After four months of an unchanged cash rate target, attention is increasingly focused on the upcoming 7 November 2023 Reserve Bank Board Meeting, when market participants reckon there is now a decent chance (somewhere between one-in-three and one-in-four at the time of writing) that the RBA will choose to deliver its first interest rate hike since June.

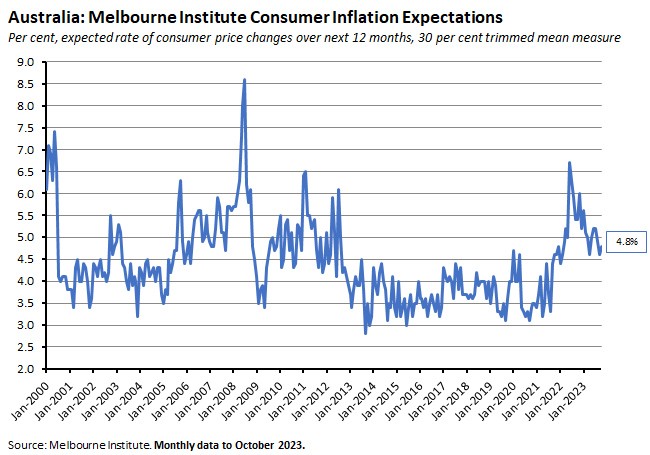

Support for that hypothesis came in this week’s release of the Minutes of the 3 October 2023 Monetary Policy Meeting. While much of the content trod familiar ground, the Minutes did sound a more hawkish note than their recent predecessors, emphasising that ‘The Board has a low tolerance for a slower return of inflation to target than currently expected.’ (Recall that in the August 2023 Statement on Monetary Policy (SOMP) the RBA forecasts had the headline rate of CPI inflation falling from six per cent in the June quarter to 4.25 per cent by the December quarter of this year, with underlying inflation as measured by the trimmed mean falling from 5.9 per cent to four per cent). The Minutes also flagged that in terms of the data flow, Martin Place would be paying close attention to upcoming news on activity, the labour market and inflation.

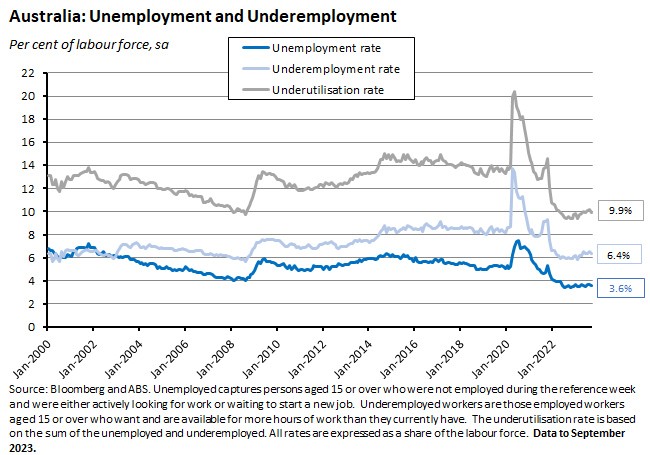

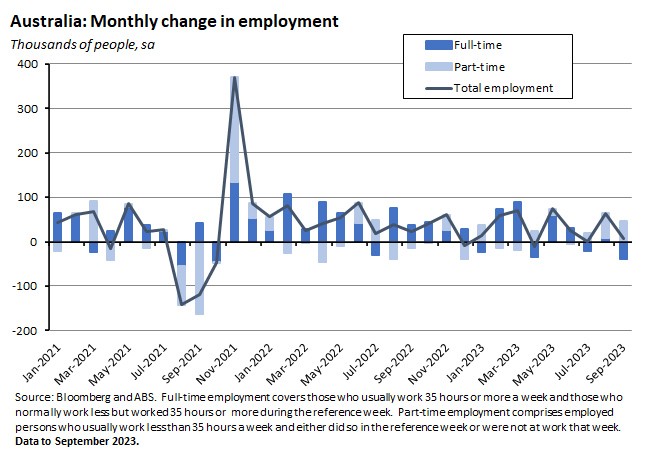

On its own, this week’s release of the September 2023 Labour Force numbers looks unlikely to sway the RBA’s thinking. Granted, falls in the headline unemployment rate as well as in the underemployment rate confirmed that the Australian labour market remains extremely tight in absolute terms. But that message was balanced by declines in the participation rate, in the employment to population ratio and in hours worked, all of which pointed to a degree of labour market easing, as did a weaker than expected increase in employment.

That means the key data to watch will be the inflation numbers, due to be published by the ABS next Wednesday. After printing at six per cent in the June quarter this year, early market estimates expect the headline CPI inflation rate to fall to comfortably less than 5.5 per cent in the September quarter (the monthly indicator ran at 4.9 per cent in July and 5.2 per cent in August). The annual rate of underlying inflation is also expected to ease from 5.9 per cent in Q2:2023 to around five per cent in Q3:2023. Those kinds of numbers would leave inflation on track to hit the RBA’s August SOMP projections. But any significant upside surprise would trigger expectations for an RBA rate hike come November.

RBA minutes sound a more hawkish note

The Minutes of the 3 October 2023 Monetary Policy Meeting of the Reserve Bank Board provided some additional background to the central bank’s decision to leave the cash rate target unchanged for a fourth consecutive month. Once again, they reported board members weighing up the relative merits of a 25bp rate hike versus extending the monetary policy pause. And once again, many of the arguments advanced for both positions were similar to those rehearsed at previous meetings.

So, according to the Minutes, the case for an increase was supported by: international evidence that core services inflation remained persistent; monthly CPI data suggesting that domestic progress in lowering services price inflation also remained slow; the expectation that higher petrol prices would support inflation over coming months and perhaps influence inflationary expectations; the impact of the wealth effect of higher house prices on household spending; the possibility that rising house prices were signalling a monetary policy stance that wasn’t as tight as the RBA had previously thought; and the inflationary impact of a weaker Australian dollar.

On the other hand, the case for leaving rates unchanged was supported by: the size of the policy tightening already delivered; the still-to-be-felt-in-full lagged effects of those previous rate increases; the retreat of inflation from its December 2022 peak; weak consumption growth and falling real household disposable incomes; the judgement that the Australian labour market ‘had reached a turning point’ based on a rising underemployment rate as well as recent falls in vacancy rates and voluntary turnover rates; and growing downside risks associated with China’s economic outlook.

After weighing up the two sets of arguments, the Board came to a familiar conclusion as:

‘…members agreed that the case to leave the cash rate target unchanged at this meeting was the stronger one. They concluded that there had not been sufficient new information over the preceding month from economic data or financial markets to necessitate an adjustment in the stance of monetary policy.’

Importantly, however, the Minutes also sounded more hawkish than some of their predecessors, reporting that:

‘…members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected.’ [emphasis added]

In deciding whether the current pace of disinflation remains in line with the RBA’s aims, the Minutes highlighted that before the next monetary policy meeting on 7 November, the RBA will have received new data on economic activity (September retail sales are published on 30 October), inflation (the September quarter 2023 CPI and the September monthly CPI indicator are published on 25 October) and the labour market (this week’s September reading, discussed below). The RBA will also update its own forecasts ahead of the 10 November release of the latest SOMP.

With this week’s labour force numbers unlikely to tip the balance either way, it will be the upcoming inflation numbers in particular – as well as any significant developments in the world economy such as more upward pressure on oil prices – that will determine whether the RBA extends its policy pause for a fifth consecutive time next month.

Other points of note from the Minutes:

- The RBA sees ‘a still-high level of demand and a range of domestic cost pressures, including for labour’ driving services inflation.

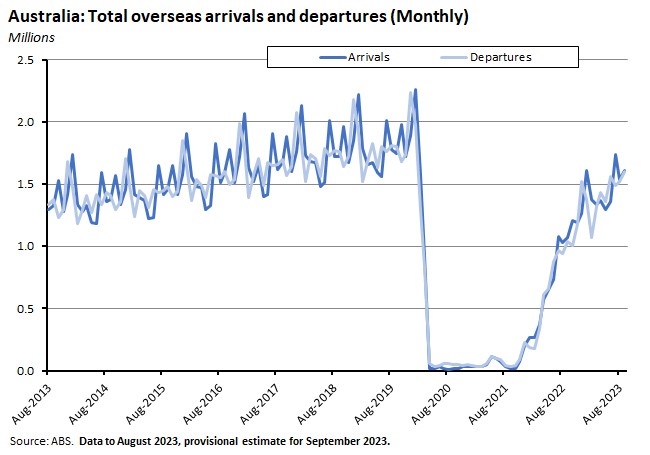

- It thinks that ‘still-tight conditions in the rental market’ mean that rents will be ‘an ongoing source of inflationary pressure over the year ahead.’

- While the RBA sees ‘few signs of the risk of a price-wage spiral materialising’ it also warns that rising labour costs and ‘poor productivity outcomes’ have combined to produce ‘strong growth in unit labour costs.’

Unemployment rate eases to 3.6 percent in September 2023

The ABS said that Australia’s seasonally adjusted unemployment rate fell from 3.7 per cent in August 2023 to 3.6 per cent last month, as the number of unemployed people dropped by 19,800. The market consensus had expected a 3.7 per cent print.

The underemployment rate also fell, dropping by 0.2 percentage points to 6.4 per cent. As a result, the overall underutilisation rate fell 0.3 percentage points to 9.9 per cent. The Bureau noted that while this was 0.3 still percentage points higher than the September 2022 reading it was also a full four percentage points lower than the pre-pandemic March 2020 result.

According to the ABS, the fall in the unemployment rate last month was mostly due to an increase in the share of people moving from being unemployed to being not in the labour force, with the participation rate falling 0.2 percentage points to 66.7 per cent in a retreat from August’s record high. The employment to population ratio also declined in September, dropping 0.2 percentage points to 64.4 per cent.

The increase in the number of employed people was a modest 6,700 (up by less than 0.1 per cent) with full-time employment falling by almost 39,900 but part-time employment growing by more than 46,500. Overall, that was a softer employment outcome than market economists had predicted: the median forecast had called for employment to rise by 20,000 in September.

Meanwhile, hours worked in all jobs fell by eight million hours (down 0.4 per cent over the month) although they were still up 2.9 per cent relative to September 2022.

Overall, this was a mixed Labour Force report. On the one hand, declines in the unemployment, underemployment and underutilisation rates all indicate that labour market conditions remained extremely tight last month. On the other, falls in the participation rate, in the employment to population ratio and in the number of hours worked, along with the smaller than expected rise in employment, are together consistent with a degree of labour market easing. All up, the net impact of the September labour force figures is unlikely to be sufficient to generate a significant shift in the RBA’s calculations ahead of next month’s monetary policy meeting.

What else happened on the Australian data front this week?

The ABS said that total dwelling commencements fell 11.8 per cent to 40,720 dwellings in the June quarter of this year (seasonally adjusted). Commencements were down 15.4 per cent compared to the same quarter in 2022. New private house commencements fell 6.6 per cent over the quarter while new private other residential commencements dropped 19.6 per cent. Dwellings under construction fell 1.4 per cent to 237,779 dwellings in the June quarter. New houses accounted for 101,820 of the dwellings under construction.

The ANZ-Roy Morgan Index of Consumer Confidence fell 3.7 index points to a reading of 76.4 in the week ending 15 October 2023, reflecting falls in all the subindices led by a 5.6 point drop in ‘current financial conditions’ and a 4.8 point drop in ‘future financial conditions.’ Weekly inflation expectations rose 0.2 percentage points to 5.3 per cent.

The ABS said that there were 300,684 registered births in Australia in 2022, a fall of three per cent from 2021. The total fertility rate fell to 1.63 from 1.7 in 2021. That compares to a replacement rate of around 2.1, excluding any impact from net overseas migration. (Australia’s total fertility rate has been below the replacement rate since 1976.) The Bureau also highlighted a significant increase in the fertility rate for women in their late 30s and early 40s in line with a steady shift to older parenthood. According to the ABS, in 1975 less than 20 per cent of births were to mothers aged between 30 and 39 but now nearly 60 per cent of births are to mothers in this age group.

Last Friday, the ABS said that there were 603,360 short-term visitor arrivals in August 2023, an increase of 254,920 trips over the same month last year. The number of total arrivals was 1,544,700, which represented an annual increase of 517,000. There were 48,770 international student arrivals to Australia in August, up 8,120 on August 2022 but still 11.3 per cent lower than pre-COVID levels in August 2019.

Also last week, the Melbourne Institute said that its estimate of inflation expectations (based on the trimmed mean measure) rose to 4.8 per cent in October 2023, up from 4.6 per cent in September.

Other things to note . . .

- Treasury Secretary Steven Kennedy on the 2023 Intergenerational Report.

- Australia is moving to a cashless society.

- A new ANU Tax and Transfer Policy Institute Paper considers the interaction of Australia’s tax and transfer system with three decades of uninterrupted growth.

- Two RBA speeches. First, Head of International Department Penelope Smith on the extraordinary decline in Australia’s net foreign liabilities. After reaching a peak of 63 per cent of GDP in 2016, Australia’s net foreign liabilities have dropped to just 32 per cent of GDP – their lowest level since the mid-1980s. That decline has been driven by two developments: national saving has exceeded national investment, producing a sequence of current account surpluses and capital outflows for the first time since the 1970s; and valuation effects associated with higher interest rates have reduced the value of our external debt stock at the same time as higher US share prices and a fall in the Australian dollar have increased the value of our external assets in Australian dollar Second, a speech from RBA Assistance Governor Brad Jones on the opportunities and challenges arising from the tokenisation of assets and money in the digital age.

- Also from Australia’s central bank, audio from Governor Michele Bullock’s fireside chat at the AFSA Annual Summit.

- It’s annual report time. Here is the RBA Annual Report 2023. Here is the Productivity Commission Annual Report 2022-23. And here is the Parliamentary Budget Office Annual Report 2022-23.

- ACCC Chair Gina Cass-Gottlieb spoke on regulatory priorities and challenges posed by the digital economy.

- The ABS published Australia’s Water Account for the 2021-22 financial year.

- Should Australia play the geoeconomics game?

- Highlights from the October 2023 IEA Oil Market Report. The IEA detects ‘evidence of demand destruction’ from higher prices as US gasoline consumption fell to two-decade lows in September 2023 but it also reports ‘buoyant’ demand growth in China, India and Brazil as well as tumbling global oil inventories in August this year. The IEA notes that the recent ‘sharp escalation in geopolitical risks in the Middle East, a region accounting for more than one-third of the world’s seaborne oil trade, has markets on edge’ and goes on to say that ‘While there has been no direct impact on physical supply, markets will remain on tenterhooks as the crisis unfolds.’

- The WSJ investigates Wall Street’s latest obsession – the ‘unknowable number’ that is the term premium. (The term premium is the part of Treasury yields that captures everything other than investor expectations for the future path of short-term policy rates.)

- On green portfolios, ESG and greenwashing.

- The New Yorker on the Great Cash-for-Carbon Hustle.

- The Economist magazine considers the global backlash against climate policies.

- An FT Big Read on Lego.

- A CSIS report on A new age of US industrial policy.

- China’s Belt and Road Initiative enters its second decade.

- Paul Kennedy returns to his 1987 book The Rise and Fall of the Great Powers and considers how the world order has since changed. (I still have an old and faded Faber Press paperback edition of his book.)

- Remembering the distinguished British economic historian, Nick Crafts.

- Marc Andreessen’s Techno-Optimist Manifesto.

- The FT’s Unhedged Podcast examines Japan’s new direction (there’s also a sceptical take on the previous Andreessen link).

- The Macro Musings podcast talks to Sam Hammond on AI, Techno-Feudalism and the Future of the State.

Latest news

Already a member?

Login to view this content