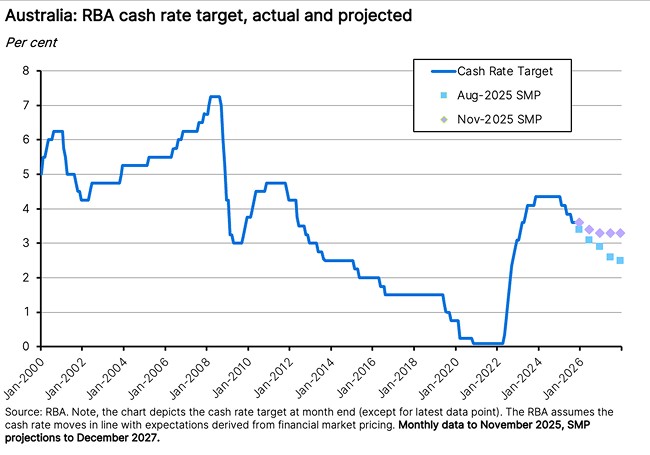

Australia’s Monetary Policy Board (MPB) voted unanimously this week to leave the cash rate unchanged at 3.6 per cent. The decision was widely expected after last week’s surprisingly strong September quarter 2025 inflation reading.

In line with those expectations, and after noting that the outcomes for underlying inflation were ‘materially higher’ than the RBA had anticipated in its August forecasts, the MPB noted in its post-meeting statement that:

‘The recent data on inflation suggest that some inflationary pressure may remain in the economy. With private demand recovering and labour market conditions still appearing a little tight, the Board decided that it was appropriate to maintain the cash rate at its current level at this meeting.’

As a result of pre-meeting consensus, RBA-watchers were – to at least some extent – focused less on the announcement and more on the tone and content of post-meeting communications as a pointer to the central bank’s future intentions. The key message is it’s now a close call whether the current easing cycle is over, or whether there is still the chance of perhaps one more 25bp rate cut next year. That was also the signal contained in market pricing around the time of the meeting. This was captured in the assumed path for the cash rate as presented in the accompanying November 2025 Statement on Monetary Policy (SMP).

That trajectory implies a much shallower path for the cash rate than the one assumed in the August 2025 SMP. It also suggests that our previous estimate of a ‘terminal’ cash rate of around three per cent looks too high.

Barring any big shocks or surprises in the meantime, the upcoming 8-9 December MPB meeting looks set to maintain the policy status quo. So, no Christmas present for mortgage-holders from the RBA at the end of the year.

Balancing inflation and labour market risks

Simplifying matters somewhat, the MPB made two key judgements this week.

The first and most important was to decide on implications of the September quarter inflation reading. On this, both the Governor’s post-meeting press conference and commentary in the November SMP sounded vigilant but not unduly alarmed. The judgement was that evidence suggests ‘a little more inflationary pressure in the economy than previously thought’, although the RBA also thinks part of the increase in underlying inflation last quarter is likely to be temporary. Governor Bullock told the press conference (twice) that the MPB had not felt the need to consider the case for a rate hike this week.

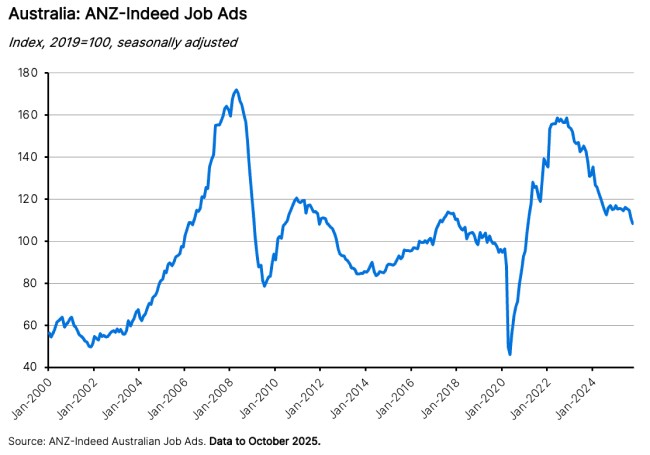

Secondly, the MPB also had to consider implications of a jump in the unemployment rate to 4.5 per cent in September 2025. In this case, the RBA’s view was that while labour market conditions had eased ‘by a little more than expected’, it still reckons some tightness yet remains in the labour market. And again, according to the Governor, the Board did not discuss a potential rate cut at the November meeting.

In both cases, then, the approach was to ‘keep calm and carry on.’ The RBA and the MPB are persisting with their cautious, data-dependent and meeting-to-meeting approach to interest rate setting. They remain mindful of two-sided risks to the outlook, while putting the emphasis more on inflation concerns.

How does the RBA see the inflation outlook?

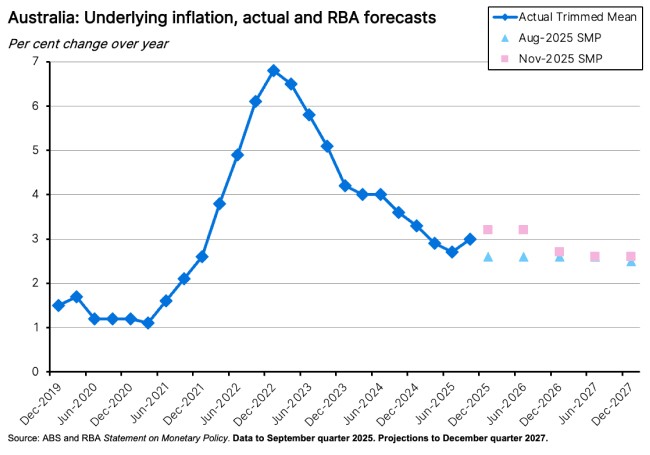

Supporting that judgement are revised forecasts for inflation presented in the November 2025 SMP.

In the near term, the new inflation projections are appreciably higher than the ones presented in the August 2025 SMP. Headline inflation, for example, is now expected to finish this year at 3.3 per cent in the December quarter (up from three per cent in the August SMP) and then to rise to 3.7 per cent in the June quarter 2026 (up from 3.1 per cent in the previous SMP) before easing to 2.6 per cent by the December quarter 2027. Even then, the SMP forecasts inflation to still be a little above the middle of the RBA’s target band in two years’ time.

Likewise, the RBA expects underlying inflation as measured by the trimmed mean to end this year at 3.2 per cent and then remain at that level through to the June quarter of next year. Previously, the RBA had pencilled in a 2.6 per cent rate for this period.

Remember, the RBA conditions these projections on the technical assumption of one 25bp rate cut to the cash rate next year. So, given one more rate cut, the RBA still sees inflation returning to its target band over the forecast horizon. But at the same time, it also reckons that with one more cut, both headline and underlying inflation will still have a ‘three’ in front of them for some time yet, and that even by end-2027, inflation will not be all the way back to 2.5 per cent. In other words, one more rate cut remains possible in this framework but is far from a given.

Finally, the SMP helpfully sets out three key judgments that underpin these projections, along with three key risks to the outlook. These are useful guides as to what to watch over the coming months to see if the economy is performing in line with the RBA’s expectations, and where to look for potential sources of disruption. The three key judgements are:

- Australian real GDP growth will stabilise around estimates of potential growth (that is, around two per cent*) from late this year.

- Labour market conditions will not ease much further (the SMP forecasts the unemployment rate ending this year at 4.4 per cent and then staying there through to the end of 2027).

- There is slightly more capacity pressure (the extent to which demand exceeds supply) in the economy and in the labour market than the RBA thought was the case in August this year.

And the three key risks are:

- Growth in demand could turn out to be either weaker or stronger than estimates of potential supply.

- The RBA could have underestimated or overestimated the degree of spare capacity in the economy and the labour market.

- Global growth could turn out to be weaker than the RBA is currently forecasting (it sees major trading partner growth running at 3.6 per cent this year and 3.2 per cent in 2026), although it also reckons there are risks in both directions.

*Back in August the RBA downgraded its estimate of trend annual productivity growth from one per cent to 0.7 per cent and its estimate of potential growth from 2.25 per cent to two per cent.

Other Australian data points to note

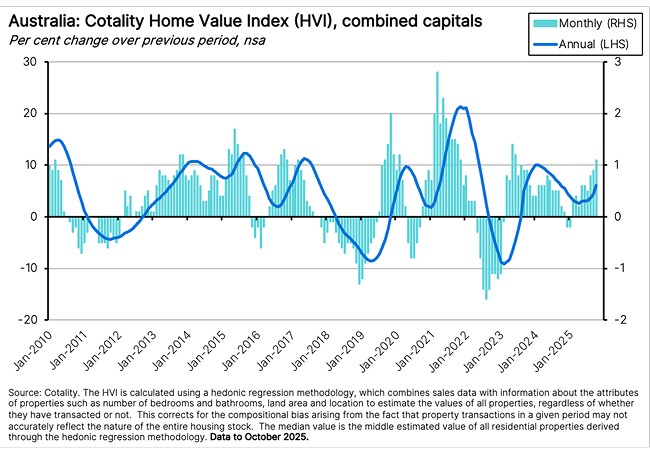

Australian house prices remained on their recent upward trajectory last month. According to the latest Cotality monthly Home Value Index, national home values rose by 1.1 per cent over the month in October 2025 to be up 6.1 per cent over the year. That marked the fastest monthly gain since June 2023. The combined capitals index was also up 1.1 per cent in monthly terms and 5.6 per cent higher over the year. Cotality says that equates to an increase of around $10,000 in the median dwelling value over the month. Since February this year, when the RBA delivered the first rate cut of the current easing cycle, median dwelling values have risen by more than $53,700.

While modest monetary easing delivered to date has played a role in stimulating the housing market, a key underlying driver of house price growth continues to be the mismatch between supply and demand. The data provider said that while its own rolling quarterly estimate of home sales is currently running more than three per cent above the five-year average, advertised supply levels are 18 per cent below average. With both commencements and completions currently growing at rates well-below their decade averages, the demand supply gap is likely to persist. Changing assumptions about the likely trajectory of RBA policy as outlined could have a moderating effect but would be pushing against that demand-supply imbalance.

Cotality also pointed to the likely upward impact on prices of the expansion in the government’s five per cent deposit scheme which took effect on 1 October and probably provided a further lift to demand. Despite repeated arguments from economists and others as to their ultimately perverse impact on prices, demand-side solutions to the housing affordability challenge continue to attract government support.

Meanwhile, the post-GFC story of the role of rising asset prices vs relatively sluggish wage gains driving uneven economic outcomes continues to play out.

Australian Job Ads: Another small piece of the labour market puzzle

ANZ-Indeed Australian Job Ads fell 2.2 per cent over the month (seasonally adjusted) in October 2025, to be 7.5 per cent lower over the year. That represented a fourth consecutive monthly drop, including a (downwardly revised) 3.5 per cent monthly fall in September. The series has now fallen for six of the last seven months. That means the direction of change in the Job Ads series is consistent with a labour market that is easing. Note that in level terms, however, the series remains elevated relative to pre-pandemic conditions, with the October Index more than eight per cent above the 2019 average.

Also released this week

The ABS published monthly and quarterly estimates of household spending. Across the September quarter 2025, real spending rose by a modest 0.2 per cent over the quarter to be up 2.7 per cent over the year. While that represents the fifth consecutive quarterly increase in household spending volumes, it is also the weakest increase since the September quarter 2024. That suggests some downside risk to the story of a recovery in household consumption that gained traction following the June quarter national accounts.

ABS Selected Living Cost Indexes (LCIs) for the September quarter 2025. The Employee LCI was up 0.6 per cent over the quarter and 2.6 per cent over the year. Employee households benefited from falls in mortgage interest charges, which fell 3.8 per cent over the quarter following the RBA’s rate cuts. By comparison, the headline rate of annual CPI inflation was 3.2 per cent (unlike the LCI, the CPI excludes mortgage interest payments).

ABS data on barriers and incentives to labour force participation in Australia for the 2024-25 financial year.

Building Approvals numbers for the September quarter 2025 from the ABS showed total dwellings approved rising 12 per cent over the quarter (seasonally adjusted) and 15.3 per cent over the year to 17,019. The Bureau said a 26 per cent increase in approvals for apartments (private dwellings excluding houses) drove quarterly growth. That rise in approvals was the highest seen since the December quarter 2022, with the number of approvals also up more than 55 per cent compared to the same period last year.

ABS data on public sector employment and earnings for 2024-25 reported that total public sector employee jobs rose 3.3 per cent between June 2024 and June 2025 to approach 2.6 million. Of that total, the Commonwealth government (including defence personnel) accounted for about 15 per cent, state governments for 77 per cent and local governments for eight per cent of employment of public sector employees.

Further reading and listening

- The Economic Weekly is now also on LinkedIn. Subscribe to catch the latest economic updates directly in your feed.

- The AFR digs into the debate over Australia’s net zero target.

- The Grattan Institute has released a new report on housing in Australia, arguing that three-storey townhouses and apartments should be allowed on all residential land in all capital cities, while housing developments of six storeys or more should be allowed as-of-right around major transit hubs and key commercial centres. A podcast discussion – Want to fix the housing crisis? Build up – is also available.

- The November 2025 edition of the RBA Chart Pack.

- As highlighted last week, the ABS will start publishing a Monthly CPI later this month (on 26 November) and has now discontinued the old Monthly CPI Indicator. In response, the RBA has released a technical note on the transition to a complete monthly CPI. Alternatively, for a shorter read on the topic, see Box C in this month’s Statement on Monetary Policy.

- A couple of FT Big Reads: the first asks, will Military Keynesianism work in Europe (a potentially challenging thesis if estimates that defence spending has a fiscal multiplier of less than one are correct); the second looks at the extreme market dominance of Big Tech.

- Related to that second piece, a crash is coming…or then again, maybe not.

- From the Deutsche Bank Research Institute, the ultimate guide to long-term investing.

- The Economist Magazine has a special report on China, energy and climate.

- Related, on EV adoption and China’s oil consumption.

- In the WSJ, how Europe’s economic problems have migrated from South to North, and how the US economy has defied ‘doomsday’ predictions on tariffs.

- A nice essay on the labour market lessons from the long-running relationship between radiology and AI.

- On chatbot ‘brain rot.’

- The OECD’s International Migration Outlook 2025 says migration flows remained high last year – some 15 per cent above pre-pandemic levels – but were down four per cent on 2023 numbers. The report also notes that following recent years of high inflows, some OECD countries are now explicitly targeting lower numbers. And it highlights the rise of migration polices as a version of talent acquisition strategies.

- Megastructures on Mars and echoes of Barsoom.

- The Joe Walker podcast in conversation with Peter Costello on Australia’s last great act of economic courage – the GST reform package.

- The Conversations with Tyler podcast talks to OpenAI’s Sam Altman.

Latest news

Already a member?

Login to view this content