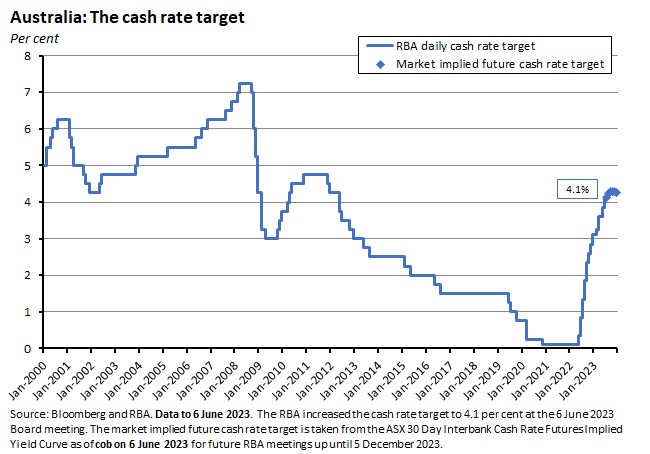

This week saw the RBA deliver its second ‘surprise’ rate increase in consecutive meetings, hiking the cash rate target by 25bp to 4.1 per cent and thereby delivering a cumulative 400bp of tightening over the past 13 months.

Tuesday’s decision, plus the accompanying RBA commentary, suggests two recalibrations of risk are now in order.

- First, Martin Place looks to have decided that the risk of inflation proving more persistent than it previously expected has increased, as have the dangers associated with a sustained period of above-target inflation. It follows that the RBA is now willing to tolerate greater downside risks to activity to bring inflation back to target in a timelier manner.

- Second, that shift in the RBA’s calculations means an increased probability of additional rate hikes from here. That in turn implies a greater risk that the central bank ends up over-tightening, tipping the economy into recession.

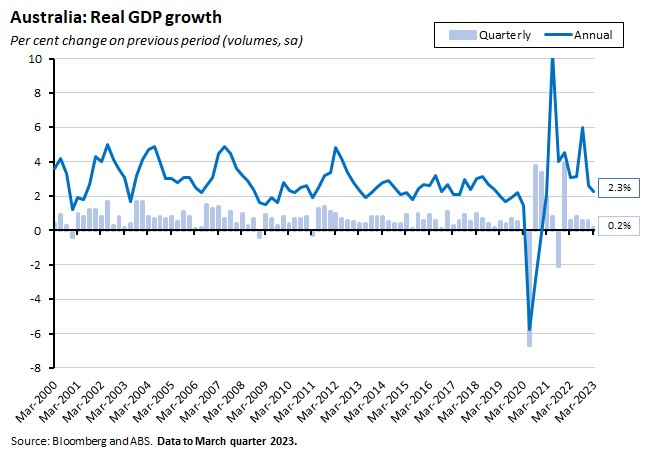

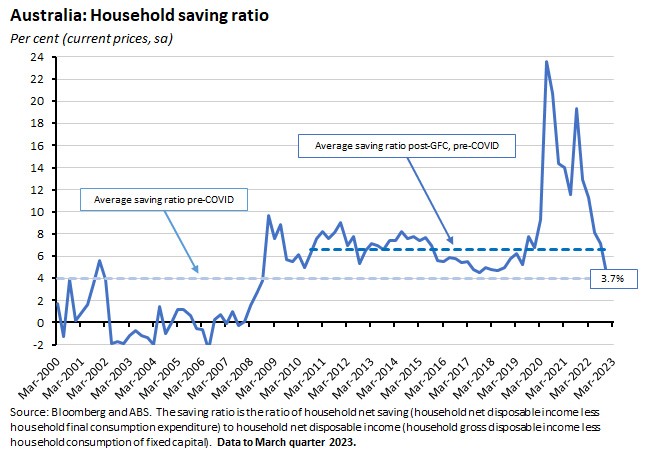

Worryingly, the March quarter 2023 national accounts – published by the ABS the day after the RBA meeting – offered little reassurance on either the inflation or the growth front. In the case of the former, slumping productivity and rising employment costs translated into another steep increase in unit labour costs, which will serve to increase the inflation anxiety level at Martin Place. In the case of the latter, overall real GDP growth slowed to just 0.2 per cent over the quarter and went backwards in per capita terms. In part, that reflected an intensifying squeeze on the household sector: growth in household consumption slowed to a quarterly rate of just 0.2 per cent – the weakest result since the Delta lockdowns in Q3:2021 – while the discretionary spending component contracted. Meanwhile, the household saving ratio fell to 3.7 per cent, its lowest level since 2008.

As always, more detail on this and the rest of the week’s economic news below. Finally, a quick but sincere thank you to those able to attend the economic update in Victoria this week either in person or online. My apologies that I didn’t manage to speak with everyone at the end.

The RBA has now delivered a cumulative 400bp of rate hikes

At its monetary policy meeting on 6 June 2023, the RBA Board decided to increase the cash rate target by 25bp to 4.1 per cent. Since the central bank started the current tightening cycle back in May 2022, it has now delivered a total of 400bp of rate increases over the space of just 12 meetings and 13 months. April’s pause in the tightening cycle has turned out to be a very short-lived affair and has been followed by two back-to-back rate increases.

This week’s decision came as something of a surprise to financial markets, which along with most market economists had expected no change in the cash rate in June. That’s prompted some analysts to speculate that it was last Friday’s decision by the Fair Work Commission (FWC) to increase all modern award minimum wages by 5.75 per cent with effect from 1 July this year that led Martin Place to act. So, what did the RBA itself say was behind another 25bp of tightening?

In the statement accompanying the rate decision, Governor Lowe said that:

‘This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable time frame.’

And went on to argue that:

‘Recent data indicate that the upside risks to the inflation outlook have increased and the Board has responded to this. While goods price inflation is slowing, services price inflation is still very high and is proving to be very persistent overseas. Unit labour costs are also rising briskly, with productivity growth remaining subdued.’

High and persistent services price inflation, rising unit labour costs, and the threat of a rise in inflation expectations are all currently front of mind at Martin Place. In this context, and in a sign that the FWC decision had at least some impact on the RBA’s calculations, Lowe cited the recent pick up in wage growth, the expectation that public wage growth would pick up further, and the fact that ‘the annual increase in award wages was higher than it was last year.’ But he also noted that wage growth was still consistent with the inflation target provided productivity growth recovered.

In a speech (A Narrow Path) delivered the day after the rate decision, the RBA Governor elaborated on some of these themes, again referring to persistently high rates of services price inflation and referencing rising rents and the prospect of large increases in electricity prices later this year. He also said that the decision to increase rates followed ‘recent information that has suggested greater upside risks to the Bank’s inflation outlook’ and added that ‘the recent data on inflation, wages and housing prices were higher than had been factored into the forecasts.’ Lowe also returned to the theme of the dangers of inflation remaining above target for an extended period:

‘There is a limit to how long inflation can stay above the target band. The longer it stays there, the greater the risk that inflation expectations adjust and the harder, and more costly, it will be to get inflation back to target.’

While the RBA says that it is continuing to navigate the same narrow path between inflation and recession, its calculations appear to have changed over the past two months after the April pause. In particular, the central bank looks to be rebalancing its relative weighting of risks away from worrying about doing too much on rates, crashing the economy and driving up unemployment to a fear of doing too little and thereby not bringing inflation down quickly enough.

What does that mean for the cash rate? Last week, we wrote that the surprisingly strong April 2023 monthly CPI reading was likely to add the RBA’s concerns about the persistence of above-target inflation and that this made ‘it more likely that there is one more cash rate hike in the works – if not next week (where market pricing still signals that a pause is the more likely option), then at either the July or August RBA meeting.’ This week’s messaging from the RBA suggests that this judgement was too conservative in terms of expecting just one more rate rise, since after this week’s increase, the central bank was still indicating that further action may be required. Governor Lowe concluded this week’s statement by warning:

‘Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve.’

Lowe used his speech this week to nominate the global economy, household spending, unit labour costs and inflation expectations as the four key inputs that will guide the RBA’s decision. Subject to that data flow, then, a further 25bp cash rate increase is now very likely, and there is a reasonable chance that we get another one after that.

One last point on the RBA. The fact that both of the past two decisions have been viewed as a ‘surprise’ by markets suggests that its comms may not be working quite as intended.

GDP growth fell again in the March quarter 2023 as the squeeze on households continued

The ABS published the National Accounts for the March quarter 2023. The headline numbers showed the pace of quarter-on-quarter real GDP growth slowing from 0.6 per cent in the December quarter 2022 to just 0.2 per cent last quarter. While that result still marks six consecutive quarters of positive growth following the contraction associated with the September quarter 2021 Delta lockdowns, it was also the weakest growth result since then. Moreover, excluding population growth, real GDP fell by 0.2 per cent over the quarter. In annual terms, real GDP growth was 2.3 per cent while real GDP per capita was up by just 0.3 per cent over the year.

Quarterly activity was driven by domestic demand, which contributed 0.5 percentage points to growth, while net exports subtracted 0.2 percentage points as a 3.2 per cent rise in imports more than offset a 1.8 per cent increase in exports.

Most of that positive contribution from domestic demand came from investment, with private gross fixed capital formation contributing 0.2 percentage points and public fixed capital formation an additional 0.1 percentage points. Total private business investment – which in a strong result rose by 3.4 per cent over the quarter and 7.1 per cent over the year – contributed 0.4 percentage points to quarterly growth, but this was partially offset by declines in dwelling investment and in ownership transfer costs.

Household consumption also contributed 0.1 percentage points to real GDP growth, but the sector showed some significant signs of weakness in the March quarter. At just 0.2 per cent, for example, quarterly consumption growth was the weakest since the 2021 Delta lockdowns and failed to keep pace with population growth. Moreover, while spending on essentials did increase by 1.1 per cent, discretionary spending fell one per cent, with the ABS commenting that cost-of-living pressures had now exhausted residual post-lockdown demand.

Total income received by household rose 1.7 per cent in quarterly terms, driven by a 2.4 per cent rise in compensation of employees. But total income payable rose 4.4 per cent, lifted by higher income tax payable and higher interest payments on dwellings as well increased spending in line with higher prices. The ABS noted that mortgage interest payments jumped by 11.5 per cent over the quarter and as a result, the amount of money spent servicing mortgages has more than doubled over the past year. And with growth in gross disposable income failing to keep pace even with the March quarter’s modest rise in household consumption, the household saving ratio fell to 3.7 per cent. That’s the lowest level since Q2:2008 and a little below the post-GFC average.

In terms of price developments, nominal GDP rose 2.1 per cent over the quarter to be 9.2 per cent higher in annual terms, with the GDP deflator up 1.8 per cent quarter-on-quarter and 6.8 per cent year-on-year. Australia’s terms of trade rose 2.8 per cent over the quarter and were little changed on their March 2022 level.

As noted in the previous section, the RBA is currently extremely focused on developments in unit labour costs and the potential consequences for inflationary pressures. Unfortunately, the news here was not helpful, with productivity growth (measured as GDP per hour worked) falling 0.3 per cent over the quarter to be down 4.6 per cent over the year. With employment costs up, that translated into another strong rise in unit labour costs, which rose two per cent quarter-on-quarter and 7.9 per cent year-on-year.

What else happened on the Australian data front this week?

- Australia ran a current account surplus of $12.3 billion (seasonally adjusted) in the March quarter 2023, up $0.6 billion from the previous quarter’s surplus. The ABS said that the overall surplus was driven by a $41.1 billion trade surplus – the second highest on record – which was up $2 billion over the December quarter. That increase in turn was the combined product of a 0.4 per cent increase in exports of goods and services (led by exports of metal ores and minerals including iron ore and record lithium exports and of travel services which recorded their highest quarterly increase on record as the number of international students in Australia retuned to 94 per cent of pre-COVID levels) and a 0.9 per cent drop in imports (due in part to a large fall in import prices, particularly of fuels and lubricants). Partly offsetting the trade surplus was a $28.5 billion primary income deficit.

- Australia also recorded a $11.2 billion goods and services trade surplus in April 2023 (seasonally adjusted), down about $3.7 billion on the March 2023 monthly result. The ABS said that exports of goods and services fell five per cent (almost $3 billion) over the month due to lower exports of metal ores and minerals, while imports of goods and services were up 1.6 per cent ($0.7 billion), driven by civil aircraft and confidential items.

- The ABS said that the general government net operating balance fell by $6.2 billion to a surplus of $6.1 billion in the March quarter 2023. Total general government revenues fell by 2.6 per cent over the quarter to $223.6 billion with tax revenues down 4.4 per cent to $180.9 billion, while total expenses were up 0.1 per cent in quarterly terms to $217.5 billion.

- The ABS experimental monthly household spending indicator rose six per cent over the year in April 2023 on a current price, calendar-adjusted basis, with spending up 8.4 per cent for services and 3.6 per cent for goods. The annual rate of spending has slowed from a peak of 29.1 per cent last August, and this year has fallen from 17.8 per cent in January, 11.9 per cent in February and 8.4 per cent in March. The Bureau said that this was mainly due to lower growth in spending on services such as holiday travel and eating out, which has continued to normalise following the pandemic.

- The ANZ-Roy Morgan Australian Consumer Confidence Index slipped lower by 0.4 points last week, keeping the index below 80 for a 14th consecutive week. The subcomponent that measures confidence about future financial conditions fell to its lowest level since the start of the pandemic in March 2020. The measure of weekly inflation expectations rose 0.2 percentage points to 5.5 per cent. General government borrowing was $5.9 billion.

- ANZ-Indeed Australian Job Ads rose by 0.1 per cent over the month in May after a (downwardly revised) 0.7 per cent monthly drop in April. That leaves Job Ads eight per cent below their September 2022 peak but still a substantial 51.9 per cent above their pre-pandemic levels.

- The ABS published Business Indicators Australia for the March quarter 2023. On a seasonally adjusted basis, company gross operating profits were up 0.5 per cent over the quarter and 7.1 per cent over the year while wages and salaries rose 1.8 per cent quarter-on-quarter and 11.4 per cent year-on-year.

- The number of payroll jobs rose 0.5 per cent between the weeks ending 15 April 2023 and 13 May 2023. Over the same period, the ABS said total wages paid were down 2.4 per cent.

- The ABS said there were 41 industrial disputes over the March quarter 2023, down 27 from the previous quarter. There were 7,700 working days lost, down from 21,600 in the December quarter 2022.

- New ABS data on mineral and petroleum exploration show expenditure on mineral exploration rose 0.7 per cent over the March quarter 2023 to be up four per cent in annual terms, while (the much smaller in absolute dollar terms) expenditure on petroleum exploration rose 16.3 per cent quarter on quarter but fell 18.9 per cent over the year.

Other things to note . . .

- The ABS lists 12 things that happened in the Australian economy during the March quarter of this year. Plus insights from the Bureau on recent trends in Australia’s current account, trade balance, and primary income position and on Government Finance Statistics.

- The latest RBA chart pack is now available.

- In the AFR, Steve Grenville on the new normal for interest rates.

- The latest Productivity Commission report on Australian government services includes new data on quality and safety in Aged Care services and Services for people with a disability. Expenditure on the 17 services covered in the report comprises more than 70 per cent of all Australian, State and Territory government spending, or about $313 billion.

- Simon Longstaff on PWC and the professions.

- The Economist magazine on what’s wrong with Australian and Canadian firms, on greying economies. And (more tongue in cheek) on desk rage.

- The June 2023 edition of the World Bank’s Global Economic Prospects (GEP) publication reckons that global growth this year will slow to 2.1 per cent from 3.1 per cent in 2022, before staging a ‘tepid recovery’ in 2024 with a 2.4 per cent increase. The Bank worries that tight global financial conditions and soft external demand will depress growth prospects for emerging and developing economies and warns that global growth could be weaker than forecast if there is further and more widespread banking sector stress, or if persistent inflationary pressures call forth additional monetary policy tightening.

- For another perspective on international economic prospects, the June 2023 OECD Economic Outlook was also published this week. The OECD’s take is that global growth has stabilised this year and will recover modestly in 2024, but that still leaves the world economy in for two years of sub-par growth. There are also updated projections for Australia, with the OECD anticipating real GDP growth of 1.8 per cent this year slowing to 1.4 per cent in 2024, and the unemployment rate rising to 4.6 per cent by the end of next year.

- This April 2023 speech by US National Security Advisor Jake Sullivan is being credited with setting out a new US agenda for the world economy.

- A look at Russian data shows the complications in measuring geopolitical risk. Local Russian geopolitical risk measures send quite different signals to those based on news sources from the Anglosphere.

- The FT has lunch with Ted Chiang. (The referenced New Yorker Essay by Chiang on ChatGPT is here.)

- The IMF’s Gita Gopinath gave a speech on the power and perils of the ‘artificial hand’ to commemorate the 300th anniversary of the birth of Adam Smith. Gopinath argues that the AI revolution has the potential to be as disruptive as the Industrial Revolution was in Smith’s time.

- Also from the IMF, the June 2023 edition of Finance & Development focuses on the mounting challenges to global trade arising from geopolitical tensions, the return of industrial policy, rising protectionism and new technologies.

- A review of a new biography of Friedrich von Hayek.

- The WSJ considers the possibility of ‘a full employment recession’ in the United States, citing collapsing labour productivity growth, possibly as a function of labour hoarding in response to an unusually tight labour market.

- Martin Wolf and Larry Diamond discuss the democratic recession and saving democratic capitalism.

- Ezra Klein talks to Fareed Zakaria on recent geopolitical developments. Klein’s short talk on beyond the ‘matrix’ theory of the mind is also interesting.

Latest news

Already a member?

Login to view this content