As widely anticipated, the RBA brought an end to its four-month long policy pause this week and increased the cash rate target by 25bp, taking it up to 4.35 per cent and bringing the cumulative tightening in the current monetary policy cycle to 425bp. That means the RBA has finally delivered the ‘insurance rate hike’ we had flagged as a possibility back in August. With the central bank signalling that it remains in data-dependent mode this week, it is too soon to rule out any further increases. But given that the policy rate is back to its highest level since 2011 and that a significant share of that 425bp of tightening will be working its way through the economy for some time yet. The hurdle for another move should now be set quite high, giving the RBA the opportunity to stay on hold until (at least) next February.

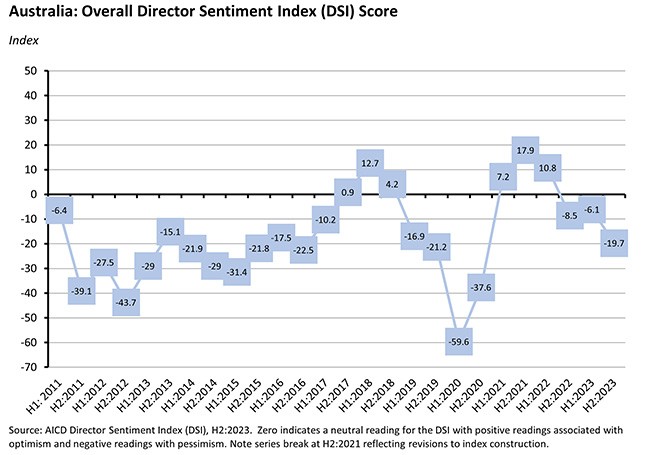

This week, we also take a dive into the results from the latest AICD Director Sentiment Index (DSI). They show that sentiment continued to weaken into the second half of this year, with the headline index falling to its lowest level since pandemic-hit H2:2020. Other noteworthy findings from the new DSI include: directors are split on the chances of Australian falling into recession over the next 12 months; labour shortages, the cost of living, and inflation and interest rates are viewed as the three leading economic challenges facing Australian businesses; and DSI respondents think that housing affordability / housing supply should be the top short-term policy priority for the federal government. More detail below and many thanks to all of you who were able to find the time to participate in the survey.

RBA hikes cash rate target by 25bp at 7 November 2023 meeting

At its meeting this Tuesday, the RBA Board decided to raise the cash rate target by 25bp to 4.35 per cent. This was Michele Bullock’s first rate hike as Governor, the first from Australia’s central bank since June this year, and the 13th of the current policy tightening cycle, which began back in May 2022. It means that the RBA has delivered a cumulative 425bp of rate increases. The RBA’s policy rate is now back to its highest level since a 25bp cut at its 2 November 2011 meeting took the cash rate target down to 4.5 per cent some 12 years ago.

This week’s move was not a surprise. A decision to hike the cash rate target had been predicted by financial market pricing and had been expected by most RBA watchers. We had anticipated a November rate increase in the weekly note following a higher-than-anticipated Q3:2023 inflation reading last month. The inflation numbers had come hard on the heels of two hawkish messages from the Bullock-led central bank, including in the minutes from the October 2023 RBA Board meeting and in the new Governor’s first speech in which she warned that ‘The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation’ and then repeated that ‘the Board has been clear that it has a low tolerance for allowing inflation to return to target more slowly than currently expected.’ Given that rhetoric and given the fact that inflation had subsequently surprised to the upside in the September quarter, it would have been difficult for the central bank not to move this week. Indeed, an extension of the monetary policy pause under these circumstances would likely have led to charges that the RBA had damaged its credibility.

Issues around credibility aside, the case for this week’s decision is set out quite clearly in the accompanying statement. It basically rested on two propositions.

First, that inflation was proving to be more stubborn than the RBA had previously hoped:

‘Inflation in Australia has passed its peak but is still too high and is proving more persistent than expected a few months ago. The latest reading on CPI inflation indicates that while goods price inflation has eased further, the prices of many services are continuing to rise briskly. While the central forecast is for CPI inflation to continue to decline, progress looks to be slower than earlier expected. CPI inflation is now expected to be around 3½ per cent by the end of 2024 and at the top of the target range of 2 to 3 per cent by the end of 2025. The Board judged an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe.’

In coming to this judgment, the Board decided that the information it had received on inflation, the labour market and economic activity in the period following the August 2023 meeting and the publication of its inflation forecasts in the August Statement on Monetary Policy collectively suggested that ‘the risk of inflation remaining higher for longer has increased.’ For example, although H1:2023 economic growth ran at a sub-trend rate, activity was still stronger than expected; underlying inflation was likewise higher than anticipated, particularly for services; despite some evidence of easing, the labour market overall had remained tight; and house prices had continued to rise.

Second, the Board remains concerned that a prolonged period of above-target inflation could influence people’s inflation expectations, even though it acknowledges that, to date, ‘medium-term inflation expectations have been consistent with the inflation target.’

In addition, the Board also has a new set of economic projections to consider. We will get the details this Friday with the publication of the November 2023 Statement on Monetary Policy, but according to Tuesday’s message from the Governor, the new numbers are set to depict a modest upward adjustment to the RBA’s trajectory for inflation. For example, the RBA now thinks that inflation will be ‘around 3.5 per cent’ by the end of next year, which is up from the 3.25 per cent it forecast back in August. It also thinks that inflation will still be ‘at the top of the target range of 2 to 3 per cent’ by end 2025, which is a bit more ambiguous – that could be in line with or slightly above August’s forecast of a 2.75 per cent rate.

The commentary also flagged a slight adjustment to the central bank’s labour market forecasts, noting that:

‘…the unemployment rate is expected to rise gradually to around 4¼ per cent. This is a more moderate forecast than previously forecast.’

Note that a 4.25 per cent unemployment rate would be in line with Treasury’s estimate of the Non-Accelerating Inflation Rate of Unemployment (NAIRU) and a little below the RBA’s (previous?) estimate of around 4.5 per cent.

Following the August 2023 RBA board meeting, we said that ‘we could be in for an extended policy pause’ but then cautioned that ‘with headline inflation still running well above target and above the cash rate itself, the arrival of any upside inflationary surprise in the data would almost certainly trigger an ‘insurance policy’ hike.’ We then largely stuck with that message through the following meetings. Both of those predictions have now played out. We saw an extended policy pause from July to October. And we have now received that ‘insurance policy’ hike following the September quarter inflation surprise. So, does that mean we are – finally – done with rate increases?

The RBA isn’t ready to concede that possibility just yet, with the Governor’s statement concluding that:

‘Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.’

In other words, as far as the RBA is concerned, we are still in the same data-dependent world as before. It follows that future monetary policy decisions remain hostage to the data flow and their implications for the RBA’s inflation forecasts. That said, and with that long-anticipated insurance rate hike finally delivered, the hurdle for another increase in the cash rate should now be set quite high.

The AICD’s Director Sentiment Index (DSI) fell further into negative territory in H2:2023.

The results from the latest AICD DSI, covering the second half of this year, are now available. The H2:2023 survey captured the views of more than 1,350 directors and was conducted between 18 September 2023 and 2 October 2023. That means that the survey closed before the 7 October attack on Israel by Hamas and the subsequent turmoil in the Middle East. It also means that it did not capture this week’s RBA decision to hike the cash rate, with the survey period instead closing just before the 4 October 2023 meeting at which Australia’s central bank had left the cash rate target unchanged for a fourth consecutive month.

The top line result this time was that the headline DSI fell further into negative territory in the second half of this year, dropping from a reading of -6.1 index points in H1:2023 to a reading of -19.7 index points in H2:2023. This was the third consecutive negative reading and was also the most pessimistic result since H2:2020 (-37.6). Notably, all five of the DSI sub-categories registered declines this time, and four of the five are now in negative territory while the remaining category (directorship conditions) has slipped to a neutral reading:

- The economic outlook was down 13 points to -6 index points

- Business conditions were down 22 points to -3 index points

- Micro / Structural policy settings fell 13 points to -13 index points

- Macro policy conditions fell ten points to -57 index points

- And directorship conditions were down three points to zero index points

The survey results indicate that directors have become more pessimistic about current and future economic conditions in Australia. For example, while 40 per cent of respondents assessed the current health of the Australian economy as strong, 30 per cent judged it to be weak, for a net balance of +10 per cent. That compares to a net balance of +27 per cent in the H1:2023 survey.

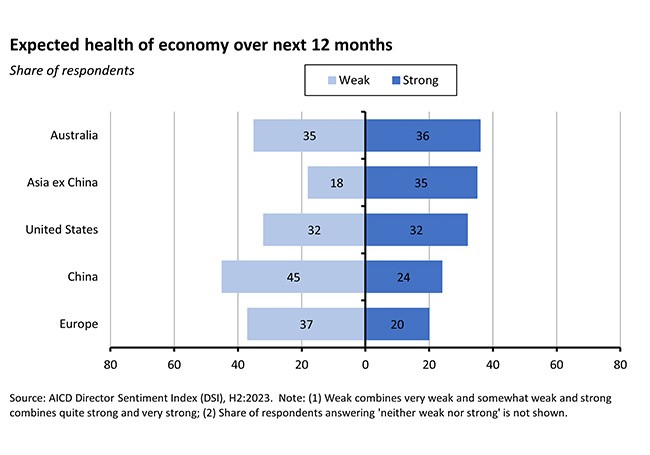

In the case of the outlook for the Australian economy over the next 12 months, 35 per cent think it will be weak vs 36 per cent who expect it to be strong. The net balance of just plus two per cent (not one per cent – due to rounding) is down from plus seven per cent in the H1:2023 survey. Elsewhere, there has been a big negative swing in perceptions of the outlook for China’s economy and a modest increase in expectations for the US and European economies (although pessimists continue to outweigh optimists in the case of the latter).

Similarly, although directors’ assessments of current business conditions in Australia fell notably in this DSI, the net balance of optimists vs pessimists remained in positive territory at plus two index points, down from +15 in H1:2023. This is no longer true for expected business conditions over the next 12 months, however, where more respondents now think conditions will be weak than think they will be strong, with the net balance dropping to minus two from +11 in the H1:2023 DSI.

By industry, directors tend to have the most positive view of future business conditions in the industry of their primary directorship (the highest shares expecting conditions to be ‘very strong’ over the next 12 months) in the information, media and telecommunications, mining, and education and training industries. The most negative views (the highest shares expecting conditions to be ‘very weak’) tended to come from directors in the construction, administrative and support services, and retail trade sectors.

In terms of anticipated business conditions within their own businesses over the next 12 months, directors painted a mixed picture. A strong majority still expected increases in costs (85 per cent of respondents expect an increase vs just two per cent expecting a fall for a net balance of +83, which is down only a little from +86 in H1:2023) and wage levels (a net balance of +69, down from +72). More directors also expected increases than decreases for turnover (a net balance of +31), staffing levels (+22) and investment levels (+13). But slightly more directors now expect a decrease than an increase in profitability (giving a net balance of minus three).

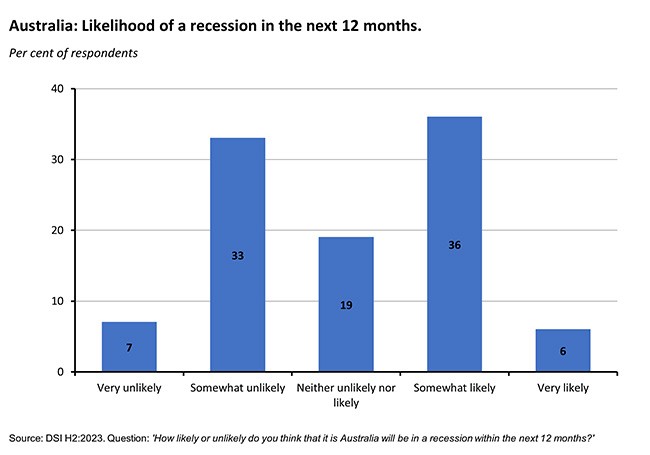

Despite the fall in overall economic and business sentiment, directors remain divided over the chances of Australia falling into recession over the year ahead. About 42 per cent of respondents think a recession is likely while 40 per cent think one is unlikely.

The breakdown of recession probability by director is interesting. Directors who think Australia is likely to fall into recession over the next year are more likely to be aged below 45, be female, be in Queensland, and be in the agriculture, forestry and fishing and in the transport, postal and warehousing industries. On the other hand, directors who think Australia is unlikely to be in a recession are more likely to be older (aged 65 or above), be in New South Wales or Western Australia, and be in the construction, finance and insurance, information and telecommunications and mining sectors.

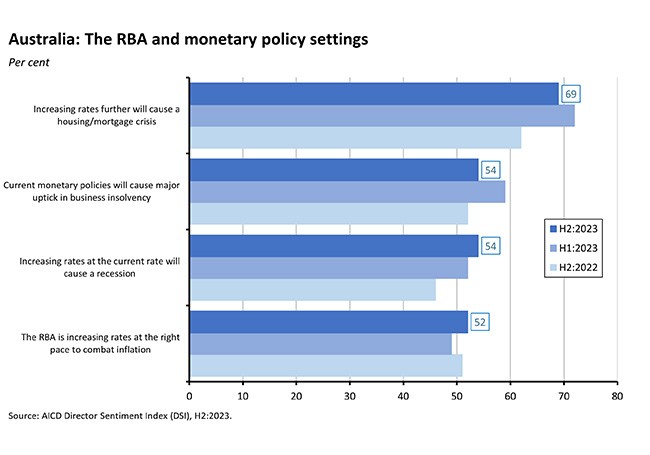

Unsurprisingly, expectations around the RBA and monetary policy are a key source of recession risk. Keeping in mind the timing of the survey (before this week’s rate hike and just before last month’s rate ‘pause’), a majority of respondents continue to believe that increasing interest rates ‘at the current rate’ will cause a recession, that current monetary policy settings will lead to a major uptick in business insolvency rates, and that further rate increases risk triggering a housing/mortgage crisis.

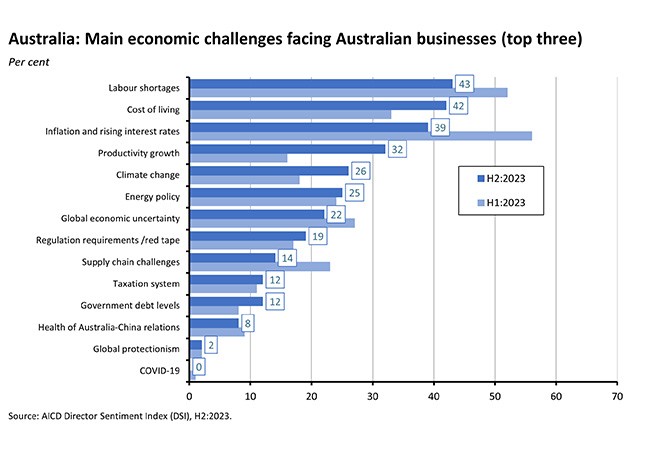

Directors continue to identify labour shortages as the most important economic challenge facing Australian businesses (43 per cent of respondents). But there are also signs that pressures are easing: the share is now well down from its 60 per cent peak in 2022 and is also lower than H1:2023’s 52 per cent. In related findings, 85 per cent of directors still think there is a skills shortage in the Australian workforce (down from 94 per cent in H1:2023) and 71 per cent think that skilled migration levels – despite overseas migration running at record highs – are not keeping up with labour demand (down from 74 per cent).

Directors now reckon that the cost of living has become a much more pressing economic challenge: it was cited as a top three economic challenge by 24 per cent of respondents in H2:2022, by 33 per cent in H1:2023, and by 42 per cent of respondents in the current DSI, just behind labour shortages. In contrast, the share of directors citing inflation and rising interest rates as a top challenge has dropped from 56 per cent in the first half of this year to 39 per cent in the second half.

Also worth noting here is that the share of DSI respondents citing productivity growth as a top challenge doubled between the two surveys conducted this year, rising from 16 per cent in the previous study to 32 per cent in the current DSI.

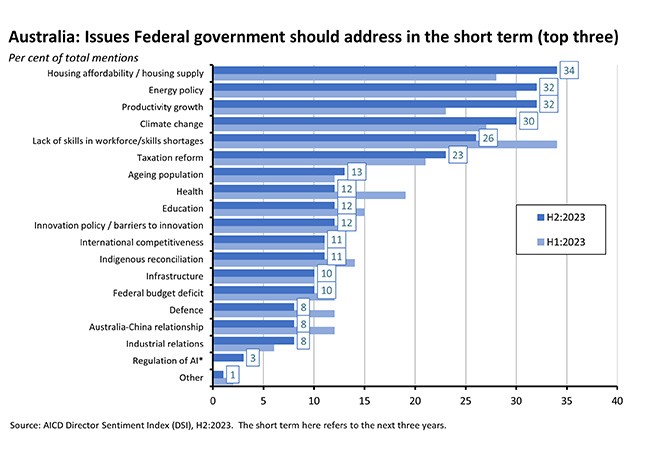

Turning to government policy priorities, housing affordability / supply is now seen as the top short-term priority. After being cited by less than one in five directors (19 per cent) in the H1:2022 DSI, it is now being nominated by more than one in three directors (34 per cent) as one of the top three issues that Canberra should tackline in the next three years. In related findings, more than one third of directors now say that the housing market has negatively impacted their business.

Productivity growth is now the joint second highest short-term policy priority alongside energy policy, consistent with the jump in the share of directors viewing productivity as a pressing economic challenge noted above. Similarly, the relative importance of skills shortages has receded somewhat while also remaining high in absolute terms.

Shifting focus from the short term to the long term (defined in the DSI as the next ten to 20 years), climate change continues to be cited as the most important policy issue for government policy. In the H2:2023 DSI, some 41 per cent of directors nominated it as a top policy priority, well ahead of second-placed ageing population (29 per cent) but down from the 50 per cent or more share the climate change option was recording between 2019 and 2022.

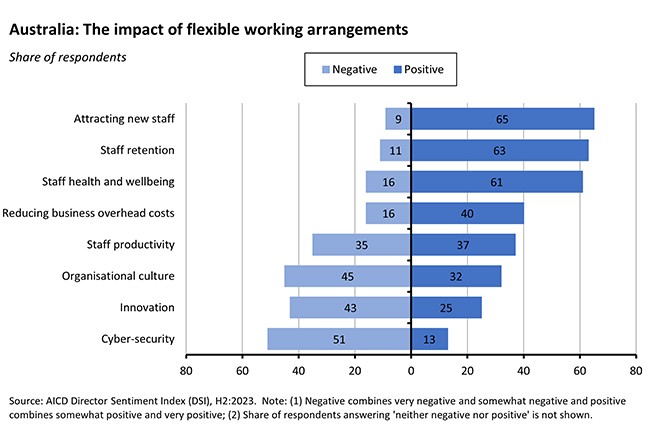

Several years into the flexible working / WFH revolution and directors still have mixed views. On the one hand, a clear majority continue to see these arrangements as having a positive impact on attracting new staff (65 per cent), on staff retention (63 per cent), and on staff health and wellbeing (61 per cent). On the other hand, a growing share worry about negative impacts on productivity (35 per cent, up from 27 per cent in H1:2023), culture (45 per cent, up from 41 per cent), and innovation (43 per cent, up from 36 per cent). The perceived negative consequences for cyber security (unchanged at 51 per cent) also remain a concern for directors.

In fact, cybercrime/data security continues to be the single most important issue ‘keeping directors awake at night’ (nominated by 45 per cent of DSI respondents) ranking ahead of legal and regulatory compliance (30 per cent) and structural change/changing business models (25 per cent).

There is much more to be found in the full DSI and a deeper dive is available here (pdf). And once again, sincere thanks to all of you who were able to take the time to participate.

What else happened on the Australian data front this week?

The ABS said that its Experimental Monthly Business Turnover Indicator for September 2023 showed month-on-month rises in 10 of the 13 published industries, with the largest gain in information, media and telecommunications (up 3.2 per cent) and the steepest fall in manufacturing (down 1.3 per cent). On a year-on-year basis, turnover was again up in 10 of the 13 published industries, although this time the largest increase was recorded in construction (up 21.1 per cent) and the largest fall in transport, postal and warehousing (down 4.6 per cent).

For the week ending 14 October 2023, weekly payroll jobs rose 0.2 per cent over the month from 16 September 2023 and increased 2.9 per cent over the year since 15 October 2022. The ABS noted that without the influence of an increase in job numbers related to the referendum, the latest data would instead have shown a slight fall of around 0.3 per cent, partly because of the seasonal downturn in education and training around the spring term break. The Bureau added that ‘monthly and annual growth in payroll jobs continue to be weaker than what we saw in 2022 and early in 2023. This…may suggest labour market growth is starting to slow.’

The ABS reported that there were 2,430,400 public sector employees in Australia in the month of June 2023. Of that total, 350,300 or about 14 per cent were employed by the Commonwealth government (including defence force personnel), 1,871,900 or about 77 per cent were employed in state government, and 208,200 or nine per cent in local government. The total represents a 3.5 per cent increase in the number of employees relative to the 2021-22 financial year, with Commonwealth government employment up 3.2 per cent, state government employment up 3.6 per cent and local government 2.7 per cent higher.

ANZ-Indeed Job Ads fell three per cent month-on-month (seasonally adjusted) in October 2023 to be 11.4 per cent lower than in the same month last year. The September 2023 monthly growth figure was also revised down from 0.1 per cent to 0.5 per cent. As a result, the number of Jobs Ads has now fallen 11.2 per cent from its September 2022 peak and is back to its lowest level since January 2022. That decline is consistent with a degree of labour market easing. Despite that fall, however, Ads remain 44.9 per cent higher than pre-COVID (February 2020) levels, implying that the degree of easing to date is still quite limited.

The ANZ Roy Morgan Consumer Confidence Index rose 2.8 points to an index reading of 77.8 in the week ending 5 November. The improvement was led by a 6.5-point rise in ‘current financial conditions’ following a cumulative 11-point decline over the previous four weeks. There was also a six-point increase in the ‘time to buy a major household item’ subindex and more muted gains for ‘current economic conditions’ and ‘future financial conditions’. ‘Future economic conditions’ softened slightly. Despite last week’s gain, confidence has now spent a record 40 weeks below the ‘85’ index mark. Confidence remains lowest among those paying off their homes – this subgroup saw another fall in confidence last week, while confidence rose for renters and those owning their homes outright. Meanwhile, weekly inflation expectations rose 0.3 percentage points to 5.5 per cent.

The ABS said Australians’ life expectancy at birth fell in 2020-2022 for the first time since the mid-1990s. Life expectancy at birth for males was 81.2 years and 85.3 years for females, a fall of 0.1 years for both. The Bureau said that this was the first time that deaths across all three years of the COVID-19 pandemic had been used to calculate life expectancy, and while the first two years of the pandemic brought the two lowest mortality rates on record from all causes, in 2022 the number of deaths increased by 20,000 with almost 10,000 of these due to COVID-19. Despite the decline, the ABS said that Australia’s life expectancy is still higher than pre-pandemic, and moreover is currently the third highest in the world (behind only Monaco and Japan).

Last Friday, in an update to the September monthly retail trade release, the ABS said that in volume terms retail sales rose 0.2 per cent in the September quarter 2023 (seasonally adjusted) but were down 1.7 per cent over the year. The ABS noted that last quarter’s rise followed three consecutive quarterly declines in retail sales volumes, commenting that the increase reflected lower price growth for retail goods, unusually warm weather, and special events like the FIFA Women’s World Cup. The Bureau also highlighted the contrast between strong population growth and weak sales growth, noting that on a per capita basis, retail volumes were down four per cent compared to their September quarter 2022 levels. That represented the largest annual fall in the history of the series. The annual pace of growth in retail prices remained elevated at 3.7 per cent in the third quarter, but this was well down from the December quarter 2022’s peak rate of 7.6 per cent.

Also last Friday, the ABS published its Experimental Monthly Household Spending Indicator for September 2023. The indicator showed household spending rose 4.9 per cent over the year on a current price, calendar-adjusted basis, with spending for services up 9.6 per cent and spending on goods down 0.1 per cent. Non-discretionary spending was up 9.2 per cent year-on-year (the ABS pointed to households spending more on fuel, food and health services) while discretionary spending rose by a much more muted 0.3 per cent (while spending on hotels, cafes and restaurants was up, this was offset by falls in spending on discretionary goods such as furniture).

Other things to note . . .

- The November 2023 RBA chart pack.

- Peter Martin reckons that ‘it’s a good bet the RBA’s Melbourne Cup Day interest rate hike will be the last.’

- But in the AFR, Richard Holden argues that rates are still too low.

- Anne O’Connell asks, is Australia’s tax regime for charities and NFP entities ‘fit for purpose’?

- Jenny Gordon on fighting risk in everything, everywhere, all at once.

- Jobs and Skills Australia’s Recruitment Expectations and Outlook Survey for the September quarter 2023 finds that there have been ‘widespread declines in both the recruitment rate and recruitment difficulty rate’ compared with the same period last year.

- Bruegel’s Andre Sapir analyses the reason for the EU-Australia trade negotiation hiccup.

- From the AFR, Martin Wolf’s take on what a Trump win could mean for the world. (FT version).

- This WSJ piece suggests that the big problem with government debt may be that our current financial market plumbing might not be up to the job.

- Learning from the Turkish experience with very easy monetary policy. Turkey’s central bank pursued a strategy of low interest rates for more than a decade in an experiment with ‘neo-Fisherian disinflation’ – the idea that persistently low interest rates would lead to lower inflation. Contrary to that theory but in line with conventional macro thinking, the outcome was a fall in the Turkish and a surge in inflation.

- A new BIS Bulletin looks at lessons from recent experiences on exchange rates, capital flows and financial conditions in emerging markets.

- An FT Big Read on the breakdown of China’s social contract.

- Also from the FT, a new series on higher for longer global interest rates.

- Related, the Economist magazine has a briefing on higher for longer global interest rates.

- Also related, at the Peterson Institute, Olivier Blanchard thinks about the implications of long real rates for public debt ratios.

- An IMF report on strong, sustainable, balanced and inclusive growth for the G-20. The Fund reports slowing global growth momentum, widening growth divergences across regions, persistent underlying inflation, and mounting debt vulnerabilities in some emerging markets. The advice for G-20 policymakers is to ‘remain focused on achieving inflation goals while striving to restore growth prospects.’ The IMF also warns that the medium-term outlook for global growth is at its lowest in decades due to a combination of short-term cyclical pressures (tighter monetary policy, fiscal consolidation, base effects from the initial pandemic recovery phase) and medium-term headwinds (slowing growth in previously rapidly growing emerging market economies especially China, weak productivity growth, a slower pace of structural reforms, a rising threat of geoeconomic fragmentation, and demographic ageing in advanced economies).

- Also from the Fund, the end of mission press release following the IMF’s 2023 Article IV Mission to China. The IMF has lifted its near-term growth projection for China to 5.4 per cent from the five per cent rate it forecast in the October 2023 WEO and while it thinks growth will then slow to 4.6 per cent next year, that forecast has similarly been revised up by 0.4 percentage points from the WEO projection of 4.2 per cent. The Fund says these revisions reflect a stronger than expected Q3 outturn and recent policy measures introduced to support the economy, primarily ‘numerous welcome measures to support the property market.’ Over the medium term, the IMF sees Chinese growth declining to about 3.5 per cent by 2028 ‘amid headwinds from weak productivity and population ageing.’

- Three new OECD reports. In its latest assessment of Agricultural Policy the OECD finds that public support rose to record levels (US$851 billion a year, of which US$518 billion was budgetary support from taxpayers and US$333 billion was transfer from domestic consumers via higher prices) during 2020-22. That was up from US$696 billion a year in 2017-19, with the increase in support driven by government efforts to shield both consumers and producers from global shocks including the Russian invasion of Ukraine and high inflation. The OECD Skills Outlook 2023 focuses on the skills and policies it thinks are needed to promote environmental challenges and technological transformations. And Health at a Glance 2023 pulls together indictors on health and health system performance across OECD members. Here is the Australia country note (pdf), which benchmarks Australia’s performance across a range of metrics.

- Institutional Investor says that US investors are sending mixed messages on ESG. On the one hand, while ESG proposals ‘surged’ during the current proxy season, fewer won shareholder approval than in recent years – it estimates that average support for US ESG shareholder proposals was cut nearly in half in the 2023 season compared to 2022. On the other hand, ‘shareholder support for anti-ESG proposals was effectively non-existent’ with such proposals winning ‘some of the lowest support on record.’

- An International Crisis Group (ICG) report on preventing war in the Taiwan Strait.

- The Fall Edition of the Journal of Economic Perspectives includes symposia on After the pandemic, Wealth, the Electricity grid, and Economics career paths. The first of these includes a useful

- Visualising the pyramid of global wealth distribution.

- The FT’s Behind the Money podcast digs into the apparent discrepancy between the latest IEA forecast of looming peak demand for fossil fuels and the recent pursuit of ‘mega-deals’ by the US oil industry.

- An LRB podcast on ‘the giant crypto fraud’.

- The Econtalk podcast considers the huge challenges facing any effort at Space Settlement.

Latest news

Already a member?

Login to view this content