This was a very light week for Australian data, with only one notable release – the Flash Estimates for the November PMIs. Still, those numbers did offer some insight on two of the key macro issues currently facing the domestic economy – the degree of inflationary pressure and the toll that the RBA’s consequent monetary policy tightening is taking on activity. On the former, survey respondents continued to report rising price pressures, with both input costs and output prices climbing at faster rates this month. On the latter, the PMI showed private sector business activity contracting for a second consecutive month, pulled down by the services sector, which reported weaker demand and falling confidence.

International attention earlier this week was focused on outcomes of the COP27 climate summit. Optimists focussed on what they said was an historic agreement to establish a ‘loss and damage’ fund to assist developing countries that suffer from extreme weather events. Poor and vulnerable countries have been seeking this for decades in the face of consistent rich-country opposition, and although nearly all important details are yet to be worked out, just reaching an agreement in principle has been declared a noteworthy achievement. Pessimists, however, have tended to focus on the fact that, at least with regard to climate change mitigation, COP27 was largely a re-run of COP26 in that it too has failed to set the world on an emissions path consistent with the Paris Agreement’s ambition to limit global warming to 1.5 degrees Celsius.

This week also saw the publication of Australia’s latest State of the Climate Report from the CSIRO and the Bureau of Meteorology. It said changes in weather and climate extremes, including extreme heat events, heavy rainfall, coastal inundation, fire seasons and drought were now happening at an increased rate and having a growing impact on the lives and livelihoods of all Australians. The report also projects future increases in the number of short-duration heavy rainfall events, in the number of dangerous fire days, and in the overall risk of natural disasters from extreme weather, including ‘compounding extremes’, where multiple extreme events occur together or in sequence.

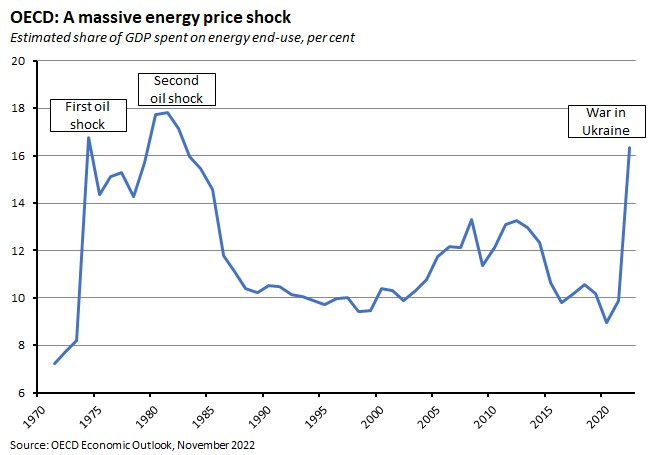

COP27 took place in the context of a world economy that is suffering from a massive energy price shock. Not only did that backdrop appear to empower some large energy producers to push back against efforts at the Sharm El-Sheikh summit to target fossil fuels and to seek steeper cuts in emissions, but it also continues to overshadow near-term global economic prospects. The latest OECD Economic Outlook, published this week, reminded its readers that over the past half century all OECD-wide recessions (with the exception of the pandemic-driven downturn in 2020) occurred when the ratio of energy expenditures to GDP were both high (13 per cent or above) and rising. This year has already seen an increase in energy expenditures of 7.75 percentage points of GDP, taking the ratio of energy expenditure to GDP up to more than 16 per cent. The scale of this increase is similar in magnitude to the first OPEC oil shock of 1974, which saw the same ratio rise by nearly 8.5 percentage points in one year, taking it close to 17 per cent. (The second OPEC oil shock in 1979 saw a further increase in energy expenditures to GDP of 3.5 percentage points over two years and pushed the ratio to nearly 18 per cent.)

The OECD notes that although the energy ratio may have returned to 1970s-like levels this year, this time does look different. The two 1970s energy shocks were both driven mostly by spending on oil (in the 1974 case, of that 8.5 percentage points rise in the energy ratio, oil accounted for more than 6.5 percentage points) and in both cases the economic impact was spread across most of the OECD. This time, the rise in energy costs is more broad-based, with large increases in the cost of gas, electricity and coal as well as oil. And the economic fallout in 2022 is heavily concentrated in Europe, while some OECD members (including the United States and Australia) are net exporters of gas and therefore are currently enjoying a lift to their terms of trade. Despite those caveats, however, the OECD’s key message was that this year’s very rapid rise in energy expenditures was ‘a warning signal about the near-term risk of widespread recessions among OECD economies’.

Contraction in Australian private sector activity accelerates in November

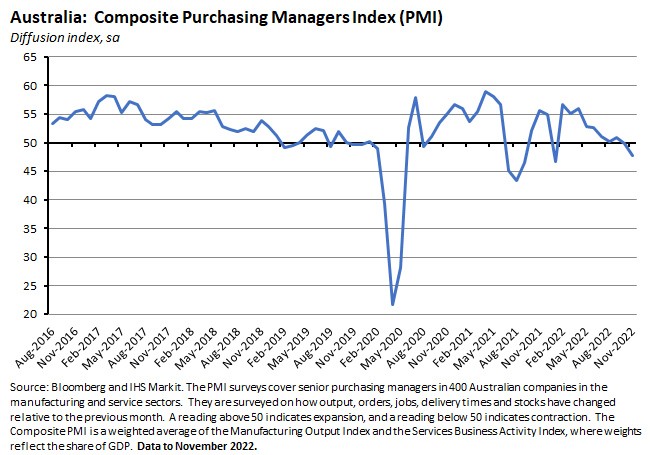

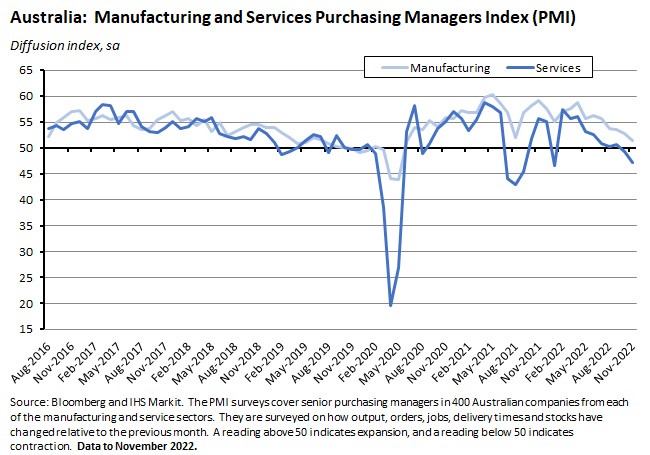

The S&P Global Flash Australia Composite PMI fell to 47.7 in November from 49.8 in October, taking the index down to a 10-month low. This was a second consecutive monthly fall and saw the PMI move deeper into negative territory, signalling that the pace of decline in private sector output has accelerated this month. Overall optimism among survey respondents slipped to a 31-month low.

As was the case last month, the overall decline in activity was driven by services. The Flash Australia Services PMI fell to 47.2 in November from 49.3 in October, again indicating a second consecutive month of contraction. According to S&P, demand for Australian services was pulled down by a combination of worsening domestic economic conditions amid tighter monetary policy along with cooling foreign demand.

In contrast, the Flash Australia Manufacturing PMI remained in positive territory for a 30th successive month, indicating ongoing expansion, although at a reading of 51.5 that index was at its lowest since June 2020.

Meanwhile, overall inflationary pressures worsened in November, with both input costs and output prices rising at faster rates. According to the survey provider, respondents cited higher shipping, raw material and employment costs as all contributing to higher prices, with firms willing to pass on these cost increases to their clients.

COP27 delivers new ‘loss and damage fund’ but no further emissions reductions

The 27th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP27) was held in Sharm El-Sheikh, Egypt this month, running from 6 November to a later than scheduled finish on 20 November. Last year, COP26 had disappointed in failing to deliver enhanced commitments to reduce greenhouse gas (GHG) emissions to levels compatible with the aim of limiting global warming to well below two degrees Celsius (2C) and preferably to 1.5 degrees Celsius (1.5C) compared to pre-industrial levels, in line with the 2015 Paris Agreement. Last year’s meeting in Glasgow had only managed to ‘keep 1.5 degrees alive’ by requesting that countries ‘revisit and strengthen’ their 2030 emissions targets in order to align with the 2015 Paris Agreement goals and do so by the end of this year. But COP27 has also disappointed on emissions targets, which remain inconsistent with Paris. Instead, optimists chose to focus on the one big announcement that the meeting did generate – a breakthrough agreement on a new ‘loss and damage’ fund for vulnerable countries.

To provide some context for this, readers may recall that the United Nations Framework Convention on Climate Change (the UNFCCC) is a product of the 1992 ‘Rio Earth Summit’ and entered into force on 21 March 1994. The 197 countries, including the EU, which ratified the UNFCCC are called Parties to the Convention and there has been a conference of the parties (COP) every year since 1995 until 2020 when the conference – COP26 – was postponed due to COVID-19 and pushed back to 2021. The UNFCCC aimed to stabilise GHG concentrations ‘at a level that would prevent dangerous anthropogenic (human induced) interference with the climate system’.

COP3 operationalised the UNFCCC in the form of the Kyoto Protocol which was adopted on 11 December 1997 and which entered into force on 16 February 2005. In December 2009, COP15 produced the Copenhagen Accord, which included the long-term goal of limiting the maximum global average temperature increase. Copenhagen also saw developed countries promise to provide funding for developing countries to reduce their GHG emissions (mitigation) and to adapt to the inevitable effects of climate change (adaptation), including by pledging to mobilise long-term finance to the tune of US$100 billion a year by 2020.

In 2015, at COP21 in Paris, countries adopted the Paris Agreement, which is a legally binding international treaty on climate change. It was adopted by 196 Parties and entered into force on 4 November 2016. Consistent with the Copenhagen Accord, it sought to limit global warming to well below 2C compared to pre-industrial levels and preferably to 1.5C. To achieve this, countries promised to aim to reach peak global GHG emissions as soon as possible and target a climate neutral world/net zero emissions by mid-century. The Paris Agreement was constructed around a five-year cycle of climate actions, whereby individual countries would produce plans called nationally determined contributions (NDCs) setting out the actions they would take to reduce their GHG emissions. These NDCs would be reviewed every five years, with each successive NDC intended to represent an upgrade on its predecessor. The Paris Agreement also reaffirmed the goal of mobilising US$100 billion of annual financing by 2020 and extended it to 2025.

While the focus and tone of the COPs that followed Paris has varied, the key issues can largely be boiled down into several broad categories, including Mitigation (which relates to the targets presented in NDCs regarding emissions reductions and associated measures seeking to limit the use of fossil fuels), Adaptation (which relates to reducing countries’ exposure and vulnerability to the impact of future climate change), and Finance (for both mitigation and adaptation). In addition, developing countries have long pushed for additional financial support to meet the costs associated with the loss and damage produced by climate-related disasters that are already occurring.

In the lead up to COP27, a range of assessments found the world was failing to do a good job across most of these metrics. Granted, one bit of positive news came from the IEA’s latest World Energy Outlook, which argued that the global energy crisis triggered by the Russian invasion of Ukraine had ‘the potential to hasten the transition to a more sustainable and secure energy system’ and the IEA now projects sustained gains for renewables and nuclear power in the global energy mix. But set against this were rising GHG emissions, increasingly severe climate risks and a series of reviews of pledged emissions reductions under NDCs that all highlighted a significant shortfall relative to the goals set by Paris:

- According to the World Meteorological Organisation (WMO)’s latest Greenhouse Gas Bulletin, atmospheric levels of the three main GHGs (Carbon Dioxide, Methane and Nitrous Oxide) all reached record highs last year.

- The February 2022 Intergovernmental Panel on Climate Change (IPCC) Working Group II Sixth Assessment Report, warned that the world will face severe climate risks before the end of the current century, even under low-emission scenarios. Indeed, the report says that ‘widespread, pervasive impacts to ecosystems, people, settlements, and infrastructure have [already] resulted from observed increases in the frequency and intensity of climate and weather extremes, including hot extremes on land and in the ocean, heavy precipitation events, drought and fire weather, and that increasingly these impacts ‘have been attributed to human-induced climate change particularly through the increased frequency and severity of extreme events’.

- Estimates from the IMF published earlier this month estimated that current global ambitions regarding emissions reductions would deliver less than half of what would be needed to limit the world to 2C of warming, and about 20 per cent of what would be needed to deliver 1.5C of warming. Moreover, the IMF reckoned, if it’s estimates were to consider only actual implementation rather than pledges, the projected shortfalls would be even larger.

- In October, the UN Environment Programme (UNEP) published its Emissions Gap Report 2022. That report projected that, based on policies currently in place and with no additional action, the result could be global warming of 2.8C over the current century. Implementation of unconditional NDC scenarios would reduce this to 2.6C and conditional NDC scenarios lower it to 2.4C (conditional NDCs refers to commitments contingent on a range of conditions including the realisation of pledged financial or technical support and the ability of legislatures to enact the necessary laws).

- Similarly, the UNFCCC’s pre-COP27 assessment of NDCs under the Paris Agreement estimated that, after taking into account implementation of NDCs up until 2030, this could see warming in the range of 2.1C to 2.9C by 2100, depending on the underlying assumptions: if estimates were restricted to unconditional NDCs only, the best estimate of temperature change was 2.5C-2.9C while including all conditional NDCs would deliver a lower range of 2.1C-2.4C. The UNFCCC also noted that although COP26 had encouraged countries to revisit and strengthen their climate plans by COP27, only 24 out of 193 nations had submitted updated plans by the time of its assessment.

Progress has been slow across the other areas as well:

- According to the OECD, developed countries have continued to fall short of their pledge to mobilise US$100 billion a year of climate finance. Instead, the OECD estimates that the value of climate finance rose four per cent from US$80.4 billion in 2019 to US$83.3 billion in 2020, and as such remains some US$16.7 billion short of the target.

- Likewise, the UNEP’s 1 November 2022 Adaption Gap Report 2022 found that international adaptation finance flows to developing countries are running five to 10 times below estimated needs, and that this gap is widening. The report warns that ‘without a step change in support, adaptation actions could be outstripped by accelerating climate risks, which would further widen the adaptation implementation gap’.

- At the same time, the OECD has estimated that 51 major countries (comprising the G20, OECD and other major energy producing and consuming economies) almost doubled their financial support for fossil fuels last year. Total government support rose from US$362.4 billion in 2020 to US$697.2 billion in 2021. And consumption subsidies in particular are forecast to rise further this year.

Disappointingly, the package of decisions that came out of COP27, including the Sharm el-Sheikh Implementation Plan failed to deliver any significant progress in terms of mitigation efforts. The plan acknowledges that limiting global warming to 1.5C still requires ‘rapid, deep and sustained reductions in global GHG emissions of 43 per cent by 2030 relative to the 2019 level’. But in the end, COP27 was unable to go beyond the outcomes of COP26. Indeed, according to press reports, while the meeting began with ambitions on the part of some developed economies to deliver an upgrade on the Glasgow 2021 results (the EU for example had sought a commitment to aim for peak GHG emissions by 2025 in order to keep 1.5C alive as a target), by the end of the gathering those same countries were fighting off a push from some big developing economies to water down COP26’s results and back away from the promise to commit to further reductions. It was a similar story on efforts to include a pledge to phase down all fossil fuels, where an initial push was reportedly subsequently blocked by Russia, Saudi Arabia and other major energy exporters. Again, the eventual outcome was a reversion to the COP26 status quo. In the end, holding the line on the existing – and according to the modelling, inadequate – pledges was the best that could be done.

The one big announcement from COP27 came in the form of what has been widely described as an historic commitment ‘to establish new funding arrangements for assisting developing countries that are particularly vulnerable to the adverse effects of climate change, in responding to loss and damage, including with a focus on addressing loss and damage by providing and assisting in mobilizing new and additional resources’. While developing economies have been pushing for some form of a loss and damage fund for decades, rich countries have been much less keen. Not only would they be expected to provide funding, but they were worried that by agreeing to hand over any money they would be admitting legal liability, leaving themselves exposed to future lawsuits. They also argued that the Kyoto Protocol’s focus on a narrow subset of industrial countries not only let key players including China and the Gulf States off the hook, but could also entail financial transfers to now-wealthy countries. The negotiations appear to circumvent these obstacles partly by being vague – the agreement focuses on the need ‘to establish a transitional committee on the operationalisation of the new funding arrangements’ and this committee will have to make recommendations on a range of critical and sensitive issues, including determining how much money will be involved, identifying new sources of financing, deciding who will be the contributors and recipients, and deciding which natural disasters will be eligible – and partly by providing reassurances on the issue of liability and the distribution of funding to vulnerable countries. In theory, the new structure is to be in place by COP28.

Finally, on finance, as well as expressing ‘serious concern’ with the continued failure of developed economies to meet their target of US$100 billion annual funding, the Implementation Plan highlights that to deliver an estimated US$4 trillion investment in renewable energy per year up to 2020 that the IEA thinks is required for the world to reach net zero emissions by 2050, a transformation of the global financial system will be required. To that end, COP27 calls for scaled up funding and reformed lending practices from the multilateral development banks, including the World Bank, and from international financial institutions more generally.

One other outcome – and a direct product of some the initial post-COP27 discontent – is that the UN climate chief now says he is planning to reform the COP process to improve its transparency and effectiveness.

What else happened on the Australian data front this week?

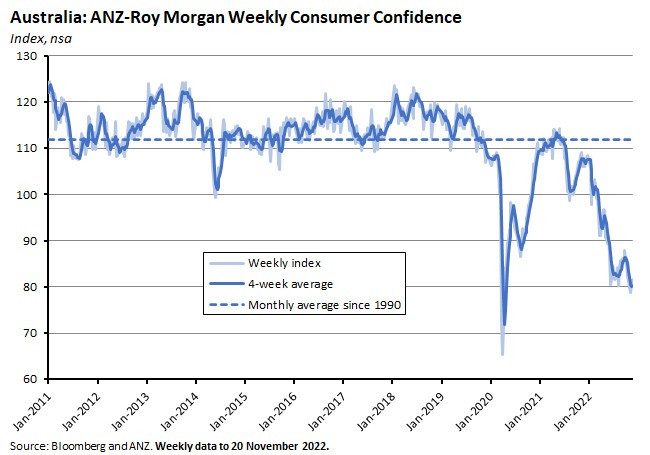

Over the week ending 20 November 2022, the ANZ-Roy Morgan Index of Consumer Confidence rose by one per cent to an index level of 81.6. The gain was driven by increases in two subindices. ‘Future economic conditions’ rose four per cent, while ‘time to buy a major household item’ jumped by 9.2 per cent, the latter perhaps reflecting spending intentions regarding Black Friday. The other three subindices all fell last week. Despite a second consecutive weekly increase, confidence remains deep in negative territory.

Last Friday, the ABS published State Accounts for 2021-22. Victoria saw the strongest growth over the financial year, with Gross State Product (GSP) up 5.6 per cent, followed by South Australia (up 5.1 per cent). NSW was bottom of the growth league table, reporting a 1.8 per cent rise in GSP.

Turning to world events…another climate conference, another cop out? This week on The Dismal Science podcast we look at the progress, or lack thereof, at COP-27, including an agreement to establish a 'loss and damage' fund for poor nations. Plus, should central banks buy bitcoin? And the cost of the World Cup.

Other things to note . . .

- State of the Climate 2022.

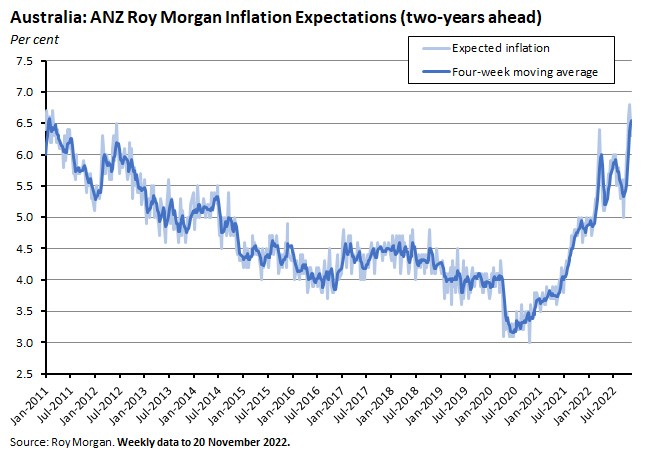

- RBA Governor Lowe gave a speech on Price Stability, the Supply Side and Prosperity. Lowe reiterated the central bank’s central forecast for inflation to peak later this year at around eight per cent, before gradually declining to be a little above three per cent by end-2024. This expected decline would be driven by the unwinding of COVID disruptions to supply, a stabilisation (and in some cases decline) in major global commodity prices, and tighter global monetary and financial conditions. He also repeated the message that while the RBA expects to increase interest rates further from here, Martin Place is not ruling out the possibility that this process could involve either a return to 50bp rate increases or a period of unchanged rates. Turning to the longer term, Lowe noted that supply side developments were likely to raise new inflation challenges for central banks, highlighting a reversal of globalisation, a demographic drag from ageing populations, climate change-driven shocks to food and other commodity prices, as well as to transport and logistics, and the potential for supply constraints related to the energy transition to influence price dynamics. All of these factors, he reckoned, were set to lead to more variable inflation and hence a more challenging future monetary policy environment.

- From the Parliamentary Budget Office (PBO), Trends in personal income tax. According to the PBO, while Australia has a low total tax-to-GDP ratio compared to other advanced economies, we have a high personal tax-to-GDP ratio. Australia’s reliance on personal income is trending back towards historically high levels, with its share of total tax receipts projected to rise to nearly 54 per cent by 2032-33 (including the impact of the Stage 3 tax cuts). The PBO also highlights governments’ ongoing reliance on bracket creep for fiscal repair.

- A submission from the Productivity Commission (PC) on the National Electric Vehicle (EV) Strategy. The PC agrees that EV’s ‘are likely to be mainstreamed from 2035 as many of the world’s major car makers switch to majority share (or even 100 per cent) EV production’, driven by EV-only new car sale mandates in major markets. But it is sceptical of calls to accelerate uptake before then by using demand-based policies, noting that in Australia the binding constraint is supply not demand. In that context, measures to strengthen Australian fuel efficiency standards and to liberalise the import of second hand EVs would offer a better approach.

- Evaluating the impact of the Industry Growth Centres Initiative.

- The ABS has updated the Australian and New Zealand Standard Classification of Occupations (ANZSCO), adding six new occupations including the four new emerging occupations of data analyst, data scientist, supply chain analyst and regulatory affairs manager.

- As noted above, the OECD has published the November 2022 Economic Outlook. High energy prices, along with tighter monetary policy, weak real growth in household incomes and falling confidence are all expected to contribute to a decline in the pace of world real GDP growth from 3.1 per cent this year to 2.2 per cent in 2023. For the OECD itself, growth is expected to fall from 2.8 per cent to just 0.8 per cent over the same period, as activity in the US and the Euro area slows to a near-crawl (just 0.5 per cent real GDP growth is forecast for both economies in 2023). That will leave major Asian emerging market economies accounting for close to three-quarters of world growth next year. The Outlook also forecasts the rate of inflation across the OECD to moderate from 9.4 per cent in 2022 to a still high 6.5 per cent in 2023. For Australia, the OECD expects growth to slow from four per cent this year to 1.9 per cent in 2023 and to 1.6 per cent in 2024

- Briefings from the Economist magazine on Indonesia’s coming economic boom (politics permitting) and the failure of FTX and the implications for crypto. Also from the Economist, the Free Exchange column asks what would it take to send crypto to zero.

- A Guardian Long Read on geopolitical thought and the case against the ‘prisoners of geography’ thesis.

- Interesting paper on Goodhart’s Law and the implications for analysis, with a focus on defence (Goodhart’s law says that when a measure becomes a target it stops being a good measure, with reference to unsuccessful attempts by the UK to target the money supply).

- This Atlantic essay reckons the Tech Industry is having a midlife crisis.

- The WSJ’s Grep Ip considers the debate around declining scientific productivity.

- Related, the Marginal Revolution blog recommends this series of essays by Brink Lindsey on the dynamism problem facing 21st century capitalism: the Age of Stasis, Loss Aversion and the Decline of Dynamism, and The Anti-Promethean Backlash.

- How WFH and other remote work changes the pattern of spending on local services: evidence from the UK.

- In the month that the world’s population passed the eight billion people milestone (on 15 November 2022), Bloom and Zucker argue that the global population bomb has been defused and the bigger challenge is now demographic ageing.

- The FT’s Martin Wolf lists his best Economics books of 2022.

- A critique of globalisation, geopolitics and Football’s Gilded Age.

- Meanwhile, the Gulf is partying while it can.

- Grattan podcast on proposed changes to Australia’s safeguard mechanism for industrial polluters.

- The Odd Lots podcast talks to Jim Chanos on crypto, tech and the golden age of fraud.

Latest news

Already a member?

Login to view this content