall in the vacancy rate compared to the rise in the unemployment rate. In terms of the Beveridge Curve, which charts the relationship between the two, that means that a movement down the curve (indicating an easing in labour market conditions) has occurred alongside an inward shift (suggesting either a potential improvement in labour market matching efficiency or that the previous outward shift was a temporary phenomenon associated with pandemic-related disruption).

Finally, the number of multiple job holders rose by 1.4 per cent over the quarter, to 970,000. The rate of multiple job holding was 6.7 per cent. That was up slightly from 6.6 per cent in the previous quarter but in line with the March and June quarter 2023 outcomes. The ABS noted that after increasing sharply since the start of the pandemic (in the December quarter 2019 the multiple job holding rate was down at 5.9 per cent), the rate has stabilised over the past year.

What will influence the RBA’s deliberations next week?

Next week, over 18-19 February the RBA Board holds its second monetary policy meeting of the year. In the release after the previous meeting, the Board said that:

‘The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out. The Board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market.’

It also flagged uncertainties around the lagged effects of previous monetary tightening and around how wages and firms’ pricing decisions would respond to current conditions.

So, given the central bank remains firmly in data-dependent – or watch and wait – mode, what have been the key data developments since that last meeting?

- The January 2024 labour force release suggested that the rate of labour market easing was running ahead of expectations. The unemployment rate rose to 4.1 per cent – the first time it had been at four per cent or higher in two years – while the underemployment rate rose to 6.6 per cent (the highest since February 2022). Hours worked fell by 10 million hours over the month. And employment growth surprised with its weakness as the economy only added 500 jobs over the month vs market expectations for employment growth of 25,000. All that said, the ABS did caution about a ‘changing seasonal dynamic with the labour market, around when people start working after the summer holiday period.’ This shift may have exaggerated the degree of labour market adjustment in the January numbers.

- The monthly CPI indicator for January 2024 suggested that the disinflation process remained on track and was also running (slightly) ahead of market expectations. The ABS reported a 3.4 per cent annual increase in the monthly CPI, unchanged from the December 2023 result and below market forecasts for a 3.6 per cent print. At the same time, the rate of inflation as measured by the CPI excluding volatile items and holiday travel eased to 4.1 per cent from 4.2 per cent, while the rate of increase in the monthly version of the Annual Trimmed Mean slowed to 3.8 per cent from four per cent. Again, however, and as we noted at the time, the nature of the monthly indicator – particularly for the first month of each quarter – means that the RBA will treat this signal with caution.

- Wage growth, as captured by the annual rate of increase in the Wage Price Index (WPI), rose to 4.2 per cent in the final quarter of last year. That was the fastest rate of wage growth since the March quarter 2009. It was also just above the RBA’s forecast of a 4.1 per cent outcome, indicating some modest upside risk to labour costs. On the other hand, there were also some offsetting details in the WPI (a slowdown in the quarterly growth rate, a slight drop in the annual headline rate of private sector WPI increases, and a moderation in wage growth for jobs covered by individual agreements which are thought to be the most sensitive to labour market demand).

- Last week’s December quarter 2023 national accounts numbers painted the picture of an economy characterised by weak overall growth, stagnant private sector domestic demand, an ongoing ‘per capita recession’ and falling living standards. The rate of annual growth in real GDP – at 1.5 per cent – was in line with the RBA’s February forecasts. There was some modest good news on productivity, although not enough to significantly turn around a still-elevated rate of growth in unit labour costs.

In addition to this list, the latest Labour Account numbers discussed in the previous story were also consistent with some loosening in labour market conditions; retail sales bounced back in January this year after having fallen in December 2023 but were flat in trend terms; monthly consumer sentiment reported a strong rise in February (although confidence also fell in the aftermath of the February RBA meeting) while remaining deep in pessimistic territory overall; and the housing market demonstrated renewed strength last month.

Pull all that together, and it is hard to see a strong case for the RBA to shift much in either direction from its judgment in early February, that ‘While there are encouraging signs, the economic outlook is uncertain and the Board remains highly attentive to inflation risks.’ It follows that the same policy outcome – no change to the cash rate target – looks the most likely outcome next week.

What else happened on the Australian data front this week?

Weekly payroll jobs increased by two per cent over the month to 17 February 2024 after having fallen by 1.6 per cent over the previous month. Jobs were up 1.9 per cent over the year. The ABS said that the rise in payroll jobs between mid-January and mid-February followed a regular seasonal pattern of business activity increasing as people returned to work after the summer break, particularly in the Education and training sector. The Bureau also noted that the rate of annual growth in job numbers through 2023-24 remains below the corresponding rate seen over 2022-23, consistent with other labour market indicators.

In the December quarter 2023 there were 67 industrial disputes involving 18,600 employees. The ABS reported 44,200 working days were lost. Over the course of 2023, there were 198 disputes involving 46,000 workers and 99,300 lost working days. Compared to 2022 that was ten more disputes, but 97,500 fewer working days lost.

According to the ABS, short-term visitor arrivals were 603,770 in January 2024, an annual increase of 191,360 trips. The number of arrivals was still 17.4 per cent lower than in pre-COVID January 2019. January this year also saw 82,890 international student arrivals. That was up 23,660 compared to January 2023 but still more than eight per cent down compared to January 2019.

The ABS Monthly Business Turnover Indicator showed month-on-month rises (seasonally adjusted) in eight of the 13 published industries in January 2024. The largest monthly increase was in Electricity, gas, water and waste services (up 5.8 per cent) followed by Transport, postal and warehousing (up 4.1 per cent) and Professional, scientific and technical services (up 2.9 per cent). The largest decline was in Arts and recreation services (down 2.2 per cent), followed by Construction (down 0.7 per cent). Turnover was up over the year in 12 of the 13 industry divisions, led by gains in Construction (up 15 per cent), Electricity, gas and waste services (up 11.8 per cent) and Professional, scientific and technical services (up 8.5 per cent). Only mining (down 9.8 per cent) reported an annual drop in turnover. The Bureau also introduced a new 13-industry aggregate indicator which was up one per cent over the month in seasonally adjusted terms and up 0.2 per cent on a trend basis. According to the ABS, in trend terms business turnover has now risen for the past six months to reach the highest level in the series’ history (which runs back to 2010). Here are more details on the new industry aggregate series.

The ANZ-Roy Morgan Index of Consumer Confidence rose 1.2 points to 82.2 in the week ending 10 March. The index has now spent a record 58 consecutive weeks below 85, with index values over the year to date ranging between a high of 84.8 and a low of 81. Weekly inflation expectations were unchanged last week at 4.9 per cent.

The ABS said that the total value of residential dwellings in Australia rose by $196.8 billion to $10,397.1 billion in the December quarter 2023. The number of dwellings rose by 52,500 to 11,134,600 and the mean price rose by $13,400 to $933,800.

Other things to note . . .

- The Treasurer’s speech to the AFR Business Summit on Monday on cutting compliance costs and boosting productivity. He reckons a second consecutive budget surplus ‘is in striking distance’, that the ‘balance of risks is shifting in our economy, from inflation to growth’, and said that the government plans to push ahead on several fronts: implementing tariff reform; streamlining the Environmental Protection and Biodiversity Conservation process; making changes to the Petroleum Resource Rent Tax (PRRT); clarifying the regulatory regime for (particularly medium-sized and smaller) banks; and pushing merger reform and competition policy.

- Related #1. Michelle Grattan examines how the Treasurer is preparing the ground for May’s budget.

- Related #2. The Treasurer is promising Australia’s biggest unilateral tariff cut in decades. See also this government press release, which estimates that the move will abolish 14 per cent of Australia’s tariffs, streamline about $8.5 billion of annual trade and save businesses more than $30 million in annual compliance costs. More details of the proposed tariffs to be cut here.

- Comments from new RBA Assistant Governor (Economic) Sarah Hunter and fellow panellists at the AFR Business Summit. (Audio/video only.)

- The latest Quarterly Statement from the Council of Financial Regulators said that ‘risks to the Australian financial system from lending to households warranted ongoing close attention but remain contained for the time being.’ According to the Council, while most households were still able to meet their debt servicing and other essential spending commitments, many had had to adjust their finances and hardship applications ‘had risen materially over the past year’. The Council also discussed ‘the challenging conditions in global and Australian commercial real estate markets’ and acknowledged that ‘Risks to the financial system from cyber-attacks have continued to increase in scale and complexity as businesses increased their reliance on technology and third-party service providers.’

- The final report of the Aged Care Taskforce.

- A look at how government incentives affect the demand for private health insurance in Australia.

- Australia’s first National Climate Risk Assessment.

- Tracking global CO2 emissions in 2023.

- A new Peterson Institute Working Paper considers the race between technology and political backlash in the context of the energy transition.

- Vaclav Smil argues that zero carbon is a highly unlikely outcome by 2050 (pdf, via FT Alphaville).

- On populism and the skill content of globalisation.

- The Economist reviews recent research suggesting that, contrary to conventional wisdom, globalisation may not have increased within-country income inequality.

- Some thoughts on China’s record manufacturing surplus.

- The March 2024 Edition of the IMF’s Finance & Development magazine includes pieces by Angus Deaton on rethinking his economics, Atif Mian on breaking the debt supercycle, John Cochrane on how inflation radically changes economic ideas, and an interview with Wendy Carlin on transforming economics teaching.

- In the WSJ, two economists debate the sustainability of the current ‘golden age’ for US employees.

- Two columns from the FT’s Martin Wolf. The first considers the dire performance of the UK economy. The second looks at the economic future of China.

- The OECD’s Competition Trends 2024.

- A summary version of the UBS Global Investment Return Yearbook 2024.

- Steven Landsburg gives ChatGTP a tricky economics exam and concludes that we still need economists (pdf, via Marginal Revolution).

- The Econtalk podcast in conversation with Azeem Azhar on living with exponential change.

Latest news

Already a member?

Login to view this content