On the domestic front, much of last year was dominated by the monetary policy – inflation nexus. Barring shocks, this year looks set to follow a similar theme, albeit with an important shift in emphasis. At the start of 2023, the initial focus was on how far and how fast the RBA would push up the cash rate, and later, as the year unwound, on when this process might end. This year, while local macroeconomists’ eyes are still likely to be glued on Martin Place, the debate has moved on to be about whether and when the central bank might start to cut the policy rate.

Hopes that this might happen sooner rather than later were raised by a softer-than-expected December quarter 2023 CPI reading. The RBA’s November 2023 forecasts from had called for the CPI inflation to end last year at an annual rate of 4.5 per cent, and for underlying inflation to print at the same rate. Instead, ABS data showed the headline rate falling to 4.1 per cent while the trimmed mean eased to 4.2 per cent. That suggested that Australia’s disinflation process was running slightly ahead of schedule. Not only did that imply an increased likelihood that the central bank was done with rate hikes, but at least for some in the markets its suggested that a first rate cut might arrive earlier than previously expected – perhaps as soon as August.

This week saw the RBA use the first monetary policy meeting of 2024 (and the first to be held under the new post-Review’s eight-meetings per year schedule) to hose down some of the more excited speculation about looming rate cuts triggered by that Q4:2023 CPI reading. After leaving the cash rate target unchanged at 4.35 per cent in line with market expectations, Governor Bullock and her Board took the opportunity to signal that in their view it was still too soon to be talking about a reduction in the cash rate, with Tuesday’s Statement commenting that:

‘While recent data indicate that inflation is easing, it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range…and a further increase in interest rates cannot be ruled out.’ [Emphasis added]

Instead, the Board indicated, it will remain data-dependent – in watch and wait mode – until it can be ‘confident that inflation is moving sustainably towards the target range.’

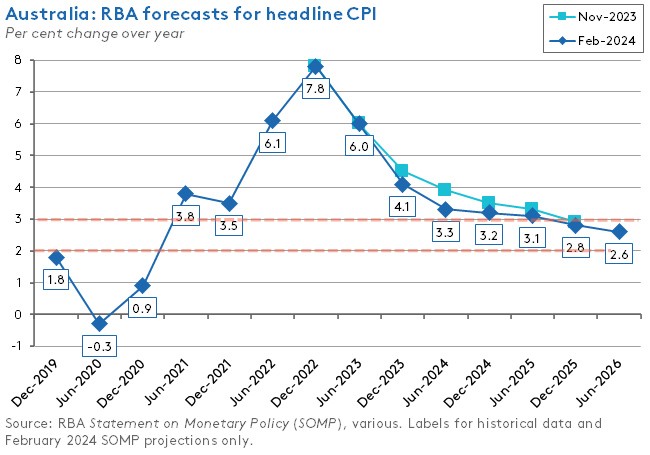

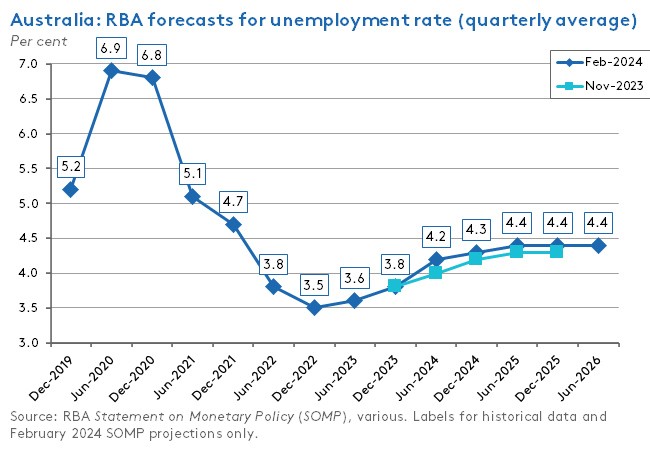

That message duly acknowledged, it’s nevertheless worth noting that the accompanying February 2024 Statement on Monetary Policy saw the RBA trim its near-term forecasts for inflation and growth while modestly lifting its projections for the unemployment rate. All of which would be expected to be consistent with a slightly more dovish outlook this year from Australia’s central bank.

As usual, more detail below.

As expected, the RBA left the cash rate target unchanged this week

On 6 February 2024, the RBA Board decided to leave the cash rate target unchanged at 4.35 per cent. That was in line both with financial market pricing and with economist expectations – nobody was expecting a different outcome on Tuesday. The decision means that the RBA has left rates unchanged for a second consecutive meeting (remember, there was no January meeting), and that over the past seven Board meetings there has only been one 25bp increase in the cash rate, announced on 7 November last year.

The accompanying Statement (now released in the name of the RBA Board collectively, rather than in the name of the RBA Governor as in the past) noted that inflation ‘continued to ease in the December quarter’ (for more on the Q4:2023 inflation reading, see below) and that there were ‘encouraging signs’ including ‘favourable signs on goods price inflation abroad’ and medium-term inflation expectations remaining consistent with the target.

Mindful that some market participants had been canvassing the possibility of an early reduction in the cash rate target, however, the Board also set out the case for continued caution. It pointed to the fact that services price inflation was declining at a slower pace than goods price inflation, consistent with the RBA’s view that the economy continued to be characterised by ‘continuing excess demand’ and by ‘strong domestic cost pressures, both for labour and non-labour inputs’; that labour market conditions ‘remain tighter than is consistent with…inflation at target’; and that despite recent declines, inflation was still above target. There were also ongoing uncertainties around external (China, Ukraine, and the Middle East) and domestic (monetary policy lags, household consumption, firms’ pricing decisions) risks.

So, despite the recent good news on the inflation front, the RBA is far from taking the disinflation process for granted. As already highlighted, the Board even explicitly noted that there may be a case for further rate increases. Here is (some of) that final paragraph from the Statement again:

‘While recent data indicate that inflation is easing, it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range. The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out. The Board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market...’

So, how should we interpret this week’s messaging? Broadly, we should take the RBA at its word. There does remain some significant uncertainty around the future path for prices in both the domestic and global economy, and it is reasonable for monetary policy to take this into account. But we should also keep in mind that the RBA is seeking to manage (inflation) expectations. That means it has a strong incentive to discourage any celebration that inflation has been defeated for fear that this could undermine progress towards that target.

In this, Australia’s central bank finds itself in a similar situation to many other advanced economy monetary authorities, as explained in the latest IMF World Economic Outlook Update:

‘…the near-term priority for central banks is to deliver a smooth landing, neither lowering rates prematurely nor delaying such lowering too much…ensuring that wage and price pressures are clearly dissipating and avoiding the appearance of prematurely “declaring victory” will guard against later having to backpedal in the event of upside surprises to inflation. At the same time…adjusting rates to more neutral levels…may be necessary…to avoid protracted economic weakness and target undershoots.’

In other words, although we have moved further along it, we’re still navigating the same narrow path that was the subject of so many speeches over the past year or two.

Some messages from Governor Bullock’s Press Conference

In a feature of the new monetary policy process this year, the Governor delivered a press conference one hour after the release of the Board’s policy decision. Mostly Governor Bullock used the opportunity to reinforce the message contained in the statement, but there were a couple of additional points worth noting.

- In terms of risks, the Governor is worried about more shocks and the potential implications for inflation and inflation expectations.

- She isn’t quite so worried about recent productivity performance (and its implications for unit labour costs), arguing that the recent quarterly productivity numbers have been ‘noisy’ rather than signalling a fundamental problem. Another item on the watch and wait list.

- The RBA doesn’t think that the Government’s proposed changes to Stage 3 tax cuts are a ‘material issue’ for inflation, given that ‘the fiscal envelope is the same’ as the original policy package.

New RBA forecasts signal somewhat lower inflation and higher unemployment

Another new feature of this week’s meeting was the simultaneous release of a new-look Statement on Monetary Policy. This included the RBA’s revised forecasts for the Australian economy. There have been several noteworthy changes since the November 2023 set of projections.

- Inflation is now forecast to decline a little faster than the RBA was expecting last year. This mainly reflects quicker goods price disinflation together with slightly softer domestic demand. As a result, headline CPI inflation is forecast to end this year at 3.2 per cent instead of 3.5 per cent while underlying inflation (the trimmed mean) is expected to ease to 3.1 per cent instead of 3.3 per cent. Both headline and underlying inflation are expected to be around the top of the target band by mid-2025 and to be in the top half of the band by the end of next year before reaching the midpoint in 2026.

- Anticipated real GDP growth has been cut back for this year. Instead of growing at 1.8 per cent across 2024, the economy is now expected to expand by just 1.5 per cent. The growth forecast for next year is unchanged at 2.2 per cent.

- The unemployment rate is now predicted to be a little higher than in the November forecasts. By the middle of this year, the unemployment rate is forecast at 4.2 per cent instead of four percent, it is projected to end the year at 4.3 per cent instead of 4.2 per cent, and it is then forecast to climb to 4.4 per cent instead of 4.3 per cent through 2025.

It’s also worth noting that these forecasts are based on the technical assumption – in line with market pricing and economist expectations at the time of the forecast – that the cash rate will remain around its current level of 4.35 per cent until the middle of this year before declining to around 3.2 per cent by the middle of 2026. That is, they are based on the assumption that the RBA will start to deliver rate cuts in the second half of this year.

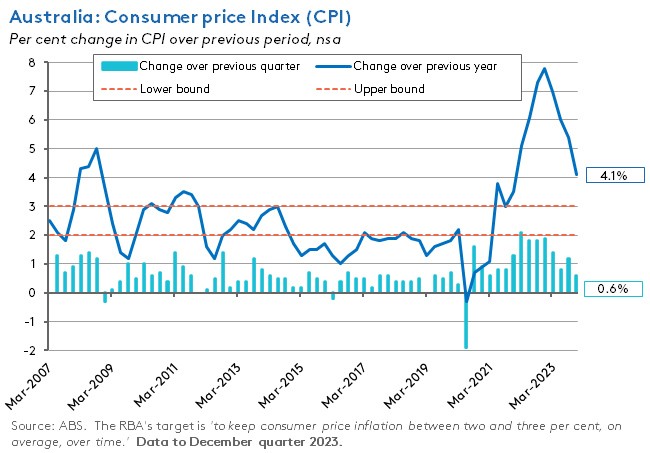

The pace of disinflation surprised to the upside last quarter

Last week, the ABS said that Australia’s Consumer Price Index (CPI) rose 0.6 per cent over the December quarter 2023 (seasonally adjusted) to be up 4.1 per cent over the year. The quarterly rate of increase was down sharply from the 1.2 per cent rise recorded in the September quarter and marked the smallest quarter-on-quarter rise since the March quarter 2021. The annual rate of increase was down from 5.4 per cent in the previous quarter and was the lowest reading since the December quarter 2021.

The result came in below market expectations for a 0.8 per cent quarter-on-quarter and 4.3 per cent year-on-year print. It was also below the RBA’s November 2023 Statement on Monetary Policy Forecast for inflation to finish the year at 4.5 per cent.

There was also good news on underlying inflation. The quarterly rate of trimmed mean inflation slowed from 1.2 per cent in Q3:2023 to 0.8 per cent in Q4:2023, which meant that the annual rate of increase dropped from 5.1 per cent to 4.2 per cent over the same period. That annual rate of underlying inflation is the lowest since the March quarter 2022. And once again, it was below both the median market forecast (4.3 per cent) and the RBA’s November projection (4.5 per cent).

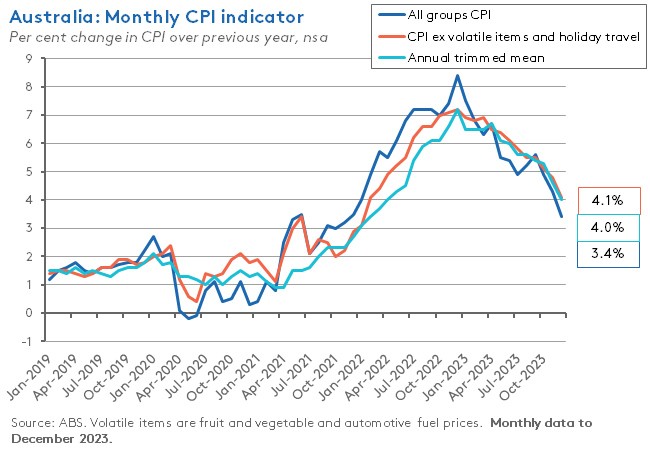

Rounding off the good news, the monthly CPI indicator for December 2023 rose 3.4 per cent over the year. That was down from 4.3 per cent in November 2023 and below the market’s expectation of a 3.7 per cent outcome. It was also the first time that the monthly inflation reading has had a ‘three’ in front of it since December 2021. The monthly trimmed mean measure recorded a four per cent annual rate, down from 4.6 per cent in November and the lowest reading since April 2022. And the annual rate of increase in the monthly CPI excluding volatile items series slowed to 4.1 per cent from 4.8 per cent, registering its lowest reading since February 2022.

So, was there anything in an otherwise upbeat set of inflation readings to be worried about? Readers will recall from last year (and from this week’s RBA commentary above) that Australia’s central bank has been concerned about persistent services inflation and about home-grown inflation. In the case of services, the gap with goods price inflation remains significant. While the annual rate of goods price inflation fell for a fifth consecutive quarter in Q4:2023, to 3.8 per cent, the corresponding rate of increase in services prices was a stronger 4.6 per cent, following only a second consecutive quarterly drop. And the RBA’s measure of market services inflation (which excludes domestic holiday travel and accommodation and telecommunications) is still running at an annual rate of more than six per cent.

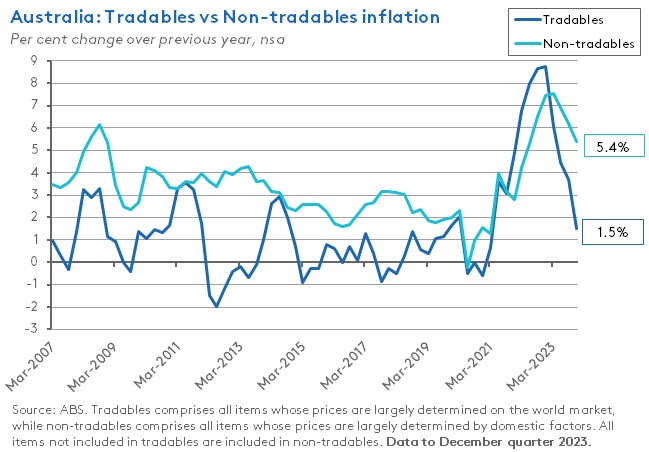

Finally, the annual rate of non-tradables inflation (which mostly reflects domestic factors) remained quite strong at 5.4 per cent. That was driven by price rises for new dwellings, rents, insurance and electricity. In contrast, tradables inflation was just 1.5 per cent year-on-year in the December quarter – well down on the peak of 8.7 per cent reached in the final two quarters of 2022. The ABS noted that there was even outright deflation in some imported goods, including clothing, footwear, furniture and household appliances.

Overall, then, this was a helpful inflation reading, showing the pace of disinflation running slightly ahead of market expectations, as well as doing better than the RBA had expected when it published November’s Statement on Monetary Policy. As such, it provided more support for the view that Australia’s central bank is likely to be done with rate hikes. That said, however, there was enough in the detail – in the form of still-elevated readings for services and non-tradables inflation – to keep Martin Place feeling cautious. As noted above, some of that caution was duly reflected in this week’s central bank comms.

What else happened on the Australian data front this week?

The ABS published December quarter 2023 updates to its Living Cost Indexes (LCIs). Over the past year, all five LCI’s increased by between four and 6.9 per cent, with the highest increase for the Employee LCI. Still, that was down from a peak rate of increase of 9.6 per cent in the June quarter of last year and from nine per cent in the September quarter. Once again, a big part of the story for the Employee LCI was the rate of growth in mortgage interest charges. These were up a sizeable 40.3 per cent over the year but down from annual increase of 91.6 per cent in the June quarter and 68.6 per cent in the September quarter. The Bureau also pointed to record annual growth in insurance costs across all household types as premiums rose for house, home contents and motor vehicle insurance.

According to the ABS, retail trade volumes rose 0.3 per cent quarter-on-quarter in the December quarter 2023 (seasonally adjusted) to be down one per cent over the year. That quarterly increase in the final quarter of last year follows a (revised) fall of 0.1 per cent in Q3:2023 and a 1.1 per cent quarterly drop in Q2:2023. The Bureau said that the rise in retail sale volumes was supported by lower price growth for retail goods, with consumers taking advantage of price discounting for discretionary items including furniture and electronics. At just 0.1 per cent, the quarterly growth in retail prices was the slowest since the September quarter 2021, while in annual terms retail prices were up just 2.4 per cent, compared to a peak of 7.6 per cent in the December quarter 2022. Retail sales were also buoyed by strong population growth: retail volumes per capita fell for a sixth consecutive quarter, dropping 0.3 per cent over the quarter and declining 3.5 per cent in annual terms.

ANZ-Indeed Australian Job Ads rose 1.7 per cent month-on-month in January 2024 (seasonally adjusted). That increase followed an upwardly revised 0.6 per cent monthly gain in December 2023. ANZ said that the 2.3 per cent increase over the past two months indicates some stabilisation in the series after a period of steady decline over the previous 12 months, and as such signals on-going labour market resilience. Overall, the series is now down 15.5 per cent from its November 2022 peak but remains almost 40 per cent higher than pre-pandemic levels.

The ABS said that Australia’s merchandise trade balance in December 2023 was almost $11 billion (seasonally adjusted), down $0.8 billion from November’s outcome. Exports were up more than $0.8 billion (1.8 per cent) over the month, led by non-monetary gold, while imports rose by almost $1.7 billion (4.8 per cent), driven by parts for transport equipment.

The ANZ-Roy Morgan Consumer Confidence Index rose 1.3 points to an index reading of 83.8 for the week ending 4 February 2024. Roy Morgan said that the bump in expectations may reflect the public digesting the full details of the changes to the Stage 3 tax cuts. Even so, consumer confidence remained below 85 for a record 53rd consecutive week and is still well below the series average of 110.7. Weekly inflation expectations fell 0.2 percentage points to 4.9 per cent. With the single exception of one week in September last year, that’s the first weekly print with a four in front of it since early 2022.

Other things to note . . .

- How 31 Australian economists see interest rates and inflation over 2024. The average forecast is for the RBA to keep the cash rate target at near its current rate of 4.35 per cent until at least mid-year and then to cut only slightly to 4.2 per cent by year-end. Six of those surveyed expect further rate increases in the first half of this year, 20 predict no change, and three anticipate a cut. On inflation, the panel expects the headline inflation rate to ease from 4.1 per cent in the final quarter of last year to 3.5 per cent by the end of this year.

- From Treasury, the 2023-24 Tax Expenditure and Insights Statement provides estimates of revenue foregone from tax expenditures. A ‘tax expenditure’ refers to the situation where the tax treatment of a class of taxpayer or an activity differs from the standard (benchmark) treatment that would otherwise apply, and can include exemptions, some deductions, rebates and offsets, concessional tax rates applying to a specific class of taxpayers, and deferrals of tax liability. ‘Revenue foregone’ estimates then measure the difference in revenue between the existing treatment and the benchmark treatment. Importantly, they only capture the existing utilisation of a tax expenditure and do not adjust for any behavioural change that would likely arise from a change in / removal of an existing tax treatment. According to the 2023-24 figures, the largest estimates of revenue foregone are associated with the concessional taxation of employer superannuation contributions ($28.6 billion), Rental deductions ($27.1 billion), the Main residence exemption – Capital Gains Tax (CGT) discount component ($25 billion)* and Main residence CGT exemption ($22.5 billion)*, the concessional taxation of superannuation equity earnings ($20.1 billion) and the CGT discount for individuals and trusts ($19.1 billion). The report also includes distributional analysis of the beneficiaries of these tax expenditures. *Capital gains or losses on the disposal of the main residence are exempt from CGT to the extent it is used as a home. This effectively provides a 100 per cent exemption, which is presented in the report as split between a component reflecting the 50 per cent discount provided to individuals and trusts for disposals of non-main resident assets, and the remainder that brings the concession up to 100 per cent.

- Also from Treasury, the advice to the Government on amending the Stage 3 tax cuts to deliver broader cost-of-living relief.

- The Grattan Institute’s take on those revisions. It estimates that about 83 per cent of tax filers can expect to pay the same or less tax over the next decade than they would under the original Stage 3 cuts, despite the impact of bracket creep. But high-income earners will end up paying ‘considerably more’.

- Also from Grattan, an update on political donations and money in Australian politics.

- A new Productivity Commission research paper on making the most of the AI opportunity. And from the end of last year, the December 2023 Quarterly productivity bulletin.

- The PBO’s unlegislated measures tracker.

- From late last year, Resources and energy major projects:2023 and Resources and energy quarterly: December 2023.

- An FT Big Read on why central banks are reluctant to declare victory over inflation.

- A speech from the BIS General Manager on where we are on the journey towards price stability.

- The OECD’s Interim Economic Outlook February 2024 was released this week. The OECD reckons that global growth will slow to 2.9 per cent this year from 3.1 per cent in 2023, before picking up again to three per cent in 2025. That represents a 0.2 percentage point upgrade to growth this year relative to the forecasts that were presented in the OECD’s November 2023 Economic Outlook, with no change to the 2025 projections. Inflation is forecast to converge to target by 2025. For Australia, the OECD thinks real GDP will grow by 1.4 per cent in 2024 before accelerating to 2.1 per cent in 2025. Both forecasts are unchanged from OECD’s November 2023 numbers. Australia’s inflation rate is now expected to run at 3.5 per cent this year (up 0.1 percentage points from November’s forecast) and 2.8 per cent next year (unchanged).

- International-organisation-forecast completionists might also want to check out the IMF’s World Economic Outlook Update and the World Bank’s Global Economic Prospects, both released in January this year.

- The latest IMF Article IV Staff Report on China. The Fund expects growth will slow to 4.6 per cent this year from 5.4 per cent in 2023, due to ongoing weakness in the property sector (amid a further fall in real estate investment, continuing financial stress among developers, slowing fundamental demand for housing, and an inventory overhang) and soft external demand. Over the medium term, growth is expected to ease further due to structural headwinds from a shrinking population and weaker productivity growth, slipping to a rate of about 3.5 per cent by 2028.

- Brad Setser on China’s New Currency Playbook.

- The WSJ’s Greg Ip crunches some numbers on US-China trade decoupling. Would a 60 per cent tariff rate do the job?

- A new report form the McKinsey Global Institute on Geopolitics and the geometry of global trade.

- The Economist’s Free Exchange column thinks Joe Biden’s chances of re-election are better than they appear because the US economy will likely become more voter-friendly. And what a second Biden term might mean for the US economy.

- Why prediction markets aren’t good at politics.

- On the first 25 years of the Euro.

- Measuring the unintended consequences of public pension fund disinvestment from fossil fuels.

- The Peterson Institute’s Monica de Bolle on drought and the Panama Canal and the role played by Amazon deforestation.

- Two from the These Times podcast. The first is from last month and considers the War for the Red Sea. The second is from this week and reviews America’s Forever War in Iraq.

- Related, the Odd Lots podcast on how global shippers are dealing with the Red Sea crisis.

- The Prospect magazine podcast in conversation with economist Daron Acemoglu, their top thinker of 2024.

- Finally, the Macro Musings podcast talking to Mark Koyama about How the world became rich and the historical origins of economic growth.

Latest news

Already a member?

Login to view this content