This week’s publication of the Minutes from the 18-19 March 2024 Monetary Policy Meeting of the RBA Board confirmed that Australia’s central bank board feels unable to signal whether the next move in the cash rate target is likely to be an increase or a decrease.

Martin Place does judge that the data flow leading up to last month’s meeting was largely consistent with the economy remaining on the RBA’s narrow path to successful disinflation and a relatively soft landing for the Australian economy. But it also considers that the outlook is highly uncertain with upside risks (persistent inflation) and downside risks (a squeezed household sector and faltering consumer spending) broadly in balance.

RBA-watchers’ broad interpretation of all this was that, given the minutes indicated that the Board did not explicitly discuss the case for a rate rise last month – a change from previous meetings – the central bank is at least sounding less hawkish than it was earlier this year. That is consistent with the consensus view that the next move in rates remains much more likely to be down than up, albeit with the minutes also indicating that the RBA is currently in no rush to deliver any such monetary policy relief. For now, though, that’s a stance that the Reserve Bank Board itself still feels unable to communicate publicly.

Also, this week, Australia’s housing market continues to see rising values as strong demand keeps bumping into constrained supply and Australian Job Ads were largely flat over the March quarter of this year.

In addition, this week’s note includes a lengthy section summarising some of the key data releases that came out while the note was ‘on pause’ for AGS and the Easter break. As well as the March RBA meeting itself, this period brought a better-than-expected inflation reading for February, a (much) stronger-than-expected labour market result for the same month, and another read on Australia’s rapid rate of population growth.

As usual, more detail below.

RBA Minutes say the Board cannot rule in or out future changes in the cash rate

The RBA published the Minutes of the 18-19 March 2024 Monetary Policy Meeting of the Reserve Bank Board. That meeting is discussed in a bit more detail in the catch-up section below, but the summary version is that last month saw the central bank leave the cash rate target unchanged at 4.35 per cent for a third consecutive meeting while tweaking the accompanying statement in a way that was interpreted as indicating a shift to a somewhat less hawkish policy stance. This week’s minutes provided us with a little more detail on the Board’s thinking while restating the same conclusion – that the Board feels unable to say whether the next change in the cash rate target is likely to be up or down. They also explained that, in the Board’s view, the data released between the previous meeting in February and the March meeting had broadly been in line with the Board’s expectations and as such had not materially altered the outlook for growth or inflation – namely, that inflation remains high but is gradually returning to target and that the labour market is moving towards full employment:

‘In finalising the Board’s statement, members…decided to emphasise that the data indicated the economy was tracking broadly as expected and that while there were significant uncertainties, the risks seemed broadly balanced. Members agreed that it was therefore not possible to either rule in or out future changes in the cash rate target.’

Buttressing the initial interpretation of the March meeting’s outcome as indicating a slightly less hawkish RBA, this latest set of minutes did not rehearse the case for a possible increase in the cash rate, which was a debate that had featured in both the February 2024 and December 2023 Minutes following last November’s rate hike. But while there was therefore an implicit shift in tone, it was not accompanied by any explicit change in the RBA’s policy stance.

An update on financial stability

The Board also discussed the March 2024 Financial Stability Review which was released by the RBA on Friday 22 March.

Starting with the big picture, the minutes note both that the global financial system had proved to be resilient to date and that global financial stability risks remained elevated. The discussion flagged three global risks of relevance to Australia:

1. Further weakness in the Chinese property sector could spill over via trade channels and a rise in global risk aversion.

2. Ongoing weakness in global commercial real estate (CRE) markets could see increases in distressed CRE sales and non-performing loans.

3. And the world financial system could suffer a disorderly adjustment in global asset prices, for example due to worse-than-expected macroeconomic developments.

In addition, the Review itself also warns of increasing threats from outside the global and domestic financial systems, including cyber-attacks, risks associated with climate change, and geopolitical tensions.

In the case of the domestic economy, the Board noted that most Australian households were still able to meet both their debt service obligations and essential expenses, supported by the strong labour market and by savings buffers built up during the pandemic.

According to the RBA’s estimates, less than one per cent of households (and less than two per cent of highly leveraged borrowers) are 90 days or more in arrears. A small group of household borrowers – around five per cent of variable-rate owner-occupier borrowers – were estimated to have a cashflow shortage with expenses exceeding incomes, and an even smaller share (about two per cent of variable-rate owner-occupiers) were estimated to have both cash flow shortages and low savings buffers.

Conditions across the business sector were assessed as ‘uneven’, while company insolvencies had risen to pre-pandemic levels due largely to difficulties afflicting smaller businesses in the construction and discretionary spending sectors. Despite challenging conditions in the domestic CRE market, the Board saw ‘little evidence to date of financial stress among owners of Australian CRE.’

Overall, while banks were reported to be anticipating increases in business and household arrears, these were expected to remain low relative to history, and the sector was judged to be well prepared to handle any increase. Risks to financial stability posed by non-bank financial institutions were also assessed by the Review to be ‘relatively contained’ although this assessment was qualified by the presence of data gaps (including in relation to CRE activities) in less-regulated institutions.

And a new operational system for the implementation of monetary policy

Lastly, the minutes also reported that Board members discussed a paper on the future approach that the RBA could use to implement monetary policy. The impetus for change came from the decline in Exchange Settlement (ES) balances or ‘reserves’ now underway as the RBA continues to unwind its unconventional monetary policy. In this context, the paper had canvassed three broad options:

1. A return to a ‘corridor system’ with scarce reserves that would involve a return to the bank’s pre-pandemic approach

2. Sticking with the current ‘floor system’ with excess reserves that was adopted during the pandemic

3. A transition to a new ‘ample reserves’ system where the RBA would meet the demand for ES balances from banks at a pre-set price close to the cash rate target, using full-allotment auctions.

Under both the scarce and excess reserve systems, the central bank sets the quantity of reserves to affect the price, while under the ample reserves system, the supply of reserves rises and falls in line with changes in demand, with limited impact for the cash rate and other money market rates. Instead, the cash rate is kept close to target by a combination of the floor provided by the rate offered on ES balances and the auction price.

The minutes report that the Board endorsed a proposal to adopt an ample reserves system. The Board reportedly felt that this framework would be more resilient to changes affecting the demand and supply of reserves than the pre-pandemic scarce reserves system (reducing the risk of unexpected liquidity shortages), and that this would help limit the RBA’s balance sheet risk and would also imply a lower risk of distortions in market prices or impairments in market functioning relative to continuing to pursue an excess reserves system.

These changes are explained in more detail in a recent speech by Chris Kent (RBA Assistant Governor, Financial Markets) on The Future System for Monetary Policy Implementation. A detailed consultation paper along with a request for submissions from the RBA is also available.

CoreLogic Home values rose for a 14th consecutive month in March 2024

CoreLogic’s national Home Value Index (HVI) rose 0.6 per cent over the month in March 2024 to be 8.8 per cent higher over the year. The HVI has now increased for 14 consecutive months since January 2023, delivering an increase of 10.2 per cent that has more than unwound the 7.5 per cent fall in the HVI recorded between April 2022 and January last year. Indeed, CoreLogic points out that the HVI has been setting new record highs each month since November 2023.

The combined capitals index was also 0.6 per cent higher over the month and was 9.7 per cent higher than in March 2023. Values increased in every capital city bar two last month, with Melbourne (no monthly change) and Darwin (a 0.2 per cent drop) the exceptions. The largest monthly increase was recorded in Perth (up 1.9 per cent), followed by Adelaide (up 1.4 per cent) and Brisbane (up 1.1 per cent). Sydney prices rose by a more modest 0.3 per cent.

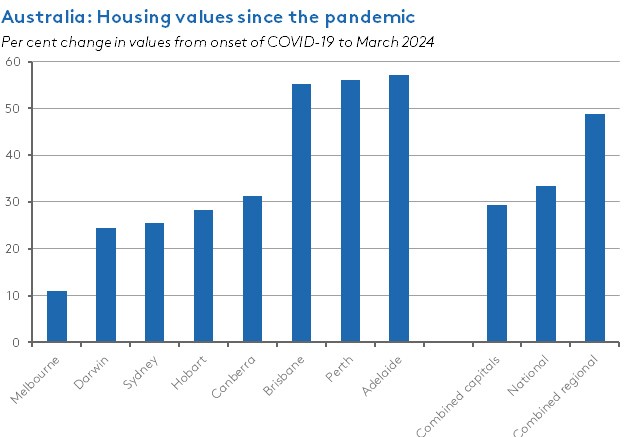

Housing values in Adelaide (57.1 per cent), Perth (56 per cent) and Brisbane (55.2 per cent) have all risen by more than 50 per cent since the onset of the COVID-19 pandemic and are now at record levels while values in Sydney and Melbourne remain a little below their post-pandemic peaks.

According to CoreLogic, the underlying driver of higher prices is a shortage of housing supply relative to demand and this continues to exert upward pressure on home values despite headwinds from high interest rates, other cost of living pressures and worsening housing affordability. It also reckons that the outlook for values remains positive, especially if the RBA meets market expectations and starts to reduce the cash rate target later this year.

The data provider highlighted the ongoing mismatch between the demand for and supply of housing, with the former boosted by the fastest rate of population growth in the history of the ABS series (see story below) and the latter still sluggish, with dwelling approvals ‘yet to show any meaningful uplift’ as the 1 July starting point for the Government’s 1.2 million new ‘well-located’ homes target approaches. In January this year, the ABS said that 12,850 homes were approved for construction, which CoreLogic noted was well below the 20,000 average monthly rate that would be needed to deliver the targeted number of new homes in five years. This week brought a February update on approvals numbers from the ABS which further reinforced this message, as total dwellings approved fell 1.9 per cent over the month to 12,520, which is 5.8 per cent lower than the number of approvals made in February 2023.

The national rental index was up 2.8 per cent in the March quarter 2024, recording the fastest quarterly pace of rental growth since the three months ending May 2022 (2.9 per cent). CoreLogic noted that while typically there is a pattern of seasonal strength for rental conditions through the first quarter of the year, in this case the annual trend in rental growth has been moving higher since last October, suggesting that the pickup in rental growth could be more than a seasonal effect.

ANZ-Indeed Australian Job Ads were flat in the March quarter of this year

ANZ-Indeed Australian Job Ads fell one per cent over the month in March 2024 (seasonally adjusted) to be 10.6 per cent lower over the year. Despite the decline, the number of job ads is still more than 32 per cent higher than pre-pandemic (2019 average) levels.

Across the March quarter 2024 overall, the average number of job ads was unchanged compared to the December quarter of last year prompting ANZ to suggest that the recent ‘stickiness’ in the series could imply that any increase in the unemployment rate from here is likely to be a gradual one. This result and interpretation are particularly interesting in the aftermath of the surprise February 2024 labour market result discussed below.

While we were away – Some key developments over the previous fortnight

The RBA left policy on hold, again

On 19 March 2024, the Reserve Bank Board announced that it would leave the cash rate target unchanged at 4.35 per cent. The decision was in line with market expectations and represented the third consecutive time since the November 2023 meeting’s 25bp rate hike that the RBA has left monetary policy on hold. Indeed, considering the eight Board meetings held from July 2023, there has only been that one rate increase, which makes November’s rate hike look something of an outlier in retrospect (although it was not a surprise at the time).

There were two key takeaways from the March decision.

First, the Board statement included a tweak to its wording that financial markets interpreted as a shift to a slightly less hawkish monetary policy stance. Following the previous February 2024 meeting, the statement had warned that:

‘The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out.’ [Emphasis added]

The March statement then changed this to:

‘The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.’ [Emphasis added]

This change in wording was generally viewed as removing – or at least winding back – the RBA’s previous bias towards a future hike in the policy rate. And, as discussed above, this impression has since been reinforced by the publication this week of the meeting’s minutes.

Second, both the statement and the subsequent press conference delivered by Governor Michele Bullock repeatedly emphasised that, from the RBA’s perspective, the economic outlook ‘remains highly uncertain’ and that as a result ‘the risks are finely balanced’ with inflation still above target on the one hand, and the economy showing some signs of weakness on the other.

The monthly CPI indicator came in a little softer than expected in February 2024

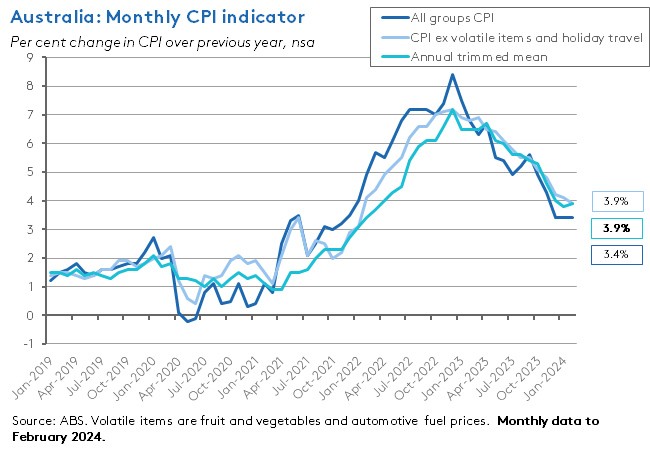

The Monthly Consumer Price Index (CPI) Indicator rose 3.4 per cent over the 12 months to February 2024. That was unchanged from the January 2024 result and slightly below market expectations, with the consensus forecast anticipating a 3.5 per cent print.

The monthly data, which were published by the ABS on 27 March, also showed the year-on-year increase in the CPI excluding volatile items and holiday travel slowing from 4.1 per cent in January to 3.9 per cent in February. But inflation as measured by the Annual Trimmed Mean moved in the opposite direction, ticking up from 3.8 per cent in January to 3.9 per cent in February this year.

The ABS said that the most significant contributors to the annual increase in the CPI indicator in February were Housing (up 4.6 per cent, driven by a 7.6 per cent increase in rents and a 4.9 per cent increase in new dwelling prices), Food and non-alcoholic beverages (up just 3.6 per cent in the lowest annual growth reported since January 2022, partly thanks to outright falls in prices for Meat and seafood, and for Fruit and vegetables), Alcohol and tobacco (up 6.1 per cent) and Insurance and financial services (up 8.4 per cent led by a 16.5 per cent jump for insurance as higher premiums across all insurance types – car, home and contents – rose once again due to higher costs associated with reinsurance, natural disasters and claims).

The Bureau also reported that holiday travel and accommodation prices fell 1.3 per cent over the year to February, as although Taylor Swift concerts pushed up hotel prices in Sydney and Melbourne, accommodation and airfare prices fell elsewhere across Australia.

While February’s labour market results showed surprising strength

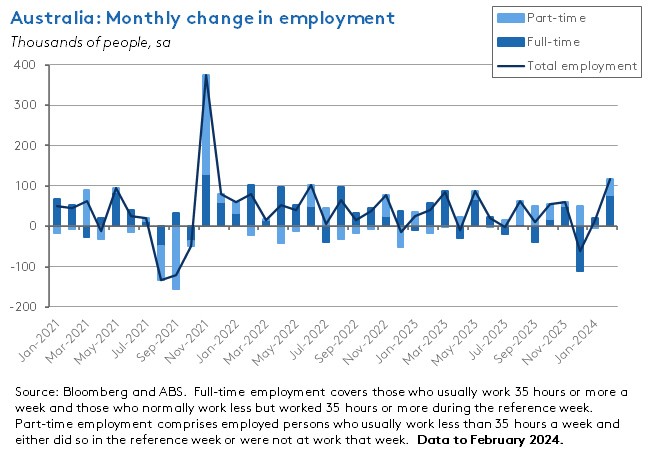

The latest ABS Labour Force data, released on 21 March 2024, reported that Australia’s unemployment rate fell 0.4 percentage points from 4.1 per cent in January to 3.7 per cent in February 2024 (seasonally adjusted). The underemployment rate also fell by 0.1 percentage point to 6.6 per cent.

Employment rebounded by an outsized 116,500 people with full-time employment up 78,200 and part-time employment rising by 38,300. Both the participation rate and the employment to population ratio increased. And hours worked jumped by 2.8 per cent (53 million hours) over the month.

Economists had anticipated a modest labour market rebound in February, with the consensus forecast predicting that the unemployment rate would edge down to four per cent and employment would expand by 40,000. The actual outcome was far stronger than this. It also seemed to run counter to some of the other labour market indicators released over the preceding months that were more consistent with a gradual easing in labour market conditions (although see this week’s Job Ads numbers reported above). Instead, the degree of labour market tightness as measured by the unemployment rate is back where it was in August 2023, as are the participation rate and the employment to population ratio.

So, what’s going on with the labour market? The last three data releases have been quite volatile, with that 116,500 jump in employment in February following a very modest increase of 15,000 in January which was in turn preceded by a larger-than-usual fall of 62,000 in December last year. An important part of the story looks to be related to a shift in seasonal patterns around the turn of the year. The ABS explained that:

‘The large increase in employment in February followed larger-than-usual numbers of people in December and January who had a job that they were waiting to start or to return to. This translated into a larger-than-usual flow of people into employment in February and even more so than February last year.’

According to the Bureau, in 2022 and 2023, around 4.3 per cent of employed people in February had not been employed in January, up from a pre-pandemic (2015-2020) average of around 3.9 per cent. This share jumped even higher, to 4.7 per cent, in February 2024. In contrast, the share of people employed in January subsequently leaving employment in February was little changed this year and has remained relatively constant over time. The jump in February employment was therefore a product of this widening in the gap between labour market entries and exits.

The ABS had already noted in February this year that since 2022, January labour market data has reported an unusually high number of people who although not employed had indicated that they had a job and were waiting to start or return to work. But it had added that it was too soon to judge whether this reflected a sustained new seasonal pattern or a temporary response to the unusual labour market conditions generated by the pandemic.

In terms of what this means for interpreting labour market conditions, the March 2024 result should help give a better read on how much of the February employment bounce was a statistical product related to a new turn-of-year pattern, and how much reflects any underlying shift in labour market demand and businesses’ hiring and firing decisions.

Job vacancies fell by 6.1 per cent in February this year

The ABS said that total job vacancies in Australia fell to 363,800 in February 2024 from 387,400 in November 2023, a drop of 6.1 per cent over the quarter (seasonally adjusted). That was the seventh consecutive quarterly drop in vacancy numbers. The number of vacancies was also down 17.7 per cent over the year and 23.5 per cent lower than the May 2022 peak, although the number of vacancies was still 59.8 per cent higher than in February 2020 before the start of the pandemic.

The number of businesses reporting at least one vacancy fell to 18.3 per cent in February from 19.7 per cent in November last year. That February 2024 share is also well down on the high of 27.7 per cent set in November 2022 but it remains notably elevated compared to February 2020’s pre-pandemic 11 per cent.

February’s retail trade numbers were influenced by ‘Swiftonomics’

Retail trade rose 0.3 per cent over the month and 1.6 per cent over the year in February 2024 (seasonally adjusted). The ABS said that the monthly numbers were boosted by the impact of seven sold-out Taylor Swift concerts in Sydney and Melbourne involving more than 600,000 ‘Swifties’ which had helped boost spending on clothing, merchandise, accessories and dining out. Look past this temporary effect however, the Bureau said, and underlying spending had stagnated in the month.

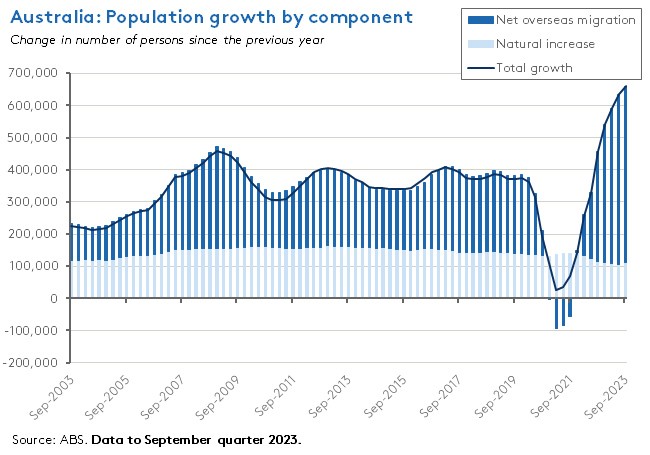

Australia’s population grew by 2.5 per cent over the year to September 2023

Australia’s Estimated Resident Population (ERP) was 26.8 million people as of 30 September 2023. That was up 2.5 per cent (659,800 people) over the year, with annual natural increase accounting for 17 per cent or 111,000 (down 3.9 per cent compared to the previous year) and net overseas migration accounting for 83 per cent or 548,500 (up by a hefty 60.3 per cent since the previous year). The ABS said that the jump in net overseas migration mainly reflected an increase in arrivals on a temporary visa for work or study. At 2.5 per cent, the annual rate of population growth is the highest in the history of the current ABS series, which goes back to 1981.

In a separate release, the ABS reported that the population of Australia’s capital cities grew by three per cent (517,200 people) over the 2022-23 year. Again, according to the Bureau, that’s the largest annual growth on record. Melbourne saw the largest absolute increase (up 167,500) while Perth had the fastest growth rate (3.6 per cent). The population of regional Australia rose by 1.4 per cent (117,300).

Australian household wealth rose for a fifth consecutive quarter in Q4:2023

The ABS said that Australian household wealth rose by 2.8 per cent or $419 billion to $15.7 trillion in the December quarter 2023. That was the fifth consecutive quarterly rise and once again residential land and dwellings were the largest driver (up $217.3 billion). Rising domestic and international share prices also helped, by pushing up the value of superannuation and direct share holdings (up $191.9 billion).

The budget position continues to track well against the MYEFO profile

Last week the Department of Finance reported that the underlying cash balance for the 2023-24 financial year to end-February 2024 was a deficit of $6.1 billion. That compares to a MYEFO profile of a $7 billion deficit. The MYEFO estimate for the full year is for a deficit of $1.1 billion.

Other things to note . . .

- The ABS has released updated high, medium, and low population projections for Australia. Australia’s population is projected (not forecast!) to reach between 34.2 million and 45.9 million people by 2071, depending on the scenario. The ten-year average growth rate is projected to decline from 1.4 per cent now to between 0.2 per cent and 0.9 per cent and the median age of the population is projected to increase from 38.5 years to between 43.8 and 47.6 years. In the absence of any further net overseas migration (that is, with NOM set at zero), an alternative set of projections shows population falling to just below 24 million by 2071.

- The new Treasury Roundup focuses on the Australian labour market, with articles on labour market matching across skills and regions, community resilience, the employment behaviour of firms reliant on temporary migrants, and incentives for secondary earnings and recipients of income support.

- Two from the Productivity Commission: Douglas Irwin gave this year’s Richard Snape Lecture on Is globalisation in retreat? And the Quarterly productivity bulletin March 2024 reckons that we are returning to ‘productivity normal’ following the disruption of the pandemic.

- How technology, new data sources and new techniques are changing the way the ABS tracks the economy.

- The March 2024 edition of Resources and Energy Quarterly reckons that ‘Australian resources and energy exports are set to ease after the extraordinary surge of 2022-23’. Softer world demand and rising global supply are forecast to see the value of our resources and energy exports fall from $466 billion in 2022-23 to $417 billion in 2023-24.

- A speech from ACCC Commissioner Anna Brakey on the Australian domestic gas outlook.

- A TTPI Policy Brief on the Stage 3 Tax Cuts and bracket creep. Author Paul Tilley argues for indexing the rate scale to permanently remove bracket creep effects and allow the tax debate to move on to more substantive measures, although one important political obstacle for any government that made this reform is that it would lose the opportunity to announce ‘tax cuts’ that return bracket creep.

- Allan Fels makes a case for the so-called Competition and Consumer Amendment (Divestiture Powers) Bill, that would enable courts to break up firms that misuse substantial market power.

- Debating Australia’s housing policy (Grattan Institute).

- On the relative price of an Australian flat white.

- The OECD launches a new series with its Global Debt Report 2024.

- Martin Wolf says democracy is still better than autocracy.

- A new IMF policy paper on macroeconomic developments and prospects for low income countries.

- Also from the Fund: Germany’s real challenges are ageing, underinvestment and too much red tape.

- The Economist magazine on how India could become an Asian Tiger.

- Larry Fink (of Black Rock)’s 2024 Annual Chairman’s Letter to Investors.

- 20 lessons from 20 years of managing (US) money.

- A long essay in the New Yorker on the (poor) state of the UK.

- Related, the IFS on living standards in the UK reckons the current parliament is on course to be the worst for living standards on record.

- The WSJ on an elusive victory over inflation and the challenges of the ‘last mile’ for central banks.

- Mapping the economic costs of war.

- Are software automation and teleworkers complements or substitutes?

- The McKinsey Global Institute has produced a new report on Investing in productivity growth.

- On Rome, Mary Beard and the classics.

- A new Lancet paper on trends in and projections for global fertility.

- The These Times Podcast talks to demographer Paul Morland about the geopolitics and economics of demographic change.

Latest news

Already a member?

Login to view this content