Last year brought Australia’s first Pandemic Budget. A few days beforehand, the Prime Minister had described it as ‘arguably one of the most important, if not the most important since the end of the Second World War’, and following the Treasurer’s budget night speech on 6 October 2020, our own analysis argued that Budget 2020-21 marked ‘the start of a new fiscal era. An era of more government spending, bigger deficits, and more government debt…an era where fiscal policy has replaced monetary policy as the key macro lever in the economy, and where the budget has been assigned a specific goal in terms of the unemployment rate.’

What’s familiar…

Just seven months on, and the government has now delivered its second budget of the Pandemic Era. And much remains the same. This budget, too, rolls out against the backdrop of COVID-19. Deficits remain swollen and the public debt stock has grown substantially. Monetary policy is still constrained - in a 29 April 2021 speech, the Treasurer acknowledged that ‘the Reserve Bank has reduced scope to lower interest rates to drive unemployment lower and wages higher. This has placed more of the burden on fiscal policy.’ And fiscal policy is still targeting unemployment – the Treasurer used the same speech to re-affirm his new version of fiscal forward guidance, linking the future of the fiscal stance to the unemployment rate.

And what’s changed…

Yet much has changed, too. Most significantly, the success of last year’s macro policy response, plus Australia’s achievements in containing the pandemic, together mean that the economic backdrop for Budget 2021-22 is far better than Treasury’s forecasters had expected when setting the parameters for its predecessor: today, growth is stronger, commodity prices are higher and unemployment is significantly lower than was thought likely back in October last year.

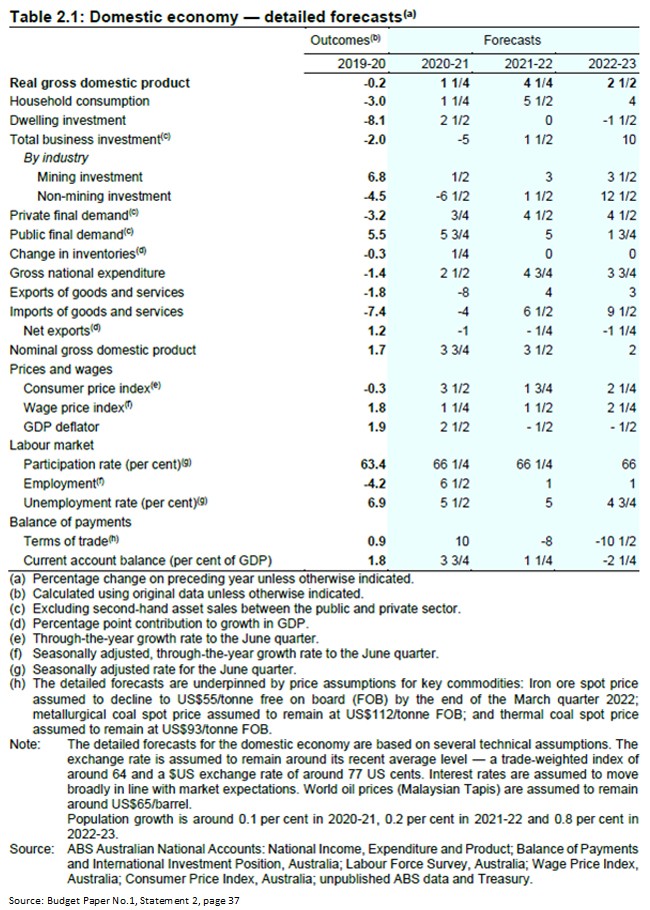

The Australian economy is now expected to grow by 1.25 per cent in real terms in 2020-21 and by 4.25 per cent in 2021-22, before growth falls back to 2.5 per cent in 2022-23. Higher commodity prices and stronger terms of trade mean that nominal growth is also stronger, 3.75 per cent in 2020-21 and 3.5 per cent in 2021-22. And the unemployment rate is expected to have fallen to 4.75 per cent by the June quarter of 2023 to 4.5 per cent by the June quarter of 2024.

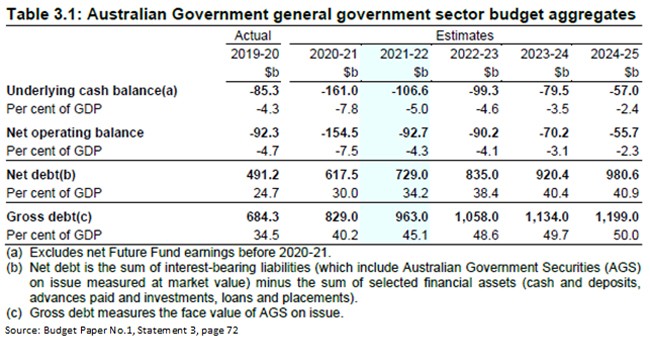

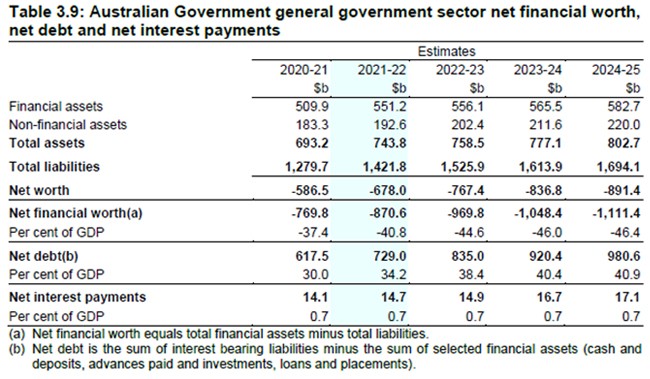

Against this much-improved economic backdrop, the underlying cash budget deficit is now expected to be $161 billion in 2020-21 (7.8 per cent of GDP) and $106 billion in 2021-22 (five per cent of GDP). Net debt will rise from $617.5 billion (30 per cent of GDP) in 2020-21 to 980.6 billion (40.9 per cent of GDP) by 2024-25.

The Government’s Economic and Fiscal Strategy

Last year, the Government introduced a new, two-phase fiscal strategy. The first phase (the COVID-19 Economic Recovery Plan) was to ‘focus on achieving a strong recovery to quickly drive down the unemployment rate’ and would ‘remain in place until the unemployment rate is comfortably below six per cent.’ Once this objective had been met, the second phase (the ‘medium-term fiscal strategy’) would ‘focus on growing the economy in order to stabilise and then reduce gross and net debt as a share of GDP.’

‘Fiscal forward guidance’ and the unemployment rate

As we discussed in some detail at the time, the Treasurer was at pains to be clear in his 29 April 2021 speech that the Government was sticking with the two-phase plan, that it judged that Australia was still ‘firmly in the first phase’, and that it ‘would not withdraw support prematurely in pursuit of fiscal consolidation.’ Indeed, the Government has doubled down on the unemployment rate objective that is the central element of Canberra’s new Fiscal Forward Guidance. That has now been upgraded to a target that is significantly more ambitious than previous one of a rate ‘comfortably below six per cent’. Instead, the Treasurer has said that the new precondition for moving from phase one to phase two of the Economic and Fiscal strategy is ‘to drive the unemployment rate down to where it was prior to the pandemic [5.1 per cent] and then even lower.’ What might ‘even lower’ mean? Here, the Treasurer noted that ‘both the RBA and Treasury’s best estimate is that the unemployment rate will now need to have a four in front of it’ to deliver higher wages and get the RBA back to its inflation target.

Targeting an unemployment rate with ‘a four in front of it’ is ambitious by recent standards: the last time the unemployment rate met that criterion was in June 2011, when it was 4.9 per cent. And the last time the economy sustained a sub-five per cent unemployment rate for a prolonged period was before the global financial crisis, between May 2006 and December 2008, when the montly unemployment rate twice fell to as low as four per cent. But that ambition is consistent with current thinking on the economy. It is broadly in line with both the RBA and Treasury’s new best guesses as to the Non-Accelerating Inflation Rate of Unemployment (NAIRU), with the broad focus of monetary policy as now being implemented by Martin Place, and with what appears to be the views of a majority of Australian economists.

The Budget forecasts first see that target being hit by the June quarter of 2023, with a projected unemployment rate of 4.75 per cent. But the budget papers are careful to note that ‘a high degree of uncertainty remains’, and therefore that the economy will have to remain in the first phase of the Strategy ‘until recovery is secured’.

Debt sustainability and r < g

What about concerns around the stock of government debt? Here the Treasurer has steered clear of facile comparisons between the Federal budget and household budgets and instead embraced the conventional economic framework that emphasises the relationship between the average interest rate on government debt (r) and the growth rate of the nominal economy (g) as one critical determinant of the trajectory of the debt stock (along with the size of the budget balance itself). Put simply, this relationship says that for a budget that is in balance before taking interest payments into account, the debt to GDP ratio will increase when r > g and fall when r < g. It follows that, depending on the size of the gap between r and g, it is possible for the debt-to-GDP ratio to stabilise or even fall even if the government runs budget deficits. With Treasury now predicting that ‘nominal economic growth will exceed the nominal interest rate for at least the next decade’, economic growth is expected to more than cover the cost of debt service. That assumption then underpins the Treasurer’s view that by growing the economy, this will deliver ‘a steady and declining ratio of debt to GDP over the medium term as we continue to move towards balancing the Budget.’

Fiscal sustainability and phase two

While it’s still some way off, the second phase of the government’s economic and fiscal strategy is – at least as currently envisioned – more conservative than the first, and sets the limits on just how ‘revolutionary’ Canberra is prepared to be. As well as a focus on ‘growing the economy in order to stabilise and reduce debt’, the Government aims to return to ‘controlling expenditure growth, while maintaining the efficiency and quality of government spending and guaranteeing the delivery of essential services’ and ‘supporting revenue growth through policies that drive growth, while maintaining a tax-to-GDP ratio at or below 23.9 per cent.’

The Economic outlook and Key Forecasts

The international economic outlook

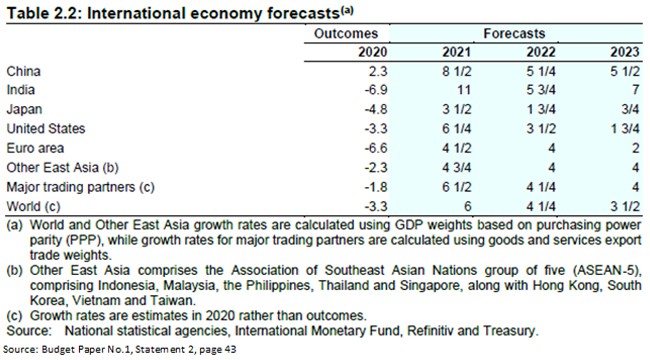

Treasury’s projections for the international economic environment see world real GDP growth at six per cent in 2021 and 4.25 per cent in 2022. Economic growth in Australia’s main trading partners is expected to be somewhat faster, at 6.5 per cent in the current calendar year and 4.25 per cent in 2022.

These numbers are in line with the latest economic projections set out in the IMF’s April 2021 World Economic Outlook (WEO), which also has world GDP growing by six per cent in real terms this year and by 4.4 per cent in 2022. Compared to last year’s budget, the international outlook has been upgraded:, the previous Budget expected world growth to run at five per cent in 2021 and 3.5 per cent in 2022, while major trading partner growth was forecast at 5.75 per cent in 2021 and 3.75 per cent in 2022.

The domestic economic outlook

Treasury’s forecasts for the domestic economy now see real GDP rising by 1.25 per cent in 2020-21 and 4.25 per cent in 2021-22. Growth is then forecast to slow to 2.5 per cent in 2022-23. As noted earlier, that compares well to the Budget 2020-21 projections that expected real GDP to contract 1.5 per cent in 2020-21 before growing by 4.75 per cent in 2021-22.

Importantly, the forecasts are based on the assumptions that although there will be localised outbreaks of COVID-19 during 2021, these will be effectively contained, that there will be no extended or sustained state border restrictions in place over the forecast period, and that a population-wide vaccination program ‘is likely to be in place by the end of 2021.’

Household consumption is forecast to grow 1.25 per cent in 2020-21 and then surge by five per cent in 2021-22 before the pace of growth moderates somewhat to four per cent in 2022-23. Consumer spending is assumed to be supported by strong household balance sheets, robust consumer confidence and an improving labour market. Dwelling investment is predicted to rise by 2.5 per cent in 2020-21 but then to be flat in 2021-22 and to decline in 2022-23 as the elevated pipeline of work – including some bring-forward in demand for residential construction – winds down. And after falling by five per cent in 2020-21 (with non-mining investment dropping by 6.5 per cent), total business investment is expected to rise by a modest 1.5 per cent in 2021-22 before jumping by ten per cent in 2022-23 as non-mining investment leaps by 12.5 per cent, with this profile underpinned by stronger business confidence, the rebound in economic activity, and the impact of business tax incentives – including the impact of the extension of temporary full expensing and temporary loss carry back measures announced in this budget.

Projections for the labour market are particularly important given the commitments under Phase One of the Government’s Economic and Fiscal Strategy, and here the forecasts assume that employment will increase by 6.5 per cent over 2020-21 before growth slows to just one per cent over 2021-22 and 2022-23. The unemployment rate falls to 5.5 per cent in the June quarter of 2020-21 and five per cent in the June quarter of 2021-22 before dropping to ‘a number with a four in front of it’ by late 2022 and then hitting 4.75 per cent in the June quarter of 2023. The turnaround relative to the labour market projections in Budget 2020-21 is quite striking: the older forecasts had expected the unemployment rate to still be up at 7.25 per cent in the June quarter of this year and to have only fallen to 6.5 per cent by the June quarter of 2022.

What does this mean for wage growth? The Budget forecast assumes a gradual pick up in the rate of increase in the wage price index, but only to 2.25 per cent by the June quarter of 2022-23 – still below the three per cent plus that the RBA thinks is compatible with its inflation target.

The other changes on the nominal side of the economy are also significant. Nominal GDP growth is expected to be 3.75 per cent in 2020-21, 3.5 per cent in 2021-22 and two per cent in 2022-23. The iron ore price forecast remains conservative – but now is forecast to fall to US$55/tonne by the end of the March quarter 2022, while the overall terms of trade are forecast to have risen by ten per cent in 2020-21 before falling by eight per cent in 2021-22. In contrast, Budget 2020-21 had been built on the assumption that the spot price for iron ore would have fallen to US$55/tonne by the end of the June 2021 quarter (in fact, by the close of last week iron ore prices had risen to more than US$200/tonne). It had also assumed weakness in the overall terms of trade, with the latter expected to fall 1.5 per cent in 2020-21 and then slump by 10.75 per cent in 2021-22. All of which meant that previous budget expected nominal GDP – effectively the tax base – to contact by 1.75 per cent in 2020-21 before growing by 3.25 per cent in 2021-22.

It’s that big change in nominal GDP in 2020-21 and the much more robust real economy that explains the much better fiscal outcomes relative to last year’s budget and described below.

As might be expected, this year’s Budget forecasts are broadly in line with the RBA’s latest views as set out in its May 2021 Statement on Monetary Policy. There, the RBA noted that Australia’s GDP is now expected to have reached its pre-pandemic level as of the March quarter of this year, that there were more people employed in March 2021 than there were before the pandemic, and that the decline in the unemployment rate (to 5.6 per cent in March) had been much quicker than expected. As a result, the RBA had upgraded its own forecasts relative to February’s Statement, with the economy expected to grow by one per cent in 2020-21, five per cent in 2021-22 and 3.25 per cent in 2022-23. Martin Place sees the unemployment rate falling to five per cent by December this year and 4.5 per cent by December 2022, where it is expected to remain by June 2023. That would again be consistent with the Government’s objective of a sustained unemployment rate with a four in front of it. (Remember, however, that the RBA also thinks that this unemployment rate will only be sufficient to drive wage inflation – as measured by the Wage Price Index (WPI) – up to 2.25 per cent by June 2023, which in turn would only push up headline and underlying inflation to two per cent, the very bottom of the RBA’s target range.)

Two other changes to the Australian economic outlook in Budget 2021-22 worth noting. First, on the trajectory for the Australian dollar, Budget 2020-21 had assumed that the exchange rate would remain at an average trade-weighted index (TWI) of around 62 and a US$ exchange rate of around 72 US cents. Tonight’s budget has the technical assumption of a TWI of around 64 and a US$ exchange rate of around 77 US cents.

Second, and perhaps more important, there are the assumptions about when the Australian economy is likely to re-open to the rest of the world. Here, Budget 2021-22 assumes that inbound and outbound international travel will remain low through to mid-2022, after which there is a gradual return in international tourism. A gradual return of temporary and permanent migration is assumed to occur from mid-2022, and small, phased programs for international students are expected to begin in late 2021.

As a result, net overseas migration is forecast to fall from a net inflow of around 194,000 persons in 2019-20 to a net outflow of around 97,000 by the end of 2020-21 and then to a net outflow of 77,000 in 2021-22 before switching to an inflow of 235,000 persons in 2024-25.

Swings in the rate of migration and therefore in the pace of population growth have important economic consequences – see for example the recent discussion on international border closures and slower population growth in the May 2021 Statement on Monetary Policy. As the RBA notes, strong population growth has been a key support for economic growth in recent decades, has helped offset domestic skill shortages, powered the demand for housing and reshaped Australia’s demographics including slowing the rate of population ageing (and also boosting the labour market participation rate).

Medium-term outlook and potential GDP growth

The current budget assumes that potential real GDP growth will fall below two per cent per annum in the near term before rising to around 2.75 per cent per annum over the medium term to 2031-32. The outlook for the level of nominal GDP growth has improved relative to last year’s budget, reflecting the faster than expected recovery, a higher level of medium-term potential GDP, and stronger commodity price assumptions. Even so, potential GDP over the medium-term is still expected to remain below its pre-pandemic level.

Fiscal Projections: Cash balance, receipts and payments

The underlying cash balance and the net operating balance

The underlying cash balance is forecast to be a deficit of $161 billion in 2020-21 or 7.8 per cent of GDP. In 2021-22 this deficit is expected to narrow to $106.6 billion or five per cent of GDP, before falling again to $99.3 billion (4.6 per cent of GDP) in 2022-23 and $79.5 billion (3.5 per cent of GDP) in 2023-24.

In accrual terms, the net operating deficit is projected to fall from $154.5 billion in 2020-21 (7.5 per cent of GDP) to $55.7 billion (2.3 per cent of GDP) in 2024-25.

To understand the positive impact that Australia’s rapid economic turnaround has had on the budget’s starting position, it’s useful to compare those figures with the projections made at the time of last October’s budget. Then, the government expected the underlying cash balance in 2020-21 to be a deficit of $213.7 billion (about 11 per cent of forecast GDP). That was then forecast to be followed by a deficit of $112 billion (5.6 per cent of GDP) in 2021-22. That means that relative to last year’s budget, the expected underlying cash deficit has shrunk by $52.7 billion in 2020-21 and by a rather more modest $5.4 billion in 2021-22.

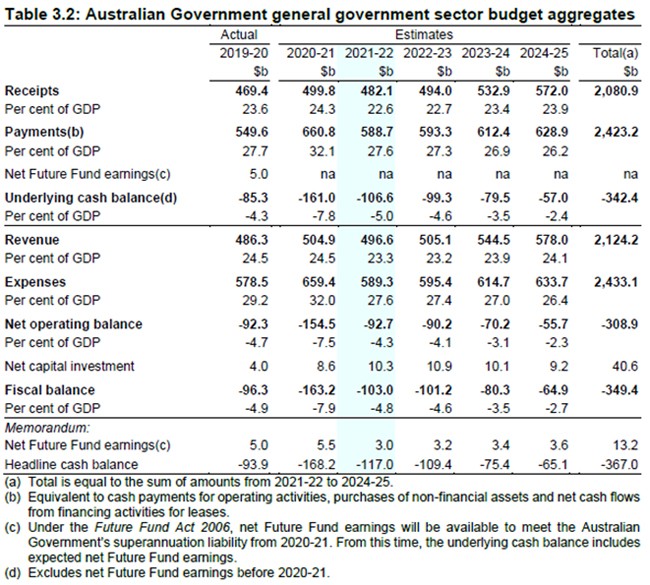

Receipts

The previous Budget 2020-21 expected government receipts to slip to $463.8 billion (23.8 per cent of GDP) in 2020-21 before falling again to $451.9 billion (22.5 per cent of GDP) in 2021-22. Instead, receipts are now projected at $499.8 billion (24.3 per cent of GDP) in 2020-21 and $482.1 billion (22.6 per cent of GDP) in 2021-22.

Payments

As a share of GDP, payments are estimated to have jumped to 32.1 per cent in 2020-21 and then are forecast to fall back to 27.6 per cent of GDP in 2021-22. Payments are then forecast to remain above 26 per cent of GDP across the forward estimates – so above the long-run average of a little less than 25 per cent of GDP.

Medium-term projections

The underlying cash balance is now forecast to improve from a deficit of 7.8 per cent of GDP in 2020-21 to a deficit of 1.3 per cent of GDP by 2031-32. Budget 2020-21’s medium-term projections had the underlying cash balance still expected to be in deficit to the tune of 1.6 per cent of GDP by 2030-31.

Fiscal projections: Implications for government debt

Net debt as a share of GDP is now forecast to rise from $617.5 billion or 30 per cent of GDP in 2020-21 to $980.6 billion or 40.9 per cent of GDP by the end of the forward estimates in 2024-25.

Again, that compares quite favourably with the projections made in Budget 2020-21, which had expected government net debt to hit $703.2 billion (or 36.1 per cent of forecast GDP) in 2020-21, and $966.2 billion (43.8 per cent) in 2023-24.

Net interest payments on that new debt profile are now expected to remain flat at 0.7 per cent of GDP throughout the forward estimates.

Medium-term projections for government debt and deficits

Net debt as a share of GDP is estimated to peak at 40.9 per cent of GDP at 30 June 2025 before improving over the medium term to reach 37 per cent of GDP at 30 June 2032. That’s a shallower debt trajectory than last year’s forecasts, which had assumed that net debt would peak at 43.8 per cent of GDP at 30 June 2024 and then improve over the medium term, falling to 39.6 per cent of GDP by 30 June 2031.

Selected policy initiatives

Tax measures – LMITO and Investment Incentives

The big tax measures in Budget 2021-22 are the extension for an additional year of the Low and Middle Income Tax Offset (LMITO), which will deliver $7.8 billion of tax relief to 10.2 million taxpayers, and the extension of the previous budget’s investment incentive measures (temporary full expensing and temporary loss carry back for businesses with a turnover of less than $5 billion), again for another year.

The LMITO provides a tax refund of up to $1,080 for a single taxpayer and applies to taxpayers earning up to $126,000 per annum. The Government estimates that its extension will benefit around 10.2 million taxpayers. The LMITO was originally part of the first stage of the Government’s three-stage Personal Income Tax Plan and was intended to be a temporary measure that would only apply to the four financial years between 1 July 2018 and 30 June 2022. It would be removed following the introduction of Stage Two of the tax plan, since in some ways the LMITO was like a ‘means-tested version’ of the Stage Two tax cuts, and as such would have effectively been replaced. But in last year’s budget when the government brought forward the Stage Two tax cuts from July 2022 to July 2020, it announced that it would retain the LMITO for another year, in order to provide a ‘one-off additional benefit.’ With the expiry of the LMITO set to deliver a substantial tax hike to a range of middle income taxpayers, the supposedly ‘temporary’ and ‘one-off’ benefit has now been extended.

Similarly, in the previous budget the Government had introduced temporary full expensing of depreciable assets for businesses with turnover below $5 billion. That will now be extended for a further 12 months until 30 June 2023. And the Government is also extending temporary loss carry back to the 2022-23 income year, which will allow companies with turnover below $5 billion to recoup tax previously paid on previous profits. Combined, these two measures are estimated to provide a further $20.7 billion of tax relief over the forward estimates period, although the cost over the medium term will be a more modest $5.3 billion as both measures work by bringing forward tax deductions or the use of losses from future years.

Supporting the Care Economy (1) – Aged Care

The budget commits $17.7 billion in new funds over the next five years to Aged Care. But note that a range of private estimates have put the costs of implementing the Royal Commission recommendations at around $10 billion per annum.

Supporting the Care Economy (2) – Child Care

There is an extra $1.7 billion for Child Care in the form of measures designed to improve affordability through increased subsidies (although this pre-Budget take from Victorian University policy analysts was that the impact on affordability would be relatively limited).

Supporting the Care Economy (3) – NDIS

The Budget commits an additional $13.2 billion of funding over four years to the National Disability Insurance Scheme (NDIS).

Supporting the Care Economy (4) – Mental Health

The Budget includes a $2.3 billion package for mental health that responds to recommendations from the Productivity Commission and the National Suicide Prevention Adviser.

A budget for women?

The Government is investing $1.9 billion in a Women’s Economic Security Package, with $1.7 billion of this reflecting the Child Care spend noted above. There is also $1.1 billion of funding for improving women’s safety.

Support for COVID-hit sectors and regions

The Government will provide an additional $1.2 billion in support for the aviation and tourism sectors, almost $300 million in support for the creative and cultural sector, and $53.6 million to support Australian education providers most reliant on international students.

Another boost to infrastructure investment

The Government has commited a further $15.2 billion over ten years to its infrastructure program, with extra funding for road, rail and community infrastructure projects.

Digital Economy Strategy

Pre-budget, the Government announced that it would put almost $1.2 billion towards further support for its ‘Digital Economy Strategy.’

Building national economic and disaster resilience

The Government is also investing in measures aimed at national economic and disaster resilience, including funding for the new National Recovery and Resiliency Agency, money to establish the Australian Climate Services, and a $10 billion Government guarantee for a reinsurance pool for cyclones and related flooding.

The Housing Market

Home ownership measures include an expansion of the first-home guarantee, a new family home guarantee targeting women and single parents, changes to the First Home Super Saver Scheme, and an extension to the HomeBuilder construction commencement period from six months to 18 months.

Training and employment

There is $2.7 billion to extend the Boosting Apprenticeship Commencements wage subsidy..

Specific analysis for directors and boards

This year’s budget contains few surprises for directors with most of the measures reflecting previous announcements or expected commitments. Key details are outlined below.

Aged care governance – implementation of Royal Commission recommendations

The Government will provide $698.3 million over five years from 2020-21 as part of the $17.7 billion response to the recommendations of the Royal Commission into Aged Care Quality and Safety. Much of these measures had already been announced in the Government’s earlier response to the Royal Commission final report.

Funding includes:

- $630.2 million to improve access to quality aged care services for consumers in regional, rural and remote areas including those with Indigenous backgrounds and special needs groups;

- $26.7 million over four years to develop a new aged care Act to replace both the Aged Care Act 1997 and the Aged Care Quality and Safety Commission Act 2018 (to be legislated by mid-2023);

- $21.1 million over four years from 1 July 2021 to establish the National Aged Care Advisory Council to provide advice to Government on the aged care sector including implementation of the aged care reforms, a Council of Elders to provide advice to Government on quality and safety in the aged care sector, and a commitment to working towards the creation of an Inspector-General of Aged Care ; and

- $6.8 million over three years from 2021-22 for information and engagement with the aged care sector, aged care users and their families about aged care reforms.

Alignment of care and support sector regulation

In an effort to improve consistency of regulation across the care and support sector, the Government will provide $12.3 million over FY22 and FY23. This will include facilitating greater information sharing between regulators, alignment of auditing arrangements and compliance and enforcement powers, review of the NDIS Quality and Safeguard Framework and consultation with the sector around options to further align regulation and safeguards.

Sexual harassment – implementation of Respect@Work recommendations

The Budget outlines the financial commitments associated with implementing the Sex Discrimination Commissioner’s landmark Respect@Work report into sexual harassment in the workplace.

$13.5m has been allocated over the coming four years including:

- $9.3 million over four years from 2021-22 to support the implementation of the Government’s response to the Respect@Work report, including for the Respect@Work Council Secretariat;

- $6.0 million over four years from 2021-22 to the Workplace Gender Equality Agency and the Australian Public Service Commission to strengthen reporting on sexual harassment prevalence, prevention and response;

- funding for additional legal assistance for specialist lawyers with workplace and discrimination law expertise.

Insolvency – further Government appetite for reform

Building on the Government’s 2020 reforms, the Budget signals further Government appetite for additional refinements to Australia’s insolvency settings. Of most relevance for directors is the commitment to commence the (overdue) independent review of the efficacy of the 2017 insolvent trading safe harbour. The AICD will be strongly supporting the retention of the safe harbour during that inquiry.

The Government has also said it will be consulting on options to: clarify the treatment of trusts with corporate trustees; and improve schemes of arrangement, including by introducing a moratorium on creditor enforcement while schemes are being negotiated.

The Government will also increase the minimum threshold at which creditors can issue a statutory demand on a company from $2,000 to $4,000.

Not-for-profits – transparency of tax exemptions

From 1 July 2023, the ATO will require income tax exempt NFPs with an active Australian Business Number (ABN) to submit online annual self-review forms with the information they ordinarily use to self-assess their eligibility for the exemption. This measure will ensure that only eligible NFPs are accessing income tax exemptions. Currently non-charitable NFPs can self-assess their eligibility for income tax exemptions, without an obligation to report to the ATO.

Superannuation – additional funding for APRA and consumer advocacy

In keeping with its ongoing focus on the operation and governance of the superannuation system, the Government will provide $11.2 million over four years to support stronger consumer outcomes in the sector by providing: $9.6 million for the Australian Prudential Regulation Authority to supervise and enforce increased transparency and accountability measures as part of the Government’s Your Future, Your Super reform; and $1.6 million to advocacy group Super Consumers Australia.

Deregulation – confirmed funding for ongoing initiatives

The Budget also confirms the earlier announced Government commitment to progress its deregulation agenda with, amongst other things, $10 million allocated over four years to modernise business communication by amending legislation in the Treasury Portfolio to be technology neutral; and $0.8 to examine options to enable electronic document execution.

Latest news

Already a member?

Login to view this content