There is growing confidence that Western Australia is finding its way back from the aftermath of the resources and construction boom and bust. However, some things have substantially changed.

At night, Perth’s new cricket and football ground, Optus Stadium, looks like something from a sci-fi movie — a giant dome lit with energy-efficient lighting. In daylight, its bronze-clad exterior reflects the colours of the Kimberley. It sits gracefully by the Swan River close to transport links — including a new six-platform train station. The 60,000 seat, multipurpose stadium project cost $1.6 billion to build under a public-private partnership model. The stadium will employ about 80 full-time staff, another 30 in the maintenance company and more than 1800 casuals on event days.

While there is much debate about the merits of sporting stadiums as contributors to economic growth, the powerful design, integrated sustainability and community credentials are symbolic of a fresh start. The official opening in January was important for a state looking keenly for good news and green shoots after four years of sharp economic decline.

Mike McKenna, CEO of the stadium, who moved from Cricket Australia in Melbourne to take up the role, says it is symbolic of confidence in the economy, the people and a city that is growing up. “Expectations are very high. This is a tourism asset that will bring people into the state and encourage them to stay longer.”

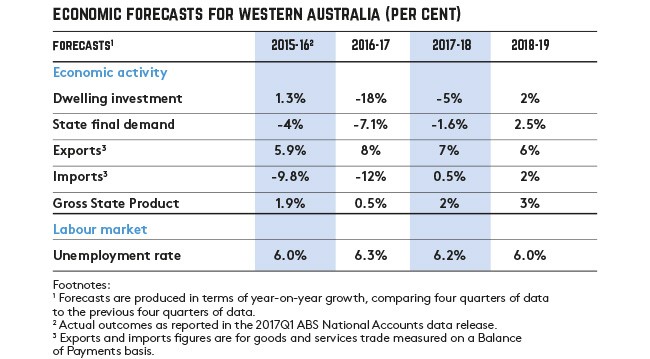

There is growing confidence that 2017 marked the end of a protracted downturn in the economy after the mother of all booms.

“The past few months, things have crystallised,” McKenna says. “People are seeing changes in the economy, a number of mining companies are hiring again, which is giving more confidence.”

WA Premier Mark McGowan says that the government can’t spend its way out after inheriting the worst set of books in the history of the state. “We have a dual responsibility to reduce recurrent spending while creating jobs. But we also have to ensure the government is getting back to surplus.”

That puts more onus on private sector investment. McGowan says the focus areas for the government are international education, tourism, communications and technology, and manufacturing. After a recent trade delegation to China, direct flights from Shanghai and Tokyo to Perth are also on the way. “Mining will continue to be a great strength, but “we’ve been making a concerted effort to diversfy the economy.“

Richard Goyder AO FAICD, chair of the AFL Commission and incoming chair of Woodside Petroleum, is cautious but confident about the big economic picture. “There are a few signs: The agricultural sector will have a strong year, commodity prices have held up well and there is a bit of catch-up to do [for business] in repairs and maintenance, there’s some replacement capital going in and a bit of excitement around lithium.”

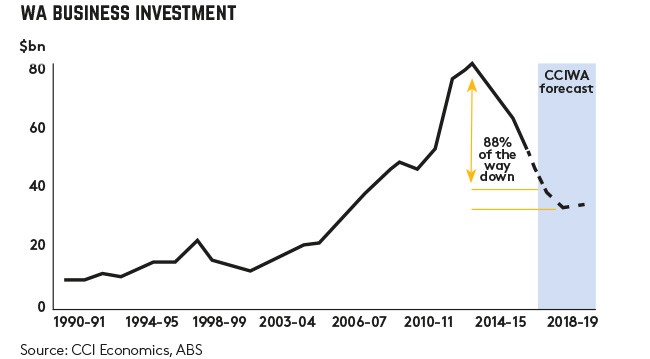

In the aftermath of the biggest increase in resource-related investment in living memory, CommSec ranked WA’s resources-reliant economy as the national laggard (State of the States report, October 2017). The loss of jobs, as the mining boom transitioned from labour-intensive construction to more capital-intensive production, inevitably took its toll. House prices fell and, for the first time in over two decades, so did interstate migration.

Kalgoorlie bucks the trend

However, WA is a state that always surprises. AICD WA services four regions: South West, Great Southern, Midwest and Goldfields, which covers the area of Kalgoorlie-Boulder. Nearly 600km east of Perth, the mining city (pop. 33,000), has a skills shortage, with vacancies for more than 300 workers in skilled resources and engineering roles.

Kalgoorlie might have an image as a wild workingman’s town in the desert, but the reality is trees, wide streets and Tidy Town credentials. While its retailers are battling the Amazon effect, it has a broad-based mining and equipment services economy well supported by infrastructure such as the Curtin University WA School of Mines, a proactive City Council and Chamber of Commerce.

Kalgoorlie property prices have held relatively steady with a median price of $327,500. Chris Fyson FAICD, managing director of The Professionals Kalgoorlie cites 2016 analysis showing that while housing sales turnover dropped, values held steady in contrast to other mining towns such as Port Hedland. “Our growth rate is very consistent,” says Fyson.

“The message is there is a strength and consistency in the Kalgoorlie-Boulder economy.”

Cecile Thaxter is the first female general manager of Kalgoorlie Consolidated Gold Mines. She runs KGCM’s famous Super Pit mine, overseeing 1100 employees, 28 per cent of whom are female. Thaxter is working on lowering the mine’s operating costs and taking the case for extra investment to extend the life of the pit [due to shut down mining operations in 2019]. She says recruitment has been challenging, but believes it’s more a marketing issue.

The City of Kalgoorlie-Boulder Council is working with community leaders on plans to revitalise the main street and priority areas for the future include energy, liveability, tourism and connectivity. Council CEO John Walker says, “If we don’t focus on making the town a better place to live, people won’t come and we won’t have a place. We’re on the cusp of something particularly good here.”

Premier McGowan has similar hopes for the state. Nearly a year after Labor decisively swept the Barnett Liberal government from office after nearly nine years in power, McGowan’s team is working on pruning back a record $43b deficit.

“People have been impressed with Mark McGowan and treasurer Ben Wyatt,” says Goyder. They have had to make tough decisions and if they’ve needed help, have reached out. There is increasing confidence across WA in a range of industries, and we’re doing our best to promote it.”

So has the state that has historically gone from boom to bust and back again learned the value of diversifying its economic base? The Government has identified several focus areas, which include attracting more investment, a $14.5m fund for new industries, and more support for innovation hubs, mining services and medical research.

Frank Cooper FAICD, AICD WA Division Council president, says that WA’s strength is in mining and value-added services, which have proved innovative. “This discussion happens every time we have a downturn. It requires long-term strategic perspective. Building a diverse economy requires investment when the capacity is there.”

Goyder says more work is needed to modernise the regulatory environment, including trading hours. WA has been campaigning for a fairer allocation of GST revenue and mineral royalty income (it currently keeps 34 cents for each dollar of GST revenue it raises). The issue has helped feed long-held secessionist tendencies, with a recent move by the WA Liberals to investigate the state seceding from the federation, its own “WAxit”.

“WAxit would be disastrous,” says Goyder. “We get enormous benefits from Federation. GST needs to be sorted out and the state shouldn’t be penalised for developing its natural resources. But it’s a more sophisticated economy than 10 years ago — and WA has always had a great entrepreneurial spirit.”

Latest news

Already a member?

Login to view this content