Last week’s note argued that in the context of an RBA that was sounding more hawkish the key deciding factor for a potential 7 November hike in the cash rate would be this week’s September quarter 2023 inflation reading. Well, now we have those numbers. And while the general trend of ongoing disinflation from the December quarter 2022 peak did continue into the third quarter of this year, the pace of that disinflation has proven to be a disappointment.

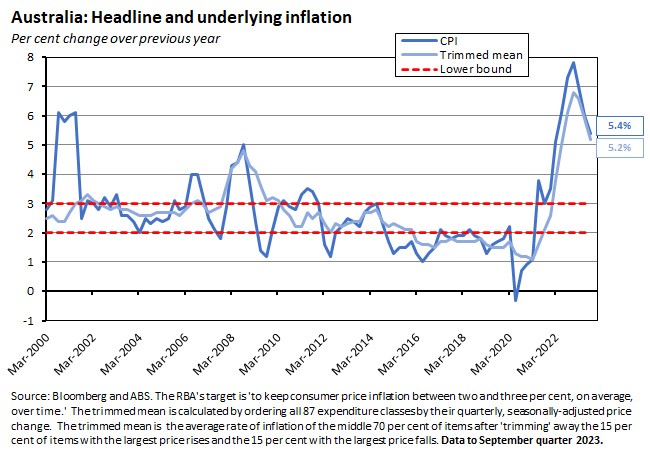

Yes, the headline rate of inflation eased from six per cent in Q2:2023 to 5.4 per cent in Q3:2023 while underlying inflation decelerated from 5.9 per cent to 5.2 per cent. But both headline and underlying inflation printed above market expectations – for 5.3 per cent and five per cent outcomes, respectively. Part of the story here was the impact of higher global oil prices on the price of automotive fuel. But the housing sector also continued to add to inflationary pressures, particularly due to high rental price inflation. Services inflation overall, while down slightly in annual terms, remained stubbornly high.

This week’s new inflation numbers also followed hard on the heels of Michele Bullock’s first speech as RBA Governor. She used that address to reinforce the hawkish message from last week’s RBA Minutes, reminding listeners that Martin Place ‘has a low tolerance for allowing inflation to return to target more slowly than currently expected’ and that the Board would ‘not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.’

Given that this week’s inflation numbers make it look difficult for the RBA to meet its current end of year inflation projections, it is now more likely than not that the RBA will feel compelled to deliver another 25bp rate hike at next month’s monetary policy meeting. Market pricing and most market economists seem to concur; the consensus view is now that, ending a four-month pause, Australia’s central bank will increase the cash rate target in November for the first time since June this year.

More detail on the inflation numbers and Governor Bullock’s speech below, along with a review of the latest PMI readings and a look at the International Energy Agency (IEA) and their new World Energy Outlook.

Inflation higher than expected in the September quarter 2023

The ABS said that Australia’s Consumer Price Index rose 1.2 per cent over the quarter and 5.4 per cent over the year in the September quarter 2023. While that meant that the annual rate of headline inflation fell for a third successive quarter, the Q3:2023 outcome came in above market expectations for a 1.1 per cent quarterly and 5.3 per cent annual print.

Similarly, while the annual rate of underlying inflation – as measured by the RBA’s preferred measure, the trimmed mean – also fell for third consecutive time, the outcome was once again stronger than the consensus forecast. The trimmed mean rose 1.2 per cent over the quarter and 5.2 per cent over the year compared to consensus forecasts for a one per cent quarterly increase and a five per cent annual rate.

The largest contributions to the quarterly increase in consumer prices came from the housing group (up 2.2 per cent over the quarter due to rises in rents, new dwelling construction costs, property rates and utilities) and the transport group (up 3.2 per cent due to increase in automotive fuel prices and other motor vehicles services).

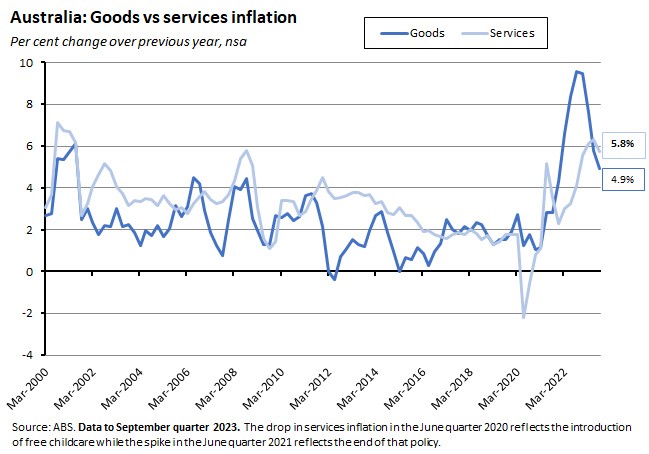

By broad category, the annual rate of goods price inflation eased from 5.8 per cent in the June quarter of this year to 4.9 per cent in the September quarter while the rate of services price inflation moderated from 6.3 per cent to 5.8 per cent – the first decline for the latter since the December quarter of 2021.

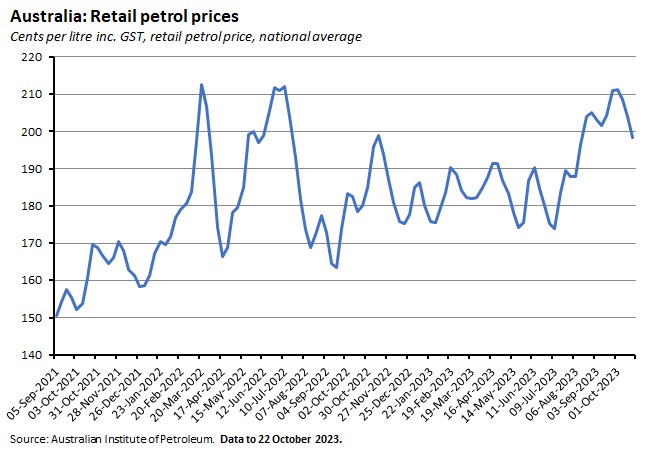

On a quarter-on-quarter basis, however, goods price inflation accelerated in Q3:2023, with prices rising 1.2 per cent (up from 0.9 per cent in the June quarter). The main drivers were automotive fuel prices (up 7.2 per cent in the largest quarterly rise reported since March 2022, mainly reflecting higher global oil prices), electricity prices (up 4.2 per cent as higher wholesale prices were passed on to consumers following the annual price review in July – and significantly offset by Energy Bill Relief Fund rebates: in their absence, the ABS said electricity prices would have soared by 18.6 per cent) and prices for new dwellings (up 1.3 per cent over the quarter). Food prices (up 0.6 per cent) saw their softest quarterly rise since the September quarter 2021.

The quarterly pace of services inflation also accelerated, increasing from 0.8 per cent in the June quarter to one per cent in the September quarter. Rents were a big driver here: they rose 2.2 per cent over the quarter (down from 2.5 per cent in June, partly due to the impact of an increase in the maximum rate for Commonwealth Rent Assistance with effect from 20 September 2023 – the ABS noted that this was the largest increase in 30 years and subtracted 0.3 percentages points from the rate of increase). On an annual basis, rental prices were up 7.6 per cent, recording their largest rise since 2009. The Bureau also reported that changes to the Child Care Subsidy that took effect from 10 July this year led to a quarterly fall of 13.2 per cent in childcare costs.

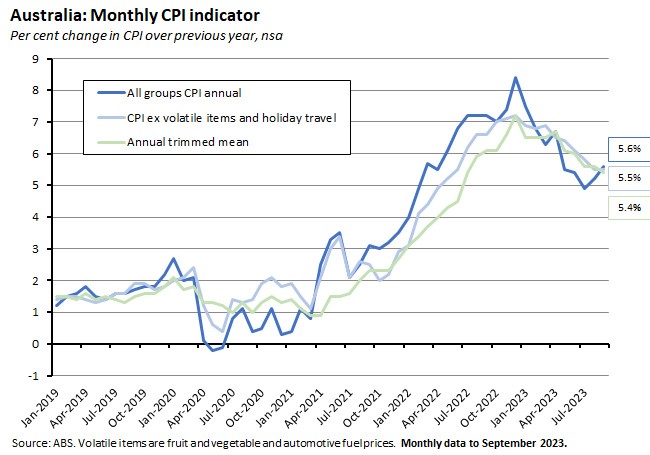

The ABS said that the Monthly Consumer Price Index indicator rose 5.6 per cent over the year to September 2023. That was the second month of accelerating inflation (the monthly indicator had already increased to 5.2 per cent in August this year up from 4.9 per cent in July). Markets had anticipated a smaller increase last month in the form of a 5.3 per cent print.

The most important drivers of the rise in the monthly indicator were increases in new dwellings (up 4.9 per cent), automotive fuel (up 19.7 per cent), rents (up 7.6 per cent) and tobacco (up 7.5 per cent). The monthly trimmed mean measure of inflation was down from August, easing from 5.6 per cent to 5.4 per cent, while the CPI excluding volatile items and travel was unchanged at 5.5 per cent.

Preparing the ground for a rate hike?

Michele Bullock delivered her first speech as RBA Governor this week, speaking on Monetary Policy in Australia: Complementarities and Trade-offs. Probably the most significant near-term implication of the speech was the re-emphasis on the hawkish message from last week’s RBA minutes that Martin Place had ‘a low tolerance for a slower return of inflation to target than currently expected.’ This week, Governor Bullock said:

‘Our focus remains on bringing inflation back to target within a reasonable timeframe, while keeping employment growing. It is possible that this can be done with the cash rate at its current level, but there are risks that could see inflation return to target more slowly than currently forecast. The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.’ [emphasis added]

As discussed above, this week’s upside surprise in the September quarter 2023 CPI print would seem to meet that criteria, as it threatens a slower pace of disinflation than the one implied by the forecasts presented in the August 2023 Statement on Monetary Policy, which had the headline rate of annual CPI inflation falling from six per cent in the June quarter to 4.25 per cent by the December quarter of this year and the rate of underlying inflation (as measured by the trimmed mean) falling from 5.9 per cent to four per cent over the same period.

A potentially important complicating factor here is that a significant driver of the increase in the quarterly inflation momentum in Q3:2023 was related to a sharp increase in automotive fuel prices. That is, it was a product of global supply shocks that have driven up the price of oil. In her speech, Bullock discussed this issue, noting that:

‘If a supply disruption is transitory and modest, monetary policy should mostly ‘look through’ it. By contrast, when the shock has a longer lasting effect on the economy and inflation, or there are a series of supply shocks in one direction, there are stronger grounds for monetary policy to respond.’

She then highlighted the key role of inflationary expectations in this decision:

‘When households and businesses have a high level of confidence that the Board will do what is needed to return inflation to target, we can afford to look through a greater share of negative supply shocks – even those that will last for a lengthy period. Of course, there are limits here. The longer a central bank permits inflation to remain outside target, the more likely it is that inflation expectations will shift. And if they do, it will require even higher interest rates and unemployment to bring inflation back to target.’

Driving home the point on inflation, Bullock concluded this section of her speech with another call back to last week’s minutes, repeating:

‘…the Board has been clear that it has a low tolerance for allowing inflation to return to target more slowly than currently expected.’

A few other points of note from her speech:

- Governor Bullock again asserted that with respect to the labour market and the Government’s ambitions regarding full employment, the RBA’s and Canberra’s objectives ‘are complementary. But we…have different time horizons to work with.’

- While the non-accelerating inflation rate of unemployment (NAIRU) is useful in helping to gauge what labour market outcomes are consistent with full employment and on-target inflation, Bullock emphasised that the concept ‘is only a starting point’ and ‘doesn’t capture all of the relevant information…Other factors – such as how broader measures of underutilisation are evolving relative to unemployment, trends in wage-setting mechanisms and mobility and, importantly, wage and inflation outcomes’ are also important.

- In the context of the RBA’s financial stability objective, the central bank has been monitoring how households have responded to higher inflation and interest rates. Echoing some of the messages in the October 2023 Financial Stability Review, the Governor noted that despite the challenging economic environment most Australian households have remained resilient. She observed that the negative impact of inflation on the spare cashflows of low-income households had on average been offset by stronger growth in labour income for those on lower incomes, and similarly, pointed out that the spare cash flows of renters had also risen on average as high inflation and rising rents have been more than offset by growth in incomes. However, on average, households with a mortgage have experienced a significant decline in spare cash flows, although the most exposed here a relatively small (about five per cent of variable rate borrowers) group of highly leveraged households.

Flash PMI estimates suggest business activity fell this month

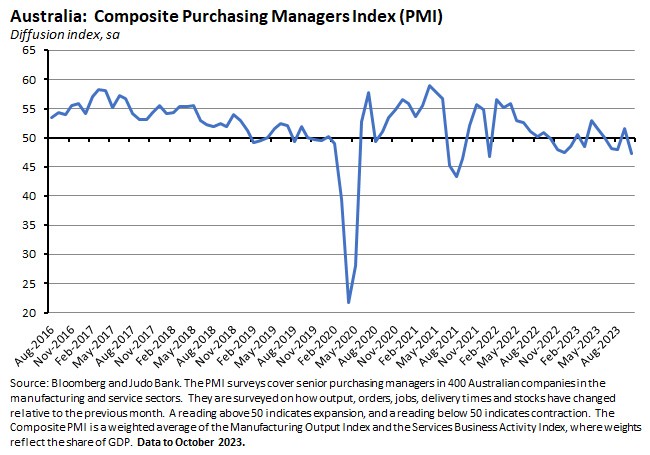

The Judo Bank Flash Australia Composite PMI fell to 47.3 in October 2023, down from 51.5 in September, taking the index to a 21-month low. This was the third time in the past four months that the Compositive Index has been below 50, indicating a contraction in business activity.

Output was down in both the manufacturing and services sectors this month. The Flash Australia Services PMI Business Activity Index fell to a ten-month low of 47.6 (down from 51.8 in September) while the Flash Australia Manufacturing Output PMI fell to a 41-month low of 45.6 (down from 49 in September). At the same time, however, the employment index remained above 50 and in expansionary territory, indicating that employers were still intending to expand their workforces, even in the face of softer output.

The PMI survey also reported that input costs ‘continued to rise rapidly,’ with the rate of increase climbing to a three-month high on the back of a rise in fuel costs pushing up input prices. Services providers also highlighted rising wages while other cost pressures include raw materials and insurance. Output prices also increased this month but were reportedly constrained by weaker customer demand, contributing to the lowest rate of charge in this measure of inflation since March 2021.

The IEA on the state of the world’s energy system

The IEA published its World Energy Outlook 2023 this week. Points of note include:

- Global investment in clean energy has risen by 40 per cent since 2020, powered by a combination of emissions reduction, energy security concerns and industrial strategies as well as a desire for more green jobs.

- The IEA highlights rapid changes for EVs and solar PV capacity. EV car sales as a share of the total have risen from 1 in 25 in 2020 to 1 in 5 this year, while the world is now spending more than US$1 billion a day on solar deployment.

- According to the IEA’s Stated Policies Scenario (STEPS)*, the average annual growth rate in total energy demand to 2030 is expected to be 0.7 per cent, or around half the rate of demand growth of the last decade. Under this scenario, global demand for coal, oil, and natural gas will peak before 2030.

- The US Inflation Reduction Act means that under STEPS, 50 per cent of new US car registrations will be EVs by 2030.

- Renewables are projected to contribute 80 per cent of new power capacity to 2030 in the STEPS, with solar PV alone accounting for more than half.

- Starting from 2025, the IEA expects ‘an unprecedented surge in new LNG projects’ (more than half in the United States and Qatar) which will ease prices and gas supply concerns and lead to a ‘glut of LNG’.

- The IEA also sees three interlinked risks to the global energy transition: risks to affordability, to electricity security, and to the resilience of clean energy supply chains.

- It also warns that ‘any deterioration in geopolitical tensions would undermine both the prospects for energy security and for rapid, affordable transitions.’

- Under STEPS, the world is projected to see a peak in energy-related CO2 emissions in the mid-2020s, but this will still leave emissions high enough to push up global average temperatures by around 2.4C in 2100, implying ‘very widespread and severe impacts from climate change.’

*The IEA’s World Energy Outlook uses three scenarios to consider the medium- to long-term outlook. The Stated Policies Scenario (STEPS) is ‘designed to provide a sense of the prevailing direction of the energy system progression based on a detailed review of the current policy landscape.’ It therefore represents a more conservative scenario than the Announced Pledges Scenario (APS) which ‘illustrates the extent to which announced ambitions and targets can deliver the emissions reductions needed to achieve net zero emissions by 2050.’ The difference between the STEPS and the APS is the ‘implementation gap’ that would need to be closed for countries to meet their announced decarbonisation targets. The Net Zero Emissions by 2050 Scenario (NZE) is ‘a normative scenario that shows a pathway for the global energy sector to achieve net zero CO2 emissions by 2050’ which is consistent with limiting the global temperature rise to 1.5C with at least a 50 per cent probability. The difference between the APS and the NZE is the ‘ambition gap’ that would need to be closed if the world was to meet the goals of the Paris Agreement to achieve net zero emissions by 2050.

What else happened on the Australian data front this week?

The ABS said that Australia’s export price index fell 3.1 per cent over the quarter and 10.7 per cent over the year in the September quarter 2023, while the import price index rose 0.8 per cent quarter-on-quarter but was down 2.4 per cent in annual terms. The Bureau highlighted a 7.1 per cent quarterly drop and a 16.8 per cent annual fall in prices for rural exports – the latter the largest annual decline since the December quarter 2009 – along with falls in lithium prices (due to rapid increases in global supply) and large swings in thermal coal prices.

The ANZ-Roy Morgan Consumer Confidence Index rose 1.8 points to an index reading of 78.2 for the week ending 22 October 2023. Confidence rose among homeowners (up 2.3 points) and those paying off a mortgage (up 3.6 points) but fell among renters (down 1.7 points). Roy Morgan noted that the index has now spent 38 consecutive weeks below 85 which is the longest such run since 1990-91. ANZ highlighted the rise in the ‘time to buy a household item’ subindex to its strongest level since early June, noting that it might reflect elevated discounting in the retail sector. Weekly inflation expectations rose to 5.7 per cent – their highest since early June this year – which ANZ said could be due to the recent bout of high petrol prices.

New ABS data on the labour force status of families. According to the Bureau, there were 7.5 million families in June 2023, of which 1.4 million (18.9 per cent) were jobless.

Other things to note . . .

- Summary of the October 2023 Deloitte Access Economics Business Outlook, which reckons that ‘Australia’s economy remains on a knife edge’, but that despite the economy already being in a ‘retail recession’ and a ‘per capita income recession’ thinks that it will survive 2023 without falling into a full-blown, formal recession.

- John Quiggin largely welcomes the decision to overturn Victoria’s EV tax since it neglected the economics of the second best and Marion Terril makes the case for congestion charges but Jago Dodson says the High Court ruling will make charging for road use very difficult.

- From the Lowy Interpreter, Steve Grenville on how Australia should react to Bidenomics.

- Peter Mares reports on the views from this month’s National Housing Conference.

- The AFR bids farewell to Max Corden, one of Australia’s most influential economists. Some thoughts on Corden from Vijay Joshi in the FT.

- Also from the AFR, why financial markets have been calm in the face of geopolitical turbulence.

- Two FT Big Reads this week, one on Ten Years of China’s Belt and Road and one on The return of the rice crisis.

- This Peterson Institute Policy Brief considers food insecurity and the world trading system.

- The OECD’s International Migration Outlook 2023 says that both international migration flows to OECD countries and labour market outcomes of immigrants are at record highs.

- Research from RAND on how technology and AI have affected US jobs in recent decades.

- Evidence from the Eurozone on the asymmetric effects of weather shocks on inflation. The authors reckon that as climate change brings more frequent and more severe weather shocks, the volatility of inflation could increase, while hotter summers could lead to more frequent and persistent upward pressure on inflation.

- Economic growth, population ageing and the need to adjust conventional measures of ‘working age,’ perhaps by shifting from the current ‘retrospective approach’ that relies on years lived since birth to a ‘prospective’ old age threshold defined as the age at which remaining life expectancy falls below 15 years. The latter increases with longevity and is correlated with mortality, physiological ageing, body strength and cognitive ability. Using this approach suggest that OECD countries are relatively ‘younger’ and non-OECD countries ‘older’ than using the traditional retrospective approach.

- The Economist magazine on the age of the hermit consumer.

- Tyler Cowen on what economists do and don’t know about macroeconomics.

- A look back to the 1973 oil price shock and the consequent Oil Revolution.

- The WSJ says the classic 60-40 investment strategy has just suffered its worst year in generations.

- The Global Tax Evasion Report 2024 (pdf) reckons that offshore tax evasion has declined by a factor of three over the last ten years, largely thanks to the automatic exchange of bank information. At the same time, however, a ‘growing list of loopholes' that have been applied to 2021’s global minimum tax on multinationals has reduced expected revenues by a factor of two. It also estimates that global billionaires have effective personal tax rate of between 0 and 0.5 per cent of their wealth – far lower than all other population groups.

- Lessons from economic history on Central Bank Digital Currency.

- The 2023 Per Jacobsson Lecture: Building resilience in uncertain times (IMF podcast).

- The Odd Lots podcast asks, what’s standing in the way of a (US) nuclear renaissance?

Latest news

Already a member?

Login to view this content