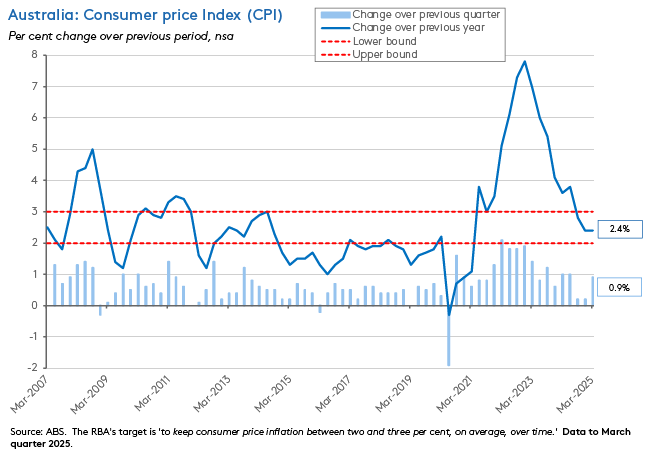

After more than three years, Australia’s underlying rate of inflation has a two in front of it again. This week’s release of the March quarter 2025 Consumer Price Index (CPI) reported that the annual rate of headline inflation remained unchanged from the December quarter at 2.4 per cent. That marked a third successive quarter of within-target band inflation. The RBA has indicated it will pay more attention to underlying inflation than the headline rate – the latter being influenced by changes in government policies around cost-of-living relief. This means the bigger news this week was the annual rate of trimmed mean inflation had eased to 2.9 per cent. That was the first sub-three per cent result for this measure since the December quarter 2021.

In fact, both headline and underlying inflation numbers came in a little bit above market consensus. In normal times, that slight overshoot might have been interpreted as strengthening the case for the RBA remaining on hold for a little longer and leaving the cash rate target unchanged at its upcoming meeting this month. But these are not normal times. Instead, the world economy continues to be roiled by trade policy uncertainty triggered by the second Trump administration in the United States. Recent weeks have brought more evidence of the disruptive impact on trade flows in the form of an import-driven contraction in US first quarter GDP, slumping Chinese export orders and falling US port activity. Meanwhile, the IMF has slashed its forecast for US growth this year by one percentage point and downgraded its outlook for global growth by half a percentage point. The Fund has also trimmed its forecast for Australian economic growth in 2025 by the same half percentage point.

The combination of continued progress on the inflation front with the ongoing deterioration in the international economic environment means the RBA’s cautious pre-Liberation Day stance toward prospects for further monetary policy easing is no longer appropriate. Instead, the central bank’s new Monetary Policy Board is likely to deliver another rate cut this month as Martin Place looks to take out insurance against an adverse external growth shock.

More detail on this week’s inflation numbers, recent trade policy developments, the latest IMF forecasts and the RBA’s evolving inflation views below.

Next Thursday 8 May, I will host an AICD webinar on Australia’s post-election economic environment, in which we will discuss the shifting international economic order in more detail, along with structural challenges facing Australian policymakers. I hope readers can join us. The webinar is free for AICD members and registration details are available here.

Underlying inflation eases in March quarter result but stronger than expected

The ABS said the headline Consumer Price Index (CPI) rose 0.9 per cent over the March quarter 2025 to be up 2.4 per cent in annual terms. The quarterly rate rose from 0.2 per cent in the December quarter 2024, while the headline rate remained unchanged.

Underlying inflation, as measured by the trimmed mean, rose 0.7 per cent over the quarter and 2.9 per cent over the year. That took the trimmed mean annual rate down to below three per cent for the first time since the December quarter 2021.

Both the headline and trimmed mean outcomes in the March quarter came in slightly above market expectations. Consensus forecasts had predicted headline inflation would rise 0.8 per cent over the quarter and 2.3 per cent over the year and underlying inflation would rise 0.6 per cent over the quarter and 2.8 per cent over the year. Still, both actual outcomes were broadly in line with the RBA’s forecasts as presented in its February 2025 Statement on Monetary Policy.

In terms of the drivers of inflation, the Bureau highlighted quarterly price rises in the Housing, Education and Food and non-alcoholic beverages Groups:

- In the Housing Group (up 1.7 per cent over the quarter), the main contributors to higher prices were Electricity (which jumped 16.3 per cent over the quarter) and rents (up 1.2 per cent). The big quarterly increase in electricity prices was due to the impact of Queensland households exhausting their $1,000 state government rebate, as well as reflecting differences in the rollout schedule of the 2024-25 Commonwealth Energy Bill Relief Fund rebate. The latter meant relief was lower in the March quarter of this year than the December quarter of last year. Excluding the impact of these policy interventions, electricity prices would have risen by just 0.4 per cent over the quarter.

- In the Education Group, quarterly increases in secondary education (up 6.4 per cent) ad preschool and primary education (up 5.6 per cent) reflected fee increases at the start of the school year, while a 3.6 per cent rise for tertiary education reflected the impact of annual CPI indexation being applied to university course fees at the start of the year.

- And in the Food and non-alcoholic beverages Group, the main driver of higher prices was fruit and vegetables (up 2.8 per cent over the quarter) reflecting seasonal reductions in supply.

Price falls over the quarter for the Recreation and Culture, Furnishings, household equipment and services, Clothing and footwear and Communication Groups partially offset these increases.

On an annual basis, rental prices were up 5.5 per cent last quarter, marking their weakest annual rise since the March quarter 2023. Similarly, the annual rate of increase for new dwellings prices slowed to 1.4 per cent, marking the weakest annual rise since the June quarter 2021. Electricity prices were down 11.5 per cent over the year, due to government mandates. And automotive fuel prices fell 5.1 per cent year-on-year due to lower global oil prices.

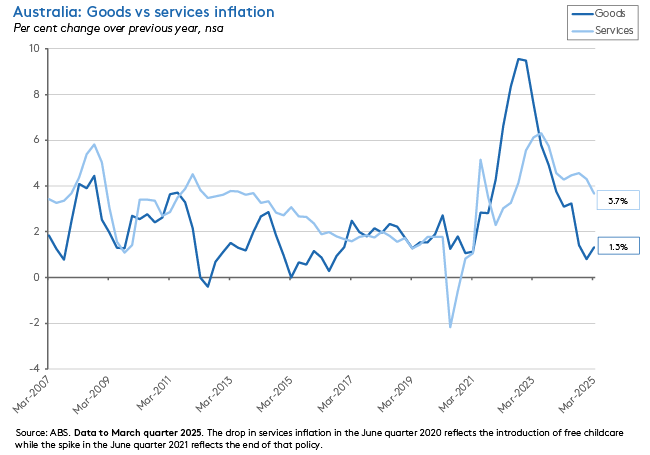

By broad analytical aggregate, annual services inflation eased from 4.3 per cent in the December quarter 2024 to 3.7 per cent in March quarter 2025 (the lowest rate since the June quarter 2022). The ABS noted that annual services inflation has continued to ease for most service categories over recent quarters, with the Bureau highlighting the contributions of lower rental price inflation and easing insurance cost increases. Meanwhile, the rate of annual goods inflation rose from 0.8 per cent to 1.3 per cent over the same period.

Non-discretionary prices rose 1.8 per cent over the quarter to be up 2.3 per cent over the year, reflecting increases in electricity, medical and hospital services and secondary education. Discretionary prices fell 0.2 per cent in quarterly terms but were still up 2.5 per cent on an annual basis. The quarterly fall was the product of declines in the prices of International holiday travel and accommodation, Furniture, and Audio, visual and computing equipment.

Global trade, policy disruption continues, keeping policy uncertainty elevated

In our pre-Easter assessment, we noted that the trade measures pursued by the US Trump administration had continued to drive a high level of trade policy uncertainty. Since that assessment, additional US trade policy developments have included the introduction of some exemptions for smartphones and other consumer electronics products (on 11 April); the announcement of a series of Section 232 investigations into imports of pharmaceuticals and pharmaceutical ingredients and semiconductor and semiconductor manufacturing equipment imports (14 April), into critical mineral and rare earths imports (15 April), and into truck imports (23 April); and an announcement from the USTR that it was introducing phased-in fees on the operators of Chinese-built ships, fees on foreign-built car carrier vessels, and restrictions on transporting LNG via foreign vessels (17 April). Most recently, the administration has announced modifications to its tariffs on cars and car parts.

The IMF reckons that as of 14 April 2025, the cumulative impact of the various measures announced to date has taken the US effective tariff rate on Chinese goods up to 115 per cent, while the US effective tariff rate on the world has risen to 25 per cent from less than three per cent in January this year. Meanwhile, Beijing’s retaliatory measures have seen the Chinese effective tariff rate on US goods jump to 146 per cent. The WTO and the Yale Budget Lab both report similar estimates. The WTO, for example, estimates that the trade-weighted average US tariff rate has increased to 25.9 per cent, including a ‘universal’ tariff rate of 10 per cent. Including the currently paused ‘reciprocal’ tariffs would increase this further to 29.9 per cent.

Note that these calculations tend to use prevailing (in the case of the WTO, 2024) trade weights to calculate trade-weighted effective tariffs. In practice, higher tariffs will lead to a mix of trade diversion and trade destruction, which means the final, actual effective tariff will be lower. For example, once tariff-induced changes in trade have taken place, the WTO reckons instead of 29.9 per cent it could be 16.1 per cent.

Similarly, the Yale Budget Lab estimates that the US average effective tariff rate is currently around 28 per cent, assuming no change in import patterns, or around 18 per cent after taking estimated changes in imports into account.

While the initial impact of these measures manifested in increased financial market volatility and falls in ‘soft’ data such as consumer and business sentiment, the impact on trade flows is now starting to appear. Notably, there have multiple reports of falling cargo bookings and shipments from China to the United States, alongside falling export orders from China. The Port of Los Angeles, a key entry route for Chinese imports into the United States, said cargo volumes are down 30 per cent over a year ago this week and it expects scheduled arrivals next week to be a third or more lower than in the same period last year. Bookings for standard shipping containers from China to the United States are likewise reportedly down 45 per cent over the year. (Note that shippings surged earlier in the year as importers sought to get ahead of incoming tariffs).

According to its latest forecasts, the WTO now expects global merchandise trade to contract by 0.2 per cent this year. That represents a hit to trade growth of almost three percentage points relative to pre-tariff projections. If the Trump administration introduces the currently suspended US ‘reciprocal’ tariffs, the WTO reckons global merchandise trade volume growth could contract by an additional 0.6 percentage points this year, while greater trade policy uncertainty could subtract a further 0.8 percentage points, together producing a 1.5 per cent decline in world merchandise trade.

IMF forecasts global trade to slow

In the April 2025 World Economic Outlook (WEO), the IMF attempted to gauge the economic impact of Trump 2.0 trade policy developments since its previous January 2025 set of forecasts, with the Fund cautioning that the ‘swift escalation of trade tensions has generated extremely high levels of policy ambiguity, making it more difficult than usual to establish a central global growth outlook’. The IMF’s central case scenario takes into account the sequence of trade policy measures announced between 1 February and 4 April this year, comprising the impact of the pre-Liberation Da’ US tariffs on Canada, China and Mexico, US tariffs on steel and aluminium and US tariffs on cars and car parts, along with Canadian and Chinese countermeasures, as well as the 2 April Liberation Day 10 per cent universal tariff and the country-specific US ‘reciprocal’ tariffs that ranged up to 50 per cent and covered around 60 countries. The Fund now expects global trade growth to slow from 3.8 per cent in 2024 to just 1.7 per cent this year. That represents a downgrade of 1.5 percentage points to the IMF’s January 2025 forecast for trade growth this year, reflecting the impact of higher tariffs, as well as the waning effects of cyclical factors that had driven the previous rebound in global goods trade.

Under this central case, the IMF now forecasts that global real output growth will slow from 3.3 per cent last year to 2.8 per cent this year, before recovering to three per cent in 2026. That means that relative to its January 2025 projections, the Fund has cut its growth forecast for this year by half a percentage point – with downward revisions for nearly all countries – and trimmed next year’s forecast by 0.3 percentage points. According to the WEO, the growth downgrades ‘are broad-based across countries and reflect in large part the direct effects of the new trade measures and their indirect effects through trade linkage spillovers, heightened uncertainty, and deteriorating sentiment’. There are particularly large downward revisions to 2025 growth projections for Mexico (down 1.7 percentage points relative to the IMF’s January forecast), the United States (down 0.9 percentage points), the ASEAN-5, Canada and China (all down 0.6 percentage points), and for Australia, Japan, the United Kingdom (all down 0.5 percentage points). The IMF has also scaled back growth projections for the EU (down 0.2 percentage points) and India (down 0.3 percentage points) for this year, albeit by a smaller amount.

Under the same central forecast, the IMF forecasts global headline inflation to slow from 5.7 per cent last year to 4.3 per cent this year and then to ease again to 3.6 per cent in 2026. While the disinflation trend remains intact, however, it is now expected to be a bit slower than the IMF predicted back in January, with the rate of increase in world consumer prices now 0.1 percentage point higher in 2025 and 2026. This upward revision reflects a 0.4 percentage point increase in expected inflation in advanced economies for 2025, with the US inflation forecast revised up by a full percentage point. The Fund attributes this forecast adjustment to a mix of ‘stubborn price dynamics in the services sector as a well as a recent uptick in the growth of the price of core goods…and the supply shock from recent tariffs.’

Note that the IMF also discusses the impact of tariff announcements made after 4 April, including the Trump administration’s 90-day pause on ‘reciprocal’ tariff rates, increased tariffs on China and exemptions for smartphones, laptops and other electronic devices and components, plus Beijing’s most recent retaliatory tariff hikes. The Fund’s judgement is that if these measures are considered on their own (excluding any impact from the associated market fallout and higher policy uncertainty) and if they are assumed to be permanent, the impact on aggregate global growth is little changed from its central case scenario. However, the country-by-country distribution of growth looks different as gains for those countries subject to lower tariffs are largely offset by poorer growth outcomes in China and the United States, due to the higher level of bilateral tariffs that also then reverberate through global supply chains.

Even after April’s downgrades to its January forecasts, the IMF still judges that risks to the global economic outlook remain tilted to the downside. Those risks include the threat of escalating trade measures and prolonged trade policy uncertainty; the possibility of sudden changes in the international monetary system in response to rising geopolitical tensions; the risk of inflationary pressures due to some combination of trade war-boosted import prices, high (and in some cases rising) inflationary expectations and disruption to the supply of key commodities; the danger of financial market volatility and correction; rising long-term interest rates; rising social discontent; increasing challenges to international cooperation and labour supply gaps.

To end on a more upbeat note, the Fund also identifies several upside risks including the potential for next-generation trade agreements, any resolution or mitigation in ongoing conflicts; a reacceleration in structural reforms and scope for an AI-led increase in economic growth.

Implications for May 2025 RBA Monetary Policy Board meeting

What will all this mean for the RBA’s new Monetary Policy Board (MPB) when it holds its next meeting later this month, on 19-20 May? At its last meeting, held 31 March – 1 April, the RBA had left the cash rate target unchanged at 4.1 per cent. But that meeting was held before Liberation Day and the consequent shock to the global economy.

According to the Minutes of that policy meeting – the inaugural one for the RBA’s new MPB – domestic risks to the outlook for growth and inflation remained ‘two-sided, with some that could result in economic activity and inflation in Australia being weaker than expected and others that could result in economic activity and inflation strengthening more noticeably.’

Turning from domestic to international considerations, the MPB’s pre-Liberation Day judgement was that:

‘Regarding risks to the outlook for the global economy, members noted these had increased and were tilted to the downside. They agreed that a significant further increase in global tariffs or other trade restrictions could materially disrupt global trade. Uncertainty about global economic policy settings could also lead firms and households to reduce spending and investment. If either of those consequences were to transpire, global economic activity could fall significantly, though the implications for inflation would be more complicated.’

The impact of these global developments for Australian monetary policy would then depend on their effects on Australian activity, employment and inflation. Discussion in the Minutes suggested that risks to activity would be skewed to the downside, if the effect of tariffs and policy uncertainty on global growth turned out to be larger than expected, if the size of spillovers to Australia was greater than anticipated and if there were material tariff increases in other economies. On the other hand, there could be offsetting impacts from any stimulus measures introduced by Beijing.

In the case of inflation, the Minutes cautioned that:

‘Some of those developments could exert disinflationary pressure, including weak demand and the potential for trade diversion, but others could be inflationary, such as potential impairments to global supply chains and exchange rate depreciation.’

After acknowledging it ‘was possible to envisage circumstances in which the impact [of global developments] was significant’, the Minutes report that the MPB’s judgement was that ‘the information to hand did not imply a significant change in the outlook, despite the substantial level of uncertainty’. While this assessment underpinned the decision to leave the cash rate target unchanged, the Minutes also confirmed:

‘Members observed that the May meeting would be an opportune time to revisit the monetary policy setting with the benefit of additional data about inflation, wages, the labour market and trends in economic activity, along with a fresh set of economic forecasts and further information about the likely evolution of global trade policies. Collectively, this information would have a considerable bearing on their decision.’ [Emphasis added]

In a post-Liberation Day speech on 10 April, Governor Bullock offered an update on the RBA’s thinking, explaining that a ‘key focus for us is how all this uncertainty is affecting decisions made by households and businesses in Australia’. She also cautioned it is still ‘too early for us to determine what the path of interest rates will be’. Since then, the mix of additional data, including this week’s inflation numbers, plus ongoing deterioration in the international economic environment, should have pushed the RBA towards the case for a precautionary rate cut this month.

What else happened on the Australian data front this week?

Not even global trade wars can stop Australian house prices, it seems. According to CoreLogic’s national Home Value Index, dwelling values recorded a third consecutive monthly increase in April 2025, rising 0.3 per cent over the month and 3.2 per cent over the year to add $2,720 to the median value of an Australian dwelling and set a new record high. The combined capitals index was up 0.2 per cent month-on-month and 2.6 per cent year-on-year, with all capital cities recording an increase over the month. National rental growth was 0.6 per cent over the month (0.4 per cent on a seasonally adjusted basis) and 3.6 per cent over the year. CoreLogic also commented that Australia’s ‘housing undersupply isn’t getting any better’ as commencements in the December quarter 2024 were 16.5 per cent below their decade average. Construction costs also rose through the March quarter 2025. Housing affordability is not improving either. The national dwelling value to household income ratio ended last year on par with record levels at eight, while home loan serviceability was also at a record high. CoreLogic reckons that for a household on median income purchasing a median value dwelling with a 20 per cent deposit, the resulting mortgage payments would swallow up 50.5 per cent of their gross income. It would also take the same median income household an average of 10.6 years to save their 20 per cent deposit.

The ANZ-Roy Morgan Australian Consumer Confidence Index fell 2.1 points to 83.4 points in the week ending 27 April 2025. The two largest falls by subindex were a 7.1-point slump in ‘future financial conditions’, which are now at their lowest level since mid-July last year, and a smaller but still significant fall of 2.9 points in ‘medium-term economic confidence.’ ANZ noted that rising global uncertainty has now offset what had been a trend of rising disposable incomes contributing to increased confidence. Meanwhile, weekly inflation expectations have risen to 5.1 per cent.

The ABS said Australia’s seasonally adjusted merchandise trade balance was $6.9 billion in March 2025, up $4 billion from February’s result. Exports were up $3.2 billion (7.6 per cent) driven by non-rural goods in general and by exports of metal ores and minerals in particular, while imports fell by about $0.9 billion, led by a $0.5 billion fall in imports of capital goods.

According to the ABS, Australian export prices rose 2.1 per cent over the March quarter but fell 4.7 per cent in annual terms, while import prices were up 3.3 per cent on a quarterly basis and 3.2 per cent higher on an annual basis. The Bureau highlighted higher iron ore and gold prices as lifting export prices and the impact of a depreciation in the Australian dollar against the US dollar in pushing up both export and import prices.

The ABS also published new international trade data for calendar year 2024. The numbers report a goods and services trade surplus of $30.2 billion, comprising exports of $644.4 billion and imports of $614.1 billion. China remained our most important export market, accounting for $196 billion of goods and services exports, followed by Japan ($75.6 billion) and South Korea ($41.7 billion). The United States was our fourth most important export market last year, accounting for $40.1 billion of export sales.

New ABS data on Australia’s population by country of birth shows that as at 30 June last year, our total population included 8.6 million people who were born overseas (31.5 per cent of the total). That is the highest share since 1891. The four most common countries of birth were England (3.5 per cent of Australia’s total population), India (3.4 per cent), China (2.6 per cent) and New Zealand (2.3 per cent).

Other things to note . . .

- The April Quarter 2025 RBA Bulletin includes essays on leading labour market indicators and the transmission of monetary policy, along with an explainer on measuring unemployment.

- Also from the RBA, Assistant Governor (Financial Markets) Chris Kent gave a speech on Australia’s external position and the evolution of FX markets. A key theme of Kent’s speech was the rising role played by Superannuation funds which has translated into a substantial increase in our net foreign equity position. That is, Australians have accumulated more shareholdings on the rest of the economy than overseas investors have accumulated Australian shares. Although much of this increase was driven by valuation effects arising from higher overseas equity valuations and depreciation in the Australian dollar, it has also been a product of rising investment by Australian superannuation funds, with the latter increasing their offshore asset allocation from nearly one third in 2013 to about half by last year.

- The ABS presents nine facts about Australia’s overseas-born population.

- On the plan for Australia to stockpile critical minerals.

- ASPI’s Agenda for change 2025 provides strategic policymaking advice for the 48th Parliament of Australia.

- The Grattan Institute suggests five ways that Australia could improve our democracy: stay on course with the National Anti-Corruption Commission (NACC); amend recent electoral reforms to level the playing field for new candidates vs incumbents; tighten the rules on taxpayer-funded government advertising; extend best practice processes to all public appointments and make public grants processes more open and competitive; and do more to reduce vested-interest influence in politics including by improving the transparency of lobbying activity.

- An FT Big Read on Australia on the eve of the Federal election.

- Also from the FT, a Special Report on the future of global trade.

- Along with the World Economic Outlook discussed above, the IMF has also published April 2025 editions of its Global Financial Stability Report and Fiscal Monitor.

- The latest Commodity Markets Outlook from the World Bank reckons that global commodity prices will slump by 12 per cent this year before falling a further five per cent in 2026, taking them to levels not seen since 2020. In real terms, the Bank projects prices to fall below their 2015-19 average, marking the end of the post-COVID/Ukraine war boom. According to the Bank, commodity price volatility in the current decade has been the highest since at least the 1970s.

- A White Paper from AllianceBernstein on Geopolitics, Mar-a-Lago Accord and Investing in the New World Order.

- Barry Eichengreen on the Trump administration, the US dollar and the geopolitics of international currency choice.

- Estimates from the Peterson Institute on the US revenue implications of the Trump tariffs.

- The WSJ looks at how the rush to beat tariffs is now distorting the US economy.

- The OECD’s Taxing Wages 2025. According to the OECD, for the average single worker, Australia has the 29th lowest tax wedge (out of 36) in the OECD, at 29.6 per cent vs the OECD average of 34.9 per cent. The tax wedge measures the tax on labour income and is given by the ratio of the sum of personal income tax plus employee and employer social security contributions less family benefits to total labour costs (where the latter is given by gross wages plus employers’ social security contributions). The average single worker in Australia faced a net average tax rate of 25.3 per cent compared to the OECD average of 25 per cent.

- Also from the OECD: a look at government support for R&D.

- The McKinsey Global Institute considers how to propel Indonesia’s productivity.

- From the same source, 10 physical realities the energy transition must tackle.

- The latest edition of the BIS Bulletin analyses AI and human capital in the context of central banks.

- On quantum theory and the enduring popularity of Schrodinger’s cat.

- Tyler Cowen talks international macro and chess with Ken Rogoff.

- The Odd Lots podcast cautions that some of America’s most important economic data is decaying. See also the Economist magazine on how crumbling statistical offices mean that in the US, UK, New Zealand, Germany and beyond, economists don’t know what’s going on.

Latest news

Already a member?

Login to view this content