This week’s set of data releases sent conflicting signals on the health of the Australian economy.

Dear readers, please note that the regular Economics update is going to take a break while I enjoy some annual leave. Publication should resume in the week beginning 24 July.

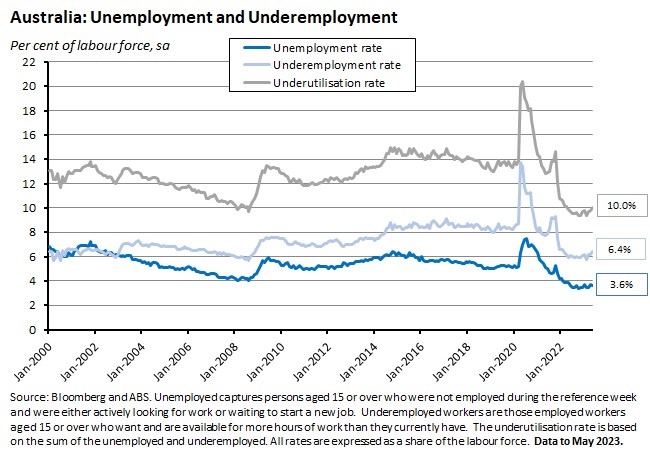

Starting with the positive, the ABS labour force report for May 2023 depicted a labour market in robust health: the economy added almost 76,000 jobs over the month, the unemployment rate fell back to just 3.6 per cent and both the participation rate and the employment to population ratio rose to record highs. Yes, the overall underutilisation rate (which adds the underemployment rate to the unemployment rate) did edge 0.2 percentage points higher to 10 per cent. But that was still almost four percentage points lower than its pre-COVID (March 2020) rate.

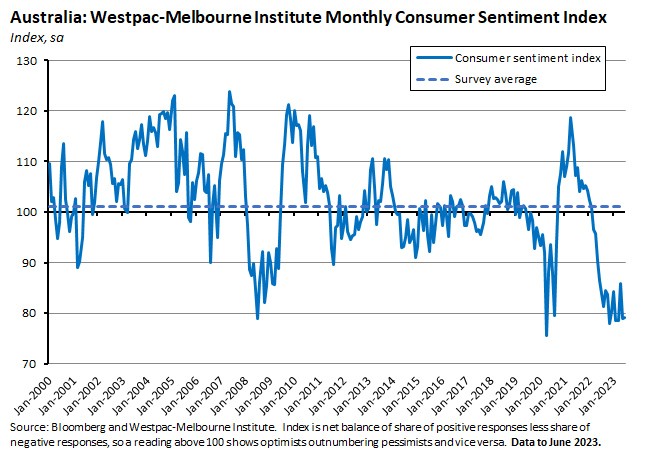

On the negative side of this week’s statistical balance sheet, however, the latest confidence readings suggest that households and now firms are deeply concerned about the future. For example, while the headline numbers for the June 2023 Westpac-Melbourne Institute Consumer Sentiment Index were little changed from the previous month, a look at the subset of readings based only on survey responses collected after the RBA’s 6 June cash rate hike reveals a steep decline from levels that were already recession-like. At the same time, according to the weekly ANZ-Roy Morgan Consumer Confidence Index, confidence dropped last week to its lowest level since the pandemic-wracked month of April 2020. Meanwhile, businesses are shedding some of their earlier relative optimism. The results of the NAB Business Survey for May 2023 reported a sharp fall in business conditions (albeit to still positive levels) while business confidence and forward orders both tumbled into negative territory.

There are two different ways to interpret these results. One take would be that while the less tangible measures of expectations might be signalling weakness, the harder numbers on jobs are telling us that in fact the economy remains in decent shape. Alternatively, one might argue that the forward-looking expectations readings are warning us that the economy is set to weaken in the months ahead, and that the backward-looking labour market reading are just informing us that things were fine as of May. Both views have a degree of merit, but on balance, the RBA is likely to place more weight on the job numbers. That means that, taken overall, this week’s releases have bolstered the case for another rate hike as early as next month. Certainly, that has been the initial market reaction, and some market economists have also lifted their estimate for the terminal cash rate for this cycle.

More detail on those data releases as well as a roundup of other data and links from the past week below.

Employment jumps, unemployment drops

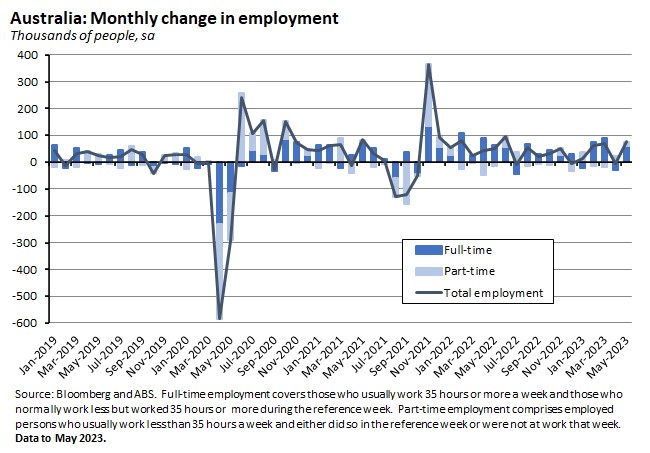

The ABS said the number of employed people in Australia rose by 75,900 (seasonally adjusted) in May 2023 to take total employment to a little over 14 million. The consensus forecast had called for a much more modest rise of 17,500. Full-time employment rose by 61,700 last month, while part-time employment rose by 14,300.

The Bureau noted that the robust growth in employment last month followed a small decline in April, when employment fell by more than usual over the holiday period and that over the past two months, employment increases averaged around 36,000, down only modestly from the 39,000 monthly average that has prevailed over the past year.

Back in March 2020, employment was just below 13 million, so the economy is now employing an additional one million people compared to before the pandemic. Moreover, both the employment to population ratio (at 64.5 per cent) and the participation rate (at 66.9 per cent) rose to record highs in May.

Although total employment was up in May, hours worked fell 1.8 per cent. The ABS pointed out this followed a 2.7 per cent rise in April, when fewer people than usual were working reduced hours over Easter, and that in overall terms hours worked remained elevated last month (about 0.9 per cent higher than in March 2023, for example). More people than usual also worked less due to sickness (4.2 per cent vs a pre-pandemic average of 3.5 per cent).

The number of unemployed people fell by 14,500 last month, taking the unemployment rate back down to 3.6 per cent, from 3.7 per cent in April. Once again, that was a better result than economists had anticipated, with the median forecast expecting no change in the unemployment rate over the month.

The underemployment rate rose to 6.4 per cent in May from 6.2 per cent in April and as a result, the underutilisation rate also increased, rising to 10 per cent from 9.8 per cent. But that still compares very favourably to a pre-pandemic underutilisation rate of 13.9 per cent.

Taken overall, not only was this a strong result, but it was also appreciably stronger than the median forecast. This shows that despite 400bp of rate increases and despite a rapid increase in the rate of net overseas migration over recent months, the labour market remains tight. Last week’s note reported that the RBA is currently very focussed on unit labour cost pressures. In that context, this week’s evidence of a still-tight labour market will add to the case for another hike in the cash rate, potentially as soon as next month.

Higher interest rates, still-high inflation undermine confidence

While a tight labour market and rising unit labour costs represent a significant upside risk for the RBA, a key downside risk relates to prospects for household spending. Here the evidence is that last week’s ‘surprise’ rate hike has taken a significant toll on household confidence. Granted, on the surface the monthly Westpac-Melbourne Institute Consumer Sentiment Index was largely unchanged in June 2023, edging up 0.2 per cent over the month to an index reading of 79.2. But the survey underpinning the index was conducted over 5 – 9 June and spanned the week of the RBA monetary policy meeting. And Westpac notes that while overall survey results showed little change in sentiment, that message does not survive consideration of the timing of the RBA’s rate hike. Before the decision was announced, confidence had lifted sharply from May’s 79 to a reading of 89. After the rate hike, however, confidence slumped to an extremely low reading of just 72.6. Moreover, sentiment has now been at ‘recession lows’ for most of the past year, and even the ‘unadjusted’ index result maintained that run of exceptional weakness.

The same monthly report also suggests that – despite strong May labour force results discussed above – households’ optimism about the future health of the labour market has started to crack. The accompanying Unemployment Expectations Index rose in June and delivered the first weaker than average reading in the current cycle, indicating that more respondents now anticipate a rise in unemployment.

Broadly consistent with this result, the weekly ANZ-Roy Morgan Consumer Confidence Index fell 3.1 points to an index reading of 72.7 last week. That marks the lowest level of confidence on this measure since April 2020 and ranks among the four weakest results recorded since the pandemic. By subindex, ANZ noted that confidence about both current and future economic conditions fell markedly following the RBA’s June rate hike, while respondents’ assessments of current financial conditions and time to buy a major household item were also weaker. While confidence fell across renters, outright homeowners and mortgage holders last week, confidence among those paying off their homes in particular hit a new record low.

To date, businesses have reported more resilience than consumers in the face of rising interest rates and high inflation. That now looks to be changing. The latest monthly NAB Business Survey captures what the report calls ‘worrying signs of a slowing in activity’ in May 2023. Business conditions fell by seven points to an index reading of +8 points last month, with declines across all three subcomponents: trading conditions (down eight points), employment (down seven points) and profitability (down five points). Sure, that still left both the overall index and all its components in positive territory, and business conditions do remain a little above their long-term average. But in terms of the direction of change, conditions have now weakened significantly since the early months of this year. Meanwhile, business confidence fell four points to an index reading of -4 points. Business confidence has now been at or below neutral since February of this year, with most industries now in negative territory.

Other forward-looking indicators were quite mixed. On the one hand, forward orders slumped by six points and moved into negative territory; but at the same time, the rate of capacity utilisation remained elevated at 84.7 per cent.

Finally, NAB’s survey results report that price and cost growth edged higher in May. Labour cost growth rose to 2.2 per cent in quarterly equivalent terms, purchase cost growth rose to 2.5 per cent and final products price growth increased to 1.3 per cent, although retail price growth continued to moderate.

What else happened on the Australian data front this week?

The Melbourne Institute’s measure of expected inflation (based on the trimmed mean measure) was unchanged in June 2023 at 5.2 per cent.

Calendar year data on international trade show that Australia recorded a goods and services trade surplus of $155.7 billion in 2022, with the value of exports of goods and services up 29 per cent to $668.9 billion and imports of goods and services up 33 per cent to $513.2 billion. The ABS said China continues to be Australia’s largest export market, accounting for 27.6 per cent of all exports last year, followed by Japan (17.9 per cent). China was also the largest source of Australian imports, accounting for 22.3 per cent of total imports. The United States (11 per cent) was our second largest supplier.

In April 2023, the number of short-term visitor arrivals rose to 544,920, up 309,450 trips from the same month last year. Total arrivals were 1,370,470, an increase of 796,540 over the year. The ABS also reported that there were 42,830 international student arrivals in Australia in April, up 21,700 compared to April 2022 but still 3.7 per cent lower than in April 2019, before the impact of COVID.

The ABS said the value of Australian residential dwellings rose by $140 billion to $9,874.7 billion in the March quarter 2023. That’s down from the peak value of $10,094.1 billion reached in the March quarter last year. With the number of dwellings rising by 52,000 to 11,020,300, the mean price of residential dwellings rose to $896,000 in the March quarter of this year, up $8,500 from the December quarter 2022.

Last Friday, the ABS published its experimental monthly business turnover indicator for April 2023. The indicator showed that turnover fell across nine of the 13 published industries over the month (seasonally adjusted), with the largest decline suffered by Mining (down 10.6 per cent) and the largest rise recorded in accommodation and food services (up 1.7 per cent). The Bureau said this was the largest set of monthly declines since July 2021 and the COVID-19 Delta outbreak. In annual terms, turnover rose in 11 of the 13 industries, led by Construction (up 18 per cent) and Other services (up 13.6 per cent).

Also last Friday, the ABS published the March quarter 2023 Labour account. According to the data, the vacancy rate remained unchanged at 2.8 per cent. That’s well above the pre-pandemic rate of 1.6 per cent, but somewhat down from the 3.2 per cent peak rate recorded in Q3:2022. The ABS also reported that the number of multiple job-holders rose 2.1 per cent to 947,000 in the March quarter – a rate of 6.6 per cent. That is the highest rate of multiple job holding in the history of the series (which goes back to 1994) and compares to a pre-pandemic (December quarter 2019) rate of 5.8 per cent. By industry, the increased rate was largely driven by increases in the Health care and social assistance and the Accommodation and food services industries.

Other things to note . . .

- The June 2023 Quarterly Statement from the Council of Financial Regulators. No surprise the Council says it ‘continues to closely monitor the resilience of Australian households to higher interest rates and cost-of-living pressures’.

- The June 2023 edition of the RBA Bulletin covers a range of issues including climate change and financial risk, new insights into the Australian rental market, the relative contributions of supply and demand to inflation, and a new explainer on the causes of inflation.

- The AFR’s John Kehoe on Australia’s Productivity Time Bomb. Also from the AFR, the RBA’s productivity problem in four charts.

- Related, Peter Martin argues there is little that workers can do to boost Australia’s lacklustre productivity growth.

- Interim report from the Productivity Commission on the Future Drought Fund.

- An FT Big Read on the outlook for the US economy.

- A Greg Ip essay in the WSJ on Bidenomics and its contradictions.

- The latest World Energy Investment report from the International Energy Agency.

- This Reuters Special Report says rich nations’ claims on climate change-related spending are not all they seem.

- The Economist asks, is the global housing slump over? It reckons that record levels of migration, strong household finances (boosted by pandemic-era savings) and shifting preferences explain market resilience.

- It does look like the US Great Resignation is over.

- The critical role of the Indo-Pacific in the semiconductor supply chain.

- A new report from the McKinsey Global Institute seeks to reimagine economic growth in Africa.

- Some evidence on the pattern of AI use across firms and countries. It finds that larger and more productive firms are more likely to use AI.

- Related, Marc Andreesen on why AI will save the world.

- Beyonce as an inflationary shock?

- Is fake news just fake news?

- The Odd Lots podcast talks to Isabelle Weber on the big rethink on inflation. See also this recent New Yorker profile of Weber. And a critical response from Noah Smith on Weber and the price controls debate.

- The These Times podcast discusses How ‘Made in China 2025’ changed the world.

Latest news

Already a member?

Login to view this content