According to ABS data released this week, Australia’s labour market remains in remarkably good shape. Despite a cumulative 300bp of monetary policy tightening from the RBA, along with a challenging international economic backdrop, the Bureau reported that the unemployment rate in November this year was unchanged at 3.4 per cent (seasonally adjusted), the lowest rate since 1974. Moreover, the participation rate last month climbed back up to the record high it set earlier this year. While it’s clearly not the case that everything labour market-related is working well right now (skills shortages and unfilled vacancies for employers, falling real wages for employees), that combination of a multi-decade low unemployment rate, alongside a record high participation rate shouldn’t go unappreciated.

Also on the Australian data front this week, consumer confidence readings demonstrated a (very) modest bit of Christmas cheer, despite last week’s RBA rate hike. The monthly Westpac-Melbourne Institute Index of Consumer Sentiment rose by three per cent in December, while the weekly ANZ-Roy Morgan Consumer Confidence Index edged slightly higher over the past week. Meanwhile, and despite another strong monthly business conditions reading, the NAB business confidence index fell into negative territory in November for the first time since December 2021. Businesses are expecting a tougher operating environment over the year ahead as the consequences of those consecutive RBA rate increases make themselves felt.

Elsewhere in the world economy, the US Federal Reserve has slowed the pace of its monetary policy tightening, by announcing a 50bp increase to the target range for the fed funds rate this week. That follows four consecutive 75bp rate rises and also comes after signs that US inflation may have peaked. But the accompanying commentary from Fed Chair Powell – as well as the projections from FOMC members – indicate that the Fed plans to continue to lift rates next year.

This is the last Weekly Note of 2022 before our regular Christmas and January publication break. I’ll be back with an Economic Update webinar on January 25 next year which as usual will be free for AICD members. I hope you can join me to talk about the extraordinary year we’ve just seen and to consider what 2023 might have in store.

Finally, many thanks to my readers for following the Australian and global economies with me through what has been an extremely turbulent year. As always, I’m grateful for your time and for the generous feedback and helpful comments. It was lovely to meet some of you in person this year at AICD events as we emerged from lockdowns, and hopefully I’ll meet more of you in 2023. Thanks also to all the folks here at the AICD whose hard work makes sure this note goes out each week.

I wish you and yours a peaceful and joyful holiday season.

Unemployment rate unchanged in November as participation returns to its record high

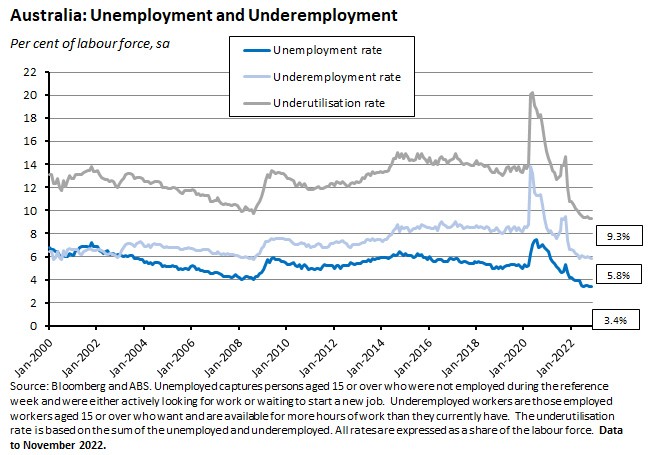

The ABS said Australia’s unemployment rate in November 2022 was 3.4 per cent (seasonally adjusted), unchanged from the October result and in line with market expectations. The underemployment rate fell from 6 per cent in October to 5.8 per cent last month, taking the underutilisation rate down from 9.4 per cent to 9.3 per cent. That’s the lowest underutilisation rate seen since February 1982 and a hefty 4.7 percentage points lower than the pre-pandemic rate. The ABS said there are now some 221,000 fewer unemployed people and 370,000 fewer underemployed people in Australia than in March 2020, with unemployment and underemployment having both fallen to around two-thirds their pre-pandemic levels.

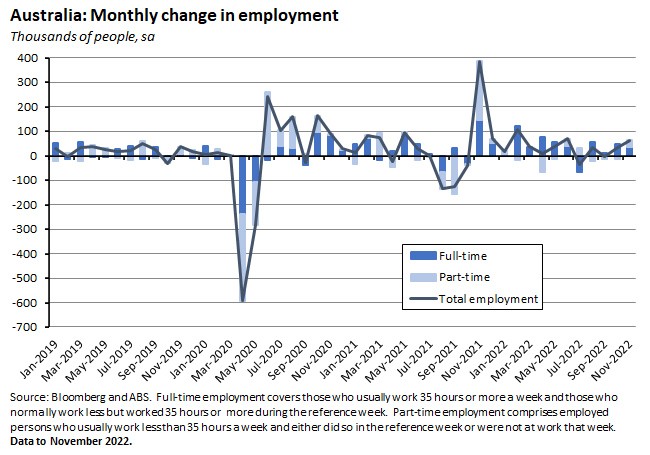

Employment jumped by 64,000 people in November, dramatically beating the consensus forecast for an increase of just 19,000. Full-time employment rose by about 34,200 while part-time employment increased by around 29,800 people.

The participation rate rose by 0.2 percentage points to 66.8 per cent, taking it back to the record high attained in June 2022. Likewise, the employment to population ratio rose to a record high of 64.5 per cent.

Hours worked fell by 8.5 million hours over the month, which the ABS said reflected a combination of payback from a 2.4 per cent surge in hours worked in October, as well as a higher than usual number of people working reduced hours due to illness. The Bureau reported that the latter increased by 50,000 in November to more than 520,000. According to the ABS, this is about a third higher than is typical for this time of year, indicating ongoing labour market disruption due to COVID and other illnesses.

Finally, note that the ABS also announced there has been a major re-benchmarking of labour force estimates, reflecting a rebasing of estimates of Australia’s Estimated Resident Population to the 2021 Census. This process happens every five years and changes the population benchmarks used to weight the estimates from the labour force survey. The Bureau said this process had ‘a negligible impact’ on headline indicators, with revisions of less than 0.1 percentage points at the national level. At the same time, the ABS also carried out its regular quarterly re-benchmarking exercise, which includes quarterly revisions to population components, including net overseas migration (NOM). In this case, the ABS reported that in the context of the pandemic there have been larger than usual revisions to NOM, producing revisions to seasonally adjusted employment (up 87,500 or 0.6 per cent) and seasonally adjusted hours worked (up 0.6 per cent) for October 2022.

Consumer sentiment shows a - very - modest bit of Christmas cheer

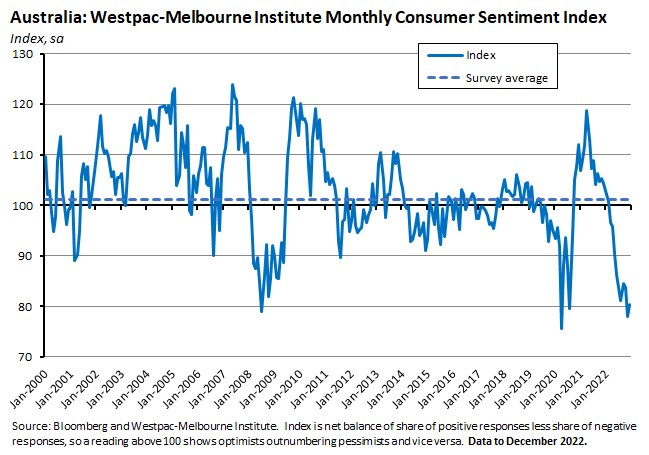

The Westpac-Melbourne Institute Consumer Sentiment Index rose by three per cent in December 2022, climbing from an index level of 78 last month (one of the weakest readings recorded outside of a recession) to 80.3 this month. Despite that gain, however, sentiment remains at levels comparable with the lows reached during the onset of COVID-19 and the Global Financial Crisis.

Drawing on questions to survey respondents about their assessment of key economic news topics, Westpac noted there were some signs that views on interest rates were becoming slightly less negative, potentially consistent with expectations that the bulk of the RBA’s interest rate increases might be over. So, 50 per cent of respondents surveyed after the December rate hike said they expected the cash rate to increase by a further full percentage point or more over the next year. That share is down from 60 per cent in November and a peak of 73 per cent in July. Westpac also pointed to a notable recovery in confidence among respondents holding a mortgage (up 11.3 per cent over the month) vs tenants (up 3.8 per cent) and those owning their property outright (down 2.7 per cent).

In a similar vein, the ANZ-Roy Morgan Consumer Confidence Index edged up by 0.2 percentage points over the week ending 11 December. Although the move was a very small one, ANZ remarked that this was the first time during the current sequence of RBA rate hikes that confidence has improved following an increase in the target cash rate. Like the Westpac assessment noted above, ANZ wondered if this was ‘perhaps a sign that households expect a pause [in rate increases] soon.’ The same survey also reported that weekly inflation expectations rose by 0.1 percentage points to 5.9 per cent last week.

Business confidence turned negative in November, but conditions remained strong

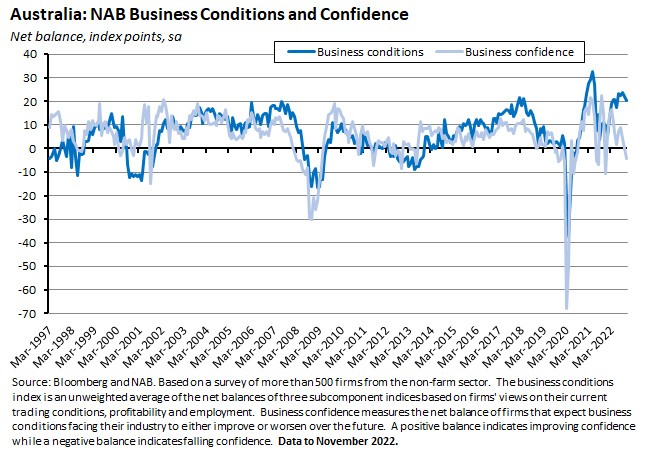

The NAB Monthly Business Survey reported that the business confidence index fell into negative territory last month for the first time since December 2021. Overall business confidence fell four points to an index reading of minus four points, with the decline led by 10-point falls in confidence in the Manufacturing, Construction and Retail industries. Confidence also fell in every state in November except for South Australia and is now in negative territory in every state except South Australia and Tasmania.

Business conditions fell by two points in November, but that still generated a very strong index reading of +20 points. All three subcomponents slid over the month but remained relatively elevated, with trading conditions now at +28 points, profitability at +20 points and employment at +13 points.

The gap between business confidence and business conditions now stands at 25 points. According to NAB, this gap is the widest on record other than at the outset of the pandemic.

NAB also reported that its survey measures of cost growth showed little sign of easing last month. Growth in labour costs rose from 2.8 per cent in quarterly terms in October to three per cent in November and the pace of increase in final product prices nudged up from 1.9 per cent to two per cent over the same period. On the other hand, growth in purchase costs eased from 4.1 per cent in October to 3.9 per cent in November.

The US Fed slows the pace of monetary tightening as inflation moderates

This week brought an important – albeit widely anticipated – development regarding the global monetary policy cycle when the US Federal Reserve’s Federal Open Market Committee (FOMC) announced that it was slowing the pace of rate hikes. The Fed had delivered four consecutive 75bp rate hikes over the previous FOMC meetings and a cumulative total of 375bp of policy tightening since the current rate cycle began back on 17 March this year. But following this week’s meeting, the Fed said it would ‘only’ increase the target range for the federal funds rate by 50bp to 4.25 – 4.5 per cent. That was still enough to take the target range to a 15-year high and bring the cumulative tightening to date to 425bp, marking the most rapid tightening of US monetary policy since the 1980s. The Fed also indicated that it isn’t done yet. The FOMC statement said that:

‘The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to two per cent over time.’

Fed signalling following last month’s FOMC meeting meant that financial markets had anticipated a decision to slow the pace of tightening. But they had also been looking to see whether the US central bank would sound more dovish in its post-FOMC communications. That hope reflected a lower than expected inflation reading in November, which saw the headline Consumer Price Index (CPI) rise by just 0.1 per cent over the month and 7.1 per cent over the year. The pace of monthly increase showed a marked deceleration from October’s 0.4 per cent rise, while the annual rate of inflation fell from 7.7 per cent in October and produced the lowest result since December last year. November’s outcome was also better than market expectations for a 0.3 per cent monthly gain and a 7.3 per cent annual rate. Core CPI inflation has eased, too, rising 0.2 per cent over the month (the slowest increase since August 2021) and six per cent over the year. All up, after peaking at a four-decade high of 9.1 per cent in June, US CPI inflation is now showing clear signs of moderation, helped by disinflationary impulses from lower energy and goods prices and an improvement in supply chains.

Despite that good news on the inflation front, however, the Fed continued to sound relatively hawkish this week. In his opening statement, Fed Chair Powell noted that inflation remained ‘well above’ the Fed’s longer-term goal of two per cent, adding that despite the ‘welcome reduction in the monthly pace of price increases’ seen in the October and November inflation data, it would ‘take substantially more evidence to give confidence that inflation is on a sustained downward path.’ In an echo of some of the language used by the RBA to explain its decision to slow the pace of Australian monetary policy tightening (in our case, from 50bp to 25bp steps), Powell said the step down to a 50bp move this month from the previous 75bp increases was recognition ‘of the cumulative tightening of monetary policy and the lags with which monetary policy affects economic activity and inflation’ but again noted that ‘we still have some ways to go.’

In terms of just how much further that might be, the December meeting also brought the publication of new economic projections by FOMC participants. These showed the median expectation for the mid-point of the target range for the fed funds rate in 2023 was 5.1 per cent (with projections ranging between 4.9 and 5.6 per cent), suggesting another 75bp of rate increases could be in store. That’s up from the September 2022 FOMC projections, where the median forecast put the 2023 mid-point at 4.6 per cent.

The new projections also show that while FOMC members see inflation slowing next year, they reckon that the moderation will be gradual and leave inflation above target: the median forecast is for the rate of increase in the price index for personal consumption expenditures (PCE) to ease from 5.6 per cent this year to 3.1 per cent in 2023 (range 2.6 to 4.1) and for Core PCE inflation (which excludes food and energy) to slow from 4.8 per cent in 2022 to 3.5 per cent in 2023 (range 3.0 to 3.8).

Tighter monetary policy is expected to impose significant costs on US activity and employment. The median forecast for real GDP growth next year has fallen from 1.2 per cent at the time of the September 2022 FOMC to just 0.5 per cent (range -0.5 to 1.0), while the corresponding projection for the unemployment rate has risen from 4.4 per cent to 4.6 per cent (range 4.0 to 5.3). The current US unemployment rate stands at 3.7 per cent as of November this year, so that implies a recession-like increase in joblessness.

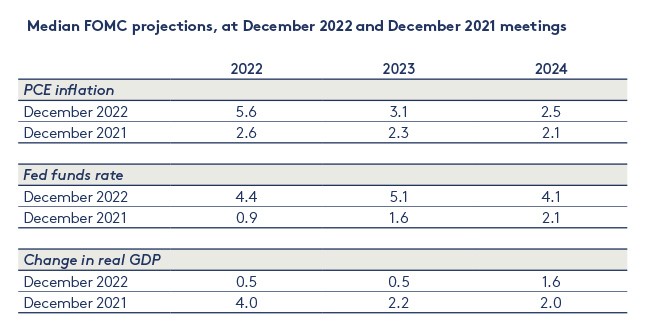

Finally, as we consider those new projections, it’s worth remembering just how differently things have turned out this year relative to what the FOMC was expecting at this time in 2021. As the table below shows, back in December last year, the median forecast was for the Fed Funds rate to finish this year at just 0.9 per cent and to rise to 1.6 per cent by the end of 2023. Forecasting is hard!

Source: FOMC projections December 2022 and December 2021. Projections for change in GDP and PCE inflation are per cent changes from Q4 of the previous year to Q4 of the year indicated, while projections for the federal funds rate target are the value of the midpoint of the target range at the end of the relevant calendar year.

What else happened on the Australian data front this week?

The ABS Labour Account release for the September quarter 2022 said that total jobs increased 0.3 per cent to 15.4 million, filled jobs increased 0.2 per cent to 14.9 billion, and the share of vacant jobs rose to 3.2 per cent. That vacancy rate set a new record high, up from 1.6 per cent pre-pandemic. Vacancy rates were particularly high in the Accommodation and food services industry (5.1 per cent vs a pre-pandemic vacancy rate of 1.2 per cent), in Mining (5.2 per cent vs a pre-pandemic rate of 3.3 per cent), and in Health care and social assistance (3.7 per cent vs 1.6 per cent). The rate of multiple job holding edged up by less than 0.1 percentage points to 6.5 per cent, which is also a record, up from 5.9 per cent pre-pandemic.

According to the ABS Characteristics of Employment release, as of August this year median employee earnings were $1,250 /week, up $50 or 4.2 per cent from August 2021. Median hourly earnings were $37/hour, up $1 from August 2021. Trade union membership has fallen from 41 per cent in 1992 to 12.5 per cent as of August 2022, with education and training (30 per cent) and professionals (19 per cent) with the highest rates of unionisation. Data on working arrangements show that the number of casual employees has increased from 2.4 million in August last year to 2.7 million this August, equivalent to 23 per cent of employees and 20 per cent of all employed. The share of employees without minimum guaranteed hours has increased slightly, up from 20 per cent in August 2016 to 21 per cent in August 2022. There were 1.1 million independent contractors (8.8 per cent of the employed) in August 2022.

In October this year, the ABS Monthly Business Turnover Indicator increased over the month (seasonally adjusted) in nine of the 13 industries for which the Bureau publishes data. The largest rise was for Electricity, gas, water and waste services (up 2.5 per cent over the month), followed by increases of 1.8 per cent for Construction and Wholesale trade. The biggest declines were suffered by Arts and recreation services (down 3.9 per cent over the month), Retail trade (down 2.5 per cent) and Transport, postal and warehousing (down 2.4 per cent). In annual terms, all 13 industries reported double-digit growth in turnover reflecting the impact of COVID-19 lockdowns last year.

National Accounts data on the Distribution of Household income, consumption and wealth for the 2021-22 financial year reported an increase of 3.7 per cent in average household gross disposable income, which rose to $139,084. The ABS said that the size of increase ranged from a 0.8 per cent rise to $54,134 for households in the lowest income quintile to a 4.3 per cent increase to $288,311 for households in the highest quintile. After taking into account the impact of government and non-profit institutions serving households (income tax, social assistance benefits, and social transfers in kind), the share of disposable income rose from 4.1 per cent to 12 per cent for the lowest income quintile and fell from 47.8 per cent to 34.9 per cent for the highest income quintile. Average household debt grew by 7.3 per cent to reach $261,492 in the same year while net worth (wealth) per household rose 7.4 per cent to $1,411,637, reflecting the strength of the housing market. Average household wealth ranged from $555,922 for the bottom quintile to $3,224,147 for the top quintile.

The Melbourne Institute measure of expected inflation (based on the trimmed mean measure of CPI inflation) fell by 0.8 percentage points in December 2022 to 5.2 per cent.

The ABS has estimated that multifactor productivity (MFP) for the market sector grew by 2.2 per cent in 2021-22 (on an hours worked basis), while market sector labour productivity rose 1.4 per cent. (MFP is defined as the ratio of output to combined inputs of labour and capital.) The 2021-22 growth in market sector MFP was the fastest seen since 2001-02 as growth in gross value added (4.6 per cent) outpaced combined growth in capital and labour inputs (2.4 per cent), where growth in capital services was 1.5 per cent and hours worked rose by 3.1 per cent. By industry, the largest rises in MFP were in Agriculture, forestry and fishing (19.2 per cent, with output lifted by a bumper grain crop), Information, media and telecommunications (7.3 per cent, reflecting the completion of telecommunications infrastructure and increased output due in part to remote work arrangements) and Transport, postal and warehousing (6.1 per cent, due to increased travel and freight services underpinned by strong online sales and that bumper grain harvest again). The largest fall was in Mining (down 2.8 per cent, reflecting the combined impact on output of adverse weather, COVID-19 related absenteeism and large-scale maintenance activities).

International Trade data for the 2021-22 financial year show that Australia ran a trade (goods and services) surplus of $147.9 billion. Total goods and services exports rose 29 per cent to $593.8 billion, while total imports rose 25 per cent to $445.9 billion. According to the ABS, China was Australia’s top export market ($180.9 billion or about 30 per cent of total exports) as well as our largest source of imports ($103.8 billion or around 23 per cent of total imports).

The ABS said there were 1,212,850 overseas arrivals to Australia in October 2022, a monthly increase of 141,330 trips. In the same month there were 1,014,820 departures, a monthly fall of 25,730 trips.

Listen to the latest episode of the Dismal Science Podcast

Other things to note . . .

- Last week, the government announced new measures to tackle high energy prices including a temporary (12 month) price cap on new domestic wholesale gas sales by east coast producers, and a plans for a new mandatory code of conduct to replace the existing voluntary one. The gas price cap will be set at $12/Gj. The NSW and Queensland governments will also set ceilings for the price of coal used for electricity generation of $125/tonne, with the Commonwealth contributing to the costs. And the Commonwealth and States will deliver targeted assistance with energy bills, with the former to establish an energy bill relief fund with up to $1.5 billion. Key background papers from Treasury are here. Here are some of the initial responses to the plan.

- Along with the latest MFP estimates (see above), the ABS has released articles on Understanding labour quality and its contribution to productivity measurement and on Has worker compensation reflected labour productivity growth? The latter reports that on average, between 1994-95 and 2021-22, a one percentage point increase in labour productivity has resulted in a 0.8 percentage point rise in real worker compensation for the market sector. Since 2011-12, however, there has been a growing gap between growth in labour productivity and growth in real employee compensation. The decoupling between productivity and wage growth has tended to be larger in industries with faster productivity growth.

- ABC Business looks at APRA and changes in the interest rate floor on mortgage serviceability tests.

- The Parliamentary Budget Office (PBO) has published Beyond the budget 2022-23 in which it sets out the PBOs latest fiscal outlook and scenarios using October’s Budget as the new baseline and examines long-term fiscal sustainability. Most of the PBO’s medium-term projections have improved relative to its 2021-22 projections (gross debt is lower as a share of GDP and the underlying cash deficit is smaller across most of the medium-term). But in the longer term, the PBO’s fiscal sustainability scenarios now project higher debt to GDP ratios than before. The PBO does conclude that ‘the fiscal position remains sustainable in all but our most extreme scenarios’ with the debt burden expected to be stable or trending downwards in 24 out of 27 long-term scenarios. It also emphasises the long-term impact of Australia’s ageing population on the budget, the rising fiscal impacts of climate change, governments’ ongoing reliance on personal income tax and bracket creep to drive revenue growth, and increased expenditures associated with the NDIS.

- The PBO has also updated its fiscal sustainability dashboard.

- A new RBA Research Discussion Paper examines the Term Fund Facility (TFF) and its impact on business lending. The paper finds ‘no statistically significant evidence that the TFF increased credit supply to businesses’, although the authors note there are some qualifications to that result.

- RBA Governor Lowe gave a speech on an efficient, competitive and safe payments system.

- The December 2022 quarterly statement from the Council of Financial Regulators noted that the council ‘continues to closely monitor the resilience of households to high inflation and rising interest rates, against a backdrop of falling housing prices’ while expecting pressure on household balance sheets to increase. It also noted that household balance sheets overall remain in decent health, that business insolvencies remain low overall despite having picked up to near their pre-pandemic level, and that banks remain ‘very well capitalised.’

- Ross Gittins’ confessions of an econocrat-watcher.

- The IMF on riding the global debt rollercoaster. Total public and private debt as a share of global GDP fell by 10 percentage points between 2020 and 2021, even though in US dollar terms it continued to rise. Despite some of the largest declines in debt to GDP ratios seen in decades, however, global debt was still about 19 per cent of GDP above pre-pandemic levels by end-2021.

- Goldman Sachs paper with projections for the world economy out to 2075 (pdf). FT Alphaville is sceptical about our ability to imagine the world that far ahead.

- New BIS Bulletin on the pros and cons of ‘front-loading’ monetary policy tightening.

- In a sign of the ongoing geo-economic struggle in the global economy, the WSJ’s Greg Ip argues that the United States and the European Union need to reach agreement over subsidies for electric vehicles and restrictions on the export of semiconductor technology to China.

- Also from the WSJ, the paper selects its best reading of 2022. And here are the Economist magazine’s best books of 2022. Also from the Economist, has the West fallen out of love with economic growth?

- Interesting new report from the McKinsey Global Institute that analyses the world economy and development progress from the perspective of about 40,000 microregions. For example, it reckons that half of the additional global GDP generated between 2000 and 2019 came from a subset of 3,600 microregions that were spread across 130 countries, covered just 0.9 per cent of the world’s land mass, and were home to 27 per cent of its population in 2019.

- An LRB Review of Bogdanich and Forsythe’s recent book on McKinsey that takes a pretty jaundiced view of the consultancy business.

- From Deepwater Horizon to Bernie Madoff: a Bloomberg Businessweek graphic on Corporate America’s Biggest Settlements.

- Against gamification.

- VoxEu column on the complex relationship between climate change and international trade.

- Most developing countries tend to liberalise trade unilaterally, not via trade agreements.

- Via Marginal Revolution, how LEGO prices differ across the world. The cheapest place to buy is Belgium, the most expensive is Argentina. (Denmark is the second cheapest). Nice graphic.

- Simon Morden on Living on Mars. (And a quick thumbs up from me for his science fiction novels, too.)

- Mohamed El-Erian reckons the world economy has entered a new economic era and discusses some of the details on the Ezra Klein podcast.

Latest news

Already a member?

Login to view this content