This week we focus on two key items. The AICD’s latest Director Sentiment Index (DSI), which highlights directors’ growing concern over productivity and regulation, and the October 2025 labour market data, which unwound September’s surprisingly large loosening.

According to the DSI results for the second half of this year (H2:2025), directors are increasingly concerned about Australia’s disappointing productivity performance and frustrated by the growing burden imposed by regulation and red tape. The productivity-sapping presence of regulatory barriers to building, investing, and generally ‘getting stuff done’ is a key message from the survey, and there is an important warning for policymakers here. The government’s declared economic and political objectives require it to deliver on ambitious plans to build more homes, advance its Future Made in Australia initiative, and oversee an exceptionally large roll out of new energy capacity in line with aggressive energy transition and emissions reduction targets. All of which requires private sector involvement. A regulatory regime that drives risk aversion, increases complexity and uncertainty, and pushes up costs makes achieving those objectives harder and even threatens to render them undeliverable.

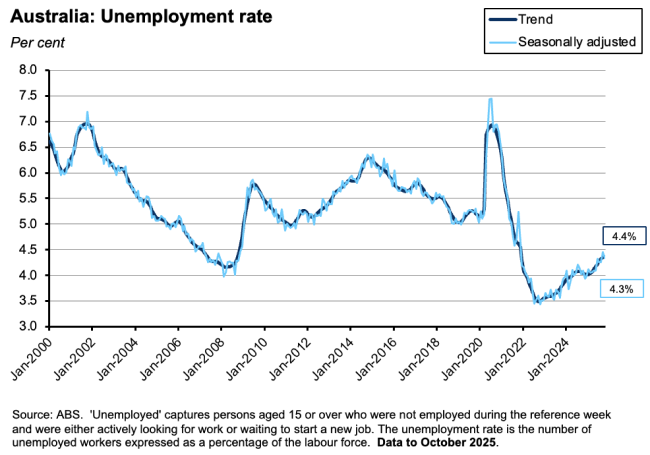

On the data front, the main news this week was that Australia’s seasonally adjusted unemployment rate eased back to 4.3 per cent in October 2025. That fully unwound the previous month’s jump to 4.5 per cent and bettered the market consensus forecast of a 4.4 per cent outcome. Last month’s growth in employment (a 42,200 gain) likewise outpaced the median market expectation (20,000). In our review of last week’s RBA decision, we noted that Australia’s central bank sounded relatively unperturbed by September’s jump in the unemployment rate, judging that if anything there was still a degree of tightness in the labour market. Indeed, one of the three key judgements underpinning the forecasts in the November 2025 Statement on Monetary Policy was that labour market conditions would not ease much further, and one of the three key risks was that the RBA might have misjudged the degree of spare capacity in the labour market. This week’s numbers will give Martin Place some additional comfort on the Monetary Policy Board (MPB)’s decision to look past that surprisingly weak September labour market outcome and on its unanimous vote to leave the policy rate unchanged.

More detail on the DSI results and the labour market numbers below plus the usual roundup of other data releases as well as suggestions for further reading and listening.

Key finding from the DSI: Productivity, regulation and reform

Twice a year, every year since 2011, the AICD has been publishing our Director Sentiment Index or DSI. Polling for the latest survey took place between 15 and 29 September this year and captured the views of 1,072 AICD members with current directorships.

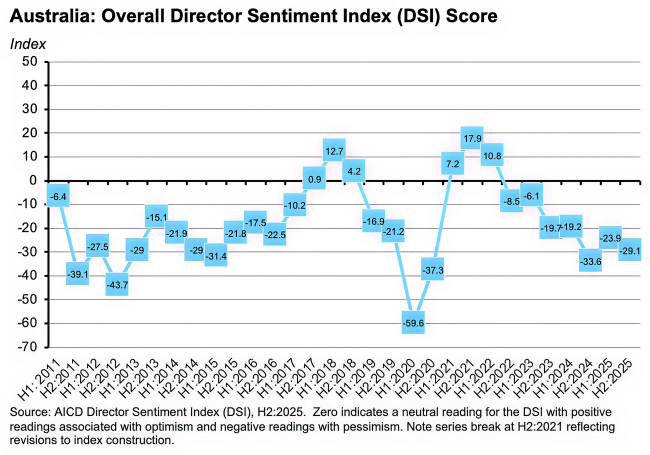

The headline result is that director sentiment has fallen since the H1:2025 survey, with the index dropping by more than five points to -29.1. That remains a little above the recent low of -33.6 recorded in the H2:2024 survey. But it is also considerably weaker than the survey average and represents the second weakest reading of the post-pandemic period.

That weakness reflects concerns that include poor productivity growth and elevated levels of global economic uncertainty, along with our survey respondents’ increasing frustration with high levels of regulation and ‘red tape.’

With the supporting survey taking place shortly after the policy debate around the August 2025 Economic Reform Roundtable (remember that?), this version of the DSI included additional questions on productivity and reform. In this context, notable findings included:

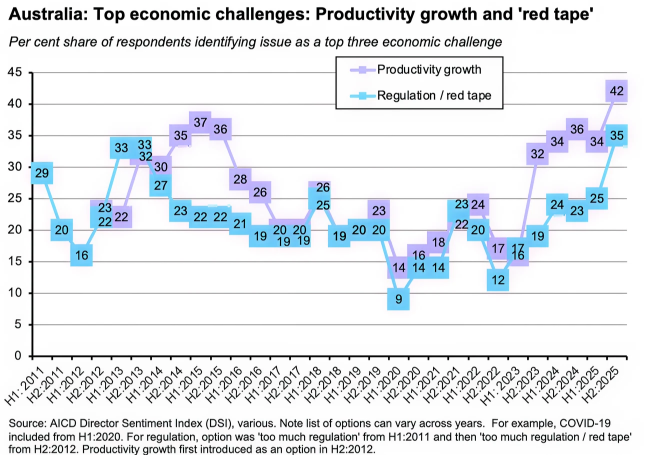

- Australia’s lacklustre productivity performance is very much on the minds of directors. They now rank productivity as the top economic challenge facing Australian businesses (with 42 per cent of respondents’ total mentions), ahead of global economic uncertainty (itself with an elevated 39 per cent of mentions) and regulation / red tape (35 per cent). And some 78 per cent of directors worry that current productivity levels are likely to pose a risk to Australia’s economic outlook. Unsurprisingly then, in terms of policy priorities, directors selected productivity growth as the top issue that the federal government should address in the short term (39 per cent of mentions), comfortably ahead of second-placed housing supply (28 per cent). Likewise, they ranked it as the second ranked issue for the federal government’s longer-term policy priorities (28 per cent), just behind climate change (29 per cent).

- The survey also tested opinion on a range of frequently cited policies to boost productivity, asking how effective each option would be. Here, the DSI finds broad support. A very large majority of respondents agreed that: faster project approvals (88 per cent of respondents), reduced regulatory costs and investment in AI and digital (both at 87 per cent), supply chain improvements (85 per cent), government support for innovation and R&D (84 per cent),and tax reforms and lower energy costs (both at 83 per cent) would be either extremely or somewhat effective in improving productivity. Even the relatively lower ranked items such as labour market reforms (78 per cent), investment in housing (76 per cent), and reduced barriers to international trade and investment (75 per cent) scored highly. Taking a slightly different cut of the data and looking only at the award of ‘extremely effective’ ratings, the standout was faster project approvals (with 53 per cent of respondents suggesting it would be extremely effective), followed by reduced regulatory costs (48 per cent) and lower energy costs (45 per cent).

- A key driver of Australia’s poor productivity performance to date has been the disappointing rate of business investment. Here the DSI results highlight regulatory complexity or uncertainty (54 per cent of total mentions) as the highest barrier to increasing business capex, followed by high taxation/unfavourable tax policies (42 per cent), policy or economic uncertainty (37 per cent) and high energy costs (33 per cent). The corresponding DSI ranking of policies that would be most likely to encourage higher investment is headed by a simplified or more predictable regulatory environment (45 per cent), followed by the availability of government incentives or grants (36 per cent), and greater policy certainty and stability (34 per cent). Interestingly, directors ranked more competitive tax rates ranked relatively lower (at 26 per cent).

- When the survey asked directors about the biggest barriers to a regulatory system that would support greater national productivity, responses highlighted a lack of focus on the cumulative burden of regulation (61 per cent of mentions) and insufficient coordination between different regulators and/or levels of government (60 per cent), followed by a bias towards a rules-based system as opposed to an outcomes-focused or more flexible one (54 per cent).

- A large majority of directors (82 per cent of respondents) thought that a major business deregulation agenda would have a positive impact on Australia’s productivity and economic growth (23 per cent thought the impact would be significant vs 47 per cent opting for a moderate positive impact). In terms of the preferred focus of any deregulation agenda intended to boost productivity, the leading candidates were planning regulations (52 per cent of mentions), industrial relations (50 per cent) and construction and building regulations (38 per cent). Only 12 per cent of respondents though deregulation was not a priority or suggested no focus.

- Consistent with the above, the DSI found that legal and regulatory compliance is the second most important issue ‘keeping directors awake at night,’ with 29 per cent of total mentions (behind cyber-crime and data security with 34 per cent). And 67 per cent of respondents said that regulatory and compliance requirements are limiting productivity growth in their business.

- The DSI also reflected on the August Reform Roundtable’s discussion of issues around fiscal sustainability, budget repair, and tax reform. When asked how to best deliver fiscal sustainability, the favourite choice of respondents was a reduction in the share of government spending in the economy (46 per cent of mentions), followed by an increase in taxation (23 per cent) and a combination of the two approaches (17 per cent). In terms of which kinds of spending to trim, by far the most popular response involved boosting the efficiency and effectiveness of government spending (85 per cent of responses). Other options were all seen as relatively less attractive, with the next highest ranked option a reduction in social spending (38 per cent of respondents) followed by cutbacks in planned increases in defence spending and reductions in spending on pensions (both at 24 per cent). There is relatively little enthusiasm for pulling back on so-called tax expenditures around superannuation (20 per cent) or the family home (14 per cent).

- Finally, turning to tax policy, the DSI offered respondents a range of ‘tax packages’ to choose from in line with the August Roundtable’s precondition that any proposed changes be revenue neutral. Of the menu of options offered by the survey, the one that attracts the approval of the largest share of respondents is a reduction in personal income taxes offset by an increase in the GST (which secured 64 per cent agreement vs 21 per cent disagreement) while the most unpopular package is the idea of trading off a removal of dividend imputation in return for a lower company income tax rate (which secured only 25 per cent agreement vs 41 per cent disagreement).

As always, there is a wealth of data in the DSI results, and a detailed Data Pack (pdf) is available for those who would like to dig deeper into the survey findings.

Labour market update: Conditions tightened in October

According to the October 2025 Labour Force report, Australia’s seasonally adjusted unemployment rate fell to 4.3 per cent from 4.5 per cent in September, while the number of unemployed people fell by 17,000. On a trend basis, the unemployment rate was unchanged at 4.4 per cent.

The underemployment rate (seasonally adjusted) also dropped from 5.9 per cent to 5.7 per cent. As a result, the underutilisation rate fell from 10.4 per cent to ten per cent. In both cases, the move took the economy back to the rates seen in August, before the September jump in reported joblessness.

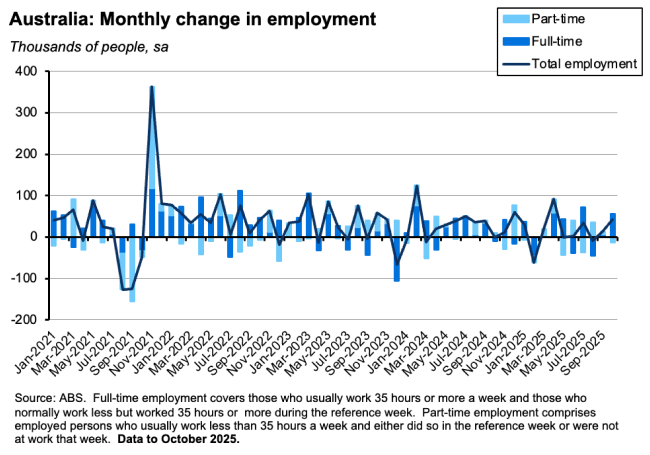

Employment rose by 42,200 last month, with full-time employment increasing by 55,300 and part-time employment falling by 13,100. The ABS noted that more unemployed people moved into employment than was typically the case in October.

Hours worked also increased last month, with the monthly rise (0.5 per cent) outpacing the growth in employment (0.3 per cent).

Finally, the employment-to-population ratio was flat at 64 per cent in October and the participation rate also held steady at 67 per cent.

Overall, then, the return of unemployment and underutilisation to August’s levels plus the jump in employment coming after September’s weak result is a reminder of the volatility of the monthly numbers. It is also consistent with the MPB’s decision to leave monetary policy on hold last week.

Other Australian data points to note

The Westpac-Melbourne Institute Consumer Sentiment Index jumped 12.8 per cent to an index reading of 103.8 in November 2025. That marks the first ‘net positive’ consumer sentiment reading since February 2022 and – excluding COVID-related disruptions in 2020 and 2021 – represents the most positive result in seven years. According to the detail of the survey, households are feeling much more confident about both the near-term and medium-term outlook for the Australian economy.

The ABS quarterly data on lending indicators reported that the total number of new loan commitments for dwellings rose 6.4 per cent (seasonally adjusted) over the September quarter to be up 5.8 per cent over the year. Within that total, lending to investors was up 13.6 per cent quarter-on-quarter and 12.3 per cent year-on-year. According to the Bureau, the number of investment loans is back up to its highest level since the March quarter 2022. That in turn also helped push the value of new dwelling loans up to a record high.

According to the NAB monthly business survey, business conditions picked up in October 2025 with the corresponding index rising one point to +9, its highest level since March last year. The index of business confidence fell one point to +6, but that still left it above the survey’s long-run average.

The ABS said that there were 695,500 short-term visitor arrivals (recorded trips) to Australia in September 2025.

Further reading and listening

- Several items from the RBA this week. The Deputy Governor gave his take on the outlook for the Australian economy. And provided more in an interview with Reuters. There is a new Bulletin article on Technology investment and AI: What are firms telling us? And a new Research Discussion Paper on Ageing and economic growth in China.

- The AFR’s Chanticleer column highlights two risks to define the next decade: rising geopolitical tensions and growing intergenerational inequality.

- Jobs and Skill Australia’s Jobs and Skills Report 2025. Some of the data presented in Chapter 4 offer interesting insights on the changing nature of the Australian economy. According to the report, service industries accounted for nearly 90 per cent of employment growth over the decade to May 2025 as well as 80 per cent of employment in that year. Growth was led by the Health Care and Social Assistance (employment up by 886,700 to more than 2.3 million or about 16 per cent of total employment), Professional, Scientific and Technical Services (up 359,700) and Education and Training (up 337,800) industries. In line with those industry numbers, the occupation that saw the largest employment growth by headcount over the same period was Aged and Disabled Carer (up 225,900), followed by Registered Nurse (up 107,600). Employment growth by skill level was strongest for the highest skill category (commensurate with a bachelor’s degree or higher) at 41 per cent and softest for the lowest skill category (secondary education) at just four per cent. Looking ahead, the Report projects that the same three industries that drove growth over the past decade will drive almost half of all employment growth over the next decade, with the Health Care and Social Assistance Industry projected to grow its employment share to 17.5 per cent.

- According to the ABS, Australia’s life expectancy at birth for the 2022-24 period was 81.1 years for males and 85.1 years for females. Both estimates were unchanged from the previous (2021-23) estimates.

- The e61 Institute’s Gianni La Cava on the big shock absorbers in Australia’s mortgage market.

- A new Treasury Working Paper examines the link between non-compete clauses and wages in Australia.

- Some push back against the case for taxing income less and consumption more.

- On best practice for supply-side reform.

- Are we headed for a US-China power-sharing agreement?

- As the COP30 Climate talks play out in Belem, Brazil, the UN’s Emissions Gap Report 2025 finds that global warming projections over this century, based on a full implementation of Nationally Determined Contributions (NDCs), are now 2.3-2.5C, while those based on current policies are 2.8C. Relative to past policies, it reckons that the new NDCs ‘have barely moved the needle.’ Likewise, the OECD’s Climate Action Monitor 2025 says that the slowdown in global action (as measured by the number of new policies and policy stringency) it has observed since 2021 continued into last year, leaving the world off track either to reach net zero by 20250, or to meet ambitions to limit warming to even 2C. And according to the latest Climate Action Tracker, the world has made little policy progress over the past four years.

- Also from the OECD, Latin American Economic Outlook 2025.

- And from the WSJ, Brazil’s Amazonian Fertilizer play.

- The Economist magazine on some potential downsides of the recession in recessions.

- How China’s Belt and Road Initiative has reshaped the landscape of trade and investment.

- Making the case for Turkey’s return to great power status.

- A column by the FT’s Martin Wolf asking whether a fragmented Europe can continue to prosper, juxtaposing Walter Sheidel’s Escape from Rome thesis on the benefits of fragmentation with the Draghi report’s lament for the inability of the EU to cooperate, collaborate and operate on a scale that matches the challenges posed by the United States and China.

- Noah Smith (Noahpinion) reckons that on current trends an increasing share of humanity will live in big countries that are badly run.

- The Odd Lots podcast looks at how Chinese real estate became the biggest bubble in history.

- The Macro Musings podcast on the history of growth driven deflation and the potential impact of AI.

- The Past Present Future podcast has resumed its Politics on trial series, with episodes on the Scopes ‘Monkey’ Trial, the Moscow Show Trials (although note that a second episode covering the trial of Bukharin is subscriber only), and the post-War Trial of Marshall Petain.

Latest news

Already a member?

Login to view this content