Looking for the economic risks and opportunities for the year ahead? Stephen Walters GAICD offers his take.

It’s that time of year when directors should be looking ahead to the likely economic challenges and opportunities in 2018. Will the signs of optimism that emerged over the course of 2017, here and overseas, continue to develop? Will escalating geopolitical tensions of this year be calmed, and what about the latest populist lurch towards protectionism? Will Australia’s unprecedented run without recession continue?

Predictions are only as good as the assumptions made, but some things, at least, seem more likely than not.

Offshore, the Trump administration may finally refocus and find some policy consistency after the distractions of 2017, and Britain will continue moving steadily towards Brexit. Chinese authorities will probably succeed in quelling potentially destabilising imbalances, for another year, at least.

Here, the economy should avoid recession for a 27th straight year and extend the stop-start transition towards more non-mining sources of growth following the biggest boom in resources investment in our history. Public and private investment will help provide growth stimulus.

Investment cylinders kicking in

The recently released National Accounts revealed welcome signs for Australia’s economy, but also evidence that the economic engine is not yet firing on all cylinders. This is despite the Reserve Bank of Australia (RBA) maintaining record low interest rates right through this year. Real GDP, for example, grew only 1.8 per cent over the year to June — the weakest outcome since the GFC. This is an unflattering comparison, given the severe damage done during the crisis.

While the long-awaited transition in the nation’s economy will continue into 2018, the consensus of market economists’ forecasts points to real GDP growth of just 2.7 per cent next year. This will be below the potential growth rate for the sixth straight year, meaning the economy again will not be fully utilising its available resources, including labour.

The good news is that investment by firms outside the resources sector is finally picking up, and Australia will continue to benefit from rising commodity exports.

Western Australia and Queensland have suffered most as mining investment has fallen, leaving New South Wales and Victoria as the best performing regions in 2017 and the national playing field is likely to be more level in 2018.

Meanwhile, public investment is set to become an even larger positive contributor to growth with a strong pipeline of local, state and Federal Government infrastructure programs. Total public investment rose 15 per cent after adjustment for inflation in the year to June. The RBA estimates that public infrastructure work yet to be done in 2017 will be just under six per cent of nominal gross domestic product.

There are already are signs of labour shortages in fields like engineering and construction because of the growing demands for these skills to help build public assets, including roads, rail links and the NBN.

Global activity improving

Australia’s increasing dependence on higher export volumes means the global economic outlook for 2018 is more important than ever. And the signs are good. Activity in China, which receives one third of Australia’s merchandise exports, has stabilised, although risks remain, particularly record-high (and still rising) debt. And Japan’s economy, which accepts 15 per cent of Australia’s exports, is enjoying a pre-Olympics construction boom.

Australia sends relatively few exports to the US, UK or Europe these day (see chart, left), but these large economies still set the tone for global conditions. The Trump administration remains intent on firing up a US economy mainly via tax cuts and increased spending on infrastructure. This most likely means an eventual inflation breakout and rising interest rates, but there should be better economic pastures in the meantime.

Household indebtedness: the key vulnerability

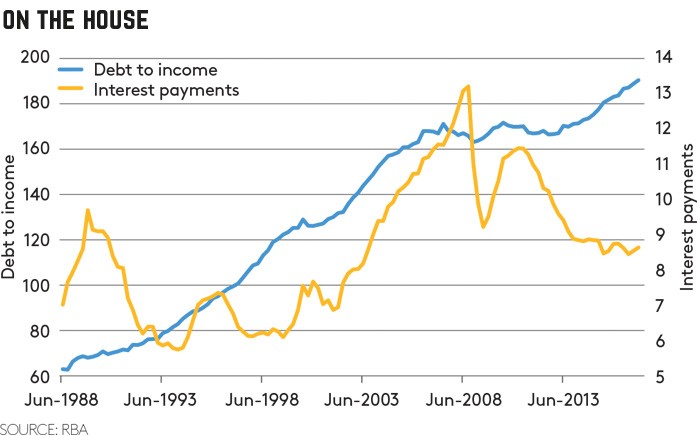

The not-so-good news is that dwelling investment will fall. The housing construction cycle peaked this year, and there is clear evidence of oversupply, particularly in east coast, inner-city apartment markets. Price falls are likely there, although values in the broader housing market will probably keep rising, albeit more modestly than before. The economy’s largest vulnerability next year will be in households — the largest single contributor to GDP. Households are facing a perfect storm of the weakest wages growth in a generation, fears of job insecurity, softening housing markets, rising energy costs, fragile confidence, and rising interest rates. Many households are responding already by cutting back on discretionary spending in order to meet the rising costs of essentials. This adjustment will continue in 2018.

Interest rates to rise

For now, the RBA is balancing isolated pockets of weakness in the economy against growing financial stability risks associated with ballooning household debt and possible fallout for the banks. Most economists expect official interest rates to rise from around mid-2018. Mortgage rates are rising now because the banks have reacted to higher funding costs offshore.

Central banks in other parts of the world will probably start raising interest rates next year, so the RBA will not be bucking the global trend. The Federal Reserve in the US has raised interest rates several times already, and has announced plans to shrink its swollen balance sheet. Canada’s central bank also lifted interest rates and the Bank of England is likely not that far behind.

Expect the unexpected

Offshore, further escalation of geopolitical tensions could undermine already fragile confidence, and shock outcomes in the contested nature of US politics can’t be ruled out. The excesses in China could finally unravel, and, in Europe, Brexit negotiations may go off the rails. Natural disasters have been a feature of 2017 — the unanticipated impact of more catastrophes could be the Black Swans of 2018.

And don’t rule out an early Federal election, and the possibility of a change of government. The Coalition enjoys a wafer-thin margin in Parliament. An election is not due until 2019. But one thing we have learned is to expect the unexpected from our political leaders.

Latest news

Already a member?

Login to view this content