According to this week’s release of the minutes from the 1 August RBA monetary policy meeting, Martin Place reckons there is now a ‘credible path back to the inflation target with the cash rate staying at its present level.’ That implies we would need to see the emergence of upside risks to the central bank’s inflation forecasts in the data to trigger another rate increase in this cycle.

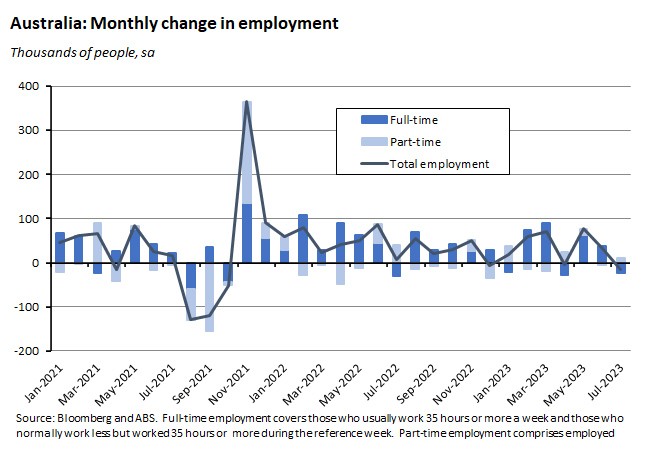

Labour market developments are going to be critical inputs to these RBA risk assessments and in that context, this week brought us important updates on both employment and wages. In neither case were the results strong enough to make the case for another rate increase. Indeed, if anything, employment data might be indicating a turning point for the labour market, as employment fell for only the second time this year.

Start with jobs. The July monthly labour force print came in softer than the consensus forecast. Employment fell by 14,600 people last month, unemployment increased by 35,600 and the unemployment rate rose to 3.7 per cent from 3.5 per cent in June. Beforehand, economists had expected employment to increase and had also predicted a smaller rise in the unemployment rate, to 3.6 per cent. The RBA minutes this week told us the central bank thinks the Australian labour market ‘might be at a turning point’. Given the recent volatility of labour market results, one month’s fall in employment is perhaps not quite enough to confirm that. But at a minimum, the July labour market result is at least consistent with the thesis of the start of a labour market shift. As such, it is hard to find any compelling case for another RBA rate hike here.

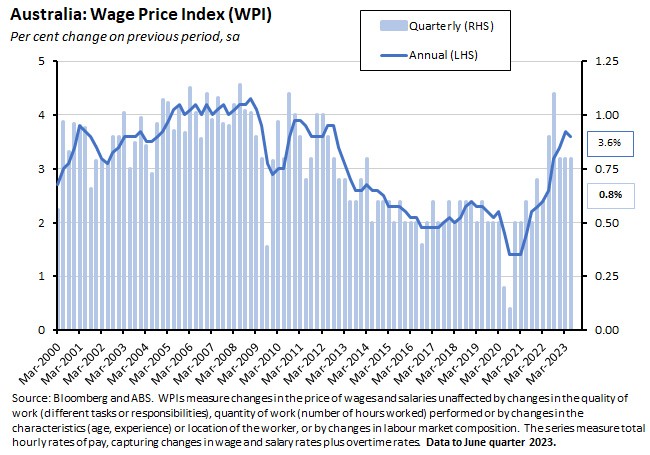

What about wages? While the June quarter 2023 wage price index (WPI) did report the quarterly momentum in wage growth as unchanged from the two preceding quarters, it also showed the annual rate of increase easing down to 3.6 per cent from 3.8 per cent in the March quarter. With last quarter’s WPI result also coming in below both the RBA’s August 2023 projection and the market’s median forecast and with wage growth continuing to have a ‘three’ in front of it, there was little in the Q2 WPI reading to sound the alarm for the RBA in terms of risks around mounting wage pressures.

Moreover, at 3.6 per cent, nominal WPI growth remains well below both the annual rate of increase in the CPI (six per cent) and in the employee Living Cost Index (9.6 per cent). As a result, real wages continued to go backwards, maintaining the cost-of-living squeeze on households. That in turn will keep downward pressure on household consumption, another variable that Martin Place is paying close attention to.

More detail on the individual releases follows below, along with the usual linkage roundup.

Employment fell and unemployment rose in July

Australia’s unemployment rate climbed to 3.7 per cent in July 2023 (seasonally adjusted) from 3.5 per cent in the previous month, as the number of unemployed people in the economy increased by 35,600. With the underemployment rate unchanged at 6.4 per cent, the underutilisation rate rose to 10.1 per cent from 9.9 per cent.

These results were notably weaker than market consensus forecasts, which had called for a 15,000 increase in employment and a more modest increase in the unemployment rate to 3.6 per cent.

Granted, in absolute terms, the labour market overall continues to look tight. The number of employed people was still up 398,900 (2.9 per cent) relative to the same month last year, while the number of unemployed workers is currently around 172,000 lower than before the pandemic. It is also worth noting that monthly hours worked rose over July, increasing by six million hours or 0.32 per cent, suggesting that the demand for labour is being met in part by increases in hours worked, with the ABS reporting that some of that increase reflected fewer people than usual taking time off during the school holidays.

So much for levels. But what about the direction of change? According to the latest download from the RBA minutes (see below), the central bank now reckons that Australia’s labour market might be at a turning point, with the lagged impact of monetary policy tightening beginning to appear in the numbers. July’s drop in employment and rise in the unemployment rate both look consistent with that interpretation.

Yes, the ABS did caution that ‘July includes the school holidays and we continue to see some changes around when people take their leave and start or leave a job. It’s important to consider this when looking at month-to-month changes, compared with the usual seasonal pattern. The only other fall in employment in 2023 was in April, which also included school holidays.’ It’s also true that the seasonally adjusted unemployment rate has been volatile this year. It has already hit 3.7 per cent in January and April this year, but on both those occasions it subsequently fell back to 3.5 per cent. So, we should be careful before reading too much into one month’s number. Still, on a trend basis, the unemployment rate has edged up from 3.5 per cent (August 2022- April 2023) to 3.6 per cent (May to July 2023), and other labour market indicators (such as vacancies and job ads) are also in line with the diagnosis of at least some labour market easing.

Wage growth eases in June quarter 2023

The ABS said the Wage Price Index (WPI) rose 0.8 per cent over the quarter in Q2:2023, to be up 3.6 per cent over the year. That was slightly weaker than the consensus forecast, which had anticipated quarterly growth of 0.9 per cent and annual growth of 3.7 per cent for the June quarter of this year.

The quarterly rate of WPI growth has now been unchanged for three consecutive quarters. However, the annual rate of increase in the WPI has eased from the March quarter 2023’s 3.8 per cent rate. At 3.6 per cent, it was also below RBA forecasts presented in the recently released August 2023 Statement on Monetary Policy, which in line with the median forecast had anticipated an annual rate of WPI growth of 3.7 per cent.

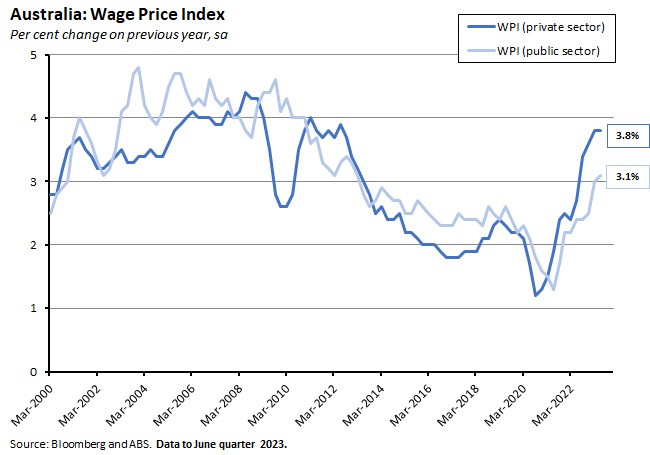

Looking at the detail, private sector wage growth last quarter was 3.7 per cent year-on-year, unchanged from the previous quarter and still running at its highest rate since the June quarter of 2012. The annual rate of growth of public sector wages rose to 3.1 per cent in the June quarter from three per cent in the March quarter, and now stands at its highest rate since the March quarter of 2013. The Bureau said this reflected a combination of Enterprise Agreement bargaining outcomes and regular scheduled increases.

Digging further into the dynamics of wage developments shows a mixed picture, with fewer jobs received wage increases last quarter, but the average size of wage increases being higher.

For example, the share of private sector jobs receiving a wage increase last quarter fell to 12 per cent, down from 14 per cent in the March quarter and 13 per cent in the corresponding June quarter in 2022. At the same time, the average hourly wage change was 4.5 per cent, up from 4.3 per cent in the previous quarter and higher than the 3.8 per cent average increase recorded in the June quarter 2022.

Similarly, across the public sector, the share of jobs receiving a wage increase was 15 per cent, compared to 38 per cent in the March quarter 2023 and 17 per cent in the June quarter 2022. The average wage increase was three per cent, unchanged from the March quarter but well up on the 2.4 per cent increase recorded in the corresponding quarter last year.

By industry, the construction sector (with quarterly wage growth of 1.3 per cent and annual wage growth of 3.9 per cent) and professional, scientific and technical services (quarterly growth of 0.7 per cent and annual growth of four per cent) were the key drivers of wage growth over the June quarter, while the Other services category recorded the lowest quarterly growth (just 0.3 per cent).

While headline numbers here are not indicating any onset of the dreaded wage-price spiral, it is worth recalling that it is next quarter’s WPI reading that will include the impact of the most recent Fair Work Commission (FWC)’s Annual Wage Review Decision on the National Minimum Wage (NMW) and minimum wage rates in Modern Awards, which increased NMW and modern award minimum wage rates by 5.75 per cent. The NMW only applies to about 0.7 per cent of Australian employees but minimum wage Modern Awards cover about 20.5 per cent of employees. However, since the modern-award reliant workforce tends to be dominated by casual and low paid workers, the FWC reckons the total wages cost of these decisions only constitutes about 11 per cent of the national wage bill, estimating that last year’s Wage Review directly contributed less than 10 per cent of total wage growth in 2022.

The Q3:2023 WPI reading will also reflect the government’s pledge to fund the FWC’s decision on the Aged Care Work Value case of a 15 per cent increase to award wages, which only came into effect from 30 June this year. The combined effect of these decisions is likely to see the pace of WPI growth pick up in the third quarter of this year, with the RBA predicting wage growth will run at 4.1 per cent by the final quarter of 2023.

Average weekly earnings rise 3.9 per cent over the year

Staying with wages, the ABS said average weekly ordinary time earnings for full-time adults was $1,838 in May this year, up 3.9 per cent or $68/week over the same month in 2022. According to the Bureau, aside from a brief spike in average earnings during the pandemic reflecting compositional effects, this was the strongest annual increase in average earnings seen since May 2013.

By sector, year-on-year growth in full-time adult average weekly ordinary time earnings was 4.1 per cent in the private sector and 3.3 per cent in the public sector. By industry, the ABS said the rise in earnings was driven by strong wage growth in the Education and training and Health care and social assistance industries. Noting that this translated into an increase in wages in female-dominated jobs such as teaching and nursing, the Bureau also commented that the gap in average weekly ordinary full-time earnings, the most commonly cited of the gender pay gap measures, fell to 13 per cent, the lowest level on record.

Average earnings for part-time employees were also up, rising 4.1 per cent over the year. All employee earnings rose 4.1 per cent, to a weekly rate of $1,399.10.

(Note that the difference between this measure of wage growth and the WPI is that the WPI is designed to measure only changes in the 'price’ of wages and salaries. In contrast, the average earnings measure also reflects changes in the quality and/or quantity of work performed and in the composition of the workforce – due for example to changes in the relative shares of full- and part-time workers or changes in the distribution of workers across industries.)

RBA Minutes explain case for extending monetary policy pause

The Minutes of the 1 August 2023 monetary policy meeting of the RBA Board delivered more detail on the central bank’s decision earlier this month to keep rates on hold for a second consecutive meeting. Much of the debate presented here will be familiar to readers by now:

- The case for a 25bp rate increase rested on the risk that inflation could prove to be more persistent than the RBA was forecasting, the observation that the RBA’s forecasts were already conditioned on a further increase in the cash rate, the fact that the cash rate was ‘notably lower’ than the policy rates in other countries, despite inflation in Australia ‘being at least as high’, and concerns that the resumption of house price increases ‘could be a signal that financial conditions were not as tight as they had assessed.’

- The case for a pause, on the other hand, relied on the point that policy had already been tightened significantly, that there were signs this tightening was working and that even though the full effects of higher rates were yet to be seen in the data, ‘consumption had already slowed significantly, there were early signs that the labour market might be at a turning point and inflation was heading in the right direction.’ As a result:

‘…members observed that there was a credible path back to the inflation target with the cash rate staying at its present level.’

As to future decisions on the cash rate target:

‘…members agreed that it was possible that some further tightening of monetary policy might be required to ensure that inflation returns to target in a reasonable timeframe. Whether or not a further increase in interest rates is required would depend on the data and the evolving assessment of risks…the Board will continue to pay close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.’

Other points of note from the Minutes:

- The outlook for China has been revised lower and is ‘subject to a high degree of uncertainty’ and ‘there could be spillover effects if the Chinese economy were to be weaker than forecast.’

- CPI inflation had eased by more than the RBA expected in the June quarter 2023, but inflation still remained high and broadly based; domestic costs pressures were expected to see persistent inflationary outcomes, especially for services; high population growth was adding demand to an already tight rental market; and wage growth was expected to pick up in the second half of this year due to a tight labour market, increases in award and minimum wages, and higher public sector wages.

- For expected wage growth to be consistent with the inflation target (as noted above, the RBA forecast has the rate of WPI increase peaking at 4.1 per cent in the December quarter of this year), labour productivity growth will need to return to its pre-pandemic trend over coming years.

- The RBA thinks there are ‘some signs that the labour market [is] at a turning point’ (the RBA forecast is for the unemployment rate to climb to 3.9 per cent by year-end and then keep rising to 4.5 per cent by mid-2025) and that the substantial rise in interest rates already delivered is now constraining consumer demand, including in the retail sector.

What else happened on the Australian data front this week?

- The ABS said that in 2022-23 there were 5,856,440 short-term visitor arrivals to Australia, nearly five times the number recorded in the previous year. New Zealand played a key role in the recovery, accounting for 18 per cent of all short-term visit arrivals. While numbers are rising, however, they are still not back at pre-pandemic levels. According to the Bureau, by June 2023 the volume of visitor arrivals had reached 82 per cent of pre-COVID levels, up from 56 per cent in January this year.

Other things to note . . .

- RBA Governor Lowe’s 16th and final opening statement to the House of Representatives Standing Committee on Economics declared ‘things are moving in the right direction’, citing falling inflation and strong employment growth as consistent with Australia still being on the ‘narrow path’ of returning inflation to target without a large rise in unemployment.

- The accompanying Hansard transcript contains a few points worth highlighting, including the observation that ‘persistence’ (of services price inflation) and ‘resilience’ (of labour markets) are the two words heard most frequently at international meetings of central bank governors. While a million borrowers have already transitioned to floating rates, there are ‘a million borrowers who are still to roll over from low fixed-rate loans to high variable rate loans’; productivity growth is ‘the No.1 medium-term economic issue’; one of the ‘disappointments’ that Lowe had with the RBA Review is that it didn’t explore the issue of monetary and fiscal policy working together in more detail; and – related – that it would be interesting to think about developing alternative institutional arrangements that would allow fiscal authorities to contribute more to managing inflation and the economic cycle.

- From the AFR, Steve Grenville on the role of micro-pricing and price discrimination in driving inflation. Against rent freezes.

- What unemployment rate is consistent with full employment? According to a recent survey of Australian economists, the median estimate is a four per cent unemployment rate, while the average is a 3.75 per cent rate. By way of comparison, the RBA reckons the NAIRU – the lowest unemployment rate that can be sustained without pushing up the rate of inflation – is around 4.5 per cent and Treasury puts it slightly lower at about 4.25 per cent.

- Chris Bowen’s speech to the Australian Business Economists this week discussed an assessment of the feasibility of an Australian Carbon Border Adjustment Mechanism, particularly in relation to steel and cement.

- On the limited effects of China’s Made in 2025 initiative: This research finds that although Beijing’s policy led to more innovation-promoting subsidies flowing to targeted firms and an increase in R&D intensity, there was little evidence of productivity improvements or increases in patenting or profitability.

- Three interesting pieces from the WSJ. First, this piece on the economic losers in the New World Order argues that huge subsidies from the US and EU are squeezing smaller countries such as the UK and Singapore (and Australia?) which lack the financial firepower to compete. Next, the Heard on the Street column considers the scary math behind the world’s safest assets, citing some problematic trends for US Treasuries, including a failure on the part of the US Treasury to extend debt maturities and lock in low borrowing costs, the CBO projection that US debt held by the public will exceed GDP this year, while interest on that debt will equal about 75 per cent of US discretionary, non-defence spending and Washington’s shrinking room for manoeuvre. Finally, a selection of charts depicting how the US and China are breaking up.

- Barry Eichengreen on Brexit.

- What if generative AI turned out to be a dud?

- Comparing the economic effects of the EU’s Emissions Trading System with national carbon taxes.

- The FT’s Unhedged Podcast on how bonds make and break nations. For the longer essay underpinning the discussion, see how bonds ate the entire financial system.

- Two from the Odd Lots podcasts. First, Ricardo Hausman explains economic complexity. The complexity index is an interesting topic, since every year its release prompts worried observations about Australia’s lowly ranking (currently 93 out of 133, just below Uganda (#92) and above Pakistan (#94)) which seems to jar with our high income per capita and strong performance on other international rankings. Second, a fun chat with Paul Krugman about Aliens and AI.

Latest news

Already a member?

Login to view this content