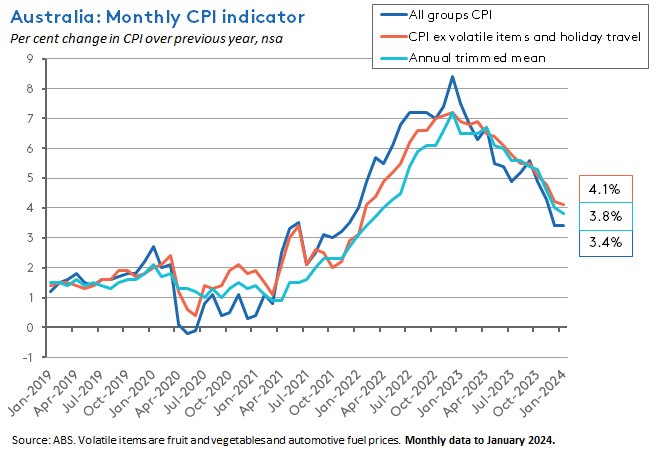

The year 2024 got off to a slightly better-than-anticipated start on the inflation front, with the ABS reporting this week that the annual rate of inflation as measured by the Monthly Consumer Price Index (CPI) Indicator was unchanged at 3.4 per cent in January. That was good news, because market economists had expected a modest increase in the headline rate to 3.6 per cent.

This (modest) positive surprise was also accompanied by data showing that inflation rates as measured by the trimmed mean and by the CPI ex volatile items and holiday travel had both eased relative to their December outcomes. Overall, then, this was a gently reassuring result regarding Australia’s progress with disinflation. That said, the usual limitations around the information content of the January monthly CPI indicator continue to apply.

As usual, more detail on this and other data releases below.

Some positive news on inflation

The ABS said the Monthly CPI Indicator rose 3.4 per cent over the year in January 2024. That was unchanged from the December 2023 result and a little softer than market expectations. The median forecast had expected an inflation rate of 3.6 per cent. As a result, on this measure inflation last month remained at its lowest rate since November 2021.

At the same time, the rate of inflation as measured by the CPI, excluding volatile items and holiday travel, eased from 4.2 per cent to 4.1 per cent, while the monthly version of the Annual Trimmed Mean measure of underlying inflation slowed from four per cent to 3.8 per cent.

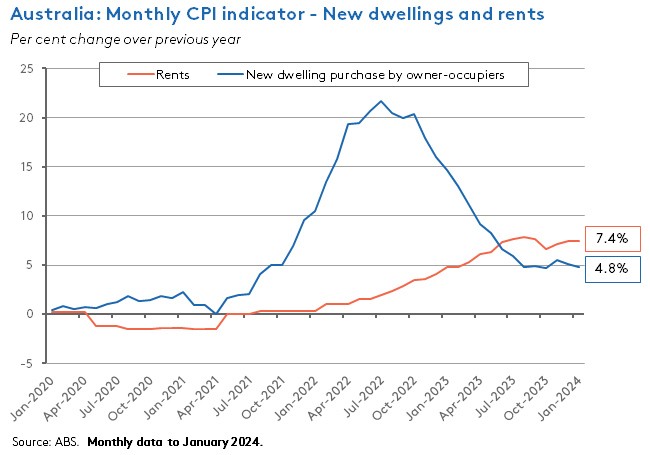

The ABS said the most significant price rises last month were for housing (up 4.6 per cent over the year), food and non-alcoholic beverages (4.4 per cent), alcohol and tobacco (6.7 per cent) and insurance and financial services (8.2 per cent).

Housing has the largest weight in the monthly CPI basket and although the annual rate of increase in in new dwelling prices continued to moderate last month (falling to 4.8 per cent from 5.1 per cent in December), the annual rate of rental price inflation was unchanged at a still elevated 7.4 per cent.

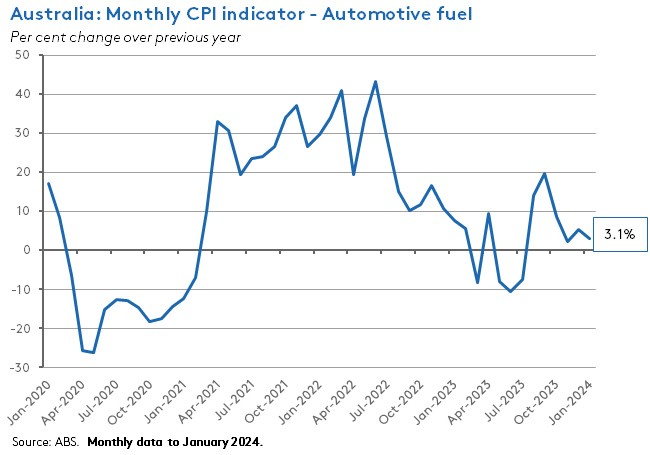

The decline in the headline number was aided by a fall in the rate of automotive fuel inflation, which slowed to 3.1 per cent in January from 5.3 per cent in December 2023. Automotive fuel prices have now fallen month-on-month for four consecutive times, in line with softer global oil prices.

Other factors helping cap the rise in inflation included a 7.1 per cent decline in holiday travel and accommodation prices as airfares continued to retreat from their post-lockdown surge and as demand for holidays eased after the peak travel period in December. Gas prices fell 1.4 per cent over the year in January after having risen by 8.5 per cent in December, reflecting the impact of base effects relating to the large 8.1 per cent monthly price rise in recorded in January 2023.

Electricity prices were up 0.8 per cent over the year in January, although that was higher than December’s 0.4 per cent increase. The ABS again pointed to the importance of the Energy Bill Relief Fund rebates that were introduced in Australia from July 2023. Without their influence, it said, electricity prices would have jumped by 15.3 per cent over the year.

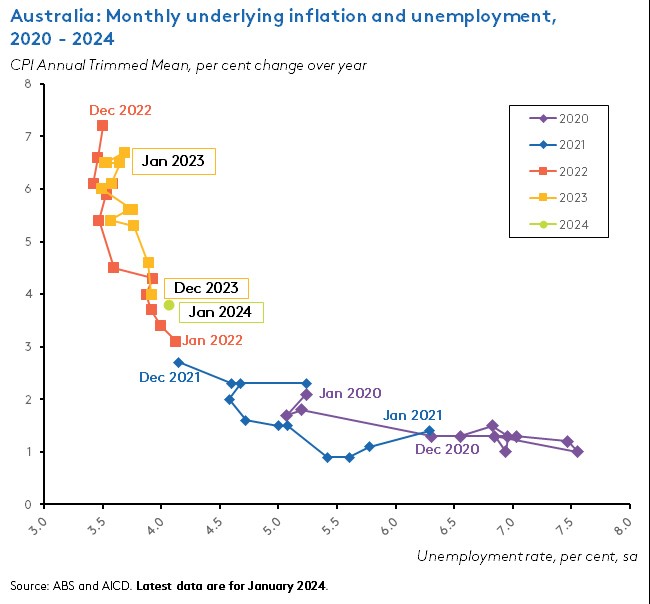

Taken overall, January’s result suggests that the disinflation process remains on track. Indeed, in line with the December quarter CPI result, it continues to (slightly) exceed market expectations. As the chart below shows, we’ve been enjoying quite steep falls in underlying inflation without too much pain in terms of higher unemployment rates. Again, that’s good news.

However, and as we’ve discussed before, the way in which the monthly CPI Indicator is constructed means that the first month in each quarter contains only limited information about the full quarterly CPI (according to the ABS it includes up-to-date price information for about 66 per cent of the weight of the quarterly CPI) and in particular it does not provide a read on many of the services and non-tradables that the RBA sees as embodying key risks to returning inflation to target on its timetable.

Finally, note that the ABS also updated the weights for the monthly CPI indicator in January. The biggest change was a 1.7 percentage point increase in the weight for the Recreation and culture group, driven by an increase in the weight for international holiday travel and accommodation of 0.9 percentage points. The ABS explained that since the re-opening of Australia’s borders in late 2021, the number of people travelling has now returned to around 90 per cent of pre-COVID levels. The Housing group continues to have the largest weight in the monthly CPI indicator (at 21.75 per cent), followed by Food and non-alcoholic beverages (17.15 per cent), recreation and culture (12.55 per cent) and Transport (11.42 per cent). More details here.

What else happened on the Australian data front this week?

According to the ABS, nominal retail turnover rose 1.1 per cent over the month (seasonally adjusted) and 1.1 per cent over the year in January 2024. That was softer than market expectations for a 1.5 per cent print, although it still represented a modest rebound following December’s 2.1 per cent monthly contraction. The bureau reported that the level of retail turnover is now back to a similar level to that recorded in September last year. Note also that the ABS continues to emphasise that changes in seasonality – due to Black Friday sales in November which saw sales rising in that month before falling back in December – have produced a shift in spending patterns.

The ABS also said total new private capital expenditure (capex) rose by 0.8 per cent over the quarter (seasonally adjusted) in Q4:2023 to be up 7.9 per cent over the year. Capex on buildings and structures was up 1.5 per cent quarter-on-quarter and 9.3 per cent year-on-year, while spending on equipment, plant and machinery fell 0.1 per cent in quarterly terms but was still 6.4 per cent higher on an annual basis. By industry, business investment was higher in both the mining (up 1.1 per cent) and non-mining (up 0.6 per cent) sectors over the December quarter. The bureau pointed to increased spending on renewable energy infrastructure as lifting capex in the electricity, gas, water, and waste services industry (up 17.5 per cent) and ongoing investment in data centres as helping to drive expenditure in the information media and telecommunications industry (up 6.5 per cent).

The same release also reported updated expectations for planned investment for the year, including a first estimate (of $145.6 billion) for planned capex in 2024-25. That was up 12.6 per cent on the first estimate for 2023-24. The Fifth Estimate for Capex in 2023-24 was $177.7 billion, up four per cent from Estimate 4. Both numbers are consistent with decent prospects for continued robust investment spending.

The latest General Government Sector Monthly Financial Statement said the underlying cash balance for the 2023-24 financial year to 31 January 2024 was a deficit of $22.4 billion. That was about $0.8 billion better than MYEFO’s projection for a deficit of $23.2 billion at this point in the year. MYEFO had predicted that over 2023-24 as a whole Australia would run a narrow deficit of just $1.1 billion, so on this basis a second consecutive budget surplus looks to be in reach.

The ANZ-Roy Morgan Consumer Confidence Index was virtually unchanged – up just 0.4 points – at a reading of 83.2 for the week ending 25 February 2024. ANZ noted that the index has hovered within a tight range of 82.8 to 84.8 since the start of this year, manifesting a ‘sideways’ trend. Roy Morgan added that the index has now been below a reading of 85 for a record 56 consecutive weeks. Weekly inflation expectations eased by 0.1 percentage points to 5.1 per cent.

Total construction work done in Australia rose 0.7 per cent over the December quarter 2023 (seasonally adjusted) to $65.4 billion, up 8.7 per cent on the same quarter in 2022. According to the ABS, building work done fell 1.1 per cent in quarterly terms to $34.3 billion, pulled down by a 5.2 per cent fall in residential construction, while non-residential construction was up five per cent quarter-on-quarter. Engineering work was up 2.7 per cent over the quarter to $31.1 billion, or 8.7 per cent higher over the year.

Other things to note . . .

- In the AFR, Robert Carling comes to the defence of Coles and Woolworths.

- Grattan on the biggest winners and losers from Australia’s international education sector.

- Australian Statistician David Gruen considers the rise of big data and integrated data assets.

- Estimating the impact of reforms to negative gearing and tax reform on home ownership.

- The WGEA’s interactive exploration of employer gender pay gaps.

- Related, the ABS Gender pay gap guide.

- A Lowy Interpreter piece on what to watch at the upcoming Australia-ASEAN summit.

- The latest issue of Australian Foreign Affairs casts an eye over the AUKUS deal and the costs and benefits of nuclear-powered submarines.

- The IMF Surveillance Note to accompany this month’s G-20 Finance Ministers and Central Bank Governors Meeting in Brazil repeats the message of January’s World Economic Outlook Update, arguing that ‘the global economy appears on track for a soft landing.’

- Briefing notes for the WTO’s 13th Ministerial Conference, which ran from 26 – 29 February in Abu Dhabi this week. Related: Alan Wolff on the uncertainty about the future of the world trading system; Michael Pettis makes his case for new rules for global trade; Keith Rockwell argues that this week’s meeting is a moment of truth for the WTO; and an FT Big Read on China’s plan to reshape world trade.

- New OECD Economic Surveys of Mexico and Egypt.

- Have changes in central bank strategy led to an increase in the natural rate of interest?

- Is the current AI bubble bigger than the 1990s tech bubble?

- On the (US) wealth of generations.

- Stephane Kelton thinks about ZIRP.

- A look at the economic impact of the 2022 FIFA World Cut.

- Air as the hot new luxury product.

- About Ant geopolitics.

- How to be a super-forecaster (with bonus swipe at economists).

- What will be at the heart of the post-entertainment society? Distraction and Addiction.

Latest news

Already a member?

Login to view this content