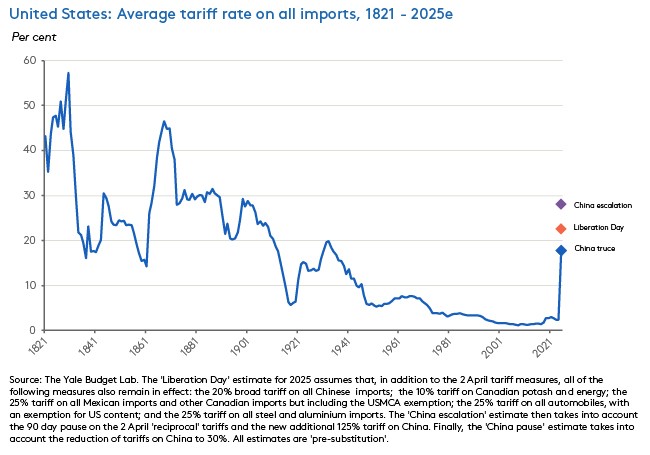

The big international economic and financial news this week was the arrival of a truce in the US-China trade war. The consensus is that – much as it did in response to the market meltdown following Liberation Day – the Trump administration has backed down in the face of external pressure. Markets welcomed the deal with an initial bounce, celebrating what they hope will prove to be ‘peak tariff’. Even if markets prove to be correct on that judgement (and that remains to be seen), the implications of recent trade policy developments are still profound and will continue to impact the US and global economic outlooks over the medium term.

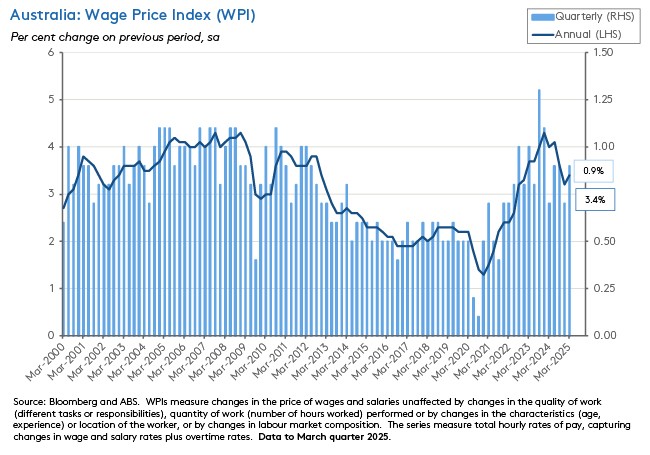

Closer to home, this week brought fresh data on the health of the Australian labour market, with updates on March quarter wage growth and April employment. Both results came in stronger than markets expected. The rate of annual wage growth increased for the first time since the June quarter of last year, rising to 3.4 per cent from 3.2 per cent in the previous quarter, while employment in the economy jumped by 89,000 people in April 2025 in the biggest monthly gain since February 2024.

Next week brings the May meeting of the RBA’s Monetary Policy Board (MPB). In the pre-Liberation Day world that Martin Place was operating in at the time of April’s MPB, this week’s robust labour market results could have made a case for the central bank remaining cautious about delivering additional monetary policy easing. But after 2 April, we are no longer in that world, and immediately after the Liberation Day tariff shock, markets started to assume that a May rate cut was locked in. Should this week’s trade ceasefire change those calculations? There is a case that the near-term outlook has stabilised and that at least some risks have now receded. So, the justification for the kind of outsized 50bp rate cut that markets were predicting immediately after Liberation Day no longer looks quite so compelling. But overall, the rationale for a precautionary 25bp rate cut on 20 May remains intact.

Below, we dig into the implications of the Washington-Beijing deal in more detail, cast an eye over the latest Australian data and provide the usual linkage roundup. As always, questions and comments are welcome. And thanks for reading!

Washington, Beijing hit pause on US-China trade war

Washington and Beijing have reached agreement on a ceasefire in their bilateral trade war. Under the deal:

- The United States said it would unwind its Liberation Day and post-Liberation Day tariff increases on Chinese imports from 125 per cent down to the 10 per cent near-universal rate it introduced on 2 April. Note, however, that the pre-existing 20 per cent tariff rate on China (initially announced as a 10 per cent tariff on 4 February and later doubled to 20 per cent on 4 March this year) will remain in place, meaning that Trump 2.0 will still have delivered an increase in tariffs of 30 per cent. That is in addition to the impact of separate tariffs on steel, aluminium, autos and auto parts, and in addition to tariffs previously applied to Chinese exports during the Trump 1.0 and Biden administrations.

- China will lower its post-Liberation Day 125 per cent tariff rate on US exports to 10 per cent. Beijing has also indicated it will cancel or suspend some non-tariff measures it had also announced as part of its retaliation, such as restrictions on the sale of rare earths.

- The new tariff rates will remain in place for 90 days to allow time for the two sides to reach a broader trade agreement.

- The announcement of the deal prompted a US stock market rally, along with increases in the US dollar and US bond yields. There were several reasons for the market cheer:

- They appear to be interpreting the agreement both as a sign of greater pragmatism on the part of Washington and – related – as indicating a larger role for Treasury Secretary Scott Bessent in the policymaking process, relative to some of the administration’s more hawkish trade policy advocates.

- Recent commentary from Bessent to the effect that the previous constellation of tariffs had been the ‘equivalent of an embargo’ and that ‘neither side wants to decouple’ have likewise been taken as signalling that Washinton is now looking to de-escalate on the trade war front, backing away from its spiral of tit-for-tat trade policy.

- Finally, markets also seem to be judging that President Trump has once again backed down in the face of external market and economic pressure. This is now repeated behaviour and as such suggests that future policy experimentation by the administration could be tamed in much the same way. The FT described this as another win for the Taco trade, where Taco stands for Trump Always Chickens Out.

Further supporting market optimism that the worst might be over on the US trade policy front and that we may have passed ‘peak tariff’ was previous news of a US-UK trade deal on 8 May (albeit one that left the new 10 per cent tariff on UK exports to the United States in place, introduced new import quotas and placed restrictions on UK access to Chinese imports). That in turn had followed 29 April adjustments to auto tariffs that also provided a degree of additional, if limited, tariff relief.

A temporary US-China trade truce is undoubtedly good news in terms of lowering the geoeconomic and geopolitical temperature, while also removing at least some immediate downside risks to the global economic outlook. And if it does ultimately signal a White House retreat from further Liberation Day-style policy announcements, it would be even better news. Likewise, if the ‘Taco’ theory now represents a binding policy constraint on the White House.

For now, however, instability that has been evident in Washington’s policymaking over recent weeks means it is just too soon to make that judgement, regardless of the current bout of market enthusiasm.

Moreover, it is also important to keep the broader picture in mind.

- Proposed tariff reductions are still temporary and come with an expiration date attached, pending further successful negotiations.

- While new US tariffs on China are much lower than the previous ones (which were so high they were set to choke off most direct bilateral trade), at well over 30 per cent, the current rate of protection remains far higher than the rate that prevailed at the start of this year. It follows that we should expect the process of US-China decoupling that was already underway before Trump 2.0 not only to continue, but also to accelerate, even if these amended trading arrangements do turn out to be the new status quo.

- The overall level of US tariffs on all trading partners also remains elevated with the 10 per cent ‘universal’ tariff looking like a new baseline for US trade policy. According to the latest estimates from the Yale Budget Lab, for example, the cumulative effect of all of the Trump 2.0 tariffs measures introduced this year, including the various reversals and pauses, is now equivalent to a 15.4 percentage point increase in the US average effective tariff. That implies an overall US average effective tariff rate of about 18 per cent, which would be the highest since 1934. Sure, this is better than the previous situation. Absent the new, lower China tariffs, the average effective tariff rate would have been around 28 per cent, which would have been the highest rate since 1903. But that still means there has been a significant rise in the level of protection and the consequent distortions to US and world trade will persist, as will associated economic costs. (All these figures are pre-substitution rates, that is they are based on trade patterns as they stand before any offsetting adjustments in the direction of trade in response to the new tariffs. The Budget Lab estimates that the current post-substitution average effective tariff rate is 16.4 per cent, the highest since 1937).

More generally, the international economic environment continues to be characterised by an elevated level of policy uncertainty that will function as a headwind to global investment and activity more broadly.

Wage growth picks up in March quarter 2025

The ABS said its Wage Price Index (WPI) rose 0.9 per cent (seasonally adjusted) over the March quarter 2025 to be up 3.4 per cent over the year. The result was stronger than the December quarter 2024 print of 0.7 per cent quarter-on-quarter and 3.2 per cent year-on-year. It was also higher than the market had expected. The consensus forecast had anticipated 0.8 per cent quarter-on-quarter and 3.2 per cent year-on-year. And it marked the first increase in the annual rate of wage growth since the June quarter 2024.

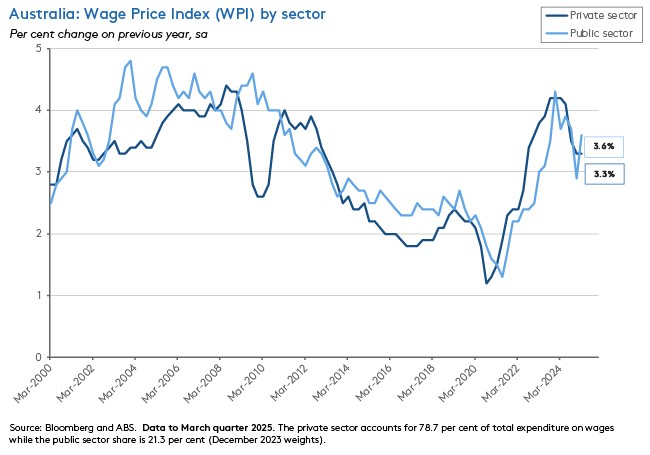

By sector, the annual rate of increase in public sector wage growth rose from 2.9 per cent in the December quarter of last year to 3.6 per cent in the March quarter of this year. In contrast, the annual rate of growth in private sector wages was unchanged at 3.3 per cent. At that rate, private sector wage growth continued at its slowest pace since the June quarter 2022.

According to the Bureau, wage growth in the public sector reflected new state-based enterprise agreements in NSW, Western Australia and Victoria, as well as (to a lesser degree) increases paid to aged care workers. Meanwhile, private sector wage growth was influenced by administrative wage adjustments due to the Stage 3 Aged Care Work Value Case and the Early Childhood Education and Care Worker Retention Payment. Together, these contributed to a 1.2 per cent quarterly increase in wages in private sector Health care and social assistance industry. Private sector wage growth excluding this sector ran at a more modest 0.5 per cent.

Related, the ABS highlighted the impact of wage increases in jobs covered by enterprise agreements, which contributed more than half of all quarterly growth for the first time since the September quarter 2020. New state-based public sector enterprise agreements were the main drivers here. In contrast, annual wage growth for those on individual contracts slowed again in the March quarter, slipping to just over three per cent. Economists often view the latter as the best gauge of relative demand and supply pressures in the labour market.

The ABS also noted that the share of outsized (greater than four per cent) wage increases fell for a third consecutive quarter.

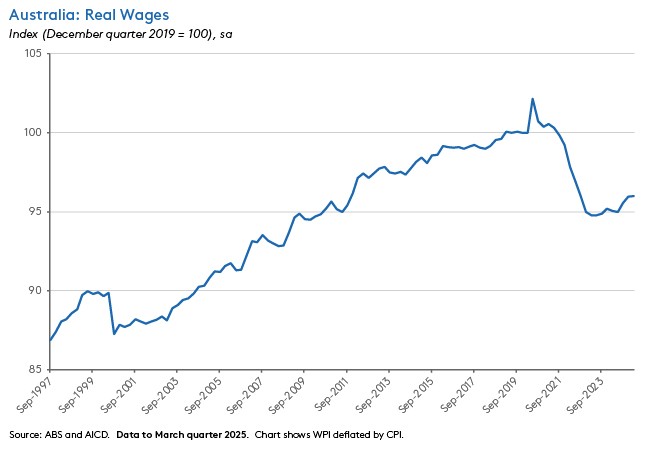

Finally, at 3.4 per cent, wage growth ran ahead of the increase in the Consumer Price Index (CPI), which rose by 2.4 per cent over the year in the March quarter 2025. Nominal wage growth has now outpaced the annual rate of headline inflation since the December quarter 2023, delivering six consecutive quarters of positive real wage growth. Despite this, however, real wages remain well down on pre-pandemic levels.

Employment jumps as unemployment rate holds steady

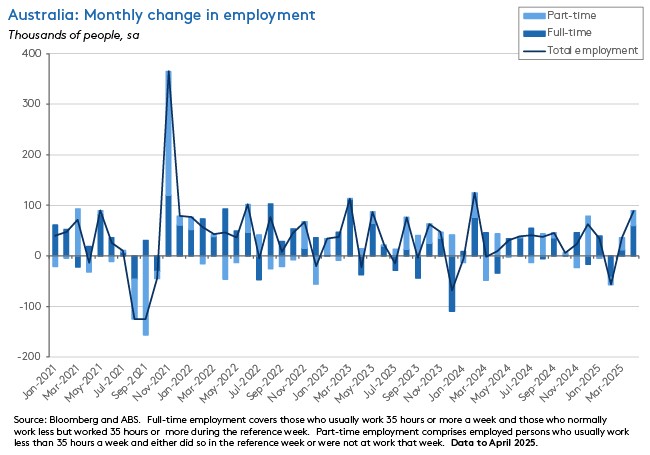

The ABS said employment rose by 89,000 (seasonally adjusted) in April 2025. That was a much stronger outcome than the consensus forecast, which had anticipated a 22,500 increase, and marked the biggest monthly increase since February 2024. Full-time employment was up by 59,500 last month while part-time employment increased by 29,500.

According to the Bureau, employment rose by 2.7 per cent or 390,000 people over the year. That comfortably outpaced the corresponding 2.1 per cent rate of population growth for people aged 15 and above. As a result, the employment to population ratio rose by 0.3 percentage points to 64.4 per cent, just below its record high of 64.5 per cent. Similarly, the participation rate also rose by 0.3 percentage points, increasing to 67.1 per cent and just 0.1 percentage point below January’s record 67.2 per cent rate.

Monthly hours worked in all jobs were little changed in April, up by a bit less than one million hours, although that did break a small run of two consecutive falls in hours worked.

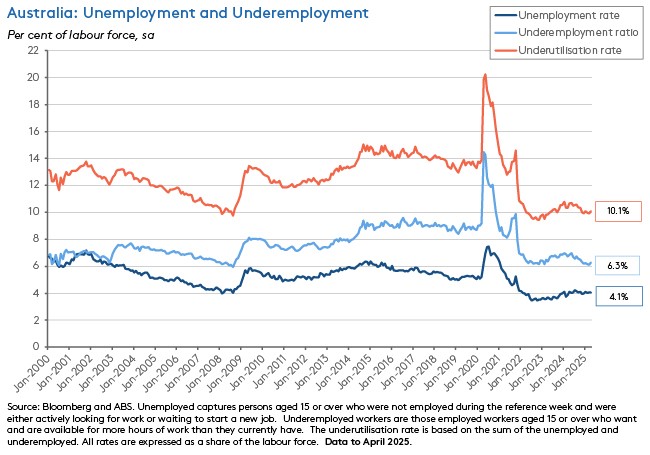

Australia’s unemployment rate was unchanged at 4.1 per cent in April, in line with the median market forecast. The underemployment rate edged higher by 0.1 percentage points from 5.9 to six per cent, while the overall underutilisation rate rose by 0.2 percentage points from 9.9 per cent to 10.1 per cent.

What else happened on the Australian data front this week?

The Westpac-Melbourne Institute Consumer Sentiment Index rose 2.2 per cent to an index reading of 92.1 in May 2025. Westpac attributed the increase to the post-Liberation Day rebound in financial markets and the clear-cut Federal election result, although sentiment overall remains in negative territory. Westpac also noted that the headline gain in the index this month likely understated the extent of the improvement in sentiment. That was because the previous April 2025 survey was in the field over the week that included Liberation Day, with sentiment among those surveyed after the tariff announcement down sharply – consistent with a sub-sample sentiment index read of just 86.6. Relative to that lower reading, May’s index reading represents closer to a six per cent rebound. Four of the five subindices improved over the month, with the biggest gain (seven per cent) for the ‘family finances vs a year ago’ subindex followed by a 2.8 per cent increase in the ‘economic outlook, next 12 months’ subindex. The ‘family finances, next 12 months’ subindex registered the only decline, slipping by 0.8 per cent. This fall occurred despite survey respondents saying they felt more confident about the likelihood of lower interest rates. The Westpac-Melbourne Institute Mortgage Rate Expectations Index (which tracks consumer expectations for variable mortgage rates over the year ahead) fell 7.5 per cent in May.

The ANZ-Roy Morgan Consumer Confidence Index rose 0.8 points to an index reading of 88.3 points to its highest level since the RBA’s February rate cut. A 3.2-point jump in the ‘short-term economic confidence’ subindex was the main driver of the weekly gain, along with a 2.5-point increase in ‘time to buy a major household item.’ There was also a small gain (up 0.9 points) for the ‘future financial conditions’ subindex. The other two subindices (‘current financial conditions’ and ‘medium-term economic confidence’ both fell. Weekly inflation expectations fell 0.4 percentage points to 4.5 per cent.

The NAB Monthly Business Survey reported that business conditions eased slightly in April 2025, with the index slipping from a reading of +3 points in March to +2 points last month. The decline was mainly driven by a four-point drop in profitability, along with a more modest one-point decline in trading conditions, while the employment subindex was unchanged over the month. Meanwhile, monthly business confidence index improved, increasing from a reading of -3 in March to -1 in April while remaining in negative territory. The survey reported that growth in labour costs was unchanged from the previous month, running at 1.6 per cent in quarterly equivalent terms. But growth in purchase costs accelerated from 1.4 per cent to 1.7 per cent. The rate of increase in product prices (up from 0.6 per cent to 0.8 per cent) and in retail prices (up from 0.9 per cent to 1.4 per cent) both picked up in April.

The ABS said the total number of new loan commitments for dwellings fell 3.5 per cent (seasonally adjusted) over the quarter but rose six per cent over the year in the March quarter 2025. Loans for owner occupiers were down 3.4 per cent quarter-on-quarter and up 4.4 per cent year-on-year, while loan commitments to investors were down 3.7 per cent in quarterly terms but 8.8 per cent higher on an annual basis. The value of new loan commitments fell 1.6 per cent over the quarter but was still 14.2 per cent higher than in the same quarter last year. The value of loans to owner occupiers was down 2.5 per cent in quarterly terms, while commitments to investors edged lower by 0.3 per cent.

According to the ABS, there were 761,230 short-term visitor arrivals in March 2025, an increase of 190 arrivals relative to March 2024. Total arrivals were 1,688,650, up 4.6 per cent over the year. There were 54,660 international student arrivals in March – that was up 10,080 from March 2024 but still 24 per cent lower than in (pre-COVID) March 2019.

Last Friday, the ABS said its Monthly Business Turnover Indicator rose 0.4 per cent (seasonally adjusted) over the month in March 2025. Turnover was up 4.6 per cent relative to March 2024.

Other things to note . . .

- The AFR profiles Australia’s new assistant treasurer.

- Grattan’s Tony Wood says Australia is at a fork in the road for energy and climate policy.

- NSW Productivity Commission releases new paper on smarter regulation through experiments.

- Ross Garnaut on energy transition and the restoration of Australian growth.

- Does economic pessimism explain Australian voters’ drift to minor parties and independents?

- A sceptical take on the new US-UK trade deal.

- New research from the IMF examines the impact of energy price shocks on the post-pandemic inflation surge. Over 2012 and 2022, global energy prices doubled relative to 2019, with a median price increase of more than 50 per cent. In Europe, where the war in Ukraine disrupted gas supply lines, the prices of oil, coal and gas rose by around 40 per cent, 130 per cent and 180 per cent respectively.

- The OECD highlights rising export restrictions on critical raw materials.

- Two FT Big Reads. The first is on China’s electricity revolution which it reckons has put China on the way to becoming the world's first ‘electrostate’ even as coal remains the dominant fuel in the country’s electricity mix. China accounts for both 80 per cent of coal-fired power under construction globally and 70 per cent of the world's utility-scale solar under construction. The second Read reviews the achievements of Elon Musk’s Department of Government Efficiency (Doge). While Doge claims it has made US$170 billion in savings – far below the initial promises of US$2 trillion – the FT finds it difficult to verify even this smaller amount.

- Olivier Blanchard has some thoughts about the evolution of mainstream macroeconomics over the last four decades.

- On pseudo-wealth and its implications for policy.

- Antony Beevor says we are still fighting World War 2.

- From the Economist magazine, why Gen X is the real ‘loser generation’ and how Saudi Arabia is changing.

- The Odd Lots podcast talks to Perry Mehrling on parallels between Trump 2.0 and the Nixon Shock.

- The Australia in the World podcast examines recent developments in SE Asia.

Latest news

Already a member?

Login to view this content