Phil Ruthven AM says historically low interest rates are a product of an unsettling global economic era.

As 2019 comes to a close, the picture of interest rates, using 10-year bond rates as the guide, is very mixed across the world’s 20 largest economies. While the three per cent average is low by historical standards, six nations are at or well above the historical average of around five to six per cent. But the US and 12 others are well below both the historical and current average. Turkey, Russia and Brazil have sick economies, leading to high bond rates. However, those with bond rates below one per cent are hardly vibrant, including Australia, whose growth has dropped to half its long-term average.

Continuing to lower interest rates and maintaining them at near-zero, or resorting to quantitative easing, cannot be the answer. It frees up capital for the private sector, but that may or may not be invested in growth.

There have been no meaningful reforms to taxation, the labour market, energy, telecommunications and other aspects of the nation’s affairs since the Hawke-Keating and Howard-Costello governments ended in 2007. Monetary policy is being asked to do all the work, when fiscal policy and reforms — in taxation, labour markets, energy policy and other areas — should be taking over the steering of the economy from monetary management, whose role is more like shock absorbers on a car.

Maintaining interest

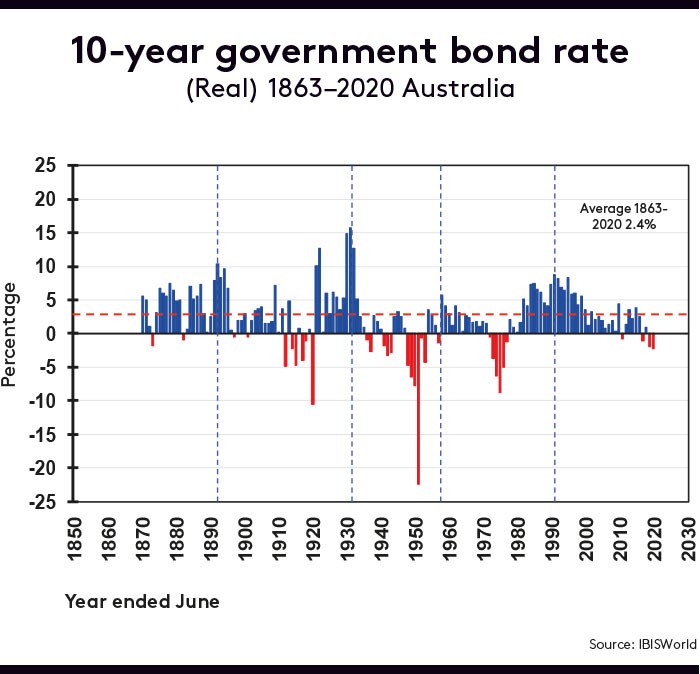

Do we really have record low interest rates in Australia? Yes, in nominal terms, at 0.75 per cent. Previous record lows were in 1894 (three per cent) and in 1950. We definitely don’t have the lowest on record in real terms, after deducting inflation (see chart below). During the past 150 years, the events that have triggered plunges in real interest rates are World War I; the 1930s recovery from the Great Depression; WWII and the postwar recovery years; the 1973 oil crisis (and resultant inflation); and right now.

Low and low-real interest rates are sometimes a harbinger or indicator of potentially serious problems, but not associated with depressions (only the recovery from depressions). They seem to be more related to global trauma such as war, and crises such as the oil crisis. The current confusion involving trade wars, populism, dictatorships, digital disruption and climate change is unsettling, to say the least.

Central banks have gone nearly as far as they can in using low nominal rates to energise economies. Some have resorted to quantitative easing, which involves the buy-back of government bonds or other financial assets to inject liquidity into the economy. These are short-term solutions, while populism is short-sighted, short-term and dishonest. The problems are much more fundamental.

In the meantime, we are experiencing other distortions in our economies. Share markets have risen to heady price-earning levels. The average is normally around 14/1, but we are around 18/1. This is not silly, given the yields on shares versus bonds, but kept in check by commercial property yields. Some overseas markets have been up to 24/1 (NASDAQ). For investors, knowing when to quit is the issue, but that means knowing when interest rates will rise.

Our exposed Achilles heel is, of course, mortgage debt — at more than 130 per cent of GDP, matched by only a few other countries, including Switzerland and the Netherlands. None of this is the end of the world compared with historical traumas and crises. But that is almost irrelevant to a society that hasn’t experienced recession for nearly three decades. We are simply not hardened for the current fears surrounding interest rates.

Latest news

Already a member?

Login to view this content