In this special edition, we feature the Climate Governance Study 2024 published last week by the AICD in partnership with Pollination.

The study finds Australian directors are intensifying their focus on climate change, yet organisations face growing challenges in executing their strategies. Based on a survey of 1,057 AICD members and consultations with 24 senior non-executive directors, the study offers practical insights and recommendations for improving governance practice. There is also a brief ‘snapshot’ document highlighting the key findings, better practice and recommendations.

Also in this newsletter:

- The US introduces its first national climate disclosure rules, while the Australian regime remains in flux;

- Consultations open on Australia’s proposed new Nature Positive laws;

- Save the date: AICD announces its third annual Climate Governance Forum (Sydney, 23 August 2024)

Climate Governance Study 2024: Moving from vision to action |

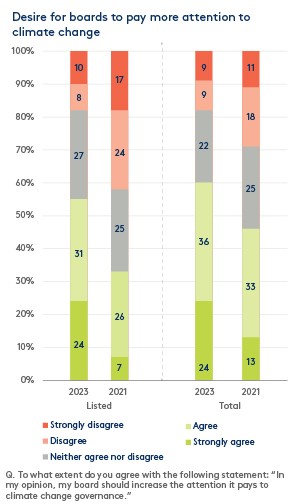

The Climate Governance Study 2024 is the second released by the AICD and builds on the insights of the inaugural 2021 climate insights study. It finds, despite several years of significant strategic and economic challenges, Australian directors report a high level of concern regarding climate-related risks to their organisations.

The intention of the study is to act as a ‘temperature check,’ assessing how perspectives and actions on climate governance are evolving among the Australian director community. Overall, it identifies fluctuating levels of board and organisational activity on climate change, with significant differences between sectors. Read the report. Snapshot of contemporary climate governance practice in the Australian marketThe Climate Governance Study 2024 provides details of the leading climate governance practices that have evolved in the past few years. The Australian Market Snapshot, which accompanies the comprehensive report, captures these insights in an easy-to-share format for inclusion in board briefings and papers. The four-page summary provides better practice guidance and recommendations relevant to all sectors, with more detailed discussion in the full report. |

The findings represent a significant turnaround in sentiment in this sector in two years. In fact, the study finds listed directors and their boards are leading climate practice in Australia across key measures. They are more likely to be investing in training (39 per cent), preparing for mandatory climate reporting (81 per cent) and setting climate targets and transition plans (43 per cent). Read more.

|

||

For the calendar:

- 20-21 March 2024: AICD’s upcoming annual Australian Governance Summit includes a session on ‘Powering the Future: The Energy Transition and Climate Governance’, featuring John Lydon GAICD (Co-Chair, Australian Climate Leaders Coalition), Dr Larry Marshall FAICD (Director, Fortescue), and Karen Moses FAICD (Director, Orica; Charter Hall). Register now.

- Friday, 23 August 2024 – save the date: Third annual AICD Climate Governance Forum (Sydney). Registrations open soon.

- 8-10 October 2024: The Australian Government will host the first Global Nature Positive Summit in Sydney. Read more.

- 11-24 November 2024: COP29 United Nations climate conference in Baku, Azerbaijan. Learn more.

Already a member?

Login to view this content