As 2023 draws to a close, it was another busy week on the Australian data front. Wednesday’s release of the Mid-Year Economic and Fiscal Outlook (MYEFO) brought positive news as higher company and personal income tax receipts allowed the Treasurer to announce that the budget bottom line is effectively in balance. Indeed, given the conservative nature of some of the key assumptions that continue to underpin the budget projections, a modest surplus for the 2023-24 year looks well within reach. Moreover, forecasts for debt and deficits are now lower for all four years across the forward estimates to 2026-27 relative to the numbers presented in Budget 2023-24. Granted, most of this fiscal repair is the product of so-called ‘parameter and other variations’ rather than the outcome of direct policy action.

Think larger tax receipts due to stronger commodity prices, more people in work and higher nominal growth than anticipated by Treasury earlier this year. But this still required Canberra to avoid the temptation of spending its taxation windfall. The fact that the Government has chosen to bank most of the savings will be welcomed at Martin Place, where the MYEFO is unlikely to sound any alarm bells. That still leaves the Government facing a potentially awkward budget trade-off next year, when it will likely have to balance louder calls for cost-of-living relief against the constraints imposed by a monetary policy that remains focused on above-target inflation.

Staying with monetary policy, last Friday brought a new Statement on the Conduct of Monetary Policy and an update to the ‘common understanding’ between the Reserve Bank Board and the Government on Australia’s monetary policy framework. The Statement introduced several changes recommended by the recent Review of the central bank, which will have implications for the conduct of monetary policy next year.

This week also delivered a new update on the health of the labour market. The messages were mixed. An increase in the unemployment rate to 3.9 per cent in November 2023 alongside rises in the underemployment and underutilisation rates, plus the absence of any meaningful growth in hours worked over the month, all point to a degree of labour market easing in the final quarter of this year. Yet at the same time, the economy added more than 61,000 jobs which was much more than market expectations, the participation rate set a new record high, and the employment to population ratio returned to its own previous record high. And all of that is indicative of the remarkable strength that the Australian labour market has continued to demonstrate since the pandemic.

As well as diving deeper into the above, we also dig into the latest readings on consumer and business confidence and review a range of other data releases.

Finally, my sincere appreciation for your readership this year, and for all the kind comments and helpful feedback. And thanks also to my colleagues who work hard each week at turning my drafts into published text. I wish you and yours a peaceful and restful holiday season.

December 2023 MYEFO reports $12.8 billion improvement to budget bottom line

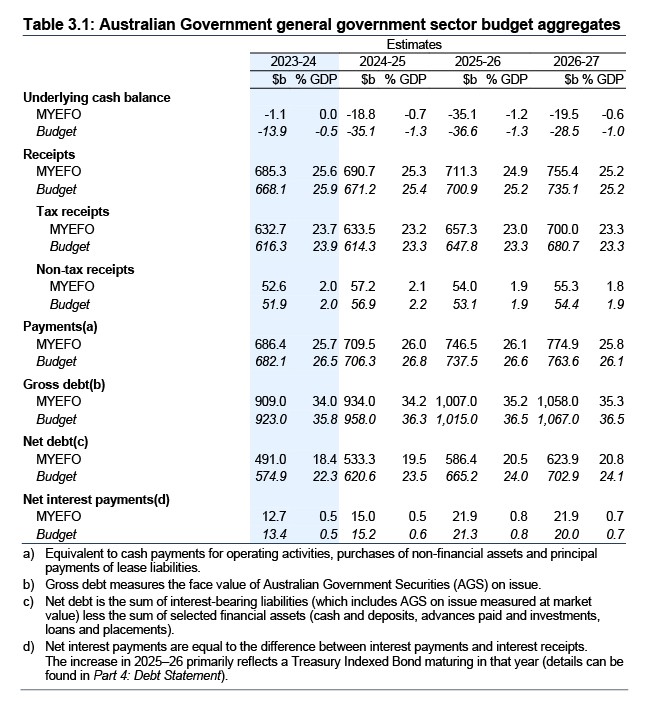

The Treasurer released the 2023-24 Mid-Year Economic and Fiscal Outlook (MYEFO) on 13 December 2023. The headline number was a forecast underlying cash deficit of just $1.1 billion for 2023-24, effectively a balanced budget at 0.0 per cent of GDP. That means the expected fiscal shortfall has been trimmed by a sizeable $12.8 billion from Budget 2023-24’s forecast (pdf) for a $13.9 billion (0.5 per cent of GDP) shortfall.

The outlook to 2026-27

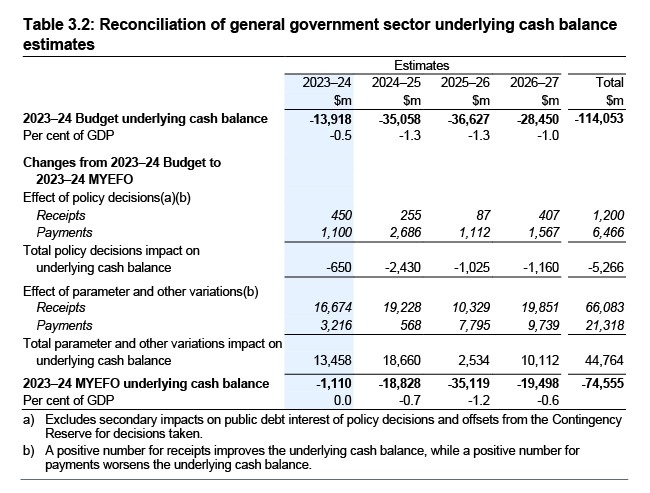

The 2023-24 MYEFO (pdf) shows that the anticipated improvements apply not just to 2023-24 but across the four years of the forward estimates. Over the period to 2026-27, the underlying cash balance is now expected to have improved by $39.5 billion, dropping from a cumulative $114.1 billion deficit in Budget 2023-24 to $74.6 billion in the December 2023 MYEFO.

Despite a smaller deficit in each year of the forward estimates in the MYEFO relative to the budget, however, the MYEFO still expects those deficits to rise over the next couple of years, reaching $35.1 billion in 2025-26 before falling back to $19.5 billion in 2026-27.

Smaller deficits mean lower financing needs and so gross debt as a share of GDP is also now forecast to be lower in each year of the forward estimates. By 2026-27 the gross debt to GDP ratio is projected to be 35.3 per cent, down 1.2 percentage points of GDP from the budget estimates. The net debt to GDP ratio in the same year is now expected to be just 20.8 per cent, which is 3.3 percentage points of GDP lower than the Budget 2023-24 numbers.

Lower projections for the debt stock mean that interest payments are lower than they otherwise would have been (by about $4.9 billion over the four years to 2026-27). But this effect is more than offset by the impact of higher bond yields, which means that total interest rates over the same period are now $4.8 billion higher than projected in Budget 2023-24. Under Treasury’s revised assumptions, the weighted average cost of borrowing over the forward estimates has risen to 4.7 per cent for the future issuance of Treasury Bonds, up from around 3.4 per cent in Budget 2023-24.

What drove the improvement in the fiscal bottom line?

Most of this fiscal turnaround reflects stronger-than-expected receipts in general and higher tax receipts in particular. Budget 2023-24 assumed that total receipts would be $668.1 billion in the current financial year, of which tax receipts would contribute $616.3 billion. Instead, according to the MYEYO total receipts will be $685.3 billion (an upgrade of $17.2 billion), largely reflecting an upward revision of $16.4 billion to tax receipts, which are now projected at $632.7 billion. Company tax receipts are now expected to be $9.2 billion higher than at the time of the Budget. That is mainly due to the boost to mining profits from much higher than forecast commodity prices (for example, the budget assumed that the iron ore price would fall to US$60/t vs current prices of more than US$130/t). At the same time, personal income tax receipts have been revised up by $9 billion (excluding policy decisions), reflecting a $5 billion lift to income tax withholding due to higher-than-expected employment and bracket creep and a $4 billion upward revision to other individuals’ receipts driven by strong capital gains and net rent from prior year returns.

Over the four years to 2026-27, tax receipts have been revised up by a cumulative $66.6 billion. Again, this is split relatively evenly between about $34.5 billion of increases to forecast company tax receipts (with upgrades to non-mining profits in line with higher nominal GDP projections also adding to receipts) and $30 billion of upgrades for personal income tax receipts. The Government says it is returning 92 per cent of these tax upgrades (excluding GST receipts) to the budget bottom line. And these increases in receipts are more than enough to offset some much smaller increases in forecast payments.

Recall that the budget numbers divide changes to public finances between changes due to ‘parameter and other variations’ and changes due to policy decisions. The former are largely outside the government’s direct control and reflect changes in the economic environment such as inflation, employment growth, or commodity prices. The latter reflect active decisions and policy choices that the government has made, for example around spending or changes to taxation arrangements. From the above discussion, it should be clear that parameter and other variations are doing most of the work here. For example, consider the $12.8 billion turnaround in the underlying cash deficit in 2023-24. Parameter and other variations work to reduce the deficit by $13.5 billion while net policy decisions increase it by $0.7 billion. Likewise, across the four years to 2026-27, parameter and other variations have increased receipts by $66.1 billion and payments by $21.3 billion for a net improvement in the budget bottom line of $44.8 billion. This is only partially offset by the impact of net policy decisions taken since the Budget, which are estimated to reduce the underlying cash balance by $5.3 billion over the four-year period (a $1.2 billion lift to receipts is more than offset by a $6.5 billion rise in payments). The net outcome of all this is the already-cited $39.5 billion turnaround in the budget position.

Still, it should be noted that the government did have to refrain from spending the windfall gains from these variations. And in that context, it has done a fairly good job in terms of fiscal restraint – no doubt encouraged by an awareness that any undue fiscal largesse would complicate the RBA’s fight against inflation and therefore risk summoning forth offsetting rate increases. Hence policy decisions only lifted payments by a slim $1.1 billion in the current financial year, with this partially offset by a $0.4 billion increase in receipts.

Changes to the medium-term fiscal outlook

According to the MYEFO, the medium-term fiscal outlook beyond 2026-27 is broadly unchanged since the budget. On the one hand, the return of (most of the) upgraded forecasts to tax receipts over the forward estimate lowers the projected level of debt. On the other hand, this improvement is largely offset by a combination of spending pressures and higher borrowing costs. For example, underlying cash deficits are now forecast to be slightly larger than the corresponding Budget 2023-24 projections for most years of the medium-term projections out to 2033-34. That in turn is driven by ongoing pressures across the same fast-growing major payments that were highlighted in the Budget. This is most obviously the case for growth in interest payments, which is now forecast to average 11.7 per cent over the 2023-24 to 2033-34 period despite a smaller debt stock. That is up from 8.8 per cent growth in Budget 2023-24 and is driven by higher bond yields. Elsewhere, there have been only relatively modest reductions in forecast spending trajectories. For example, growth in Commonwealth funded participant payments for the NDIS is now expected to average 10.1 per cent instead of 10.4 per cent, while growth in aged care payments is now expected to average 5.7 per cent instead of 6.1 per cent.

The net impact of these changes is that gross debt is now expected to peak at 35.4 per cent of GDP in 2027-28 and fall to 32.1 per cent by 2033-34. The gross debt to GDP ratio is now lower across the entire projection period to 2033-34 when compared to the numbers presented in Budget 2023-24.

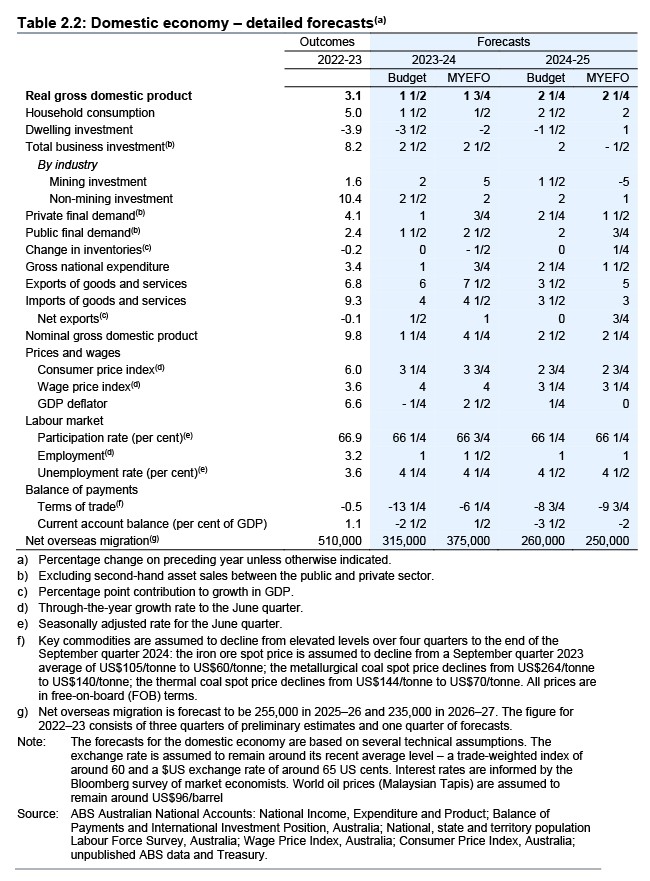

Changes to the economic outlook

The MYEFO makes only modest changes to the economic projections set out in Budget 2023-24. For example, forecast world real GDP growth for 2023 has been upgraded from 2.75 per cent to three per cent, the projection for 2024 is unchanged at three per cent, and the outlook for 2025 has been trimmed by a quarter percentage point to 3.25 per cent. Similarly, forecast major trading partner growth has been upgraded by a quarter percentage point to 3.5 per cent for this current calendar year but left unchanged at 3.25 per cent and 3.5 per cent respectively for the following two years.

Turning to the domestic economic outlook, the MYEFO sees forecast real GDP growth in 2023-24 edge higher from 1.5 per cent to 1.75 per cent (although within the GDP numbers, note that the estimated growth in household consumption is now much weaker for this year, offset by stronger public demand) while it leaves projected growth unchanged at 2.25 per cent for 2024-25. The inflation forecast for 2023-24 has been raised from 3.25 per cent to 3.75 per cent but again, the 2024-25 forecast of 2.5 per cent is unchanged. There are also no changes to forecast unemployment rates of 4.25 per cent and 4.5 per cent for 2023-24 and 2024-25 and no changes to forecast wage growth. The numbers for net migration have been adjusted up for 2023-24 (from 315,000 to 375,000) and down for the following year (from 260,000 to 250,000). One large change – and one of the key parameter variations discussed above – is that growth in nominal GDP this year is now expected to be 4.25 per cent, which is much stronger than the Budget’s forecast for 1.25 per cent growth. But next year expected nominal GDP growth has been scaled back by one quarter of a percentage point to 2.25 per cent.

The MYEFO also retains the Budget’s conservative forecasts for commodity prices. The iron ore price is still expected to fall to US$60/t, for example. That allows scope for further upside revenue surprises that could take the budget from balance and into surplus by the end of the financial year.

Unemployment rate rises to 3.9 per cent in November 2023

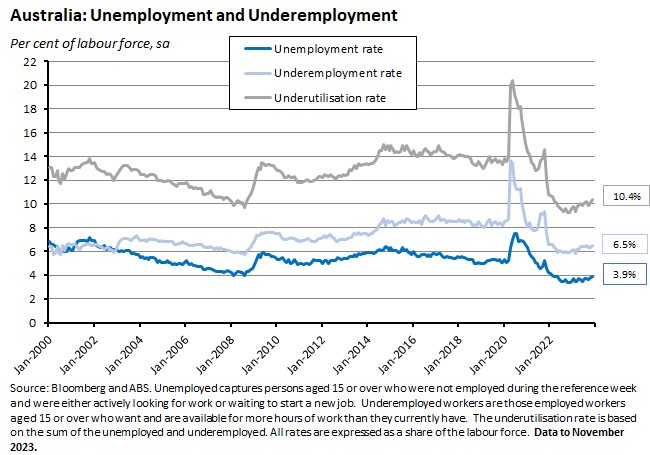

The ABS said that Australia’s unemployment rate rose by 0.1 percentage points to 3.9 per cent in November 2023 (seasonally adjusted), up from 3.8 per cent in October, noting that October’s result has been revised up from the previous estimate of 3.7 per cent. The market’s median forecast had anticipated a 3.8 per cent unemployment rate. The number of unemployed people rose by 18,800 to 572,000.

The underemployment rate rose by 0.2 percentage points to 6.5 per cent, taking the overall underutilisation rate up from 10.1 per cent in October to 10.4 per cent in November.

At the same time, employment surged by 61,500 in November in a result that was much stronger than the market consensus forecast of an 11,500 gain. Full-time employment rose by 57,000 and part-time employment was up by 4,500, taking total employment up to 14,257,500 people.

Monthly hours worked in November were up just one million over the month, leaving them basically flat in per cent terms. This slowdown in the rate of growth of hours worked is consistent with the rise in the underemployment rate noted above.

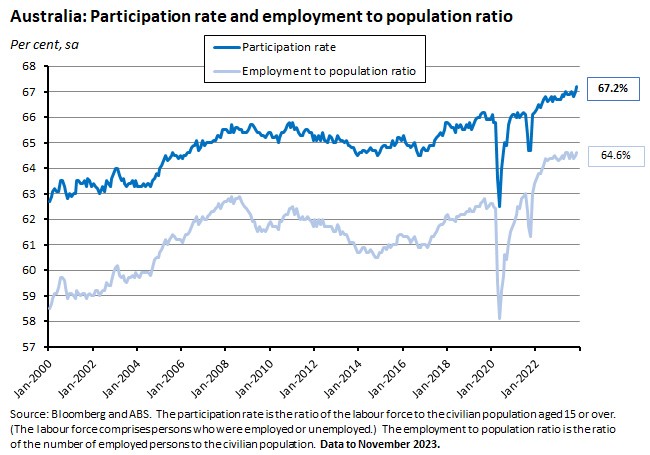

The combination of a strong increase in employment and a rise in unemployment reflected another increase in the participation rate, which rose 0.2 percentage points to 67.2 per cent, setting a new record high. The employment to population ratio also rose to 64.6 per cent from 64.5 per cent in October, returning to the record high it set earlier this year.

The November Labour Force release sent mixed messages on the health of Australia’s labour market. On the one hand, there were clear signs of further labour market easing in the data as a second consecutive monthly rise took the unemployment rate up to its highest rate since May 2022. Similarly, the overall underutilisation rate has climbed to its highest level since February 2022. And growth in hours worked has also slowed. On the other hand, relative to the pre-pandemic labour market, conditions remain tight. By way of comparison, at the end of 2019 the unemployment rate was 5.1 per cent and the underutilisation rate was 13.3 per cent, for example. Moreover, employment growth remains strong in the face of robust growth in the working age population and both the participation rate and the employment to population ratio currently stand at record highs.

Modest falls in WFH, vacancy and multiple job holding rates and in casual employment share

According to the latest Characteristics of Employment, in August 2023 median employee earnings were $1,300 per week, up $52 or 4.2 per cent from August 2022. Median weekly full-time earnings were around $1,600, up from $1,500 in the same month last year – a $100 or 6.7 per cent rise.

In the same month, the share of employed people working from home on a regular basis was 37 per cent, down from a high of around 40 per cent in 2021 but five percentage points above its pre-pandemic level.

The share of casual employees was around 22.4 per cent of total employees in August 2023, down from 23.7 per cent in the same month last year, and down from 24.1 per cent in February 2020. The Bureau said this shift reflects much stronger growth in non-casual employment in recent years, in addition to the impact of the pandemic.

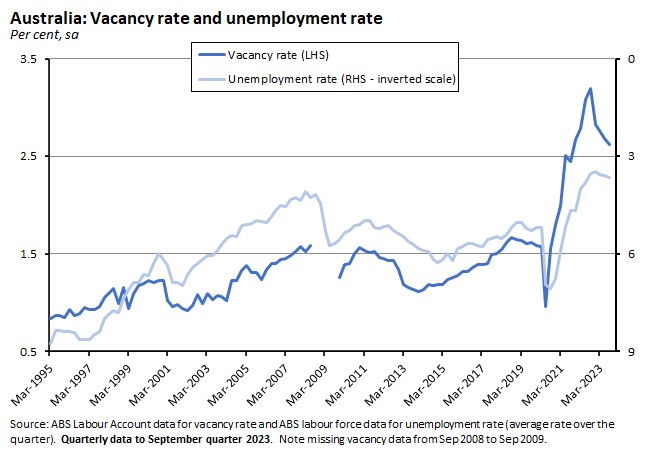

Last Friday’s release of the September quarter 2023 Labour Account data showed further signs of modest labour market easing. For example, hours worked fell by 0.7 per cent over the quarter to 5,879 million hours. That was the first decline since the September quarter 2021, although in annual terms hours worked were still up a very strong 4.2 per cent. Growth in the number of filled jobs was 0.8 per cent over the quarter, down from the 1.1 per cent growth over the previous quarter. And the number of job vacancies fell for a fourth consecutive quarter and were down 15.6 per cent over the year. As a result, the share of vacant jobs eased to 2.6 per cent from 2.7 per cent in the June quarter. The vacancy rate is now down noticeably from its September 2022 peak of 3.2 per cent.

That said, the Bureau also pointed out that vacancies remained an impressive 85 per cent higher than their pre-pandemic level while the vacancy rate is still comfortably above the 1.6 per cent rate recorded in the December quarter 2019.

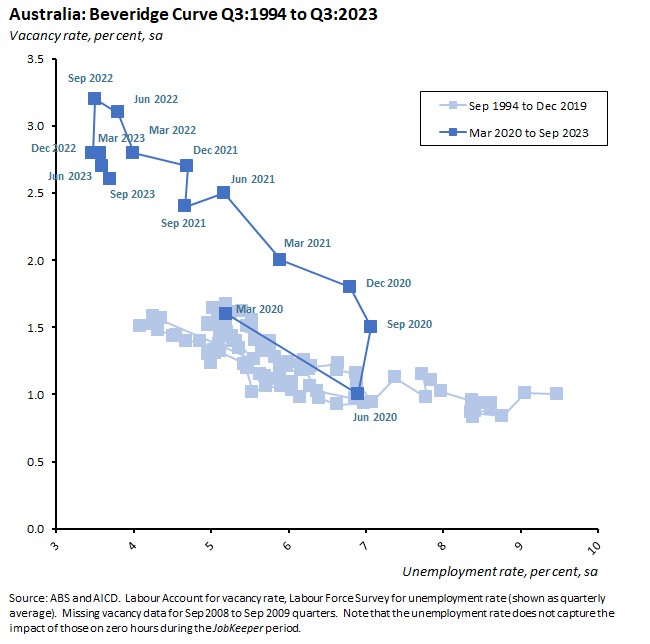

The new Labour Account numbers imply that the Beveridge Curve (the relationship between the unemployment rate and the vacancy rate) continued to shift inwards in the third quarter of this year, as vacancy rates declined faster than the rise in unemployment.

Accompanying the Labour Account numbers, the latest ABS data on multiple job holding said that in September 2023 there were 955,600 multiple job-holders, or about 6.6 per cent of all employed people. That share was slightly down from the series high of 6.7 per cent recorded in the June quarter of this year. Between 1994 and 2019, the rate of multiple job holding ranged between five and six per cent, but this relative stability then ended with the pandemic. Initially, there was a large decline, with the rate slumping from six per cent in the March quarter of 2020 to a low of 5.1 per cent in the June quarter of the same year. Since then, however, the rate has climbed to have been above since six per cent since the December quarter 2021.

New Statement on Conduct of Monetary Policy

On Friday, 8 December 2023, the government published an updated Statement on the Conduct of Monetary Policy. The Statement ‘records the common understanding of the Reserve Bank Board and the Government on key aspects of Australia’s monetary and central banking policy framework.’ The updated version also reflects some of the recommendations from the recent Review of the Reserve Bank.

The Statement was last refreshed in September 2016 and the new Statement is about 700 words longer than its predecessor, largely reflecting the impact of the Review and the government’s response. Some points of note:

- In line with Review’s recommendations on clarifying the RBA’s statutory monetary policy objectives, instead of including ‘the economic prosperity and welfare of the people of Australia’ as one of three goals of monetary policy along with the stability of the currency and the maintenance of full employment, the new Statement says this will now be ‘an overarching objective for monetary policy’ and that the RBA can ‘best fulfil this mandate by conducting monetary policy in a way that will best contribute to both price stability and full employment.’ (Note that another Review-recommended change here is the switch from the phrase ‘stability of the currency’ to ‘price stability.’)

- There have been some adjustments to the Board appointment process. The 2016 Statement said that ‘New appointments to the Reserve Bank Board will be made by the Treasurer from a register of eminent candidates of the highest integrity maintained by the Secretary to the Treasury and the Governor.’ The 2023 version tweaks the process, explaining that ‘New appointments of external members to the Reserve Bank Board will be made by the Treasurer from a shortlist of candidates. A panel comprising the Secretary to the Treasury, the Reserve Bank Governor and an independent third party will compile the shortlist through a process that is transparent and focused on ensuring the Reserve Bank Board has the right balance of skills and experience to best discharge its functions. To support this, the Government commits to maintaining and publishing a skills matrix for the Reserve Bank Board on the advice of the Secretary, Governor and Reserve Bank Board.’

- The 2023 Statement reaffirms the flexible inflation target as the appropriate framework for achieving price stability. But where the 2016 Statement noted only that ‘an appropriate goal is to keep consumer price inflation between two and three per cent, on average, over time’ the new version adjusts and expands on this in several ways. For example, it drops the qualifier ‘on average, over time’ in line with the Review’s recommendation, which had argued that the inclusion of this qualifier made it harder to say whether the target was being met, so limiting accountability. It also adds that ‘The Reserve Bank Board sets monetary policy such that inflation is expected to return to the midpoint of the target’ which is in line with the Review’s argument that aiming at the midpoint would maximise the chance that the target would be met and therefore best anchor inflation expectations. And later the Statement says that ‘when inflation is expected to be significantly away from the midpoint of its target of between two and three per cent or labour market conditions are expected to deviate significantly from those consistent with full employment, the Board commits to communicating how long it expects it will be before it again meets each of its objectives and why.’ With the RBA in the past having noted the benefits to flexibility accruing from the previous approach, some of these adjustments could be seen as trading off flexibility for increased accountability.

- One somewhat controversial recommendation from the Review was that in the operation of the flexible inflation targeting regime, ‘Equal consideration should be given to price stability and full employment.’ The new statement does not go this far, saying instead that policy decisions should ‘where necessary, balance the price stability and full employment objectives of monetary policy.’ The Statement does say that the RBA’s role is ‘to focus on achieving sustained full employment’ which it defines as ‘the current maximum level of employment that is consistent with low and stable inflation.’ And the Statement also adopts another Review proposal, stating that ‘The Reserve Bank Board commits to regularly communicating its assessment of how conditions in the labour market stand relative to sustained full employment, drawing on a range of indicators and recognising that full employment is not directly measurable and changes over time.’

- In terms of meeting the Review’s recommendations on transparency and accountability, the Statement now says that (in addition to the 2016 requirements to announce and explain decisions, release minutes, and provide commentary and analysis on the economic outlook) the ‘RBA Governor will hold media conferences after each Board meeting.’ Moreover, ‘Once the new Monetary Policy Board is operational it will publish an unattributed record of votes and will publish Board papers after five years. Members will conduct at least one speech or public engagement each year.’

- In response to the Review’s discussion and recommendations around the use of unconventional monetary policy tools, the Statement now says that while ‘The Reserve Bank Board’s primary approach to implementing monetary policy will be through varying the level of the cash rate target…there may be circumstances under which other monetary tools may help to achieve the Board’s objectives for monetary policy…the Board should use its judgement to determine what these tools are, when they are needed and how they are to be deployed most effectively. The Reserve Bank Board will communicate a framework to guide the use of additional monetary tools, including the benefits, costs and risks associated with available tools…The framework will also detail the decision-making approach that the Board intends to adopt when it believes that there may be a need to use or discontinue alternative monetary tools…In addition, the framework will set out considerations at the outset about how these additional tools might be exited under different scenarios.’

- Finally, the Statement acknowledges the Review-inspired changes to the RBA’s governance framework, including the division of responsibilities between the new Monetary Policy Board (comprising the Governor, Deputy Governor, Secretary to the Treasury, and six external members) and the new Governance Board (comprising the Governor, Deputy Governor, Chief Operating Officer, and six external members). The first will take responsibility for monetary policy and the RBA’s role in preserving financial system stability while the second will be responsible for oversight of the management and organisational affairs of the RBA.

What else happened on the Australian data front this week?

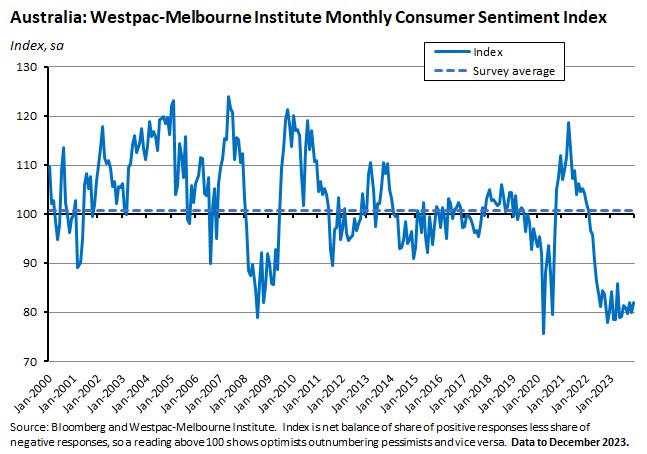

The Westpac-Melbourne Institute Index of Consumer Sentiment (pdf) rose 2.7 per cent over the month to an index reading of 82.1 in December 2023, up from 79.9 in November. Across the subindices, ‘finances vs a year ago’ rose 5.9 per cent over the month (but at 68.2 was still more than 30 points below a neutral reading of 100) while ‘finances next 12 months’ rose 3.9 per cent to 90.4. The ‘economic outlook, next 12 months’ subindex fell 2.2 per cent to 78.7 but the ‘economic outlook, next five years’ rose by 9.7 per cent to 94.9, recording a strong recovery from November’s 12-month low. Westpac pointed to a lift sentiment from the RBA’s decision to leave the cash rate target unchanged at its 5 December 2023 meeting, noting that while the average confidence index for those surveyed before the meeting was just 79.1, that rose to 83.4 across those surveyed after. The importance of the interest rate effect was also visible in the ‘finances next 12 months’ subindex, which jumped by nearly 10 per cent for consumers with a mortgage in December, after having slumped by more than 15 per cent in November following the RBA’s rate hike last month. Despite the modest uptick in December, however, Westpac noted that 2023 still marked the second worst calendar year for household sentiment in the history of the series back to 1974.

Meanwhile, the Westpac-Melbourne Institute Unemployment Expectations index eased 1.2 per cent to an index reading of 128.9 in December, indicating that slightly more households now expect the unemployment rate to fall over the year ahead than was the case in November.

The ANZ Roy Morgan Consumer Confidence Index rose 4.4 points to an index reading of 80.8 in the week ending 10 December 2023. All the subindices rose over the week, led by a nine-point jump in ‘current financial conditions’ and a 5.4 point rise in ‘future economic conditions’. Confidence is now at its highest level since February 2023, albeit still low in absolute terms. As with the monthly Westpac-Melbourne Institute Sentiment series, the uptick in the weekly confidence measure in part reflects the RBA’s decision to leave the cash rate on hold last week, with ANZ reporting stronger confidence among homeowners (both those with mortgages and outright owners). It might also have been helped by a drop in weekly inflation expectations, which fell 0.6 percentage points to five per cent, which is the second-lowest reading in six months.

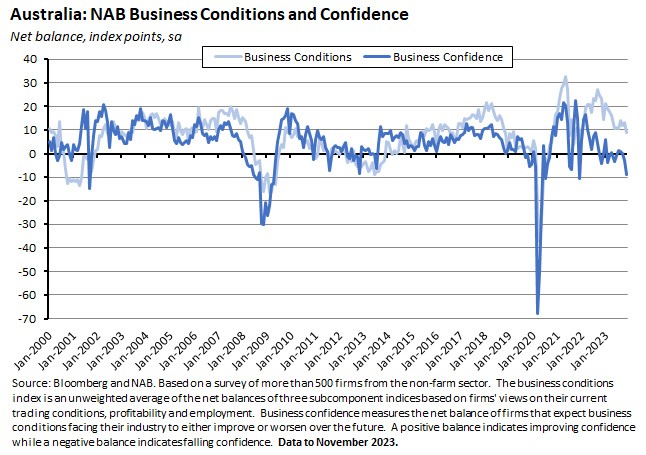

According to the November 2023 NAB Monthly Business Survey both activity and the business outlook weakened last month following the RBA’s delivery of the 13th rate increase in the current tightening cycle. Business conditions fell four points from an index reading of +13 to an index reading of +9 points. That sent conditions down to their lowest level since early 2022, although they remained above average. By component, trading fell six points to +13, profitability also fell six points to +6, and employment was unchanged at +8 index points.

Business confidence fell six points over November to take the index down to -9 index points. Business confidence is now at its lowest level since 2012 (excluding the COVID-19 period). Forward orders fell three points to -4 index points and the capacity utilisation rate edged down to a still high 83.9 per cent.

NAB said that the declines in conditions and confidence last month, along with the softening in forward orders, were together consistent with another soft period of activity in the final quarter of this year, following on from the subdued readings on Q3:2023 GDP. NAB also commented that the gap between conditions and confidence continued to be unusually large – a feature of the survey since the second quarter of 2022. It noted that the movements in confidence over the past year or so have been broadly correlated with movements in official interest rates and changes in interest rate expectations: so confidence started to fall as the RBA began to lift rates in Q2:2022, then fell to below average as the RBA continued to hike through late 2022 and into 2023. Most recently, confidence has fallen again in anticipation of and then following the November 2023 rate hike.

At the same time, NAB also reported that price and cost growth accelerated over the month. Labour cost growth rose from two per cent in October to 2.2 per cent in November (quarterly equivalent terms) while growth in purchase costs jumped from 1.9 per cent to 2.5 per cent. Final product price growth rose from one per cent to 1.2 per cent and retail price growth increased from 1.8 per cent to 1.9 per cent.

The ABS Monthly Business Turnover Indicator for October 2023 reported falls over the month in seven of the 13 published industries, led by a six per cent drop in Arts and recreation services, a 3.6 per cent decline in Administrative and support services, and a two per cent fall for Electricity, gas, water and waste services, with the Bureau highlighting the fact of monthly falls across industries reliant on consumer spending. The largest monthly rises were for mining (up 1.7 per cent) and professional, scientific, and technical services (up 1.6 per cent). On an annual basis, there were only falls in five of the 13 published industries. The biggest year-on-year falls in turnover were in mining (down 14.3 per cent due to lower commodity prices) and in Electricity, gas, water and waste services (down 7.3 per cent) while the biggest rises were recorded in Construction (up 16.4 per cent) and Other services (up 9.9 per cent).

The ABS said that Overseas Arrivals and Departures data for October 2023 showed that short-term visitor arrivals were 607,930 (up 177,460 trips on the same month last year) while total arrivals were 1,742,840 (an annual increase of 529,990).

Updated ABS estimates of Industry Multifactor Productivity (MFP) showed that in 2022-23 on an hours worked basis, market sector MFP fell 0.5 per cent – only the second fall in annual MFP since 2011-12. Market sector gross value added (GVA) rose 3.8 per cent (the second largest increase since 2012-13) while capital services grew 1.6 per cent and hours worked rose 6.9 per cent, contributing to combined growth in capital and labour inputs of 4.3 per cent. Market sector labour productivity fell 2.9 per cent as hours worked outpaced the rise in GVA. That was the biggest fall in the history of the series. See also this new ABS article on interpreting productivity statistics.

Australia’s population was 26,638,544 people as of 30 June 2023. That was up 2.4 per cent or 624,100 people over the year. That is the highest annual growth rate recorded in the series history back to the June quarter 1981. According to the ABS, of that annual increase, net overseas migration contributed 518,100 and natural increase contributed 106,100.

The ABS reported that there were 67 industrial disputes in the September quarter 2023, involving 18,800 employees with 37,100 lost working days. Over the year ended September 2023, there were 211 disputes and 76,100 lost working days. That compares to 182 disputes and 244,200 days lost in the year to September 2022.

Australia’s trade balance on goods and services was a surplus of $158.9 billion in the 2022-23 financial year. Total goods services exports were up 15.8 per cent or $93.7 billion to $686 billion while imports of goods and services rose 18.4 per cent or almost $82 billion to $527.2 billion. This ABS release contains detailed financial year data on Australia’s trading partners and on trade in services.

Other things to note . . .

- The December quarter 2023 Quarterly Statement by the Council of Financial Regulators reported that the Council had discussed the resilience of the financial system ‘to threats such as cyber-attacks, geopolitical tensions or climate change.’ The statement also noted that the ‘high level of household leverage was also identified as having the potential to pose risks to the financial system and economy. Budget pressures were being widely felt across households due to high inflation and increased interest rates, and the share of borrowers falling behind on mortgage payments had risen. However, the uptick in loan arrears was occurring from very low levels.’

- Related, a speech from the Andrea Brischetto, RBA Head of Financial Stability, on Financial Stability and the Financial Health of Australian Mortgagors. According to Brischetto, while budget pressures are being felt ‘very broadly’ across Australian households, ‘to date most households have managed to adjust to these pressures.’ Some of that adjustment has been through increased working hours or switching to a higher-paid job. Some has been through paring back consumption. And some has been through reductions in savings. That adjustment means that, to date, the pressure on household budgets has not produced a sharp increase in financial stress. For example, close to 99 per cent of personal and housing loans remain on or ahead of schedule. And the RBA estimates ‘that less than two per cent of variable-rate owner-occupier borrowers are currently at real risk of not being able to cover their basic expenses and mortgage payments out of their current income and don’t have significant savings buffers to fall back on.’ It also reckons that even ‘if the unemployment rate were to increase by two percentage points (around three to four times as sharply as projected in the November 2023 Statement on Monetary Policy), the share of borrowers at risk of running out of savings buffers over the next year or so would likely remain at low single-digit levels.’ Finally, ‘much less than one per cent of loans are estimated to currently be in negative equity.’

- A speech from RBA Governor Michele Bullock on Modernising Australia’s Payments System.

- Also from the RBA, a new Research Discussion Paper on monetary policy and non-mining business investment. The authors use firm-level data to find evidence that contractionary monetary policy (increases in interest rates) leads to lower investment, both by reducing the number of firms investing and by reducing the amount of investment done by those that do invest. Unsurprisingly, firms that are financially constrained or more dependent on external financing are more sensitive to changes in monetary policy, which suggests that a key policy channel is firms’ access to finance. Interestingly, the authors do not find evidence to support the argument that expansionary monetary policy disproportionately supports ‘leader’ firms and thereby reduces competition.

- The Australian Government’s new Migration Strategy. Changes include a new Skills in Demand visa with three targeted pathways, promises of streamlined labour market testing and visa processing, new visa settings to increase migrant worker mobility, simplification of the migration system via reducing visa classes, and a package of ‘integrity measures to lift the standards for international students and education providers’ including through higher English language requirements, more scrutiny of ‘high-risk student visa applications’ and restrictions on ‘onshore visa hopping’.

- The government has announced that it will introduce increases for foreign investment fees for housing, including a tripling of fees for the purchase of established homes and a doubling of vacancy fees for all foreign-owned dwellings purchased since 9 May 2017. It also promised to ensure that foreign investment application fees for Build to Rent projects are kept at the lowest commercial level, regardless of land type.

- ABC Business on the debate over net migration. Rachel Stevens assesses the government’s new migration plans. And more commentary from Michelle Grattan.

- The AFR looks back at the floating of the Australian dollar.

- A new Productivity Commission research paper on the growth of industry levies (narrowly defined, sector-specific taxes) in Australia. The paper finds that the number of levies has grown from 26 to 248 since 1980 and argues that this is leading to ‘an increasingly complex and inefficient tax system that risks limiting productivity growth.’

- Two new IMF working papers, one looking at the relationship between climate change and migration, and one looking at housing wealth effects and consumption in Europe.

- For Carnegie, Robert Green reviews the de-dollarisation efforts of the BRICS.

- The OECD on the PISA 2022 results, which reported an ‘unprecedented performance drop’ between 2018 and 2022, with record falls in the average performance in mathematics and reading across OECD countries (although science performance did not change significantly). The OECD said the sharp drop in performance was only partly attributable to the COVID-19 pandemic, noting for example that falling maths scores were already apparent before 2018. Interestingly, the Australia country note reports that average 2022 results were about the same as in 2018 for mathematics, reading and science.

- On reinterpreting the Beveridge Curve.

- How Mexico became a key player in the US-China trade war.

- The EIA on Red Sea choke points and international oil and gas flows. Total oil shipments via the Suez Canal, the SUMED pipeline and the Bab el-Mandeb Strait accounted for about 12 per cent of all seaborne traded oil in the first half of this year, while LNG shipments though these strategic routes accounted for about eight per cent of world LNG trade.

- Related, the FT on the twin canal crises and the threat to global trade flows. A drought in the Panama Canal has prompted authorities to reduce the number of crossings (this October was reportedly the driest in the region since at least 1950, partly due to the El Nino) and a spate of attacks on cargo vessels by Yemen-based Houthis is posing a threat to some Suez traffic.

- Also from the FT, Andy Haldane analyses the time-consistency problem facing central banks as they try to convince financial markets that monetary policy will remain tighter for longer even as the balance of risks is tilting from inflation to growth.

- The Editor’s Introduction to the IISS Armed Conflict Survey 2023 reckons the survey captures ‘a world dominated by increasingly intractable conflicts and armed violence amid a proliferation of actors, complex and overlapping motives, global influences and accelerating climate change.’ The intensity of conflict has risen over the past year, with the number of fatalities up 14 per cent and the number of events up 28 per cent, pointing to ‘an increasingly problematic situation in many parts of the world in terms of humanitarian, stabilisation and reconstruction needs.’

- The Economist Magazine selects its best books of 2023.

- The These Times podcast on Ukraine’s Dark Winter Ahead.

- The Past, Present, Future podcast on building sustainability. (The free online version of the Dieter Helm book referenced can be found here although I haven’t read it).

Latest news

Already a member?

Login to view this content