Contrary to both last week’s prediction and the market consensus view, the RBA’s Monetary Policy Board (MPB) decided to leave the cash rate target unchanged at 3.85 per cent this week. That said, with Governor Michele Bullock repeatedly using her post-meeting press conference to stress that the decision was not about the direction of travel, but rather about timing, the likelihood is that a rate cut has only been deferred until next month’s MPB meeting.

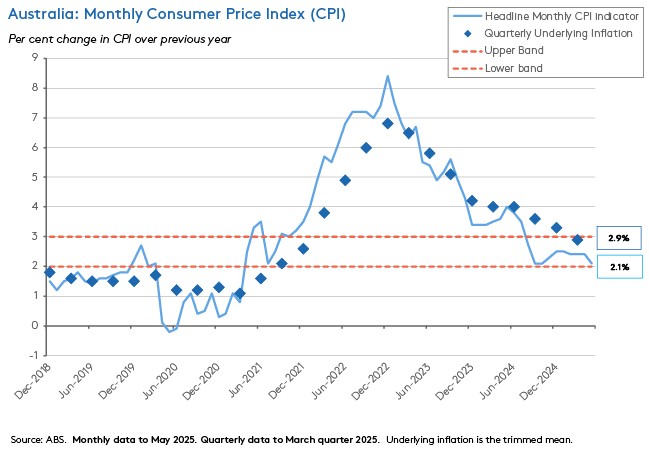

Although we got our call wrong, the MPB’s decision was not quite as big a surprise as some initial media commentary suggested. We’d previously noted that the decision wasn’t the slam dunk that market pricing seemed to assume. After arguing that a soft result in the form of the May 2025 monthly Consumer Price Index (CPI) Indicator should have ‘strong, positive implications’ for the probability of a rate cut this month, we also advised that ‘Australia’s central bank is careful about placing too much weight on what it sees as the ‘very volatile’ monthly Indicator. From Governor Bullock’s perspective, the RBA only gets ‘four readings on inflation a year’ with monthly readings offering only supporting evidence. So, there is still an argument for caution.’ According to her press conference in the aftermath of this week’s MPB meeting, many of us RBA-watchers had indeed placed a little too much weight on the ‘volatile’ monthly CPI Indicator. According to the Governor, the MPB voted to wait for the June quarter’s CPI result – due on 30 July – to better assess inflationary momentum in the economy. If it delivers a benign result that will set the Board up for a rate cut at the 11-12 August meeting.

That said, not all the nine-member MPB agreed with this approach. For the first time, this month the RBA published an unattributed record of votes at the Board meeting, revealing that while six members were in favour of the decision to hold, three voted against. And taking at face value the Governor’s repeated assertion that a rate cut is now only a matter of timing, we agree with the minority here: Why wait for August?

Unsurprisingly, the MPB meeting also discussed the international economic situation. Both the accompanying policy statement and the Governor’s press conference suggested that while the RBA remains concerned about global policy uncertainty, it now thinks the risk of a severe world economic downturn triggered by a trade war has retreated since the Board discussed the possibility of a bumper 50bp rate cut in its May meeting this year.

The international backdrop to that judgement is…interesting. On the one hand, US President Donald Trump has just extended another tariff deadline. The reciprocal tariffs he announced on ‘Liberation Day’ but then paused for 90 days on 9 April was due to come into effect on 9 July this week. Instead, Trump has pushed back the deadline by another three weeks to 1 August. On the other hand, this week also saw the President threaten new 50 per cent tariffs on copper (prompting US copper futures to register their biggest one-day move on record and surge to an all-time high) as well as trail the possibility of imposing tariffs of up to 200 per cent on pharmaceuticals. In addition, he dispatched a series of threatening tariff letters to targeted economies. Still, despite all the sound and fury, broader market reaction to all this trade noise remains muted, relative to the post-2nd April fallout earlier this year. In other words, the MPB’s call that markets no longer expect the severe trade war scenario to materialise is holding. The TACO (Trump Always Chickens Out) take appears to be alive and well, at least where trade policy is concerned, and at least for now.

However, the more muted the market reaction to tariff announcements becomes, the less effective will be concerns about potential adverse market reactions as a constraint on future trade policy moves. Or in more colourful market jargon - there’s a risk that the TACO trade ends up eating itself.

We flesh out the messages from this week’s MPB meeting in a little more detail below and review the latest Trump tariff news (albeit accompanied by an increasingly familiar sinking feeling that everything could have changed before AICD hits send on our weekly email). There is also a roundup of the rest of the week’s data and our usual linkage collection. And as always, comments and questions are welcome. A reminder too that for those readers who like to see the accompanying charts, if you click though to the web page version, you will find them all there.

Finally, the Economic Weekly Update will be taking a short break next week, but we should be back in your email the following Friday.

Board leaves cash rate target unchanged at 3.85 per cent

At its meeting on 8 July 2025, the RBA’s Monetary Policy Board (MPB) decided to leave the cash rate target unchanged at 3.85 per cent. The decision came as a surprise to financial markets and to most RBA-watchers. It also split the MPB. For the first time this month, the Board published an unattributed record of votes in the post-meeting statement. Accordingly, we know that this week’s policy decision involved a majority vote, with six members in favour and three against. (The MPB has nine members: three ex officio members comprising the Governor, Deputy Governor and the Secretary to the Treasury plus six non-executive members appointed by the Treasurer. These are currently Marnie Baker, Renee Fry-McKibbin, Ian Harper, Carolyn Hewson, Iain Ross and Alison Watkins.)

The move to publish votes is now enshrined in the revised Statement on the Conduct of Monetary Policy announced by the Treasurer this week and formally agreed by the MPB at this week's Board meeting. The revised Statement also includes another of the RBA Review’s transparency and accountability measures, noting that MPB members will be ‘expected to conduct at least one speech or public engagement each year’.

The communication accompanying this week’s decision said the Board was more comfortable waiting for more information – primarily the June quarter 2025 Consumer Price Index (CPI) reading due on 30 July – before delivering any further monetary policy easing. After May’s ‘confident’ rate cut, the MPB has returned to cautious mode.

While conceding that it still faces an uncertain economic outlook characterised by the presence of downside risks associated with both international trade policy and domestic economic conditions, the MPB’s statement also highlighted several areas of domestic economic resilience. In the Board’s view:

- Private domestic demand has shown signs of a gradual recovery (this despite the run of lacklustre monthly retail numbers we highlighted last week)

- Real household incomes have picked up

- Some measures of financial stress have eased

- Labour market conditions remain tight

- While wage growth has softened somewhat, productivity growth has not increased, leading to high growth in unit labour costs.

Two other factors were behind the MPB’s collective desire to ‘wait for a little more information to confirm that inflation remains on track to reach 2.5 per cent on a sustainable basis’.

First, the balance of opinion on the Board thinks the case for a rate cut this month places too much weight on the soft Monthly CPI Indicator for May 2025, which had reported the headline annual rate dropping to just 2.1 per cent. To some extent, this is because the RBA distrusts the Indicator itself, which it views as volatile and partial, and therefore as providing only an imperfect guide to ‘true’ inflationary momentum in the economy. A point we have made before. But according to Governor Bullock’s press conference it is also because the RBA saw causes for concern in the detail around housing costs and durable goods, which it reckons imply slight upside risks to the upcoming June quarter CPI result. Thus, according to this week’s statement:

‘While recent monthly CPI Indicator data suggest that June quarter inflation is likely to be broadly in line with the forecast, they were, at the margin, slightly stronger than expected.’

To the extent the monthly readings are of limited help, the governor explained the MPB had only a single quarter of underlying inflation sitting (just) within the target band to argue the case for another cut. Hence the desire to wait for that June quarter CPI print (see chart for a comparison of the recent history of the two series).

Second – and notable in the context of this week’s international news – the Board is now sounding a bit less concerned about the international environment than it was back in May, when it considered the case for a bumper 50bp rate cut in the aftermath of Liberation-day induced market carnage. Today, the (majority of the) MPB judges that the risk of a severe, trade policy-led downturn has receded somewhat:

‘While the final scope of US tariffs and policy responses in other countries remains unknown, financial market prices have rebounded with an expectation that the most extreme outcomes are likely to be avoided.’

Put all that together, and the Board arrived at the decision to leave policy unchanged:

‘With the cash rate 50 basis points lower than five months ago and wider economic conditions evolving broadly as expected, the Board judged that it could wait for a little more information to confirm that inflation remains on track to reach 2.5 per cent on a sustainable basis.’

One last point worth highlighting. During her press conference, the media quizzed the Governor over the RBA’s communications strategy, with the question being that since markets were so surprised by this month’s decision to hold, didn’t that indicate a central bank comms failure? The response was significant. The Governor effectively said that under new MPB arrangements, the scope for giving pre-meeting guidance to markets was now quite limited, as RBA management is unable to make strong assumptions about what independent MPB members will decide ahead of the Board meeting.

TACO on tariffs, again?

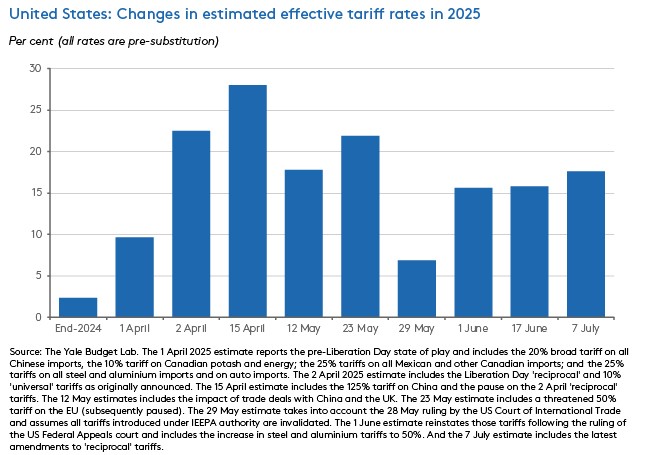

On 2 April this year, the Trump administration announced a near-universal tariff of 10 per cent on imports into the United States, along with higher ‘reciprocal’ tariffs (that are not really reciprocal) of up to 50 per cent on the more than 50 countries running what Washington deemed to be unacceptable bilateral trade balances. Both sets of tariffs went into effect on 9 April. Then, within a few hours, President Trump said he would pause reciprocal tariffs for 90 days, ostensibly to allow time for negotiations with trade partners but likely in response to an extremely negative financial market reaction. To date, negotiations (in one form or another - it’s not clear yet whether all these merit the description of a full agreement) have only concluded with three of the affected countries: the United Kingdom, China and Vietnam.

That deadline was due to expire on 9 July this week. But President Trump has now extended it, pushing it back by three weeks to 1 August. Earlier, his Treasury Secretary Scott Bessent suggested that trade action was unlikely to come before the US Labor Day holiday, due 1 September this year. Granted, Trump staged this retreat in the context of sending out multiple letters to trade partners, which in some cases introduced revised reciprocal tariff rates, where the latter included a mix of increases and reductions (including a sharp increase for Brazil from 10 to 50 per cent). He also promised tariffs of 50 per cent on copper from 1 August and of up to 200 per cent on pharmaceuticals, both of which are subject to ongoing Section 232 National Security investigations. Similar investigations into semiconductors, critical minerals, timber and lumber, trucks and commercial aircraft and jet engines are also underway, while increased section 232 tariffs on steel and aluminium of 50 per cent have already taken effect as have amended tariffs on the auto sector.

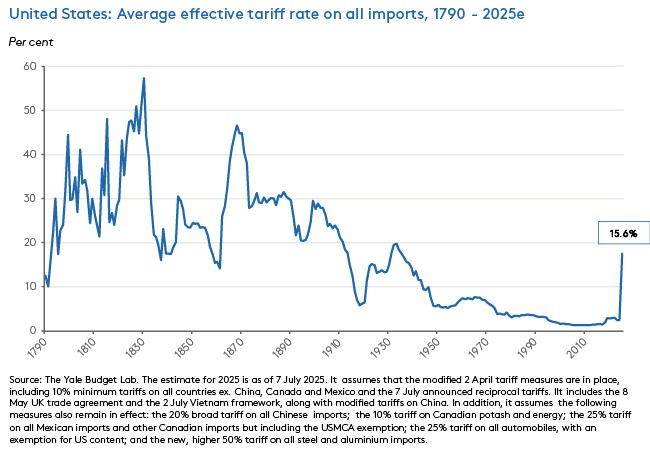

The Yale Budget Lab has been tracking the ever-changing impact of Washington’s trade policy moves this year on US effective tariff rates. The latest numbers consider the state of play as of 7 July and include the framework agreement with Vietnam and new tariff rates outlined in the 14 letters sent out earlier this week. They do not capture the proposed copper tariff or the latest adjustments to ‘reciprocal tariffs’ announced in the second bout of tariff mail. On that basis, the Budget Lab estimates that the overall US average effective tariff rate is now 17.6 per cent, the highest since 1934. After taking the potential impact of tariff-induced substitution effects into account, the Budget Lab puts the post-substitution effective rate at 16.5 per cent, the highest since 1936. By way of comparison, at end-2024 the effective tariff rate was just 2.4 per cent.

As the chart below highlights, the US effective tariff has swung dramatically over the course of this year as tariff pauses have come and gone, court rulings have shifted, trade deals have been negotiated and tariff coverage expanded. On the eve of ‘Liberation Day,’ the pre-substitution rate stood just below 10 per cent. The next day it jumped to more than 22 per cent. And following escalating tensions with Beijing it climbed again, approaching 30 per cent. While it has since retreated, the volatility has continued.

Meanwhile, after their initial horrified reaction to the 2 April 2025 tariff announcements, financial markets appear to have become increasingly sanguine regarding the sustained noise around US trade policy. Yes, there have been individual market shocks (this week saw dramatic moves in US copper futures and at the time of writing the Brazilian real had slipped against the US dollar in response to the threat of higher tariffs, for example). But to date, there has been nothing like the post- ‘Liberation Day’ fallout. So far, markets seem to buy the TACO thesis, although as noted above, there is a risk that this assumption could become self-defeating.

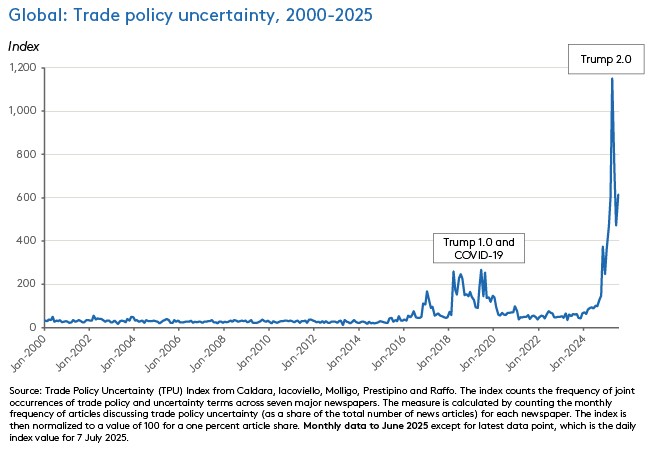

Trade policy uncertainty has also retreated from its ‘Liberation Day’ highs (seechart below). Nevertheless, it remains extremely elevated when compared with the entirety of the 2000 to 2024 period.

At these levels, uncertainty is likely to be taking a toll on economic prospects. As we noted last month, several official forecasters have already downgraded their projections for global economic growth this year and next. Meanwhile, early signs of disruption to trade and FDI have also started to appear. Import stockpiling is up, leading to rising storage costs and evidence of port congestion. And according to UNCTAD, the outlook for FDI in 2025 has turned negative, with early data showing record-low deal and project activity.

What else happened on the Australian data front this week?

According to the June 2025 NAB Monthly Business Survey, business conditions improved last month, with the business conditions index jumping by eight index points to a reading of +8 index points. There were large accompanying gains in the trading conditions and profitability subindices and a more modest gain for the employment measure. At the same time, business confidence rose three points to +5 index points, marking a third consecutive monthly increase. Capacity utilisation also rose for a second consecutive month and at 83.3 per cent is now above its long-term average, while a rise in forward orders took that indicator close to its long-run average. Finally, last month brought minor change in cost indicators. Labour cost growth edged down from 1.6 per cent (quarterly rate) in May to 1.5 per cent in June, while purchase cost growth rose from 1.2 per cent to 1.5 per cent over the same period. Growth in final product prices rose from 0.5 per cent to 0.6 per cent but retail price growth eased from one per cent to 0.6 per cent.

The ANZ-Indeed Australian Job Ads Index rose 2.9 per cent in June 2025, increasing from an index level of 114.8 in May to 116.9 last month, marking its highest level in 12 months (although the index remained in the same tight range of 114-117 that it has maintained since the middle of last year). The monthly increase was the strongest recorded since September 2024 and follows two consecutive months of decline.

The 13-industry aggregate for the ABS Monthly Business Turnover Indicator reported a 0.1 per cent monthly fall (seasonally adjusted) in May 2025, although this also corresponded to a 3.3 per cent increase over the year. The May result also marked the first fall in monthly business turnover since October last year. Five industries reported monthly declines, with the largest falls for Arts and recreation services (down 5.5 per cent with the Bureau highlighting an 11.2 per cent slump in gambling activities following an April increase), Manufacturing (down 1.3 per cent) and retail trade (down 0.8 per cent). The biggest monthly increases were for Electricity, gas, water, and waste services (up 1.7 per cent), Wholesale trade (up 1.1 per cent) and Accommodation and food services (up one per cent).

The ANZ-Roy Morgan Consumer Confidence Index rose 1.4 points to an index level of 88.6 for the week ending 6 July 2025. Four out the five subindices increased over the week, led by a 6.3-point jump in ‘current financial conditions’ and a three-point bounce for ‘medium-term economic confidence’. The only decline was for ‘time to buy a major household item’ which dropped six points, reversing some of its previous gains as end-of-financial-year sales wound down. Consumer confidence has now risen for three consecutive weeks, and the index is at its highest level since mid-May this year. Meanwhile, ‘weekly inflation expectations’ rose by 0.3 percentage points to five per cent.

Last Friday, the ABS said its Monthly Household Spending Indicator (MHSI) rose 0.9 per cent over the month (current prices, seasonally adjusted) in May 2025 to be up 4.2 per cent compared to May 2024. According to the Bureau, the monthly increase was the product of a 1.1 per cent increase in spending on discretionary goods and services, including clothing and footwear (up 3.7 per cent), transport (up 1.7 per cent), and dining out. Non discretionary spending rose by a more modest 0.5 per cent over the month. Seven of the nine spending categories that comprise the MHSI rose in May, with only Alcoholic beverages and tobacco (down 1.4 per cent) and Food (down 0.1 per cent) registering declines.

Other things to note . . .

- Let the guessing games begin: the AFR wonders which MPB members voted for a rate cut.

- Last Friday, Prime Minister Anthony Albanese gave a speech on Australia’s economic outlook in which he said the government’s primary focus was shifting ‘from bringing inflation down, to getting growth and productivity up’. Spruiking the upcoming roundtable in Canberra, the PM declared that ‘Tax reform will be an important part of this conversation, but not the whole of it,’ before going on to acknowledge the importance of the regulatory reform and ‘making it easier for business to create jobs, start and finish projects, invest in new technology and build new facilities. Some of this involves government doing less. Clearing away unnecessary or outdated regulation. Eliminating frustrating overlap between local, state, and federal laws’. The Q&A session is also available, during which the PM sounded lukewarm at best about the case for increasing the GST, commenting that ‘I'm a supporter of progressive taxation, consumption taxes by definition are regressive in their nature, so that's something that doesn't fit with the agenda.’

- The July 2025 RBA Chart pack.

- Also from the RBA, a speech by Deputy Governor Andrew Hauser on What Has Australian Macroeconomic Thought Achieved in the Past Century – and Where Can it Contribute in the Next? According to Hauser, the outlook for the global economy poses ‘fundamental questions’ for Australian macro ‘along at least three dimensions:’ (1) How will the composition and geography of export markets shift in response to evolving trade policies and geopolitical alliances, and what will this mean for market, pricing, and resource allocation? (2) How long will global commodity demand for ‘traditional’ minerals including coal, gas and iron ore persist, and will markets for ‘new economy’ minerals and renewable energy sources take their place? (3) How will these kinds of structural shifts change the shocks hitting the Australian economy and influence the nature of the policy response?

- And already noted above, but included here for completeness…the new Statement on the Conduct of Monetary Policy.

- The Productivity Commission (PC) has published the 2025 Trade and Assistance review. According to the PC, in 2023-24 Australian government trade and industry budgetary assistance increased by 3.9 per cent to $16.1 billion but stayed unchanged at as share of GDP at 0.61 per cent and in line with the median level over the last 28 year. Of that assistance, just over half (52.3 per cent) took the form of tax concessions, with budgetary outlays making up the balance. The PC also reported the results of trade policy modelling, which suggest that proposed US trade policy measures would likely have a small positive impact on Australian production in the long run. That is because: Australia could benefit from relatively low additional US tariffs on our imports relative to those imposed on many other US trading partners; we could benefit from lower import prices due to a global oversupply of imports previously sent to the US market; and we might be the recipients of capital outflows from the United States. However, the PC also warned that the negative effects associated with growing economic uncertainty would outweigh any minor positives.

- Related, PC deputy chair Alex Robson says Australian should respond to the Trump administration’s tariff threats by ‘continuing to embrace and advocate for free trade’ and refrain from any retaliation, since ‘imposing retaliatory tariffs will only lead to worse economic outcomes for Australia’.

- Grattan’s Alison Reeve says beware the classic industry policy trap.

- In the FT, Martin Wolf on the British malaise.

- A look at how tariffs propagate through domestic production networks.

- In the WSJ, Greg Ip on Trump’s ‘fiscal dominance’ play. The US administration’s tax cuts imply dramatic increases in government borrowing, which normally would see offsetting increases in (long term) interest rates. But Ip reckons Washington’s cunning plan is to break the link between budget deficits and interest rates by putting pressure on the Fed to cut rates while simultaneously shifting debt issuance towards short-term securities and Treasury bills. *Fiscal dominance characterises a situation where the central bank shifts its focus from inflation to financing the government. It does not have a good record.

- On monetizing primacy.

- Another case study of the Trump administration’s economic diplomacy: how US MNCs escaped the global minimum corporate tax.

- The OECD’s Employment Outlook 2025 focuses on the Demographic Crunch. According to the report, real wages are now growing ‘virtually everywhere’ in the OECD but remain below their early 2021 levels in about half of OECD countries. Looking further ahead, the report warns that in the absence of ‘decisive policy action’ the combined impact of a declining working age population and a rising old age dependency ratio will weigh significantly on GDP per capita growth over the medium term, with growth slowing by about 40 per cent in the OECD area over 2024-60 vs 2006-19.

- The Economist magazine considers China’s growth targets.

- An IMF explainer on how the Fund finances itself and why it matters for the world economy.

- A new Grattan podcast reviews the complications around Australia’s gas strategy.

- The FT’s Unhedged podcast canvasses three surprises that might spook markets. US profit downgrades, US-EU trade talks turning nasty, and a weak US bond auction. Also from the FT, the Martin Wolf-Paul Krugan series ended with a listener Q&A session. It has been enjoyable to listen to the two economic heavyweights, although at times a greater divergence in opinions would have been interesting.

- Ezra Klein talks to Kyla Scanlon about the attention economy.

- The Econtalk podcast asks, what is Capitalism?

Latest news

Already a member?

Login to view this content