Overview

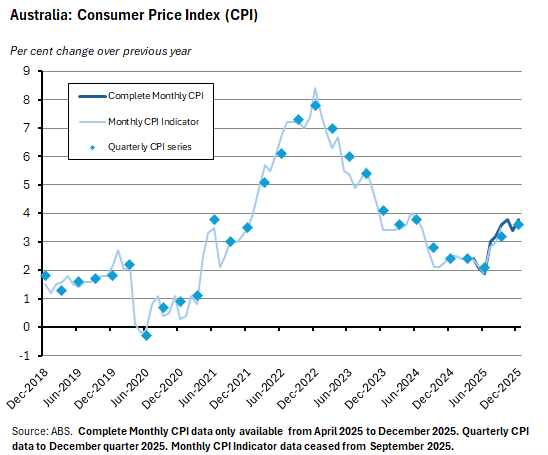

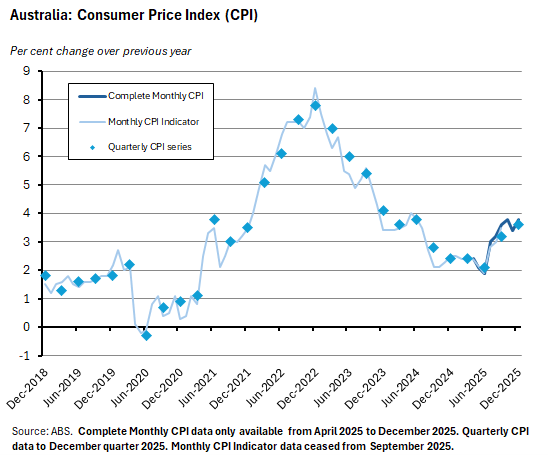

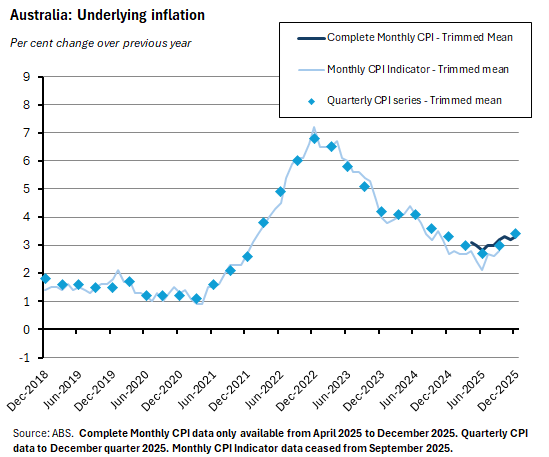

- Inflation ended 2025 uncomfortably high, with both headline and underlying rates sitting clearly above the top of the RBA’s target band.

- Next week’s MPB meeting is now likely to deliver a 25bp rate hike following this inflation result as well as December’s surprisingly strong labour market numbers. A case for holding remains, but the balance of risks has shifted firmly towards tightening.

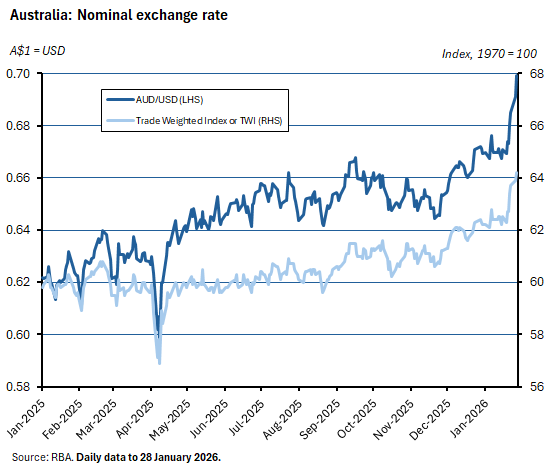

- The recent appreciation of the Australian dollar suggests a source of potential downward pressure on inflation while also signalling shifting global monetary and financial conditions.

This week’s note looks at an upside surprise on inflation, what it means for next week’s Monetary Policy Board (MPB) decision, and how a stronger Australian dollar might shape the policy conversation.

Last week, we said that the strong December 2025 labour market result had increased the probability of a rate hike at the upcoming MPB meeting. But we also said we would wait to see the latest inflation data before finalising our rate call. Well, now we know that in the December quarter of last year, the headline rate of inflation climbed to 3.6 per cent while the RBA’s preferred indicator of underlying inflation rose to 3.4 per cent. With both measures moving decisively further away from the top of the target band, this week’s Consumer Price Index (CPI) numbers suggest the market consensus is likely to be correct, and that Australia’s central bank will announce 25bp of policy tightening on 3 February. If so, that would take the cash rate target back up to 3.85 per cent, unwinding one-third of last year’s 75bp of cumulative policy easing and returning the policy rate to its August 2025 level.

A noteworthy subplot to this Australian inflation-interest rate story has been the recent rise in the Australian dollar, which has been testing US$0.70 this week. Some of this strength has reflected a period of US dollar weakness. Although do note that at the time of writing, the greenback had rallied following comments from US Treasury Secretary Scott Bessent. Bessent said he continued to support a strong-dollar policy and he also ruled out US foreign exchange market intervention to boost the Japanese yen – something which had been on traders’ minds in recent days. Still, as the chart below confirms, the Australian dollar trade-weighted index (TWI) has also risen markedly since the start of this year. If sustained, this currency appreciation should help on the inflation front.

Below, we look at the inflation data in more detail and consider the implications of the stronger Australian dollar and what it tells us about key global economic issues. Plus, the usual roundup of other data releases and selected suggestions for further reading and listening.

Inflation ended 2025 looking uncomfortably high

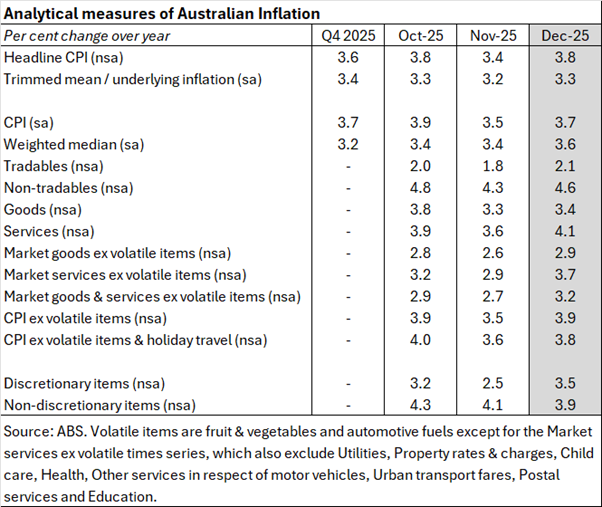

The ABS said that Australia’s CPI rose one per cent over the month in December 2025, taking the annual rate of headline inflation up to 3.8 per cent. That was above last November’s 3.4 per cent result, and it also exceeded the market’sconsensus forecast for a 3.6 per cent print.

On a quarterly basis, the rate of headline inflation increased from 3.2 per cent in Q3:2025 to 3.6 per cent in Q4:2025. Back in its November 2025 Statement on Monetary Policy (SMP) forecast, the RBA had predicted a 3.3 per cent result to end the year.

The RBA’s inflation target is framed in terms of this headline rate. But the central bank pays more attention to underlying inflation – as measured by the trimmed mean – when it wants to assess price pressures in the economy. In theory, this helps it to look through any volatility created by one-off or temporary price changes. Here, the Bureau said that the trimmed mean rose 0.2 per cent over the month to be up 3.3 per cent over the year. That annual rate was up slightly from the previous month’s outcome of 3.2 per cent, but in line with the market consensus forecast.

Recall, we have previously noted the RBA’s explanation that it will take it some time to understand the properties of the new monthly CPI series introduced last October. Meanwhile, Martin Place plans to continue to focus on the previous quarterly measure of underlying inflation which the Bureau now publishes in an Appendix to the main release.

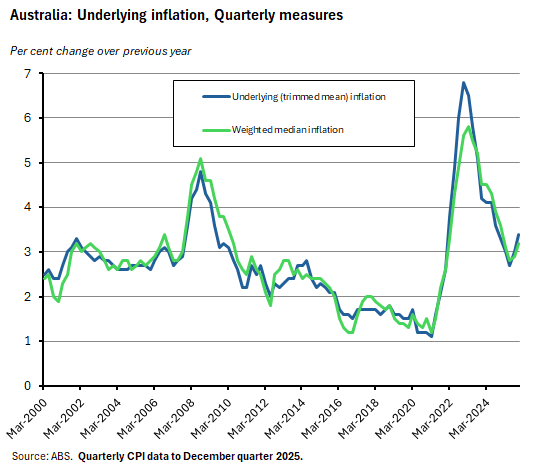

In this context, annual underlying inflation, as measured by the trimmed mean, picked up from three per cent in the September quarter to 3.4 per cent in the December quarter last year. That result was slightly stronger than both the consensus forecast of 3.3 per cent and the RBA’s November SMP forecast of 3.2 per cent. An alternative quarterly measure of underlying inflation – the weighted median – also picked up in year-on-year terms in December, rising to 3.2 per cent from 2.9 per cent.

Finally, a look at the monthly analytical series produced by the ABS also shows the annual rate picking up across all but one main category last month (the exception was non-discretionary items).

The MPB will be inclined to react by tightening policy

Following last December’s MPB meeting, we highlighted the shift in the central bank’s risk assessment of inflation, concluding that the Board was set to debate the case for a rate hike come February.

With both headline and underlying inflation not only remaining above the top of the inflation target band but also overshooting the RBA’s current forecasts (a new SMP and new projections will arrive next week), MPB members will be under pressure to vote for a rate hike when they meet. The case for tightening is further reinforced by last week’s evidence that the Australian labour market is yet to show any significant signs of weakening, with the monthly unemployment rate instead ending 2025 at just 4.1 per cent. A rate hike would also be consistent with the hawkish tone that has tended to characterise the central bank’s recent communications.

A case for remaining on hold could still be made. A dovish MPB member might, for example, emphasise the RBA’s publicly expressed caution around interpreting the new monthly CPI series. They could cite the elevated level of global economic and policy uncertainty that has characterised the first weeks of 2026. And they could point to the change in financial conditions implied by a strengthening Australian dollar and the higher market-implied profile for the expected cash rate trajectory as delivering a degree of effective policy tightening even in the absence of a formal change in the policy rate.

There is still some merit to be found in the idea of continuing to watch and wait. Even so, after the latest inflation numbers, the case for tightening is the one likely to persuade the MPB.

The stronger Australian dollar…and the weaker US one

If sustained, the recent appreciation of the Australian dollar will also have consequences for monetary policy by putting downward pressure on inflation.

All else equal, an appreciation of the exchange rate reduces the competitiveness of Australian firms in overseas markets by increasing the relative price of Australian goods and services. That will squeeze export volumes and dampen activity. Similarly, at home, a stronger currency will encourage consumers to switch away from domestic offerings to relatively cheaper imports. In addition, by boosting the relative costs of Australian production, it will also reduce the attractiveness of some investment projects. As a result, there will be direct implications for inflation (through lower import prices) and indirect ones (through softer domestic activity). On one estimate, for example, a ten per cent appreciation in the real TWI would lead to a reduction in overall consumer prices of around one per cent over a three-year period.

Recent exchange rates movements also reflect several interesting developments in the global economy. For example, part of the Australian dollar appreciation against its US counterpart has been driven by diverging expectations regarding monetary policy. As highlighted last week, inflation and monetary policy cycles are showing signs of divergence. Markets are expecting an RBA rate increase to come as soon as next week. In contrast, although the US Federal Reserve halted a run of three consecutive rate cuts and held the Fed Funds rate unchanged at its meeting this week, markets still expect further policy easing in the United States, even if it has to wait on the appointment of a more White-House-friendly successor as Fed chair.

That last point also informs the view that there are several structural pressures on the value of the US dollar now in play across the world economy, with the greenback in 2025 suffering its biggest decline since 2017. Frequently cited drivers of the ‘sell the US’ narrative include: the geoeconomic fallout from shifts in geopolitics – such as the Greenland furore – as an expanding variety of investors seek either to hedge or even scale back their US exposure; elevated fears about the future of Fed independence and the consequences for the relative attractiveness of US financial assets of a more politically malleable Fed Chair; longer-running concerns about medium-term US fiscal sustainability given the current backdrop of large fiscal deficits and rising public debt; and most recently, speculation about the possibility of joint US-Japanese FX intervention to boost a faltering Yen.

Other Australian data points to note

According to the NAB Monthly Business Survey December 2025, both business conditions and business confidence rose last month. The NAB measure of business confidence increased by one point to an index reading of +3 while business conditions strengthened by two points to +9. Regarding cost and price pressures, the survey reported that the rate of increase in labour costs rose from 1.5 per cent in November to 1.8 per cent in December, growth in purchase costs rose from 1.3 per cent to 1.4 per cent, and product price growth accelerated from 0.6 per cent to 0.9 per cent, with only growth in retail prices slowing last month (all in quarterly equivalent terms). The reported rate of capacity utilisation eased from 83.5 per cent in November to 83.2 per cent in December but remained well above its long-run average. NAB reckoned the survey detail wasconsistent with solid economic momentum around the turn of the year.

Note also that last week’s S&P Global Flash Australia PMI said that private sector activity expanded in January 2026 at its fastest pace in five months, with activity picking up in both manufacturing and services industries. The survey also pointed to a softening in the rates of input cost and output price growth, with lower services cost inflation offsetting an increase in cost pressures for manufacturing.

The ABS said that both Australian export and import prices rose over the December quarter. The export price index was up 3.2 per cent in quarterly terms but down 0.3 per cent over the year, while import prices were up 0.9 per cent over the quarter and three per cent higher over the year. Both price indices were affected by sharp price gains for non-monetary gold, as investors sought a haven from geopolitical risk.

Further reading and listening

- The AFR says that despite all the communicating it is doing, economists are finding it harder to read Australia’s central bank.

- One take on assessing the Productivity Commission’s proposals to change Australia’s company tax mix. But according to the AFR, the Australian Treasury has some reservations.

- The e61 Institute examines the dynamics of Australian petrol price cycles.

- New OECD research on regulatory compliance costs and productivity compares the wage share devoted to compliances tasks across Europe, the United States, and Australia.

- In the FT’s Weekend Essay, Odd Arne Westad considered Greenland, America and the end of Atlanticism.

- Relevant to the discussion on the US dollar above, the BIS analyses (US) dollarisation waves.

- Also related, how the US Fed makes decisions and how Liberation Day reduced the safe asset status of US Treasuries.

- Beijing’s purge of the People’s Liberation Army (PLA) senior leadership. What does this mean for the Davidson Window? According to ASPI’s The Strategist, it probably cuts imminent Taiwan war risk. Probably.

- A WSJ long read on China’s ‘deflation doom loop’.

- The IEA lists seven certainties about energy for an age of uncertainty.

- The Economist magazine considers the ascent of the Indian economy.

- From Brookings, a primer on public finance in the age of AI, which considers what happens if AI gradually erodes the two main tax bases that underpin modern economies: labour income and human consumption.

- The Ezra Klein show talks to Henry Farrell about Mark Carney’s this-is-a-rupture-not-a-transition speech and they also discuss the theory of weaponized interdependence. The Australia in the World podcast analyses Davos, Greenland and Carney’s speech from a local perspective. For their part, the Econoclasts were unconvinced.

- Related, the Past Present Future podcast has two episodes on the weirdness of American power.

Latest news

Already a member?

Login to view this content