As global financial markets track the uncertain progress of the Trump administration’s flagship tax and spending bill their Australian counterparts have been looking ahead to next week’s RBA meeting. (The US bill was still stalled in the House at the time of writing but we discussed the potential debt implications of an earlier iteration of the bill here).

After last week’s weaker-than-expected monthly inflation reading, we argued that a July rate cut was increasingly likely, albeit not quite the slam dunk that market pricing seemed to assume. This week brought another soft retail trade result, indicating that Australian households remain cautious on the spending front. Since the start of this year, the monthly retail print has come in below the consensus forecast in February, March, April and now May in a sign of persistent weakness in consumer spending. With the RBA tracking household consumption as one of the key domestic uncertainties sitting behind its economic forecasts, the continuing run of lacklustre results should add to the case for the Monetary Policy Board (MPB) to deliver a 25bp reduction in the cash rate target on 8 July. Plus, there is uncertainty around the looming 9 July 2025 deadline for Trump’s 90-day-pause on his 2 April ‘reciprocal tariffs’.

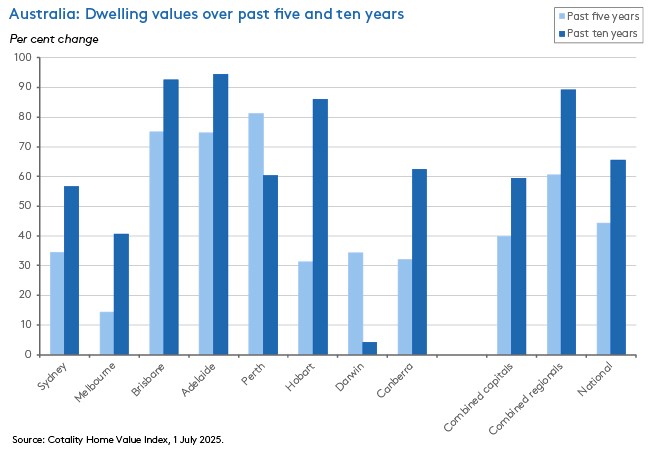

Meanwhile, the impact of the two 25bp rate cuts the RBA has already delivered this year, together with the prospect of more to come has been making itself felt in the Australian housing market. According to Cotality, national home values rose for a fifth consecutive month in June this year, with increases across all capital cities except for Hobart. The national and combined capitals indices both reached new peaks last month, as did dwelling values in Sydney, Brisbane, Adelaide, Perth, and Darwin. The old cliché about the Australian economy – that it is basically a quarry with a housing bubble attached – continues to resonate. With Canberra now contemplating measures to strengthen economic resilience and fiscal sustainability, that caricature – crude and (somewhat) unfair though it may be – should nevertheless resonate in upcoming discussions around building national economic resilience, setting the future of the tax base and beyond.

More on housing values and building approvals below, together with several supporting charts, as well as the regular data and linkage roundups.

Housing values up again in June 2025

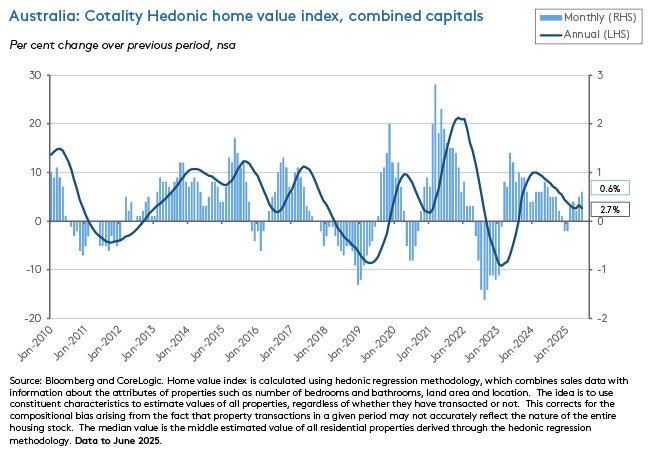

Australian housing values rose for a fifth consecutive month in June 2025, with the Cotality National Home Value Index rising 0.6 per cent over the month to stand 3.4 per cent higher in annual terms. The Combined capitals index was also up 0.6 per cent in monthly terms and rose 2.7 per cent year-on-year. Values increased over the month in all but one capital city. Gains ranged from 0.5 per cent in Adelaide and Melbourne and 0.6 per cent in Sydney to 0.7 per cent in Brisbane, 0.8 per cent in Perth, 0.9 per cent in Canberra and 1.5 per cent in Darwin. The one exception – Hobart – saw values fall 0.2 per cent.

According to Cotality, the RBA’s February 2025 rate cut was ‘a clear turning point for housing value trends’. Since then, May’s rate cut and the expectation of more to follow through the second half of the year have helped to propel sentiment. At the same time, however, the volume of home sales has remained relatively low, with housing turnover in H1:2025 running at an annualised pace of just 4.9 per cent compared to a decade average of 5.1 per cent. Advertised stock levels are also low, running at 16.7 per cent below their previous five-year average.

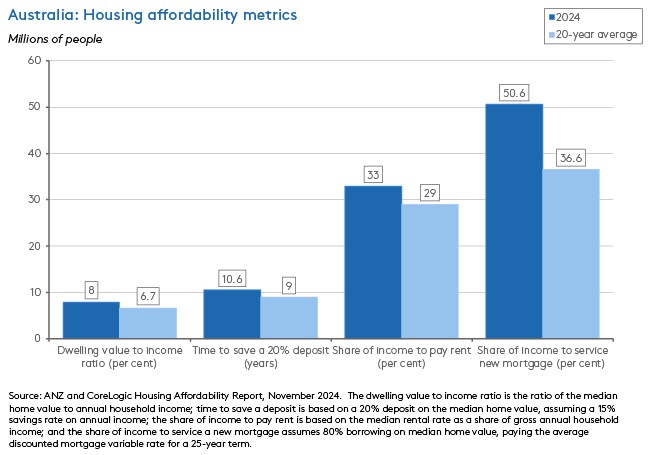

According to Cotality, rental growth has continued to slow, with the national rent index rising 1.3 per cent through the June quarter, marking the softest second quarter result since 2020. On an annual basis, national rental growth has eased from a peak of 9.7 per cent in November 2021 to just 3.4 per cent by June this year – the lowest reading since February 2021. This slowdown has happened despite vacancy rates remaining around the mid-one per cent range, which is well below their pre-pandemic five-year average of 3.3 per cent. Rental affordability is a key limiting factor here, with rental households estimated to be spending around one third of pre-tax income on rent. Slower rates of net overseas migration are another driver of softer rental growth.

Looking ahead, further rate cuts, a still-tight labour market and limited progress with lifting supply (see next story) all look set to support housing values. Pushing in the opposite direction are rising affordability constraints (see chart above), elevated levels of household debt and slowing population growth. Cotality also points to lending policies and regulations as another potential headwind for house prices.

Building approvals pick up in May

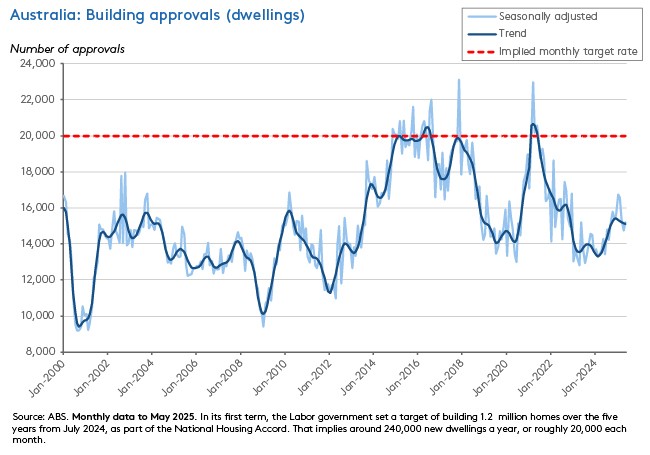

The ABS said the number of total dwellings approved rose 3.2 per cent over the month in May 2025 (seasonally adjusted) to 15,212, which was 6.5 per cent higher than the number of approvals in the same month last year. The market consensus forecast had anticipated a stronger four per cent monthly gain. At 9,454, approvals for private sector houses were up 0.5 per cent over the month and 3.4 per cent higher over the year. Approvals for private sector dwellings excluding houses (5,571) increased 11.3 per cent month-on-month and rose 11.9 per cent year-on year.

On a trend basis, approvals are currently running at just over 15,000 per month. Targets set by the National Housing Accord require an average monthly construction rate of around 20,000.

What else happened on the Australian data front this week?

The ABS said retail trade rose 0.2 per cent month-on-month in May 2025 (seasonally adjusted) to be up 3.3 per cent in year-on-year terms. That was a softer result than expected. The consensus forecast was for a 0.5 per cent monthly increase. According to the Bureau, retail spending in May was largely driven by a bounce back in Clothing, footwear, and personal accessory retailing (up 2.9 per cent) and department stores (up 2.6 per cent) after both had seen large falls in April. The ABS attributed the increase to purchases of winter clothing after people had earlier held off due to a warmer-than-usual April. Otherwise, households were restrained in their expenditure, with a monthly fall in food-related spending (down 0.2 per cent) and no change in household goods retailing. Food related spending dropped for the first time in 2025 due to a 0.4 per cent decline in food retailing, while turnover in Cafes, restaurants and takeaway foods services was unchanged.

Australia’s international goods trade balance (seasonally adjusted) fell from a surplus of $4.9 billion in April 2025 to a surplus of $2.2 billion in May 2025, a decline of around $2.6 billion. According to the ABS, goods exports were down $1.2 billion, driven by a $0.9 billion fall in exports of other mineral fuels, while goods imports were up $1.5 billion with imports of capital goods rising by $0.8 billion.

The ANZ-Roy Morgan Consumer Confidence Index rose 0.5 points to 87.2 for the week ending 29 June 2025. The subindices paint a mixed picture, with rises for ‘short term economic confidence’ (up 1.2 points), ‘medium term economic confidence’ (up 2.8 points) and ‘time to buy a major household item’ (up 3.9 points) largely offset by falls for ‘current financial conditions’ (down 4.9 points) and ‘future financial conditions’ (down 0.2 points). The second consecutive weekly jump in the ‘time to buy a major household item’ subindex took it up to its highest level since March 2022, boosted once again by end-of-financial-year sales. ‘Weekly inflation expectations’ were unchanged at 4.7 per cent, despite last week’s softer-than-expected inflation reading.

Other things to note . . .

- The June 2025 Resources and energy quarterly (REQ) reckons the outlook for Australian resource and energy commodity exports is moderately weaker than it was back in the March quarter of this year. The weakness is due to the impact of rising trade barriers on international economic activity. As a result, the REQ forecasts the value of these export earnings to fall from an estimated $385 billion in 2024-25 to $369 billion in 2025-26 and then to drop again to $352 billion in 2025-27. According to the REQ, iron ore prices will soften, reflecting the combined impact of robust growth in global supply and a more subdued outlook for world steel production, with the latter due to increased trade barriers and plans to wind back Chinese steel production to lift profitability. It also projects gas prices to ease slightly as new US and Qatari supply enters the global market (while cautioning that renewed violence in the Middle East could trigger price spikes, particularly if it disrupts shipping through the Strait of Hormuz). The REQ also thinks thermal coal prices will remain subdued as high levels of domestic coal production plus renewables work to limit import demand from China and India. In contrast, it has revised up the outlook for gold export earnings due to higher gold prices and strong demand from investors and central banks in an environment marked by elevated geopolitical and economic uncertainty.

- The e61 Institute highlights five ways in which Australia’s economy is exceptional. According to the authors, we have high population growth and one of the world’s largest construction industries; one of the smallest manufacturing industries in the developed world, the highest minimum wages in the developed world and a ‘uniquely complex’ awards system. Our government cash transfers are ‘exceptionally targeted’ at the poorest and we hold substantial private wealth, mostly in housing and superannuation, while also retaining access to large amounts of liquidity.

- A Grattan Institute Report on Saving the NDIS. Podcast version.

- The AFR on how Victoria is shaming other states on housing.

- On the relationship between interest rates and house prices.

- This new RBA Research Discussion paper examines the impact of household diversity (in terms of income and wealth) on how different types of economic demand and supply shocks such as changes in monetary policy, labour supply and firm profitability/ mark-ups influence economies.

- Insights from the ABS on migrant settlement outcomes.

- John Quiggin is sceptical about the ‘baby shortage’ thesis.

- The BIS Annual Economic Report 2025 has chapters on Sustaining stability amid uncertainty and fragmentation, financial conditions in a changing global financial system and the next-generation monetary and financial system. The BIS warns the anticipated soft landing for the global economy ‘suddenly seems more elusive’, arguing that ‘long-standing economic relationships that have sustained global prosperity for decades are now under strain’.

- Related, the FT’s Martin Wolf draws on the BIS report to warn of the risks of funding states via casinos.

- Also from the BIS, Maurice Obstfeld says the international monetary and financial system is at a fork in the road.

- The Economist magazine presents 10 charts to explain Trump’s big, beautiful bill.

- From the same source, the dream scenario for prediction markets.

- Another new e-book from the CEPR. This one is on the state of globalisation.

- According to the World Investment Report (WIR) 2025, last year global foreign direct investment (FDI) inflows fell 11 per cent to US$1.5 trillion, marking a second consecutive year of decline.* The WIR also reckons the outlook for FDI this year has turned negative. It cites escalating trade tensions, geopolitical fragmentation and economic volatility as leading to sharp downward revisions for most FDI projections, with early 2025 data showing record-low deal and project activity. (*In fact, headline flows increased by four per cent but according to the WIR, this was inflated by ‘volatile financial flows through several European economies with high levels of conduit flows. When these are excluded, global FDI flows in fact declined by 11 per cent on a like-for-like basis.’)

- The WSJ reckons China is quickly eroding the US lead in AI.

- The latest IMF country report on Ukraine.

- Goldman Sachs on the future of European Defence.

- The Atlantic Council’s Freedom and Prosperity Indexes 2025.

- Capitalism’s Next Act: Brad DeLong offers his thoughts on John Cassidy’s new book, Capitalism and its Critics.

- Betting on catastrophe.

- The Macro Musings podcast talks to Mark Blyth about winners and losers from inflation.

- The latest in the Past Present Future’s history of bad ideas series: Meritocracy.

- How to be a Super Ager.

Latest news

Already a member?

Login to view this content