The RBA brought the monetary policy year to an end with a 25bp hike to the cash rate target this week, delivering an eighth consecutive interest rate rise. So, not exactly a ‘Merry Christmas’ from Martin Place, but the economy will now get a break while the central bank takes a holiday in January before considering whether to resume the tightening process at its 7 February 2023 meeting. This week the RBA was still signalling that there are more rate rises to come, but while we have not yet reached the terminal rate, absent any further large inflationary surprises we are likely getting reasonably close.

A big drop of economic data from the ABS this week included the national accounts, which saw third quarter GDP growing at 0.6 per cent over the quarter and 5.9 per cent over the year. That was a little below market expectations and also marked a downshift from the 0.9 per cent quarterly growth recorded in Q2:2022. Still, fairly robust increases in household consumption and business investment last quarter suggest that the RBA’s rate hikes are largely yet to make themselves felt. Meanwhile, a fall in the terms of trade and a surge in income debits saw Australia run its first current account deficit since 2019. And the value of residential dwellings suffered their biggest quarterly decline in the history of that data series.

There will be one more Weekly Note next week before our own Christmas/January publication break, but we’ll be back with an Economic Update webinar on 25 January next year, which as usual will be free for AICD members.

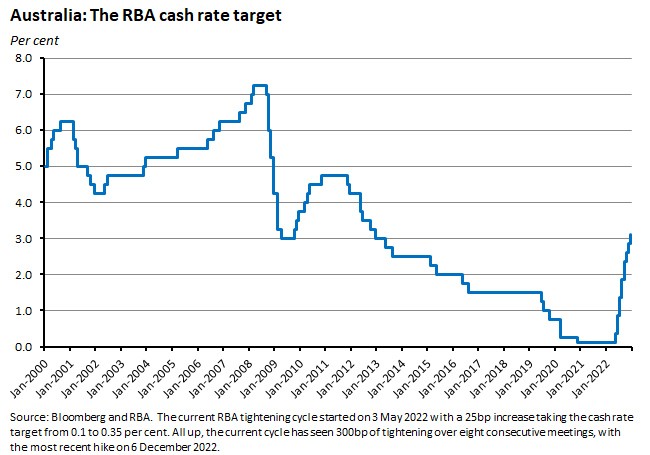

The RBA takes the cash rate target up to 3.1 per cent

At its meeting on 6 December 2022, the Reserve Bank Board decided to increase the cash rate target by 25bp to 3.1 per cent. The last time that the target had a ‘three’ in front of it was in 2013. The move was in line with our assessment last week and means that the RBA has now delivered a total of 300bp worth of monetary policy tightening over eight consecutive meetings since it started raising the cash rate target in May this year.

Consistent with recent RBA communications, this week’s accompanying statement combined a message that Martin Place continues to expect to increase interest rates further from here with a relatively cautious tone in terms of just how much more tightening will need to be delivered and how quickly. So, after having previously noted that ‘Inflation in Australia is too high’ and that a tight labour market and firm price-setting behaviour require close attention in order to avoid a ‘prices-wage spiral’ the statement goes on to begin its concluding paragraph by noting:

‘The Board expects to increase interest rates further over the period ahead, but it is not a pre-set course.’

A reasonably robust Q3:2022 GDP report (see next story) will have done little to change the RBA’s views here in terms of where the economy is coming from. But in terms of where it might be heading to, the discussion in this week’s statement also notes that there ‘has been a substantial cumulative increase in interest rates’, that ‘monetary policy operates with a lag and that the full effect of the increase in interest rates is yet to be felt in mortgage payments’, that household spending is expected to slow from here, and that the global economic outlook has deteriorated. Balancing the resulting downside risks to activity with the need to return inflation to target means that that same concluding paragraph continues on to remind readers:

‘The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market.’

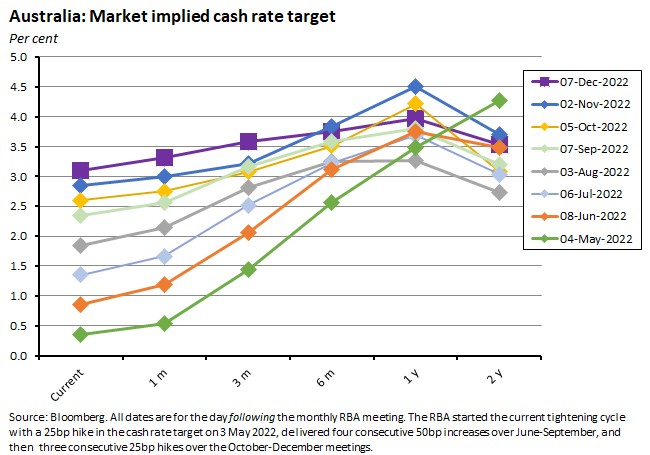

The RBA will now take a summer break, delivering a pause in the regular rate setting process until the Board meets again on 7 February 2023. Financial market pricing implies that next year will bring more rate increases in line with the RBA’s own assessment, with Bloomberg’s market implied cash rate projections indicating that the rate could have risen to be a bit below four per cent in a year’s time, for example. But market pricing also now implies that the terminal rate of the current cycle will be at a lower level than was the case after the October and November RBA meetings.

For example, the ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve as of market close on 7 December 2022 suggested that the cash rate might peak at somewhere north of 3.6 per cent per cent next year, which would imply that there are 50bp or 75bp of rate hikes yet to come.

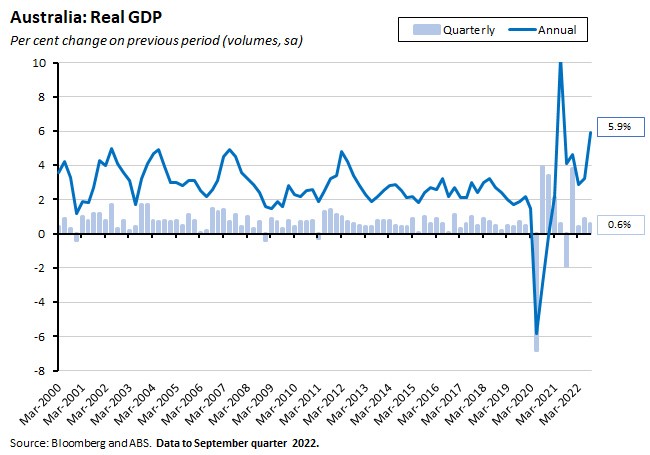

Real GDP grew by 0.6 per cent over the quarter and 5.9 per cent over the year in Q3:2022

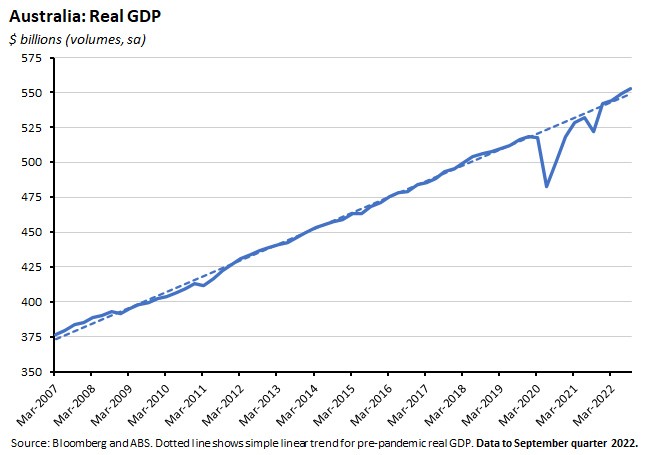

The National Accounts for the September quarter 2022 showed that real GDP rose 0.6 per cent over the quarter (seasonally adjusted) to be 5.9 per cent higher than in the same quarter last year. In per capita terms, GDP growth was 0.4 per cent quarter-on-quarter and 4.7 per cent year-on-year. Real GDP growth in Q3:2022 came in a little softer than the consensus forecast, which had predicted 0.7 per cent quarterly growth and a 6.3 per cent year-on-year rise. Still, the economy has now expanded for four consecutive quarters after having contracted in the September quarter last year during state-level lockdowns triggered by the COVID-19 Delta outbreak.

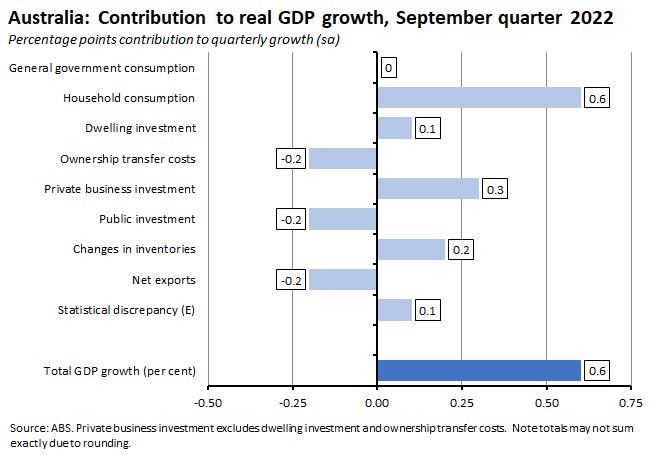

Based on the expenditure measures of the national accounts, economic growth continues to be powered by household spending, which rose 1.1 per cent over the quarter and jumped by 11.8 per cent over the year, and which contributed 0.6 percentage points to GDP growth. The ABS said that consumption growth was driven by discretionary spending (up 1.8 per cent over the quarter and contributing 0.4 percentage points to overall GDP growth), including expenditure on hotels, cafes and restaurants (up 5.5 per cent), transport services (up 13.9 per cent) and the purchase of vehicles (up 10.1 per cent): households are on the move again. Spending on essentials, meanwhile, rose by 0.6 per cent over the quarter and contributed 0.2 percentage points to GDP growth. Spending on services (up 1.7 per cent over the quarter and contributing 0.5 percentage points to GDP growth) continues to outpace spending on goods (up 0.3 per cent and contributing 0.1 percentage points).

Total private business investment grew by 2.5 per cent over the quarter and contributed 0.3 percentage points to overall quarterly growth. Dwelling investment also rose 0.8 per cent over the September quarter, marking the first quarterly increase in that series since the same quarter last year. The ABS said that the latter reflected a slight easing of material and labour shortages as well as fewer wet weather impacts relative to previous quarters. These gains were broadly offset by a fall in public investment and a marked decline in ownership transfer costs, where the latter was due to the cooling in the housing market in response to higher interest rates.

Net inventories contributed 0.2 percentage points to GDP growth as businesses continued to build stocks. But net exports subtracted roughly the same amount as growth in imports of goods and services outpaced a more modest rise in exports.

In nominal terms, GDP rose 0.8 per cent over the quarter to be up 13.1 per cent over the year, as faster growth in domestic prices (the GDP deflator was up 0.2 per cent over the quarter and 8.5 per cent over the year) was offset by a 6.6 per cent quarterly decline in the terms of trade driven by the combined effects of lower export prices and higher import prices. Nominal household consumption spending was sustained by another fall in the household saving ratio, which dropped from 8.3 per cent to 6.9 per cent, and which is now more in line with pre-pandemic, post-GFC levels. The savings ratio has now fallen for four consecutive quarters as spending (including increases in mortgage interest payments) continues to run ahead of growth in household incomes

On a production basis, gross value added (GVA) in the economy rose by 0.8 per cent over the quarter and by 5.7 per cent over the year. By industry, growth in GVA was driven by large contributions from construction and transport, postal and warehousing, and a smaller contribution from mining, along with contributions from a range of services comprising accommodation and food services, administrative and support services, professional, scientific and technical services, and wholesale trade.

On the income side of the national accounts, compensation of employees (COE) rose 3.2 per cent over the quarter, with private sector COE up 3.4 per cent but public sector COE increasing by a more modest 2.4 per cent. The quarterly growth in COE was the highest seen since the December quarter of 2006. On an annual basis, COE rose by a strong ten per cent. The gross operation surplus (GOS) of private non-financial corporations fell 2.3 per cent over the quarter, although it was still up 17.8 per cent over the year.

Productivity growth (GDP per hour worked) rose 0.6 per cent over the quarter but fell 0.7 per cent in annual terms, while real unit labour costs rose by two per cent quarter-on-quarter but were still down 2.5 per cent relative to the September quarter 2021.

Taken overall, the September quarter GDP results depict an economy enjoying reasonably solid growth driven largely by household spending with important supporting roles for private business investment and inventory increases. That was enough to more than offset growth headwinds from net exports, public investment and ownership transfer costs.

Annual growth rates this time were also flattered by comparisons with a third quarter last year that was marked by significant lockdowns across New South Wales, Victoria and the ACT that had produced a substantial decline in household spending and an overall contraction in GDP growth. Back then, real GDP had fallen below its pre-pandemic levels. Now, GDP is comfortably above its pre-pandemic level and the economy looks to have closed the output gap, restoring real output to its pre-COVID trend.

Importantly, however, the impact of higher interest rates has yet to make itself fully felt, either on activity or on inflationary pressures. Economic growth is set to slow from here, as consumer spending is squeezed by falling real incomes and rising debt service costs, and as noted above, household savings rates have already fallen back to around pre-pandemic levels.

On the Dismal Science this week, we discuss whether ChatGPT heralds the robot productivity revolution, the final rate rise for the year, another good GDP number and Australia's current account dipping into deficit.

What else happened on the Australian data front this week?

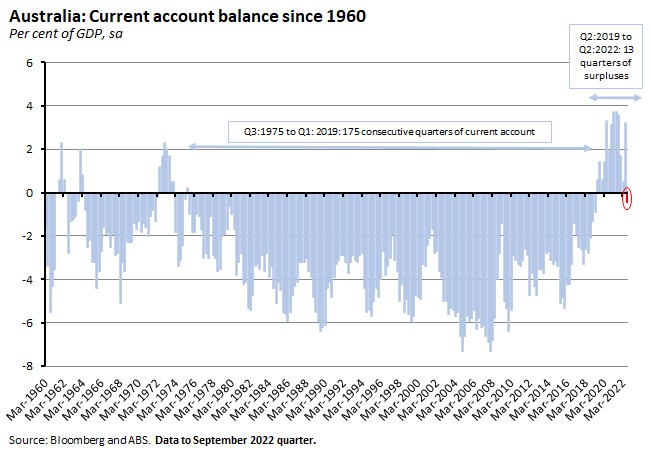

The ABS said that Australia reported a current account deficit of $2.3 billion in the September quarter of 2022 (seasonally adjusted), down from a surplus of $14.7 billion in the previous quarter, a swing of $17 billion.

September’s deficit was the first current account deficit since the first quarter of 2019 and ended a run of 13 consecutive quarters of current account surpluses. It was also a surprise – the consensus forecast had been for a $6 billion surplus for the quarter.

The shift to a deficit last quarter was driven by a combination of a smaller trade surplus and a wider net primary income deficit. The balance on goods and services trade fell from a surplus of $42.3 billion in Q2:2022 to a surplus of $31.2 billion in Q3:2022. The value of goods exports fell by $2.5 billion over the quarter (led by drops of $4.7 billion in the value of exports of coal and coke and $1.6 billion in the value of ore exports that were only partially offset by an increase in the value of grain exports) while goods imports were up a strong $6.2 billion. Also, on the trade account, while services exports rose by $2.2 billion, services imports jumped by $4.5 billion.

The other big move was that the net primary income deficit rose by $6.4 billion to a record $33.2 billion, mainly due to an increase of $5.8 billion in income payments to non-residents in part reflecting high operating profits and strong dividend payments on portfolio investment, particularly in the resource sector.

The terms of trade fell 6.6 per cent over the quarter driven by falls in the price of coal and metal ores along with an increase in import prices.

Australia’s net international investment liability position increased by $17.1 billion to $861.6 billion at the end of the quarter. Australia's net foreign equity fell $0.3 billion to an asset position of $301.1 billion while net foreign debt increased by $16.7 billion to a liability position of $1,162.7 billion.

Australia recorded a $12.2 billion trade surplus in October (seasonally adjusted), down $0.2 billion from September’s $12.4 billion result. The ABS said that exports of goods and services were down slightly, easing by almost $0.6 billion or 0.9 per cent to $60.1 billion. Imports of goods and services fell by $0.3 billion or 0.7 per cent to $47.9 billion.

The ABS Tourism Satellite Account for the 2021-22 financial year shows Tourism GDP rising 24.6 per cent to $35.1 billion in chain volume terms, while tourism’s contribution to GDP rose to 1.6 per cent. Both numbers are well down on their pre-COVID (2018-19) levels, of $69.1 billion and 3.1 per cent, respectively. Likewise, while the number of tourism filled jobs rose to 501,400 that is still well below the pre-COVID peak of 701,100 filled jobs.

ABS data on industrial disputes show that there were 70 disputes in the September quarter of this year, involving 22,200 employees and with 28,100 working days lost. While the number of disputes was 18 higher than in the June quarter, there were 51,500 fewer employees involved and 100,000 less working days lost. In year-ended terms, there were 59 more disputes in the year ending Q3:2022 than in the year ending Q3:2021, and 179,700 more working days lost.

Government Financial Statistics for the September Quarter 2022 report that the general government net operating balance moved from a surplus of $13.2 billion in the June quarter to a deficit of $15 billion in the September quarter. The ABS said that total revenue fell by 14.2 per cent over the quarter, pulled down by a 16.6 per cent ($32 billion) drop in tax revenue – the largest quarterly percentage fall recorded in the history of the series (since 2014). Total expenses were down by 2.3 per cent over the same quarter.

The ABS weekly payrolls jobs and wages release for the week ending 12 November 2022 showed that payroll jobs rose 0.7 per cent over the previous month and 0.5 per cent over the past fortnight. Total wages paid fell 0.2 per cent over the month but were 0.3 per cent higher over the fortnight. The Bureau said that the slow pace of growth in payroll jobs seen during 2022 pointed to tightness in the labour market, along with disruptions from people being sick and the impact of major weather events.

The ANZ-Roy Morgan Consumer Confidence Index fell by 0.5 per cent over the week to 4 December 2022, indicating little change in household confidence which remains at a low level. Weekly inflation expectations dropped by 0.4 percentage points to 5.8 per cent, moving back below six per cent for the first time since early October after four consecutive weekly declines.

The ABS Monthly Household Spending Indicator showed spending rising 20.7 per cent through the year (current prices, calendar adjusted basis) in October 2022. October’s was the 20th consecutive rise in the indicator in annual terms. Spending on services was up 34.2 per cent over the year while spending on goods rose by a more modest 9.3 per cent. Non-discretionary spending rose 21 per cent through the year and discretionary spending grew by 20.4 per cent. By category, spending increases ware largest for transport (up 42.3 per cent in annual terms), hotels, cafes and restaurants (up 39.9 per cent) and clothing and footwear (up 32.2 per cent).

According to the September quarter 2022 Business Indicators release from the ABS, company gross operating profits slumped 12.4 per cent over the quarter (seasonally adjusted) although they were still up 8.5 per cent over the year. Mining drove the fall in profits, with a 19.1 per cent fall over the quarter. Wages and salaries rose 2.9 per cent over the quarter and climbed 11 per cent in annual terms. In real terms, inventories rose 1.7 per cent month-on-month and grew 7.9 per cent year-on-year.

The total value of residential dwellings in Australia fell $358.9 billion to $9,674.4 billion in the September quarter 2022. That was the largest quarterly fall in the history of the series, which began in September 2011. The ABS also reported that the number of residential dwellings rose by 45,300 to nearly 10.9 million. As a result, the mean price of residential dwellings fell $36,800 to $889,800 in Q3:2022.

ABS data on labour hire workers show that in June this year, 319,900 people had a job in labour supply services, or 2.3 per cent of all employed people. Over the past decade, the industry has accounted for between two and 2.7 per cent of total employment,

The ABS said expenditure on mineral and petroleum exploration fell in the September 2022 quarter. Spending on mineral exploration fell 1.5 per cent over the quarter (seasonally adjusted) but was up 22.8 per cent over the year, while spending on petroleum exploration fell 5.5 per cent month-on-month and dropped 22.8 per cent year-on-year.

Last Friday, the ABS published lending data for October 2022. New loan commitments for housing fell 2.7 per cent over the month (seasonally adjusted) to be 17.1 per cent lower over the year. Lending for owner occupiers was down 2.9 per cent over the month and fell 17.2 per cent in annual terms, while the corresponding declines for lending to investors were 2.2 per cent and 17 per cent, respectively. The Bureau also noted that, although the value of owner-occupier refinancing between lenders fell 1.3 per cent, that still left refinancing running at more than $12 billion and well above pre-pandemic levels as borrowers sought out lower interest rates. The ABS also said that the value of personal fixed term loans fell 0.5 per cent over the month – driven by a 3.8 per cent drop in lending for the purchase of road vehicles – but rose 11.7 per cent over the year.

Other things to note . . .

- Following the publication of the Q3:2022 national accounts, the ABS lists 12 things to know about the Australian economy right now.

- The RBA December 2022 Chart Pack.

- The latest RBA Bulletin including pieces on new measures of household and business financial stress based on news, search and social media data, and on the RBA’s securities lending facility (SLF).

- Yet more from the RBA: a speech on the economics of a Central Bank Digital Currency in Australia and a collection of the information provided to the ongoing Review of the RBA.

- Andrew Leigh Speech on market power and mark-ups in the Australian economy arguing that competition and dynamism have declined.

- The ABARES December quarter 2022 Agricultural Outlook forecasts that the gross value of Australian agricultural production will be a near-record $85 billion over 2022-23, just shy of 2021-22’s record outcome, while the value of exports in 2022-23 is forecast to set a new record of more than $72 billion, driven by crop exports as world grain prices have been pushed up due to war in Ukraine and drought in the US, Europe and Argentina. The strong result comes despite the damage associated with the flooding on the east coast of Australia.

- Insights from the ABS into Government Finance Statistics, Q3:2022.

- Submission from the Grattan Institute to the Joint Standing Committee on Trade and Investment Growth on how Australia can become a green-energy superpower.

- The latest BIS Quarterly Review describes how shifting market perceptions of the trajectory of monetary policy have shaped financial markets, warns of ‘emerging signs of fragility in the markets for agency mortgage-backed securities’ and cautions that the disruption to UK sovereign bond (gilt) markets in late September this year could be a precursor to ‘similar episodes in other markets and jurisdictions.’

- A new entry in FT Alphaville’s occasional Axes of Evil series considers the charts depicting various economic and financial outlooks for 2023.

- The full contents of the December 2022 edition of the IMF’s Finance & Development magazine are now available, including Daniel Yergin on bumps in the energy transition, Nordhaus and Lloyd on a nuclear resurgence, Cutler and Glaeser on cities after the pandemic, and an interview with Amir Sufi on the state of household debt.

- The World Bank’s International Debt Report 2022 warns of rising debt-related risks for all developing economies, noting that their external debt had risen to US$9 trillion by the end of 2021, after having more than doubled over the previous decade.

- An FT Big Read on Germany’s broken business model.

- On teleworking, labour markets and cities.

- China’s growing water challenges could have global implications.

- New estimates on profit shifting to global tax havens posit that the share of multinational profits made outside of the HQ country and shifted to tax havens rose from less than two per cent in the 1970s to 37 per cent by 2019.

- RAND report on the perils and promises of machine learning in public policy.

- The OECD Pensions Outlook 2022.

- Nature article on the economics of marriage in China.

- The Economist magazine’s best books of 2022.

- Harold James says Geopolitics is for losers.

- The Odd Lots Podcast talks to Brad Delong on the FTX collapse and lessons from the South Sea Bubble.

- The Macro Musings podcast in conversation with Noah Smith on The State of Macroeconomics (this one is a bit ‘inside baseball’).

Latest news

Already a member?

Login to view this content