Managing company assets and liabilities is a tough task during the biggest recession in almost a century. Directors outline how their boards are responding.

The positive news out of the COVID-19 recession of 2020 is that many Australian businesses have responded quickly. They moved early to shore up their balance sheets with debt or equity and by cutting back on operational spending.

At the outset of the crisis in March, many businesses paused and took stock with a cashflow forecast: looking at future spending commitments, income and how much of it was at risk, the funding they had in place and how secure it was, and the organisation’s tolerance to a cashflow reduction.

“Between the global financial crisis and now, in my observation, companies are better prepared,” says Jennifer Lambert FAICD, a non-executive director of BlueScope Steel, NEXTDC and Mission Australia. “They’ve built up some reserves and know they need to prepare for the storm or the event or the rainy days. They’re probably going in a little bit more resilient.”

After an initial operational response — cutting back on expenditure, stopping new commitments, pausing on hiring — companies turned their focus to shoring up their debt funding. They made sure debt was secure, kept the bank informed and checked their lender would continue to support the organisation. Debt covenants and payment schedules were considered — and in some cases, renegotiated to provide extra headroom.

As pressing as the need might have been, says Lambert, a key consideration in any capital raising is the position it will leave the business in when the crisis ends. For debt funding, the issue is how much pressure that extra debt puts on the company in the future, even as interest rates remain low. “What I’m seeing is that companies are very conscious of preserving these businesses to actually grow and thrive post-crisis,” she says. “It’s keeping that fine balance. You want to keep enough reserves to ride this out, but not necessarily at the cost of investing.”

At the outset of the pandemic, there was a fear that credit markets would seize up as they had during the global financial crisis (GFC). In fact, the opposite happened — in part because of coordinated government interventions on debt markets to keep them liquid, including purchases by the Australian Office of Financial Management (AOFM).

“US debt markets have been incredibly liquid,” says David McCarthy, managing partner financial advisory at Deloitte Australia. He notes that the US$50b issued in non-investment grade debt in April was the highest since 2013. Additionally, Australian banks have been supportive, providing payment deferrals.

Some companies raised equity or debt capital simply because they needed the cash to survive and not fall into insolvency. Others took a prudent approach to ensure that they were ready with cash on the balance sheet to meet future challenges. A third group wanted capital because they saw a potential strategic opportunity for an acquisition or expansion.

Central to any of these motives should be scenario planning, says McCarthy. Early on in the pandemic, a lot of boards were asking management if they needed to tap equity markets. Those companies that had robust forecast scenarios outlining their future liquidity at different stages of the crisis were better able to form a view about whether their balance sheet would need topping up.

Scenario planning

“What’s really important for boards is to always have the ability to project out their liquidity needs under different operating scenarios,” says McCarthy. “Scenarios are not predictions about what will happen. They’re just hypothesis about what could happen. They’re designed to open your eyes to hidden risks, but also to what opportunities might be in front of you.”

He says directors need to drive a culture of ensuring their company has a robust financial model that asks: In these situations, how does our liquidity look? What would our debt capacity look like? At what points would we need — or not need — to go to the market? Lachlan Edwards, co-founder of investment banking advisory Faraday, told an AICD webinar on capital raising in September that directors are looking at alternative providers of debt, such as non-authorised deposit-taking institutions (ADIs), securitisation of their assets, which ties up less equity than bank debt, and borrowing against inventory or accounts receivable. He warned against merely accepting the lowest-priced debt, saying companies should diversify their funding sources. “When times are volatile and uncertain, and when we are going into periods of economic downturn, often flexibility is more important than price,” he said. “Consider who is the best provider.”

For some companies there is no choice. They have already borrowed as much as they can and so their next port of call will, by necessity, be the equity markets. Low interest rates make debt an attractive option and while servicing the interest payments generally isn’t an issue, the debt will eventually have to be paid and companies are being cautious about their gearing ratios, says Robin Low GAICD, a non-executive director of Appen, IPH and Marley Spoon. “That’s why I think that equity capital, even though it may come at a cost, is often preferable because that actually strengthens your balance sheet and you’ve got no commitment,” she says.

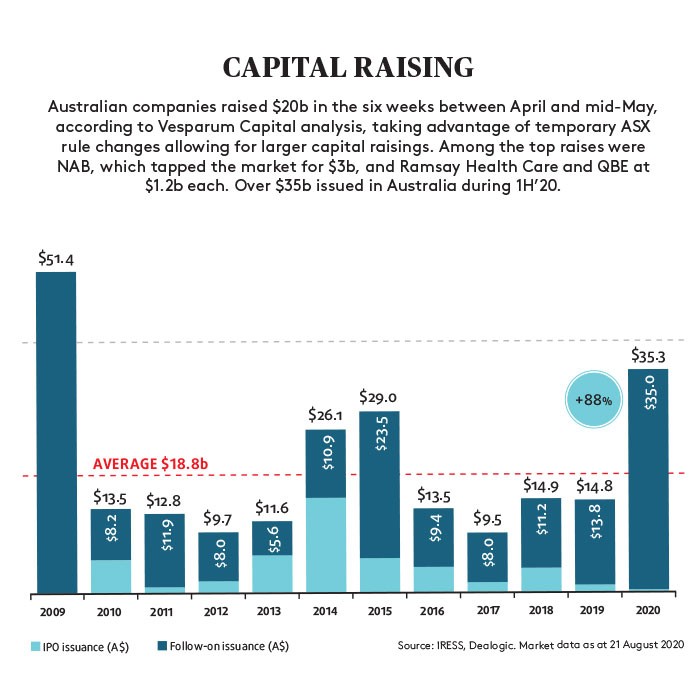

Companies also rushed to raise equity at the start of the pandemic because it was unclear how long that funding window would stay open. The raisings came bigger and faster than they did during the GFC, in part because they were different sorts of events. The GFC was mostly focused on finance companies and was a “known problem”, says Timothy Toner, founder of Vesparum Capital. The pandemic, a once-in-a-century problem, was a lot more uncertain.

“A lot of companies, given that uncertainty, took the conservative option to raise additional capital,” says Toner.

But the indirect cost of equity capital was very expensive. Toner says some companies were raising money at a 40–60 per cent discount on top of an already lower share price. In some cases, the indirect costs were more than double those from the GFC. “It’s the indirect cost that’s not as well understood by boards, and certainly smart boards spend more time thinking about indirect costs, dilution, share price and discount than the average company,” he says.

Toner adds that a key consideration in capital raisings is to recognise they are highly-dilutive transactions and need to be fair to all shareholders, encouraging all investors to participate — in part because raising money from existing shareholders is cheaper than finding new ones. Retail shareholders, in particular, need to be looked after because they are a “valuable class of shareholder” — they are buy-and-hold investors who tend to support management and follow board recommendations in the event of a takeover, says Toner.

Equity issuance has continued beyond the initial rush, with data from financial advisory Dealogic showing $35.3b in equity capital raisings so far this year to the end of August, second only to the $51.4b raised during the GFC. As Emily Smith, director of investment banking and capital markets at Credit Suisse, pointed out at the AICD capital raising seminar, there were still four months left of 2020. “While markets have recovered, volatility has declined and risk appetite is a at more normal level, companies are issuing equity to protect themselves from any further volatility and macro-economic risk,” she said.

Alan Murray, managing director of advisory firm 333 Capital, expects to see more companies restructure as the economic impact of COVID-19 wears on.

“The full scale and duration of the problem is still unknown,” he says. “It’s very different from the GFC where we could pretty much scope it out. Here, it’s pretty much consider as we go. When companies have cut their costs as much as they can, extended all their payment terms and financially borrowed what they can, then they’re pretty much only left with a couple of options.”

Murray says there is a growing trend towards solvent restructures, where the restructure is undertaken with agreement with creditors, perhaps to take debt for equity or to take a haircut on the debt. Solvent restructures produce better outcomes because not all liabilities crystallise — such as lease agreements, for example — in the same way they would under an insolvent restructure, so the debt at issue is lower.

There is also the issue of what the organisation looks like on the other side of the pandemic. Low says Australian companies have generally adapted and performed well during the crisis. While a normal change program might take six to 18 months, companies have turned their operations around rapidly, moving their entire staff to working from home in just a couple of weeks, for instance.

“It’s been the most massive shock and I don’t think any of us have experienced anything like it,” she says. “It makes you rethink everything — your debt, your equity, your strategy — it’s how do you do things differently? It’s been the biggest stress test that we’ve experienced.”

Latest news

Already a member?

Login to view this content