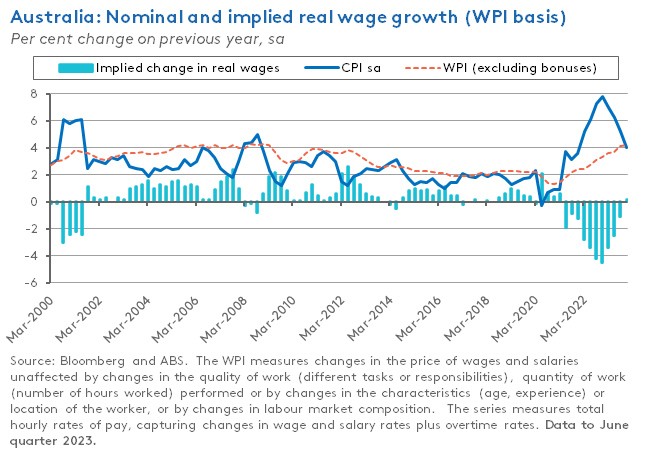

This week, the ABS reported that the annual rate of nominal wage growth in Australia, as measured by the Wage Price Index (WPI), rose to 4.2 per cent in the final quarter of last year. That means wage growth ended 2023 slightly above the RBA’s 4.1 per cent forecast. It also means that after 10 consecutive quarters in which wage rises ran below the annual increase in the Consumer Price Index (CPI), real wage growth finally turned positive. A look at the detail shows that wage growth last quarter was driven by centralised wage and salary reviews, strong wage gains for jobs covered by enterprise agreements and a jump in public sector wage growth.

The Q4:2023 wage numbers arrived in the same week that the Minutes from the RBA’s 5 – 6 February 2024 Board meeting were published. Those Minutes confirmed that although the RBA Board still thinks it is on track to return inflation to target, it nevertheless remains concerned enough about uncertainties around the pace of disinflation that it feels unable to rule out the possibility of another increase in the cash rate. That is, Australia’s central bank remains firmly in data-dependent mode.

Given that data dependency, will this week’s wage release change the RBA’s mind in terms of the future direction of monetary policy? Probably not. Rather, it will reinforce the sense of caution about any future policy easing already apparent at Martin Place. The RBA had previously indicated it expected nominal wage growth to remain strong through the end of 2023 and across the first half of this year. Hence the result won’t come as much of a surprise. And despite the strong headline growth rate, there were enough reassurances in the detail of the WPI numbers (a slowdown in the overall quarterly growth rate, a slight drop in the annual headline rate of private sector WPI increase and a moderation in the pace of increase in wages for jobs covered by individual agreements, which are thought to be the most sensitive to labour market demand) to offset any concerns about a wage breakout.

Still, there are two interconnected risks relating to wage growth to keep an eye on here. First, while there are signs that the Australian labour market is cooling (see last week’s discussion of the latest unemployment numbers) which would be expected to lead to a future moderation in the pace of wage growth, there is some risk that the same institutional arrangements that saw wage growth lag tightening labour market conditions on the way up will similarly see it lag loosening labour market conditions on the way back down. Second, the RBA is explicitly relying on Australia’s productivity growth returning to its pre-pandemic performance to reconcile still-elevated wage growth with the inflation target. If that normalisation in productivity growth fails to materialise, rising unit labour costs will threaten the disinflation process.

Finally, ‘Flash’ PMI results for February reported an increase in price pressures this month, with firms reporting a rise in input costs in a sign that the disinflation process continues to face some challenges.

As usual, more detail below.

Annual wage growth picks in Q4:2023 but quarterly growth eases

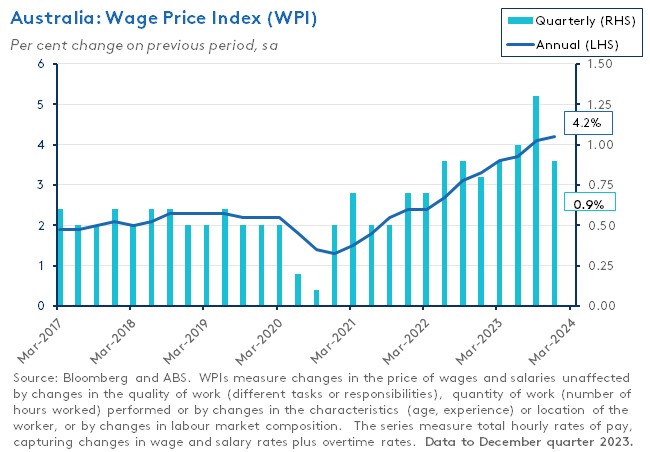

The ABS said Australia’s Wage Price Index (WPI) rose 0.9 per cent over the December quarter 2023 (seasonally adjusted) to be up 4.2 per cent over the year. The pace of quarterly wage growth was down from the September quarter’s 1.3 per cent (the highest quarterly growth in the 26-year history of the WPI series and heavily influenced by the Fair Work Commission’s annual wage review decision as well as the removal of various public sector state wage caps). It was also a little below the one per cent gain recorded in the June quarter of last year, but above the 0.8 per cent quarter-on-quarter rise recorded in Q4:2022. On the other hand, the annual rate of increase last quarter was the highest recorded since the March quarter 2009.

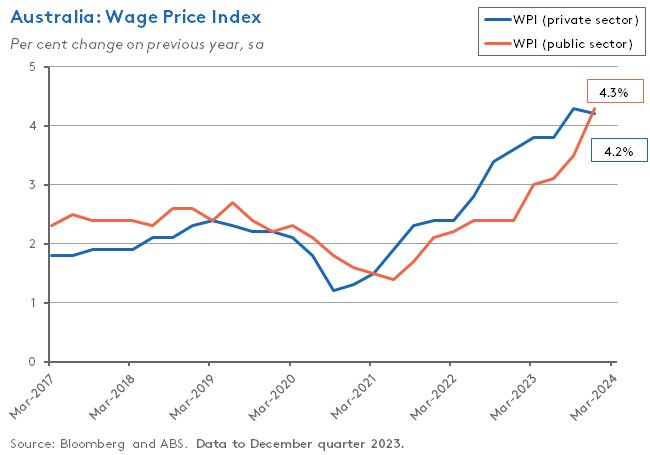

Private sector WPI was up 0.9 per cent in quarterly terms and 4.2 per cent on an annual basis, with the annual rate of increase down slightly from the previous quarter’s result. The December quarter saw particularly robust growth in public sector wages, up 1.3 per cent over the quarter and 4.3 per cent over the year. That quarterly increase was the highest in 15 years. The December quarter 2023 was also the first time that annual growth in public sector wages outpaced growth in the private sector since the December quarter 2020 and was the highest public sector annual wage growth since the March quarter 2010.

In explaining the increase in public sector wage growth, the ABS highlighted newly implemented enterprise agreements for essential workers in the health care and social assistance and Education and training industries linked to NSW and Queensland state wage policy outcomes, top up payments from a Cost of Living Adjustment for some Queensland employees and several new local government bargaining outcomes.

By weight, private sector wages account for almost 79 per cent of employers’ expenditure on wages vs around 21 per cent for the public sector. That means that private sector wage results drive the overall outcome for the WPI, with the public sector usually contributing between 10 and 25 per cent to overall wage growth. But the December quarter last year saw a considerably higher contribution from the public sector at 34 per cent.

By method of setting pay, the ABS said jobs covered by enterprise agreements (EAs) contributed almost half of quarterly growth, with the corresponding annual rate of wage growth running at around 4.7 per cent. This was a larger than usual contribution from EAs for the final quarter of the year, which the bureau said was driven by the implementation of newly negotiated agreements across both the public and private sectors.

The bureau also highlighted that wage increases for jobs covered by individual arrangements (which tend to be more sensitive to labour market demand) eased last quarter, with the annual rate of wage growth slowing to 3.7 per cent from 3.9 per cent in the September quarter.

The median market forecast for the December release had expected the WPI to be up 0.9 per cent over the quarter and 4.1 per cent over the year, so while the quarterly growth outcome was in line with expectations, the annual result was a little stronger than anticipated – although that partly reflected an upward revision to annual growth in the September quarter 2023 from four per cent to 4.1 per cent.

Similarly, the December print showed wage growth running a little faster than the RBA had been expecting. The RBAs’ February 2024 forecasts had predicted wage growth to end last year at an annual rate of 4.1 per cent and then to still be that rate by the June quarter of this year before easing to 3.7 per cent by year end (note also that RBA minutes this week show the central bank expected nominal wage growth to remain ‘robust’ in the near term (see next story)).

Finally, at 4.2 per cent, the annual increase in the WPI was (just) ahead of the annual increase in the CPI in the December quarter of last year, meaning that annual real wage growth was positive for the first time since the March quarter 2021.

Martin Place remains concerned about slow disinflation

According to the Minutes of the 5 – 6 February 2024 Monetary Policy Meeting of the Reserve Bank Board, the start of this month found Board members once again debating the relative merits of a 25bp increase in the cash rate target versus leaving policy unchanged.

The case for another increase was:

‘…centred on the observation that it would take some time for inflation to return to target and the labour market to full employment. Inflation was expected to take a further two years or so to return towards the midpoint of the target range under the central forecast…Members noted that an increase in the cash rate target…could slow the growth of demand further and reduce the risk of inflation not returning to target in an acceptable timeframe.’

While the case for no change was based on:

‘…the observation that the risk of inflation not returning to the board’s target within a reasonable timeframe had eased. The moderation in inflation over preceding months had been slightly larger than previously expected and global inflation outcomes had provided additional confidence that inflation in Australia would moderate further. Data on the labour market and consumer spending had also been weaker than previously expected…it was possible that conditions in the labour market were already consistent with full employment, although this was judged to be unlikely.’

In deciding to leave monetary policy settings as they were, members also noted that the RBA’s central forecast was still for inflation to return to target within an acceptable timeframe, and that:

‘…the risks around the outlook were broadly balanced; there was a risk that inflation proves more persistent but there was also a risk that consumer spending weakens more sharply than it had to date.’

In deciding how to communicate their decision to the public, members noted that:

‘…it would take some time before they could have sufficient confidence that inflation would return to target within a reasonable timeframe. Uncertainty about the outlook for the economy was high…the costs of inflation not returning to target within the envisaged timeframe were potentially very high. Given this…it was appropriate not to rule out a further increase in the cash rate target.’

All of which keeps the RBA in data-dependent mode and – contra financial market expectations – unwilling to rule out the possibility of future rate increases while it remains concerned about the pace of disinflation. As we noted in our previous comments on the meeting, Martin Place is still in watch and wait mode.

It follows that three scenarios for policy remain in play.

First, should the data flow continue to be broadly consistent with a disinflation path that meets the RBA’s base case, then while the next move in the cash rate is likely to be down, that move is unlikely to arrive until well into the second half of this year.

Second, should the rate of disinflation continue to run ahead of the RBA’s expectations (as it did in the December quarter of last year) and/or should the economy start to weaken more rapidly, then the pace of monetary policy easing could always be accelerated.

But third, if signs emerge indicating that disinflation is starting to lag the already gradual path that the RBA has baked into its central forecast, then the case for another rate hike will mount.

For now, the recent flow of data has remained broadly consistent with the first of these three scenarios (although see next story). But the RBA will be keeping a close eye on the numbers to make sure that this remains the case. And, as we argued after the board meeting, the central bank will also continue to work to influence expectations through its communications to keep them consistent with its preferred disinflationary path.

Other points to note:

- For board members, the three most ‘material risks’ are ‘the potential for inflation to be more persistent than anticipated, productivity growth not to recover as assumed and consumption to weaken more markedly than in the staff’s central forecast’.

- While the discussion referenced the recent increase in global shipping costs (partly due to the disruption in the Red Sea) and the consequent upside risk to tradables inflation, it also noted that cost increases to date were much smaller than those seen during the pandemic.

- Inflation in Australia had ‘moderated’ with both headline and underlying inflation ending the year below the RBA’s previous expectations and members discussed whether goods price inflation could fall further, given ongoing excess capacity in the Chinese economy. But they also emphasised that services prices inflation was proving more stubborn.

- High inflation, higher taxes and tighter monetary policy had led to a ‘noticeable slowing’ in demand growth over last year, implying some downside risks to household consumption and therefore overall activity.

- As at end 2023, the RBA thought conditions in the labour market were ‘tight, relative to what would be consistent with sustained full employment’. That implies that the central bank would be looking to see unemployment and underemployment move above their December 2023 levels of 3.9 per cent and 6.5 per cent (as at January this year, those rates had edged up to 4.1 per cent and 6.6 per cent, respectively).

- Growth in nominal wages was expected to ‘remain robust in the near term before moderating in response to further easing in the labour market’. So, this week’s WPI reading (previous story) was unlikely to come as a surprise, even though it came in a little above the RBA’s February projections.

- In line with that labour market view, the RBA continues to judge that ‘the level of aggregate demand remained above the economy’s supply capacity’.

February’s Flash PMI sends a warning on the disinflation front

The Judo Bank Flash Australia Composite PMI (pdf) rose from a reading of 49 in January 2024 to 51.8 in February 2024, taking the composite indicator into positive territory for the first time since September last year and sending it to its highest level since April 2023. The rise in the composite index was driven entirely by stronger activity in the services sector, with the Flash Australia Services PMI Business Activity Index rising from 49.1 in January to 52.8 this month, another 10-month high, lifted by a strong rise in new orders. In contrast, both the Flash Australia Manufacturing Output PMI and the Manufacturing PMI were in contractionary territory this month.

In a potentially concerning sign for the pace of disinflation, the PMI results indicated that price pressures intensified across the economy this month. Services and manufacturing firms both reported higher input costs due to rising raw materials and transport costs, with services firms also citing high labour costs. As a result, the composite output price index rose to its highest level since September 2023, reversing some of the lower readings reported during the December quarter of last year. Judo Bank reckons the current output price index level is consistent with domestic inflation running at an above-target 4-5 per cent.

What else happened on the Australian data front this week?

In more labour market news and consistent with the strong WPI result discussed above, the ABS said average weekly ordinary time earnings for full-time adults rose 4.5 per cent over the year in November 2023, increasing to $1,888.80. According to the bureau, that 4.5 per cent increase (equivalent to $81 a week) was the strongest rise seen May 2013, aside from a brief spike during the early phase of the pandemic. Average earnings growth was 4.4 per cent in the private sector and 4.9 per cent in the public sector. Annual growth in full-time adult average weekly total earnings was 4.2 per cent, while growth in all employees average weekly total earnings was 3.9 per cent. The bureau also reported that the gender pay gap in average weekly ordinary full-time earnings (which it said is the most commonly cited gender pay gap measure) narrowed to 12 per cent in November from 13 per cent in May 2023, setting a new record low.

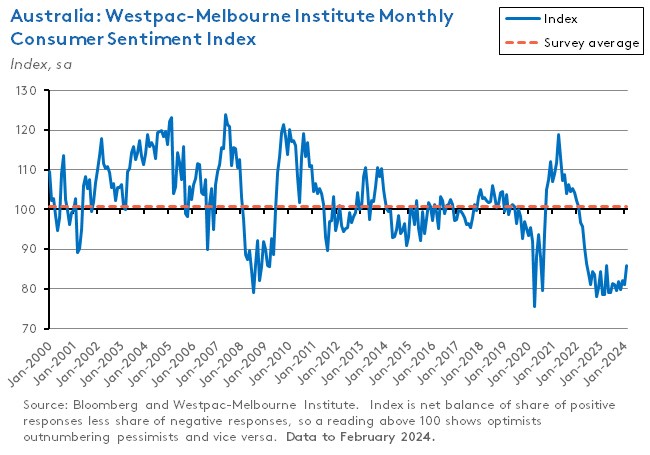

The ANZ-Roy Morgan Consumer Confidence Index rose 0.2 points to 82.8 in the week ending 18 February. According to Roy Morgan, the index has now spent a record 55 consecutive weeks below the 85 level. ANZ said a drop in confidence about both the short- and medium-term economic outlook (possibly a consequence of the increase in the unemployment rate to 4.1 per cent in January) was offset by improvements in current and future financial conditions, with the latter increasing to above the ‘neutral’ level. Weekly inflation expectations rose 0.3 percentage points to 5.2 per cent.

Other things to note . . .

- A look at the collapse in nickel prices and implications for the Australian nickel industry. According to the piece, an important part of the story is Chinese investment into Indonesian nickel mines and processing plants, which has contributed to a surge in production, a huge increase in Indonesia’s market share, and a dramatic fall in prices. See also this piece from Reuters, which argues that what Australia needs is a bifurcation of the global nickel industry, with a split between nickel that is produced with a low climate impact and that which is not.

- Grattan analysts on why tax cuts are not the same as tax reform. Also from Grattan, a submission on making lobbying more transparent.

- Ken Henry talks to ABC Business about failings of Australia’s tax system and the need to shift the tax burden away from personal income tax, company tax and payroll tax while moving to ‘fix up the mess’ around how we tax consumption, replacing stamp duties with ‘a decent property tax’ and finding ‘a way of getting more revenue out of the country’s exhaustible natural resources, particularly fossil fuels’.

- Related, ABC Business on ‘Australia’s last generation of true economic reformers’ – Henry, Ross Garnaut, Allan Fels and Rod Sims.

- But Richard Holden in the AFR isn’t keen on the Garnaut-Sims plan for a Carbon Solutions Levy (pdf). Their response.

- CEDA’s economic and policy outlook 2024.

- New data from the ABS on the use of restraint clauses by employers. Restraint clauses in employment contracts are conditions that restrict an employee from sharing information, moving to a competitor, or prohibiting a former employee from approaching clients or co-workers. The bureau finds that almost 47 per cent of Australian businesses use at least one of the four main types of restraint clause - non-disclosure clauses (used by 45.3 per cent of businesses surveyed); non-solicitation of clients (25.4 per cent); non-compete clauses (20.8 per cent) and non-solicitation of co-workers (18 per cent). The majority of businesses using restraint clauses said they applied to between 76 and 100 per cent of their employees. Non-compete clauses – which are thought to be particularly important regarding their impact on labour mobility and on the ability of firms to fill vacancies – are used by about 40 per cent of large businesses, but only around 20 per cent of small businesses.

- A sign of the times/public sentiment? Drawing on the Fels ACTU report linked to last week, a piece listing ‘eight ways retail pricing algorithms gouge consumers.’

- The Productivity Commission on the right approach to AI regulation and on why the gap hasn’t closed.

- A new CEPR online book considers the monetary policy responses of 15 central banks to the post-pandemic inflation shock along with broader policy lessons and analysis. Chapter one is by two of the authors of the recent review into the RBA and considers the Australian case from that perspective.

- See also Joseph Gagnon’s analysis of the role of supply shocks in driving inflation over 2021-23.

- I’m a bit late to this, but here are the Eurasia Group’s Top Risks for 2024. Number one is the US election, number two is the Middle East on the brink and number three is the partition of Ukraine.

- A WSJ Long Read on the secret oil-trading ring that helps Russian oil evade US sanctions.

- Also from the WSJ, how the war in Europe boosts the US economy.

- Related, the Brookings Institution’s Ukraine Index.

- The Economist says 2024 is a giant test of nerves for democracy.

- On Economic transformation and a new economic order.

- John Muellbauer makes the case for a green land value tax which would supplement taxes on land and property with discounts related to carbon- (or energy-) efficiency.

- Chris Giles in the FT with some interesting comparisons of EU and US economic performance.

- Two pieces from the Journal of Economic Perspectives. The first looks at how the failure of Silicon Valley Bank in March last year can explain the underlying economics of banking and banking crises while the second considers skilled immigration, firms, and the global geography of innovation.

- New research using UK survey and firm accounts data to look at WFH. The research suggests that firms with higher levels of WFH have higher productivity and lower wage growth*, and finds a strong relationship between firm age and remote working, with employees in younger firms working significantly more days offsite. It also reports that managers overall expect remote working to remain at similar levels to today by 2028. *Note that the authors say this relationship is not necessarily causal, but could instead reflect the types of firms that make more use of remote working.

- The FT’s unhedged podcast on the dilemma of the ‘supercompany’. If you’d prefer a written take, here’s Robert Armstrong’s recent column on where increasing returns come from.

- The These Times podcast has run two episodes putting the Ukraine war in recent historical context. Part 1 and Part 2.

- The Australia in the World podcast looks back at the lessons from 2023 and forward to what this year might hold.

Latest news

Already a member?

Login to view this content