Following the banking Royal Commission, the number of APRA-regulated funds are expected to shrink to make way for more self-managed and industry super funds by 2029, writes Ben Power.

In November 2019, two Queensland-based industry superannuation giants, Sunsuper and QSuper, announced they were discussing a possible merger. Combined, they would eclipse AustralianSuper to become the largest superannuation fund in Australia, with assets totalling more than $350 billion.

The talks are the latest in an intensifying matrix of mergers sweeping through the sector that is set to create a series of mega industry funds with potent power. There are big changes afoot in the nation’s superannuation system which could also reshape the investment, corporate and board landscape.

“Consolidation is happening at a pace that hasn’t happened in the past 10 years,” says Naomi Edwards FAICD, the independent chair of Tasplan Super and a non-executive director of the AICD. “I know a lot of legal advisers and consultants who say they’re currently dealing with multiple trustee boards who are considering mergers.”

As these changes take shape, directors will need an improved understanding of these megafunds, which will own increasing numbers of listed companies and infrastructure.

And as major super funds become larger and more sophisticated, they will increasingly be tapping the skills of directors from outside the superannuation industry in key areas of finance, marketing, investments and regulation.

“The [super fund] businesses are growing and developing very quickly to become much more complex institutions,” says Linda Elkins, national sector leader, asset and wealth management, at KPMG, adding that funds will need to hire directors with new skills such as marketing, compliance and investment to match that development.

Savings success

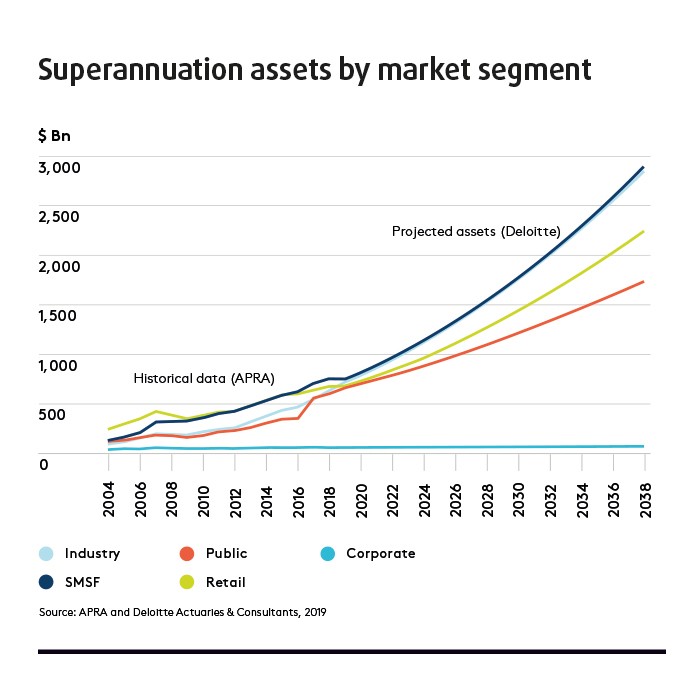

Australia’s super assets have ballooned to $2.9 trillion as of September 2019, making it the world’s fourth-largest retirement savings pool. The nation’s super assets are forecast to more than triple to $10.2 trillion by 2038, according to Deloitte’s recent report, Dynamics of the Australian Superannuation System, authored by the company’s principal, Diane Somerville.

Australia’s approach to retirement income is lauded as a global success. According to the 2019 Melbourne Mercer Global Pension Index, Australia has the third-best pension system in the world behind the Netherlands and Denmark. But in recent years, the sector has been reshaped by a number of legislative changes, inquiries and reviews.

The Hayne Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry exposed serious issues in the super sector, including breaches of the Corporations Act 2001 (Cth), structural issues related to vertical integration of banks, and even charging fees to dead people. Commissioner Kenneth Hayne AC QC also criticised the role of the Australian Prudential Regulation Authority (APRA), which regulates retail, industry, corporate and public sector funds, and the Australian Securities and Investments Corporation (ASIC) in supervising superannuation funds.

Room for improvement

The Productivity Commission review into the efficiency and competitiveness of the super system, handed down in December 2018, found the sector still had inefficiencies, including excessive fees. In that same month, APRA released a package of prudential requirements to strengthen the focus of superannuation trustees on delivering quality outcomes for members. APRA will require funds to annually benchmark and evaluate their performance in delivering sound, value-for-money outcomes for members.

The federal government has also recently requested public submissions for its upcoming Retirement Income Review, which aims to examine the current state of the Australian retirement income system and how it will perform in the future.

In December 2019, APRA released its MySuper Product Heatmap, which revealed underperforming funds. APRA is likely to use the indicator to pressure laggard funds to merge or exit the industry. “APRA is trying to weed out chronic underperformers,” says Ian Fryer, head of research at independent pension and superannuation researcher Chant West.

The future of super

Deloitte’s Dynamics of the Australian Superannuation System (November 2019) forecasts the nation’s super assets will almost triple to $10.2 trillion by 2038. The legislated increase in the Super Guarantee will provide a major tailwind with compulsory employer contributions set to rise from 9.5 per cent to 10 per cent in July 2021; then to 12 per cent by July 2025.

However, growth will vary depending on the type of super. Australia’s super industry is fragmented into five major categories. Four are regulated by APRA: not-for-profit industry funds formed to service specific industries; public sector funds for government employees; the largely bank-owned retail funds; and corporate funds run by companies.

The fifth category, private self-managed super funds (SMSFs), are regulated by the Australian Taxation Office (ATO).

Deloitte expects industry funds and SMSFs to keep growing strongly during the next 20 years, with each to have $3 trillion in assets by 2038.

Corporate funds are expected to decline and flatline as more companies stop managing their own super funds. Public sector funds are expected to grow at a reasonable rate.

However, retail funds will lag the growth of industry funds and SMSFs in the wake of the reputational damaged suffered in recent years, particularly following the banking Royal Commission.

Joining forces

Funds are responding to greater focus on member outcomes, performance and increased regulatory scrutiny with one strategy: mergers.

“Perhaps the most significant outcome of this myriad of inquiries, reviews and proposed changes to superannuation will be a major consolidation of superannuation funds through fund mergers,” said KPMG in its Super Merger Insights report in February 2019.

In addition to QSuper and Sunsuper (the latter merged with AustSafe Super in June 2019), a raft of other funds have merged, begun mergers, or are in talks to merge — Hostplus and Club Super, Equip Super and Catholic Super, and VicSuper and First State Super, whose merger will see it become Australia’s second-largest profit-to-member super fund with $120b in assets. More are expected to be announced in the coming months.

Funds believe merging — which APRA is encouraging — allows funds to offer more benefits to members at lower costs.

More mergers to come

According to Rice Warner’s Superannuation Market Projection 2019 report, within five years, the industry will be dominated by nine funds controlling $1.7 trillion. That includes a merged QSuper/Sunsuper with $350b of assets, AustralianSuper with $325b, AMP with $200b and UniSuper with $150b. When combined with the strong growth of super savings to $10.2 trillion by 2038, these megafunds will make super funds an increasingly powerful force in corporate Australia, particularly in listed markets. If funds continue to hold a similar allocation of assets to Australian shares as they currently do, Deloitte says they will “dominate the Australian Stock Exchange holdings” and estimates the proportion of the ASX owned by super funds will almost double to 60 per cent by 2038. “In the future, an increasing number of directors’ investors will be through super funds,” says Fryer. “Therefore, in some ways, they [directors] will be answerable and accountable to those super funds.”

Flexing their muscle

Super funds are expected to use their increasing clout. Russell Mason, lead national superannuation partner at Deloitte, says for the past 15–20 years, industry funds were largely passive shareholders. He expects that to change. “We think they will become activist shareholders,” he says.

Some Australian funds have already been at the forefront of issues around climate change, modern slavery and corporate governance, but expect them to increasingly play a role in environmental, social and governance (ESG) decisions that impact the broader Australian community and fund members.

In particular, big industry funds are increasingly using their influence to become power players in corporate Australia. They voted against the remuneration reports of the big four banks in the wake of the banking Royal Commission. Three big industry super funds — AustralianSuper, Cbus and Hostplus — then played a major role in the fallout of the Westpac scandal, when AUSTRAC launched legal action against the bank in November 2019, alleging 23 million breaches of anti-money laundering laws.

Rules of engagement

The growing importance of super funds means directors of companies need to understand their stature and boost engagement with them. “I recommend directors look at their largest shareholders, especially industry funds, and as much as possible, build strong relations with them,” says Mason, who knows of directors who have instigated briefings with half a dozen funds that between them own 20 per cent of their company. “They were getting in the funds to explain what they were doing and to build good relations.”

A number of positives could emerge from the increasing power and size of super funds. Edwards says it could change the system where funds are advised by proxy consultants on corporate governance issues.

“A lot of boards have concerns around some aspects of the proxy adviser house system,” she says. “As funds become bigger, it is more likely that they can engage directly with companies.”

Directors and funds can also find common cause in a long-term outlook. “Super funds have a very long-term horizon, so they should be a very attractive investor to a listed company,” says Edwards. “There should be a strong alignment between them. It enables a dialogue that rests around the very powerful shared long-term goal, as opposed to short-termism, which can only be a good thing.”

Did you know?

According to the 2019 Melbourne Mercer Global Pension Index, Australia has the third-best pension system in the world behind the Netherlands and Denmark.

When opportunity knocks

As megafunds evolve to become sophisticated financial businesses, it is expected they will increasingly look for non-super directors. Elkins says there has been a shift in focus from the independence of fund directors to the board’s skills matrix, which, she adds, is an increasing focus of APRA.

Mason notes that APRA expects boards to do regular assessments and assess skills gaps. Will that create more opportunities for directors?

“Absolutely,” says Elkins. “The role of being a director on a super board is becoming more challenging and important.”

Somerville says trustee boards are looking at what skills base each director has and assessing if they have a skills gap. “They are then bringing in people from outside the super fund director space and getting that diverse view.”

Opportunities are set to open for directors with skills across investment, administration, technology, marketing and regulation. In the past, many funds outsourced investment management, but they now have the scale to do it themselves. AustralianSuper already manages 40 per cent of its assets in-house and wants to increase that to 50 per cent by June 2021.

Elkins says to expect a boost in demand for directors with investment experience in equities and property. “Very obviously, the funds will need to make sure they get directors who are capable of overseeing that investment management,” she says.

Edwards sees strong demand for technology skills as super funds hold more data. “Things such as dealing with AUSTRAC legislation, cybersecurity and privacy will become important.” As funds seek to engage with members, demands for marketing skills will also rise, adds Edwards. And, Somerville says, funds will seek compliance regulatory skills to deal with a more complex governance environment.

Australia’s superannuation environment is complex and ever-changing. The Retirement Income Review brings another cloud of uncertainty, but whatever emerges from it, one thing is guaranteed: superannuation will continue to grow and the creation of megafunds with enormous power is inevitable.

Also certain is that they will wield that power. Corporate Australia should take note.

Merge mania

The number of APRA-regulated super funds in Australia is set to shrink considerably. In its Super Insights Report (2019), KPMG estimates APRA-regulated funds will fall from 217 to just 85 in 2029.

Corporate funds will fall from 24 to six; industry funds from 38 to 12; public sector funds from 37 to 15; and retail funds from 118 to 52. By contrast, the number of SMSFs is projected to grow from 596,225 to 770,759 by 2029.

Data compiled in APRA’s MySuper Product Heatmap outlines key insights:

- Member outcomes vary widely across the industry, and underperformance is evident across all industry sectors and investment risk profiles.

- Higher fees are generally correlated with lower net returns, although there are exceptions.

- More single-strategy products outperform the investment benchmarks than lifecycle product stages.

- Low-balance accounts are most impacted by administration fees, while high-balance accounts are most impacted by percentage-based fees.

Latest news

Already a member?

Login to view this content