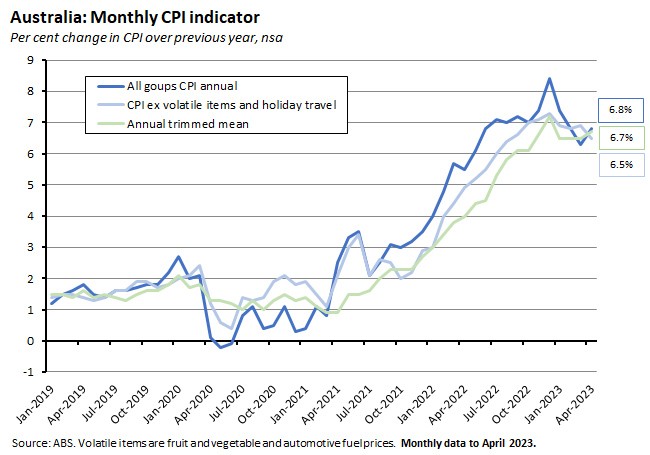

This week, the monthly Consumer Price Index (CPI) indicator for April 2023 reported a surprisingly strong annual increase of 6.8 per cent. That was well above the market consensus forecast for a 6.4 per cent rise and took the headline rate back up to its February 2023 level, unwinding the March fall to 6.3 per cent.

With the main factor driving April’s surprise result being base effects due to the impact of last year’s changes in fuel excise, the data are not signalling a sudden resurgence in inflationary pressures. However, with the April CPI report also delivering mixed messages on underlying inflation, it is likely to add to the RBA’s concerns about the persistence of above-target inflation. As such, it makes it more likely that there is one more cash rate hike in the works – if not next week (where market pricing still signals that a pause is the more likely option), then at either the July or August RBA meeting. Meanwhile, a third consecutive monthly increase in Australia’s home values in May this year – and the strongest of the three to date – has added additional complexity to the monetary policy environment.

The monthly CPI indicator surprised to the upside in April

The ABS said that the monthly Consumer Price Index (CPI) Indicator rose 6.8 per cent over the year to April 2023. That was up from a 6.3 per cent increase in March 2023 and was also significantly above market expectations for a 6.4 per cent print. According to the Bureau, the most important contributors to the annual increase in the CPI reading were Housing (up 8.9 per cent), Food and non-alcoholic beverages (up 7.9 per cent), Transport (up 7.1 per cent) and Recreation and culture (up 6.4 per cent). Key points follow:

- There were offsetting developments in the Housing component of the CPI. On the one hand, the annual rate of increase in new dwelling prices fell to 9.2 per cent in April, down from 11.1 per cent in March and well below the peak 21.7 per cent rate recorded in July last year. The ABS said that softer demand and improvements in the supply of materials explained the deceleration in price growth, but that labour and material cost increases remained significant. On the other hand, however, rent prices rose 6.1 per cent in annual terms in April, up from 5.3 per cent in the previous month, as high demand and low vacancy rates continue to bite. Meanwhile, the rate of increase in electricity prices also remained elevated, at 15.2 per cent (down only modestly from March’s 15.7 per cent rate).

- The 7.9 per cent rise in Food and non-alcoholic beverages was mainly driven by the categories of Food products (not elsewhere classified), Bread and cereal products, and Dairy and related products, with the ABS highlighting the role of increased input costs.

- Automotive fuel prices rose by 9.5 per cent over the year and drove the rise in Transport costs. That jump reflected the comparison with April 2022 when fuel prices had dropped 13.8 per cent following a 22 cents per litre cut in the fuel excise that was introduced on 30 March 2022.

- The 6.4 per cent annual rise for Recreation and culture was mostly driven by an 11.9 per cent rise for Holiday travel and accommodation. The latter rate was down from the 13.9 per cent growth rate recorded in March this year.

Those who had been hoping for more evidence of disinflation / less evidence of persistent inflation were still able to point to a slowdown in the pace of month-on-month increases for the seasonally adjusted version of the monthly indicator, which has now eased from 0.6 per cent in February and 0.5 per cent in March to 0.3 per cent in April. Unfortunately, we cannot read too much into this. In the quality subsection to the methodology notes for the monthly indicator, the ABS cautions that:

‘…the main objective of the Monthly CPI Indicator is to measure the change between average price levels during the reference month and average price levels for the corresponding month in the previous year. Although it is possible to derive month-on-month changes from the Monthly CPI Indicator series, these movements can be volatile. This is due to a combination of seasonal effects and differences in the coverage of prices used to compile each monthly estimate. For these reasons, we recommend using comparisons of the current month to either the same month in the previous year, or three months prior, to gain insights from the Monthly CPI Indicator. These comparisons remove differences in coverage between the periods being compared and, in the case of annual movements, reduce the impact of other seasonal factors, making the extent of price change in the monthly CPI indicator easier to identify.’

A more important qualification to the headline message of a spike in the annual inflation rate is the nature of the key driver of that rise. Here, the ABS stressed the impact of the base effects arising from the halving of the fuel excise tax in April 2022 (the policy then being fully unwound by last October).

In this context, it is useful to recall that the Bureau reports measures of underlying inflation that are intended to reduce the impact of irregular or temporary changes in the CPI. Alongside the usual measure of the CPI excluding volatile items (fruit and vegetable and automotive fuel prices), this month’s release included two new measures: the ‘Annual trimmed mean’ and the ‘CPI excluding volatile items and holiday travel), both of which a recent ABS investigation found provided a reasonable measure of the quarterly trimmed mean – the RBA’s preferred measure of underlying inflation. The ABS had suspended publication of its previous monthly estimate of the trimmed mean in December last year. It has now tweaked the calculation by moving from using quarterly to annual movements for the ‘trimming’ process after finding that there was a downward bias in its original monthly version relative to the quarterly trimmed mean. In the case of the latter measure, the idea is that events such as Christmas, Easter and school holidays can have a significant impact on airfare and accommodation prices, injecting another substantial source of volatility into monthly price moves.

It turns out that the message from these measures of underlying inflation was mixed in April. The rate of CPI inflation excluding volatiles slipped slightly, falling from 6.9 per cent in March to 6.8 per cent. Similarly, the rate of CPI inflation excluding volatiles and excluding holiday travel also slowed, in this case from 6.9 per cent to 6.5 per cent over the same period. But the trimmed mean measure showed inflation moving in the opposite direction, climbing from 6.5 per cent in March to 6.7 per cent in April.

The immediate financial market response to the surprise of a 6.8 per cent headline print was to assume an increased probability of a rate hike next week. And given that the RBA is in self-declared data-dependent mode, it makes sense that new data would change the odds of a rate move in this way. But since the jump in the headline rate was largely driven by changes in the rate of fuel excise, how much will this influence the upcoming rate decision? If the only thing going on was the automotive fuel story, then April’s CPI reading might be expected to have little influence on the central bank’s deliberations next week. Indeed, market expectations had already discounted the possibility of a modest increase in the headline rate due to the base effect. But, as noted above, the underlying inflation measures also sent conflicting signals with the so-called ‘exclusionary’ measures easing while the revised trimmed mean measure increased.

Overall, the mixed messages from the latest monthly numbers should not set off alarm bells at Martin Place, but they also seem unlikely to assuage the RBA’s recent concerns regarding the possibility of inflation persistence.

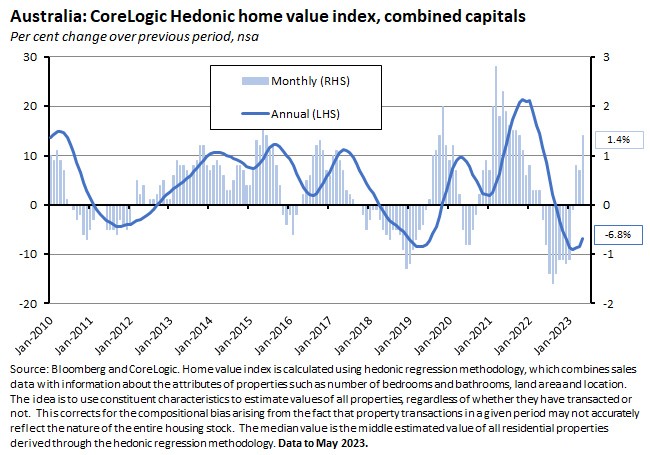

CoreLogic home values rose for a third consecutive month in May 2023

CoreLogic’s national Home Value Index (HVI) rose 1.2 per cent over the month in May 2023, although the index was still down 6.8 per cent in annual terms. This was the third consecutive monthly increase and the strongest to date – outpacing the 0.6 per cent growth reported in March and the 0.5 per cent rise in April. The combined capitals HVI rose by an even stronger 1.4 per cent over the month but fell 6.8 per cent over the year.

All capital cities reported an increase over May, with the strongest gains for Sydney (up 1.8 per cent), Brisbane (up 1.4 per cent) and Perth (1.3 per cent). The combined regional index rose by a more modest 0.5 per cent in monthly terms, although that too represented a marked acceleration relative to 0.2 per cent and 0.1 per cent results in the previous two months.

CoreLogic reckons that the turn in the housing cycle is the joint product of low levels of available housing supply and rising housing demand. That supply-demand mismatch – likely underpinned by stronger population growth – is currently more than offsetting the drag from higher interest rates, although CoreLogic also cautions that ‘the outlook for housing remains highly uncertain given the possibility of further rate hikes, the potential for higher levels of mortgage stress and persistently low levels of consumer sentiment.’

Finally, for the RBA, the turn in the housing market represents another complication in setting monetary policy. Readers might recall that the minutes to the 2 May RBA Monetary Policy Board Meeting referenced the previous rise in house prices, noting that while the RBA does not target asset prices, nevertheless ‘members agreed that movements in asset prices provide relevant information and need to be considered when assessing the outlook for activity and inflation.’

What else happened on the Australian data front this week?

The ABS reported that the value of construction work done in Australia in the March quarter 2023 was up 1.8 per cent from the December quarter 2022 (seasonally adjusted) and 5.1 per cent higher over the year. That increase was driven by a 5.3 per cent quarterly jump in the value of engineering work done, which was also up 14.9 per cent in annual terms. Non-residential construction edged higher by 0.3 per cent over the quarter and 2.2 per cent over the year. But total building work done fell, pulled down by a two per cent quarterly decline in residential construction (which was also down 5.1 per cent over the year).

The ABS also reported that private new capital expenditure (capex) rose 2.4 per cent over the March quarter 2023 (seasonally adjusted) to be up 6.3 per cent over the year. Spending on buildings and structures was up 1.3 per cent quarter-on-quarter and 6.8 per cent year-on-year, while the corresponding growth rates for expenditure on equipment, plant and machinery were 3.7 per cent and 5.8 per cent, respectively. By industry, mining capex was up 1.7 per cent over the quarter and non-mining capex up 2.7 per cent. The Bureau said that the 3.7 per cent quarterly rise in capex on new equipment and machinery was the largest since the March quarter 2021. It also highlighted a large (23.1 per cent) fall in equipment capex by the construction industry, which it linked to the current fall in building approvals (see below). Turning to business expectations about future investment, the ABS said Estimate 6 for 2022-23 was $162.6 billion (a 2.7 per cent increase over Estimate 5 for the same year) while Estimate 2 for 2023-24 was $137.6 billion (a 6.4 per cent rise over Estimate 1 for that year).

The RBA said that the rate of growth of private sector credit in the economy was 0.6 per cent over the month in April 2023 (seasonally adjusted) and 6.6 per cent in annual terms. That reflected a 1,1 per cent monthly increase in credit to non-financial businesses. A 0.3 per cent monthly rise in housing credit was little changed from previous results.

The total number of dwellings approved in Australia in April 2023 fell 8.1 per cent over the month (seasonally adjusted) to be down 24.1 per cent over the year. Approvals for private sector houses were down 3.8 per cent over the month and 18.6 per cent over the year, while approvals for private sector dwellings excluding houses fell 16.5 per cent in monthly terms and dropped 35.4 per cent on an annual basis. The ABS said that the number of dwellings approved has fallen to its lowest level since April 2012, with approvals for private sector dwellings excluding houses at their lowest since the January of that year. With approvals running at their weakest level in more than a decade, and with population growth having picked up, the current pressure on rental markets looks set to be sustained while the impact on house prices will offset the headwinds from higher interest rates and low levels of household confidence.

The weekly ANZ-Roy Morgan index of consumer confidence fell by 1.1 points last week to a reading of 76, remaining below 80 for a 13th consecutive week. The biggest weekly fall by subindex was for ‘current financial conditions’, which dropped by 4.3 points and was below a reading of 70 for a fourth week in a row. ANZ said that at 76.8 the average confidence level for May 2023 was the weakest calendar-month average recorded since December 1990, while the most recent weekly result was the fifth worst since January 2020. Average confidence remains much lower for those paying off their home vs confidence levels for renters and those owning their homes outright. Finally, the weekly measure of inflation expectations rose 0.2 percentage points to 5.3 per cent.

Last Friday, the ABS said that on a seasonally adjusted basis, (nominal) retail sales in April 2023 were unchanged over the month but stood 4.2 per cent higher than their level in April 2022. According to the ABS, retail turnover has plateaued over the last six months, due to consumers winding back their spending on discretionary goods in response to cost-of-living pressures and higher interest rates. Further supporting the view that consumption is running into mounting headwinds, April’s outcome was below the consensus forecast for a 0.4 per cent monthly rise while the annual rate was the slowest recorded since September 2021.

The ABS has published the 2021-22 edition of Australian Industry. According to the Bureau, the data show an increase in operating profits across almost all industries (the two exceptions are construction and electricity, gas, water, and waste services) as rising revenues more than offset increased input costs and a decline in COVID-19-related government subsidies. The mining industry had a particularly good year, with earnings rising by 32.7 per cent ($54.3 billion) and industry value added up 29.5 per cent ($64.6 billion). Other strong performers in terms of earnings growth included wholesale trade (up 30.2 per cent or $8 billion), agriculture, forestry and fishing (up 26.2 per cent or $5.6 billion), manufacturing (up 17.8 per cent or $7.6 billion) and rental, hiring and real estate services (up 13.5 per cent or $8.5 billion).

The ABS said that deaths due to COVID-19 were 1,314 in the four months to April 2023 (although the Bureau noted that the actual number of deaths in March and April will likely increase over time as additional registrations arrive). That compares to 3,802 in the same period last year and 10,144 deaths across the whole of 2022. Provisional total mortality statistics report 12,736 deaths in February this year of which 214 were deaths due to COVID-19 that were certified by a doctor. That was more than 78 per cent lower than the 784 COVID deaths in February 2022. At the same time, as the pandemic has continued the number of people reported to be dying ‘with’ COVID-19 (as opposed to it being the underlying cause of death) has increased.

Other things to note . . .

- The Opening Statement to the Economics Legislation Committee by Treasury Secretary Steven Kennedy.

- A new article from the ABS on international comparisons of CPIs sets out key differences between the Australian measures and the approach taken by a group of selected other economies comprising New Zealand, the US, the UK, Canada and the EU. Key differences include approaches to measuring owner occupied housing, the treatment of used motor vehicles, and how frequently the weights used for the CPI basket are updated.

- In the AFR, Garnaut and Vines say that the Australian economy has suffered from a ‘lost decade’ and that the reforms recommended by the recent RBA review would by themselves have been unlikely to lead to superior economic outcomes. Instead, better performance would have required better settings across a wider range of policies including ‘fiscal, monetary, trade, energy, immigration, competition, labour and other areas’.

- The Lowy Institute’s John Edwards with a new paper analysing chips, subsidies, security and great power competition.

- Related, Eric Helleiner on the revival of neomercantilism.

- The Economist magazine reckons the global economy should say farewell peace dividend, hello war tax.

- BIS research examining the macroeconomic effects of the energy transition. The possibility of a new metals and minerals supercycle could be good news for Australia.

- The NY Fed’s John Williams on measuring the natural rate of interest.

- A look at the long term relationships between peaking population levels, flat-lining population growth, and resource use.

- From the OECD, the Sovereign Borrowing Outlook 2023.

- This FT Big Read asks, is COP28 destined to be a flop?

- FT Alphaville offers a beginner’s guide to accounting fraud. Here is part two.

- A Vox column ponders how some people get away with doing nothing at work.

- Tyler Cowen talks to Seth Godin about marketing and meaning. Covers lots of ideas, but the point about how large language models will facilitate scams tailored to the individual was one that caught my attention.

- This came out a little while back but I missed linking: the Jolly Swagman podcast has a four hour-plus discussion with Ken Henry.

Latest news

Already a member?

Login to view this content