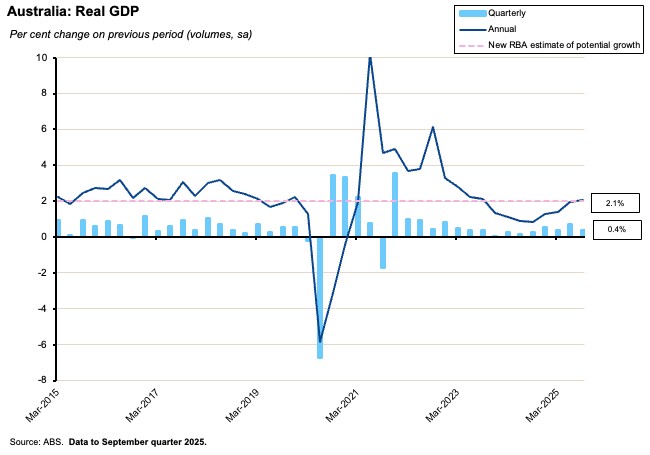

The main economic news this week was the release of the September quarter 2025 national accounts. Growth came in a bit weaker than the market had expected, but nevertheless at 2.1 per cent delivered the fastest rate of annual growth in two years.

There are at least three things worth noting about this week’s GDP numbers.

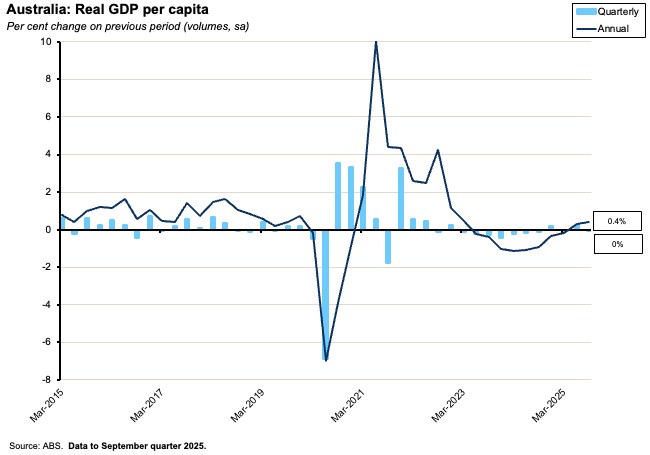

First, after a prolonged period of sub-two per cent results, annual real GDP growth has a ‘two’ in front of it again (in fact, revisions in this week’s release also have growth running at two per cent in the June quarter, up from the previous estimate of 1.8 per cent). Likewise, the economy has now generated two successive quarters of positive annual growth in GDP per capita after the previous sequence of eight consecutive declines. All of which is good news and consistent with an ongoing recovery in economic activity.

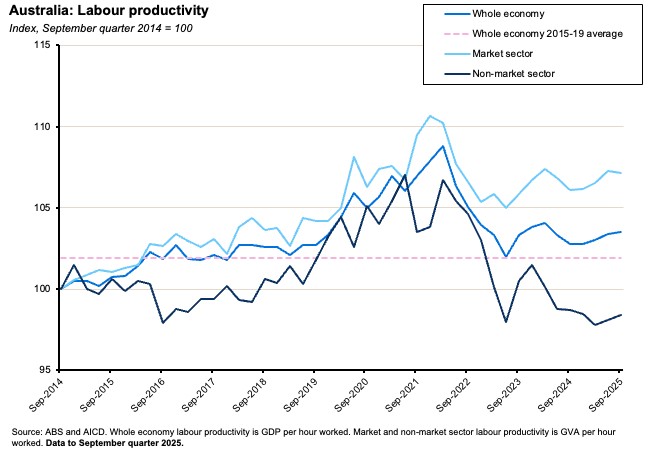

Second, there were also encouraging signs in the detail of the numbers. Growth in the September quarter was private sector-led, for example, with a particularly strong contribution from private business investment underpinned by the ramp up in spending on data centres. Household consumption also picked up. And while last quarter’s increase in spending was all on essentials, the latest ABS read from the October 2025 Monthly Household Spending Indicator shows a surge in discretionary expenditure. Finally, labour productivity growth (measured as GDP per hour worked) rose to 0.8 per cent year-on-year after having been almost stagnant in the June quarter.

But third, and less happily, the juxtaposition of the Q3 quarter national accounts with the disappointingly strong third quarter CPI results that arrived earlier this year makes for uncomfortable reading, by suggesting that the economy may be approaching its speed limit. Continued rapid growth in unit labour costs also supports this interpretation. If this is right, it follows that the RBA now has little room left for any further policy easing. Indeed, financial markets are now speculating on the timing of a first cash rate increase next year. At the time of writing, markets had fully priced in an increase for the 3-4 November 2026 Monetary Policy Board (MPB) meeting.

More detail on the national accounts below, along with a roundup of the rest of the week’s data releases, plus the usual selection of further reading and listening. And a final reminder that I will present an economics webinar next week that will be free for AICD members.

Real GDP UP 2.1 per cent over the year to the September quarter 2025

The ABS said Australian real GDP grew 0.4 per cent (seasonally adjusted) over the September quarter to be up 2.1 per cent over the year. That compared to (upwardly revised) quarterly growth of 0.7 per cent (adjusted from the previous estimate of 0.6 per cent) and annual growth of two per cent (up from 1.8 per cent previously) in the June quarter. The market consensus forecast had anticipated real GDP growth of 0.7 per cent quarter-on-quarter and 2.3 per cent year-on-year, so the outcome was weaker than expected. Even so, at an annual rate of 2.1 per cent, growth last quarter was still the fastest rate of expansion recorded since the September quarter 2023.

GDP per capita was flat over the quarter as output and population growth increased in tandem, while through the year growth in output per head was marginally positive at 0.4 per cent, with population growth running at an annual rate of 1.7 per cent. Productivity growth also picked up, with GDP per hour worked climbing 0.2 per cent in quarterly terms to be up 0.8 per cent over the year.

In nominal terms, GDP grew 1.7 per cent quarter-on-quarter and 5.4 per cent year-on-year, with the GDP implicit price deflator up 1.3 per cent overthe quarter and 5.4 per cent over the year.

Australia’s terms of trade were 0.3 per cent higher than in the June quarter of this year. A fall in export prices (driven by LNG) was more than offset by a larger fall in import prices (influenced by a stronger AUD), resulting in the first terms of trade increase in this calendar year. That still left them 0.2 per cent lower than in the September quarter 2024, however.

Private demand drives GDP growth lastquarter

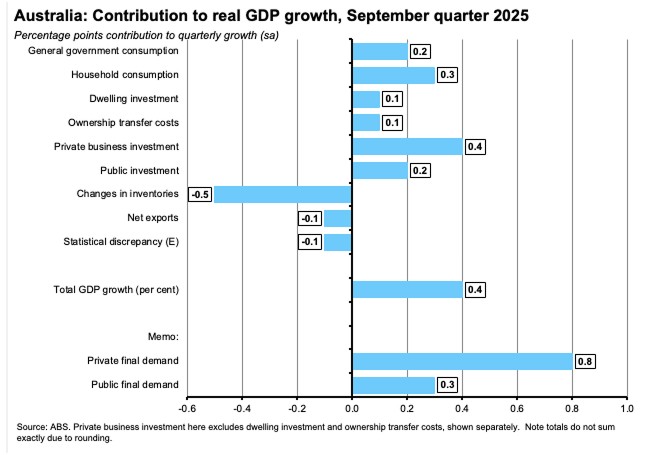

A 1.1 percentage point contribution from domestic demand was the main driver of the 0.4 per cent increase in real output over the September quarter. Private demand (which contributed 0.8 percentage points) led the way, while public demand played a supporting role (contributing a further 0.3 percentage points).

Private business investment played a key role, contributing 0.4 percentage points to quarterly growth. It rose 3.2 per cent over the quarter to be 3.7 per cent higher over the year, with the ABS highlighting strong increases in capital expenditure on machinery and equipment, due to the ongoing expansion of data centres across NSW and Victoria. Increases in dwelling investment and ownership transfer costs further added to a strong overall contribution from private fixed capital formation.

Household consumption contributed an additional 0.3 percentage points to quarterly growth, with consumer spending up 0.5 per cent over the quarter and 2.5 per cent over the year. This was driven entirely by increased spending on essentials, which rose one per cent over the quarter and 2.6 per cent over the year, as households spent more on financial services (reflecting partly the impact of the increase in the superannuation guarantee to 12 per cent), electricity (due to lower electricity rebates) and health. In contrast, discretionary spending fell 0.2 per cent from the previous quarter, although it was still up 2.3 per cent over the year.

Turning to public demand, public investment rose three per cent over the quarter, contributing 0.2 percentage points to the overall quarterly rate of real GDP growth (although public capex was still down 3.1 per cent on an annual basis). Here, the key driver of the quarterly story revolved around public corporations investing in renewable energy, water, telecommunications, and rail transportation projects. There was also a rebound in defence investment from the June quarter’s decline. General government consumption rose 0.3 per cent over the quarter and 2.6 per cent over the year, contributing another 0.2 percentage points to quarterly growth.

Headwinds last quarter included a strong negative contribution from a rundown in inventories, particularly in the mining sector where companies sought to service increased export demand for coal despite subdued production. This subtracted half a percentage point from overall growth. Net exports were a more modest headwind, subtracting 0.1 percentage points, as a rise in imports – lifted in part by the imports of computer equipment linked to the expansion of data centres – outpaced growth in exports.

Household income, spending and saving

Gross household disposable income rose 1.7 per cent over the quarter, boosted by rises in the compensation of employees (the Bureau highlighted increases in minimum wage payments, increased bonuses and private sector redundancy payments here) along with a lift in superannuation income, thanks to gains from the Australian equity market. A rise in income tax payable served as a partial offset to these gains, but that still saw growth in disposable income outpace growth in household spending, with the latter rising by 1.4 per cent over the September quarter.

As a result, the household saving to income ratio rose to 6.4 per cent last quarter, up from six per cent in the June quarter. Higher savings, an increase in disposable income, and ongoing increases in housing wealth (see data roundup below) should all provide support for household spending.

Are we hitting the economy’s speedlimit?

As noted above, despite the headline quarterly and annual growth rates printing a bit softer than the market had expected this week, the good news was that the annual rate of Australian economic growth has now had a ‘two’ in front of it for two consecutive quarters (thanks also to the June quarter revisions). Likewise, the annual rate of per capita real GDP growth has also been positive for two consecutive quarters, if only modestly.

The not-so-good news is that while September quarter GDP numbers were weaker than expected, the September quarter (and October monthly) inflation numbers had previously printed higher than expected.

One way to interpret this is that when growth is around the two per cent mark, we are at or approaching the economy’s effective speed limit, which then manifests in inflation that threatens the RBA’s target. That interpretation would be broadly consistent with the RBA’s decision in August this year to lower its estimate of medium-term trend productivity growth (discussed here) to an annual rate of 0.7 per cent, which in turn saw the central bank wind back its assessment of the rate of growth in potential output for the Australian economy to a mediocre two per cent.

If that interpretation is right, it would be unwelcome news. A two per cent speed limit is disappointingly low compared to past performance. It would likewise imply that there is little headroom for any further pickup in activity without bringing the RBA into play to cool things down again.

Granted, a more positive spin on GDP data might instead focus on the increase in the annual rate of productivity to 0.8 per cent last quarter, and hope that as the economy normalises, productivity growth will pick up further. That would ease the constraint imposed by the speed limit by increasing it. There are some indications that productivity may have bottomed out around late 2024/early 2025, and there are reasons for cautious optimism regarding the scope for improvement from here – ranging from the possibility of a pro-cyclical pickup in productivity growth in line with stronger activity through to a future payoff from the increase in private business investment discussed above. Of course, we also know that we should not read too much into volatile quarterly productivity numbers.

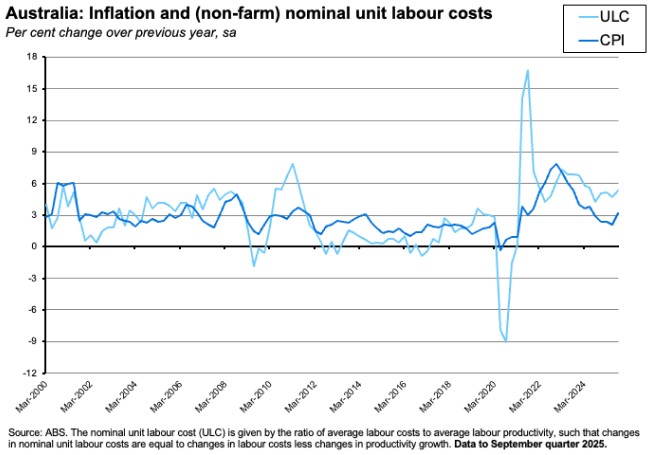

Finally, a related way to look at these issues draws on the discussion a couple of weeks ago on unit labour costs (ULCs) and what wages are telling us. According to the September quarter national accounts, non-farm wage growth picked up to around six per cent and annual growth in non-farm ULCs rose to above five per cent. This is not a particularly comforting set of numbers. Recall, the RBA reckons that a sustainable AENA rate of wage growth in the medium term is around 3.2 per cent (equal to 2.5 per cent inflation at target + 0.7 per cent productivity growth).

Other Australian data points to note

The ABS said Australia’s current account deficit was $16.6 billion in the September quarter of this year, an increase of almost $0.5 billion on the June quarter’s $16.2 deficit. Australia’s financial account reported a record surplus of $31.2 billion, driven by large net inflows of debt (up $28.4 billion last quarter).

According to the latest edition of Government Finance Statistics from the ABS, the general government net operating balance was a deficit of $32.2 billion in the September quarter 2025, while net general government borrowing totalled $42.7 billion

Also from the ABS, Business Indicators for the September quarter 2025 show company operating profits flat over the quarter (seasonally adjusted) while wages and salaries were up 1.5 per cent.

Cotality said that its National Home Value Index rose one per cent over the month in November this year, with values 7.5 per cent higher over the year. The Combined Capitals index was up one per cent month-on-month and 8.6 per cent higher year-on-year. Last month, Cotality reported that Australia’s housing affordability had further deteriorated this year when measured in terms of the price to income ratio. (With the median house value now worth 8.9 times average income), the time to save a deposit (nearly 12 years for the standard median deposit) and the share of income needed for rent (a record 33.4 per cent). The cost of servicing a new loan also remains elevated, demanding 45 per cent of median household income. APRA recently announced a new policy limiting high debt to income (DTI) ratio loans to 20 per cent of new lending for authorised deposit-taking institutions (ADIs). The new rule will take effect from 1 February next year and APRA intends it to ‘pre-emptively contain a build-up of housing-related vulnerabilities in the financial system.’ For its part, Cotality reckons the impact of APRA’s decision to tighten macro-prudential rules will have only a limited impact on home values, given that most recent mortgage originations remain comfortably below a DTI of six.

The ABS said that on a seasonally adjusted basis, the number of total dwellings approved in October 2025 was 15,832, down 6.4 per cent over the month and 1.8 per cent lower over the year. A 13.1 per cent monthly drop in approvals for private dwellings excluding houses drove the fall in total approvals.

The total value of residential dwellings in Australia rose to $11.9 trillion in the September quarter of this year. The ABS said the number of residential dwellings was 11.4 million, while the mean price of residential dwellings was $1,045,300. According to the Bureau, Queensland has now joined NSW as the second state to have a mean dwelling price of more than $1 million.

Australia’s seasonally adjusted balance on goods trade was a surplus of $4.4 billion in October this year, up $0.7 billion from September. The ABS highlighted robust growth in exports and imports of non-monetary gold.

ANZ-Indeed Australian Job Ads fell 0.8 per cent over the month in November this year (seasonally adjusted), to be down 6.3 per cent over the year. Job Ads have now fallen for five consecutive months and for seven of the past eight months.

The ABS Monthly Household Spending Indicator rose 1.3 per cent over the month (seasonally adjusted) in October 2025 and was 5.6 per cent higher over the year. The Bureau said the monthly growth rate was the biggest increase since January 2024 and reflected a surge in discretionary spending, as households took advantage of promotional events to buy clothing, footwear, furnishings, and electronics. Spending on services was also up, with the ABS pointing to the way that major concerts and cultural festivals drove demand for catering, hospitality and hotel stays.

Further reading and listening

- Treasury Secretary Jenny Wilkinson’s opening statement to the Economics Legislation Committee, Senate Estimates. In her view, ‘the macroeconomic picture is one of solid growth in business and dwelling investment, with household consumption recovering more gradually and exports holding up despite a more challenging global environment. The unemployment rate has drifted up…but the unemployment rate remains low…There have been significant declines in inflation over the past few years, but most recently, inflation has been a bit higher thanexpected, partly due to temporary factors.’

- In the AFR, Warren Hogan says the RBA should raise the cash rate next week.

- Australia’s new National AI Plan. Some early reactions.

- The ABS analyses household solar electricity generation in the national accounts. Australia now leads the world in per capita household solar, with more than four million homes – roughly one in three – equipped with solar panels. The ABS reckons that between 2010-11 and 2024-25, household solar electricity generation increased 20-fold to account for roughly eight per cent of total electricity generation, while rooftop solar installation costs per kilowatt of installed capacity fell 75 per cent over the same period.

- Last week, the government released its fourth Annual Climate Change Statement which highlighted Canberra’s new 2035 emissions reduction target of 62 – 70 per cent below 2005 levels along with its Net Zero Plan. The Climate Change Authority also published Australia’s emissions projections 2025 which suggests that on currently implemented policies, Australia is on track to beat its earlier 2030 emissions target of a 43 per cent reduction, but would miss the new 2035 projections in the absence of further measures. And the latest National Greenhouse Gas Inventory quarterly update reports emissions of 437.5 million tonnes of CO2-equivalent over the year to June 2025, down 2.2 per cent on the previous year and 28.5 per cent below June 2005 levels.

- A take on APRA’s decision to introduce new debt-to-income limits on housing loans with effect from early next year.

- Keynote speeches from last month’s Australian Institute of International Affairs (AIIA) Conference, including the Minister for Foreign Affairs Penny Wong on a new doctrine for foreign policy based on Region, Relationships, Rules and Resilience, and AIIA National President Heather Smith on Australia becoming adrift in a new paradigm, in a world that is ‘increasingly undemocratic, grievance-driven, aggressively interventionist and multipolar.’

- The Grattan Institute’s 2025 ‘Wonks List’ offers ‘technical reads for policy enthusiasts.’ And the same Institute’s Summer Reading list for the Prime Minister.

- The government released the report of the 2023 review into public sector board appointments processes, No favourites. According to the executive summary, ‘the current board appointment arrangements are not fit for purpose. They have let down the Australian people, undermined the integrity and effectiveness of the public sector and exposed Ministers to unnecessary risk.’

- The OECD has published the latest issue of its Economic Outlook, which describes an international environment characterised by resilient growth but with increasing fragilities. Like the IMF’s forecasters before it, the OECD acknowledges that the ‘global economy has proved more resilient than expected this year’, with this resilience supported by easier financial conditions, rising AI-related investment and trade and supportive macro policies. But the OECD is still concerned about a range of risks, including further adverse changes in trade policies and rising financial market dangers. Here is the accompanying Australia Economic Snapshot, which projects economic growth to accelerate from an estimated 1.8 per cent this year to 2.3 per cent in 2026 and 2027. The OECD predicts underlying inflation to fall to 2.6 per cent next year and to 2.5 per cent by the following year while it forecasts the unemployment rate to rise to 4.5 per cent by 2027. This edition of the Outlook also includes a Chapter making the case for a regulatory reset to lift OECD productivity.

- Also from the OECD, Pensions at a Glance 2025. The report notes that, on average across the OECD, the number of people aged 65 and over per 100 people aged 20‑64 (one variant of the age dependency ratio) is projected to increase from 33 in 2025 to 52 in 2050. It was just 22 in the year 2000.

- A WSJ long read argues that Europe’s success in cutting carbon emissions has come at the cost of significant economic damage.

- Also from the WSJ, US spending on AI is helping boost forecasts for global growth, although the gains may be concentrated in regions inside the AI supply chain.

- The Economist Magazine looks at some numbers on AI adoption in the United States and suggests that ‘[t]hree years into the generative-AI wave, demand for the technology looks surprisingly flimsy.’

- This FT Big Read asks, Is China winning the innovation race? Related, a second story examines China’s booming biopharma industry.

- The IMF’s latest Article IV Staff Report on the Indian economy.

- On understanding hidden external exposures in domestic supply chains.

- Economists at the Federal Reserve Bank of San Francisco look at the economic effects of tariffs and distinguish between supply side (higher inflation) and demand side (lower inflation) effects, which operate over different time horizons. And economists the Richmond Fed find that US housing markets already appear to reflect long-term sea level rise exposure in property prices.

- The Guardian says we’re in the Age of the ‘scam state,’ where the term ‘refers to countries where an illicit industry has dug its tentacles deep into legitimate institutions, reshaping the economy, corrupting governments and establishing a state reliance on an illegal network.’ The story quotes one expert who reckons that cyberfraud is now a dominant economic engine for the entire Mekong sub-region.

- BBC Science Focus on the 25 most powerful ideas of the 21st century, so far.

- The Conversations with Tyler podcast quizzes Dan Wang, author of Breakneck: China’s quest to engineer the future.

- The Gray Area podcast asks economic historian Brad DeLong, what counts as progress?

- In what serves as an interesting companion piece to last week’s link to the extended conversation with Hugh White, the Odd Lots podcast talks with Graham Allison on the US, China and the ‘Thucydides Trap.’

- Ian McEwan on the present as future past, on the Past Present Future podcast

Latest news

Already a member?

Login to view this content