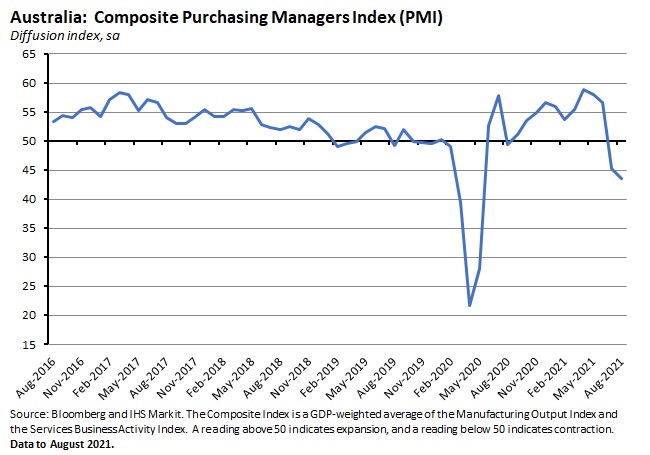

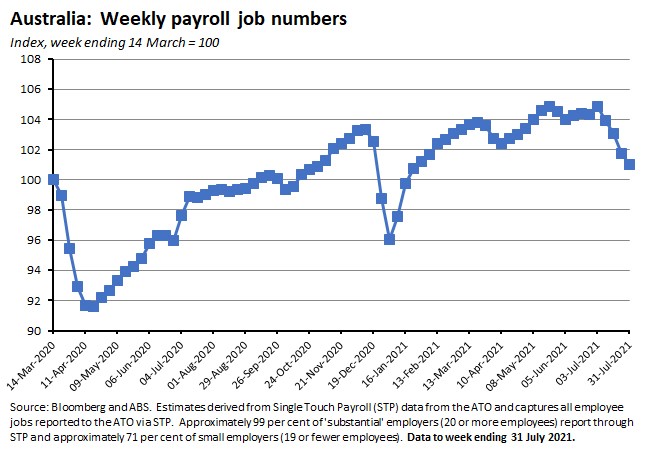

The Flash Composite Purchasing Managers Index (PMI) for Australia fell deeper into negative territory in August, hitting a 15-month low and signalling a second month of falling activity as lockdowns and Delta continue to weigh on the economy overall and on services industries in particular. Payroll jobs data for the last two weeks of July reinforced that sombre message, with a two per cent decline in overall numbers along with falls in almost every industry.

Unsurprisingly, Greater Sydney has been particularly hard-hit, with payroll jobs now down 9.2 per cent over the five weeks since the NSW lockdown began on 26 June. Bloomberg’s latest survey of economists reported a fall in the median forecast for GDP growth this year for the first time since last September as well as a modest increase in the expected unemployment rate for the remainder of the year. But in a reminder that conditions continue to diverge across Australia, weekly consumer confidence actually edged higher last week as strong increases in confidence in South Australia, Western Australia and Brisbane offset declines in Victoria and New South Wales. Finally, two important inputs into next week’s Q2 GDP reading sent contrasting messages this week: data on construction work done in the June quarter came in considerably weaker than the median forecast while private capital expenditure surprised on the upside.

This week’s readings include ANZ on the state economies, the ABS on the latest count of Australian businesses, the pandemic M&A boom, inflation and the Powell Doctrine, preparing for the next pandemic, a gloomy take on the global outlook, why the gig economy has disappointed, the global and Eurozone tourism shocks, and an interesting look at ownership and property rights that includes the much-debated (at least pre-COVID) question: is it OK to recline your seat during a flight?

Finally, stay up to date on the economic front with our AICD Dismal Science podcast . Listen and subscribe: Apple Podcasts | Google Podcasts | Spotify

What I’ve been following in Australia . . .

What happened:

The IHS Markit Flash Composite PMI (pdf) fell to 43.5 in August, down from 45.2 in July.

According to the survey provider, demand, business activity and employment conditions all deteriorated over the month, with private sector businesses reporting a reduction in their staffing levels for the first time since October 2020. Despite the decline in economic conditions, however, business sentiment improved in August with firms apparently hopeful about vaccination progress.

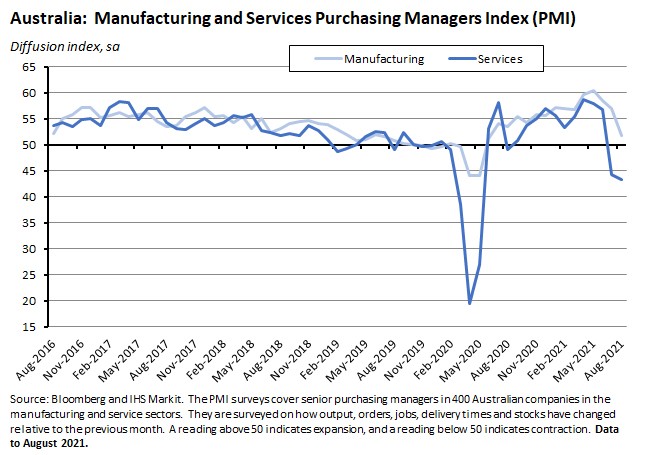

The Flash Manufacturing PMI dropped to 51.7 from 56.9 in July with new orders and output both falling into contractionary territory. The Flash Services PMI fell further into contractionary territory, dropping from 44.2 in July to 43.3 in August.

Reported price pressures for private sector firms eased slightly this month even as the overall rate of cost inflation remained above the long-run average. At the same time, output price inflation picked up over the months as firms reported passing on higher costs to clients.

Why it matters:

Lockdowns and Delta mean that activity in Australia’s private sector fell for a second consecutive month in August as the Composite PMI dropped to a 15-month low. Likewise, the Services PMI moved further into contractionary territory, also slipping to its lowest level since May 2020. Manufacturing activity continues to expand, with the Manufacturing PMI still above 50, although a sharp fall in the index this month delivered the weakest reading for the series since June 2020.

More positively, the reported improvement in business sentiment in August – service sector optimism regarding the year ahead rose to a four-month high this month – suggests that businesses continue to expect a return to stronger conditions once the current wave of COVID cases has passed and a higher vaccination rate allows a shift to economic re-opening.

What happened:

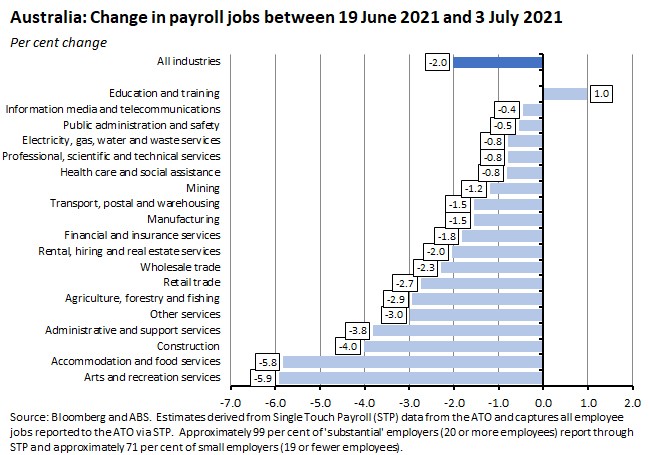

The ABS said that the number of payroll jobs fell by two per cent between the weeks ending 17 and 31 July 2021, following a fall of 1.8 per cent over the previous fortnight. Total wages paid fell 2.7 per cent over the most recent fortnight of data after recording a 3.2 per cent drop over the preceding fortnight.

Payroll job numbers were down 3.7 per cent over month overall but were still one per cent higher than they were a year ago, in the fortnight ending 1 August 2020.

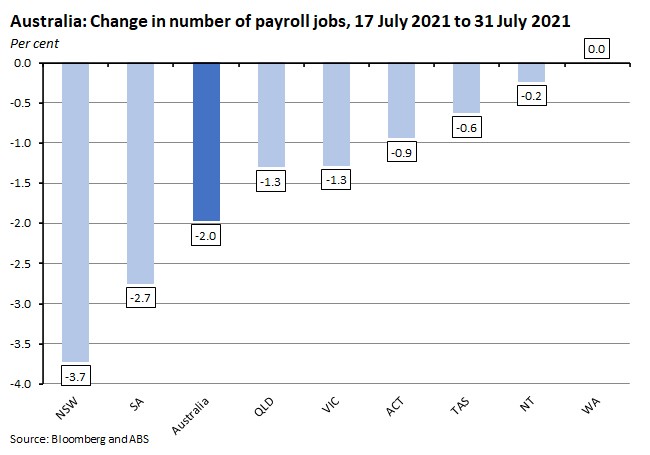

Across states and territories, over the fortnight ending 31 July, payroll jobs fell in every geography except Western Australia (where job numbers were flat), with the largest falls including a 3.7 per cent decline in New South Wales, a 2.7 per cent drop in South Australia and 1.3 per cent falls in Queensland and Victoria.

Every industry except education and training saw a fall in job numbers over the second half of last month. The largest declines in the two weeks to 31 July were in arts and recreation services (down 5.9 per cent), accommodation and food services (down 5.8 per cent), construction (down four per cent) and administrative and support services (down 3.8 per cent).

Why it matters:

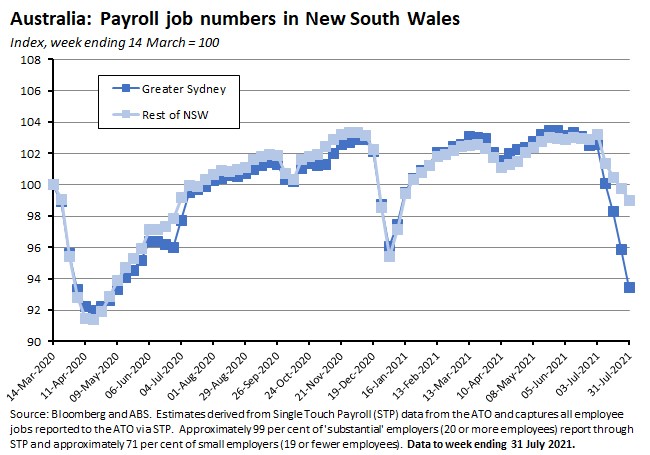

The latest fortnight of payroll jobs data captures the impact of restrictions in the fourth and fifth weeks of lockdowns in New South Wales (including the pause in construction activity), lockdowns in Victoria and South Australia, and travel and border restrictions across all states and territories. The numbers highlight the significant impact that the Greater Sydney lockdown in particular is having on the labour market: payroll jobs in New South Wales were down 3.7 per cent in the second half of July and down 7.1 per cent over the five weeks since the lockdown began on 26 June this year. Greater Sydney has seen some of the largest job declines, with payroll numbers over those five weeks down by 9.2 per cent compared to a 3.9 per cent drop in the rest of New South Wales.

The Bureau said that three industries – accommodation and food services, retail trade and construction – accounted for more than 44 per cent of national job losses in the second half of July and more than 45 per cent of job losses in New South Wales, with the state accounting for around half of all payroll jobs lost nationwide in accommodation and food services, around two thirds of losses in retail trade, and around three quarters of losses in construction.

Note that the payroll data are based on estimates collected from the Single Touch Payroll (STP) system, where a payroll job is defined as a relationship between an employee and their employing enterprise, where the employee is paid in the reference week through STP-enabled payroll or accounting software and reported to the ATO. (Where an employee is paid other than weekly, the established payment pattern is used to include payroll jobs paid in weeks outside the reference week). Payroll data are therefore unable to account for job attachment where a payment has not been made, for example where a jobholder was temporarily stood down without pay. This distinction is important because current COVID-related government support payments are paid directly to people or businesses, rather than through payrolls (as was the case with JobKeeper). Hence some of the fall in payroll jobs reported here will include employees who were still attached to their job but who were temporarily stood down and not paid by their employer.

What happened:

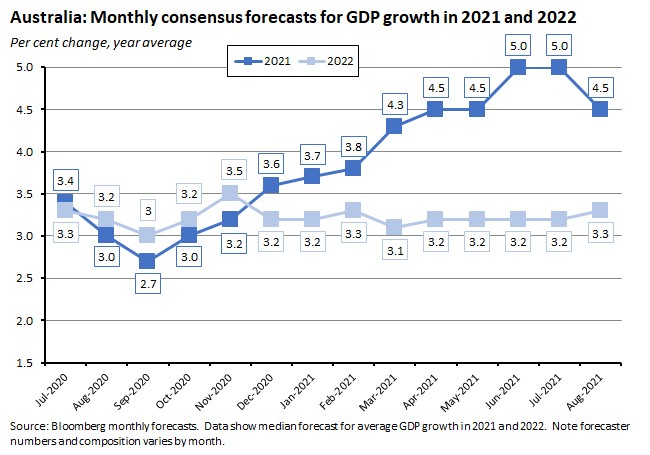

The August 2021 Bloomberg Survey of Economists shows that the consensus (median) forecast for GDP growth this year has fallen to 4.5 per cent, down from five per cent in the July survey.

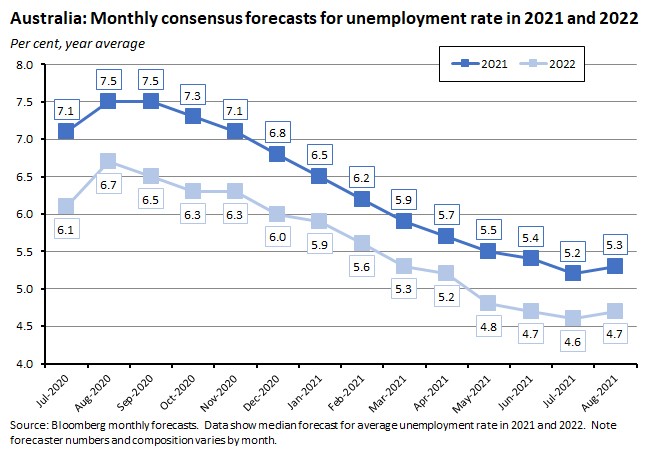

The median forecast for the unemployment rate has edged up to 5.3 per cent from 5.2 per cent.

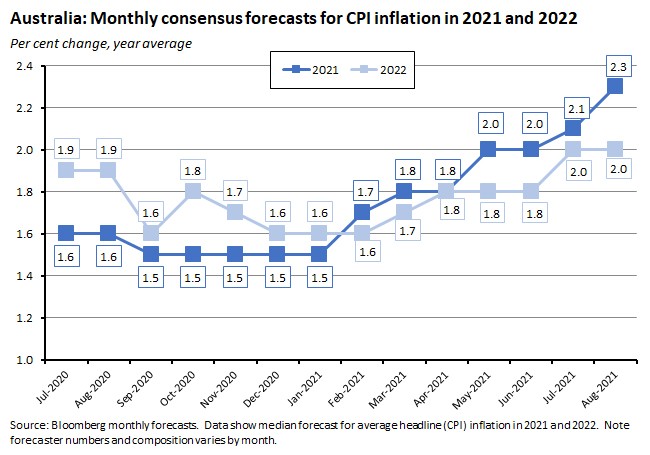

And inflation forecasts have increased to 2.3 per cent from 2.1 per cent.

Why it matters:

The August survey reported the first decline in the median growth projection for this year since September 2020, as forecasters incorporate the implications of the Delta variant and state lockdowns into their numbers. In particular, while in July’s forecast roundup the consensus was that September quarter GDP this year would rise by 0.4 per cent over the June quarter, the August median forecast is now for a two per cent quarterly fall. Likewise, expectations for unemployment have been adjusted upwards. In July, the median forecast was for an unemployment rate of 4.8 per cent in the final quarter of this year but the August forecast is up at 5.1 per cent (although note that by Q1:2022 the consensus still expects the unemployment rate to be back below five per cent).

Finally, inflation expectations have increased again this month. But the increase is seen as mostly temporary: inflation in 2022 is still expected to be relatively subdued.

What happened:

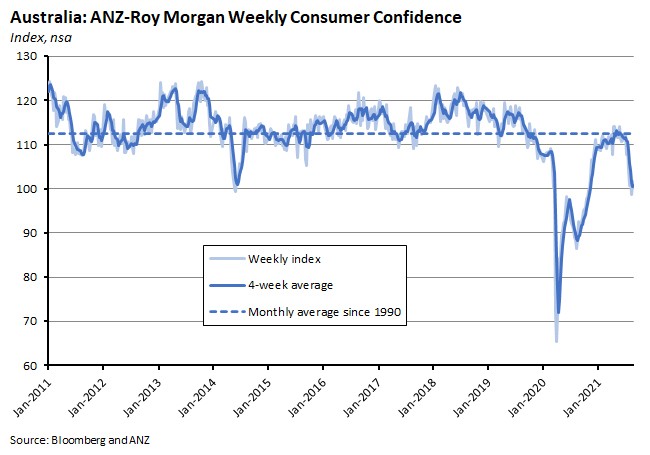

ANZ-Roy Morgan Consumer Confidence rose 0.5 per cent to an index reading of 101.6 for the week ending 22 August 2021.

There were mixed readings across the five subcomponents last week, with declines for ‘future financial conditions’ (down 0.3 per cent) and ‘current economic conditions (down 6.9 per cent) offset by increases for ‘current financial conditions’ (up seven per cent), ‘future economic conditions’ (up 0.3 per cent) and ‘time to buy a major household item’ (up 1.6 per cent).

Inflation expectations fell 0.1 percentage point to 4.4 per cent after having hit a 26-month high of 4.5 per cent the previous week.

Why it matters:

Despite rising case numbers in New South Wales and new lockdowns in Victoria and the ACT, consumer confidence actually edged higher last week. That reflected diverging economic conditions across Australia, with strong increases in confidence in South Australia (up eight per cent), Western Australia (up 11.4 per cent) and Brisbane (up 1.7 per cent). In contrast, confidence was down in Victoria (a 2.9 per cent fall) and New South Wales (a 1.9 per cent decline). Overall, national confidence is 8.9 index points higher than the same week a year ago.

What happened:

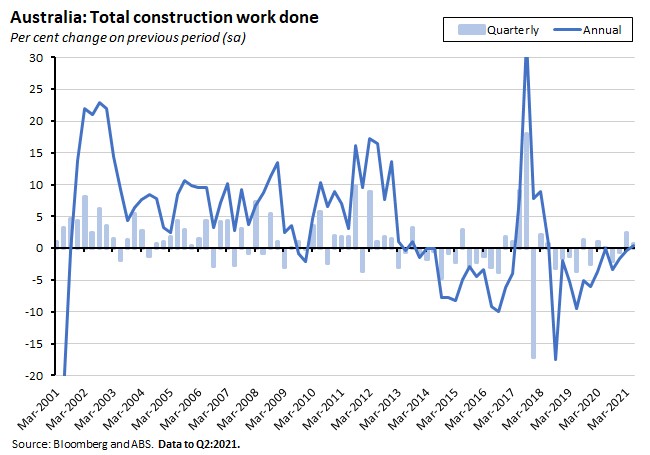

According to the ABS, construction work done in Australia rose 0.8 per cent in the June quarter of 2021 to reach $52.9 billion (seasonally adjusted). Work done was 0.4 per cent higher than in the same quarter last year.

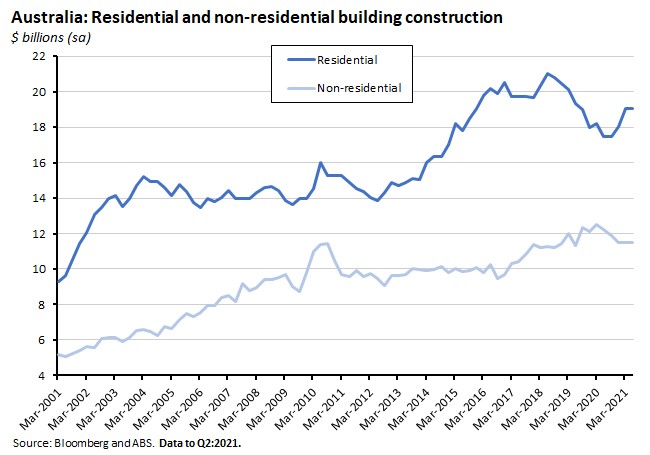

Total building work done rose 0.1 per cent to $30.6 billion in Q2:2021, 2.8 per cent higher than in Q2:2020. Of that total, residential construction ($19 billion or about 62 per cent of all building work done) fell 0.1 per cent over the quarter but was still up 8.9 per cent over the year. Non-residential construction ($11.5 billion or 38 per cent of the total) rose 0.3 per cent in quarterly terms and fell six per cent year-on-year.

Engineering work done rose 1.8 per cent over the quarter but fell 2.7 per cent over the year.

Why it matters:

The median forecast had been for a 2.8 per cent quarter-on-quarter rise so the actual 0.8 per cent print was softer than expected. Construction work done over the quarter was mostly driven by the 1.8 per cent rise in engineering construction. In contrast, building work done only edged up 0.1 per cent relative to the March quarter with that modest rise driven entirely by non-residential building work.

This quarter’s decline in residential construction follows two consecutive quarters of strong quarterly growth (up 3.1 per cent in the final quarter of last year and up 5.8 per cent in the March quarter of this year) that had been powered in part by the stimulus provided by the government’s HomeBuilder program. Applications for the program closed on 14 April this year, although the government extended the construction commencement requirement for all applicants from six months to 17 months from when the eligible contract was signed.

What happened:

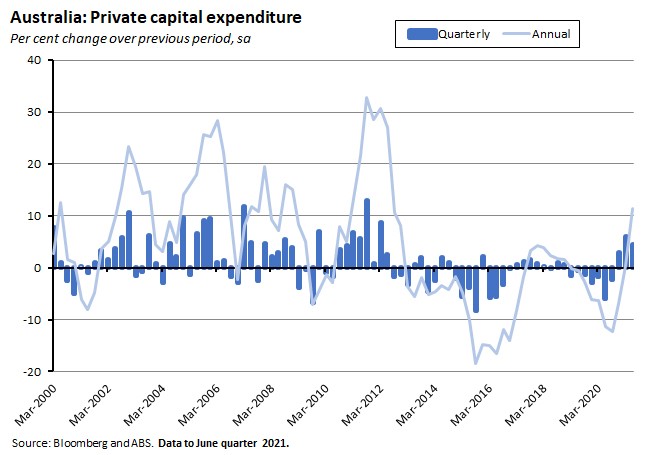

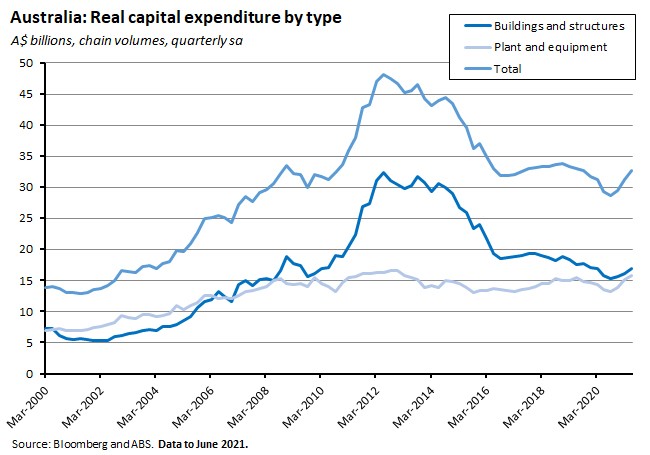

ABS data showed that private new capital expenditure in Q2:2021 rose by 4.4 per cent over the quarter (seasonally adjusted) to be 11.5 per cent higher over the year.

Capital spending on building and structures rose 4.6 per cent quarter-on-quarter and 6.5 per cent year-on-year while spending on equipment, plant and machinery rose 4.3 per cent in quarterly terms and 17.3 per cent on an annual basis.

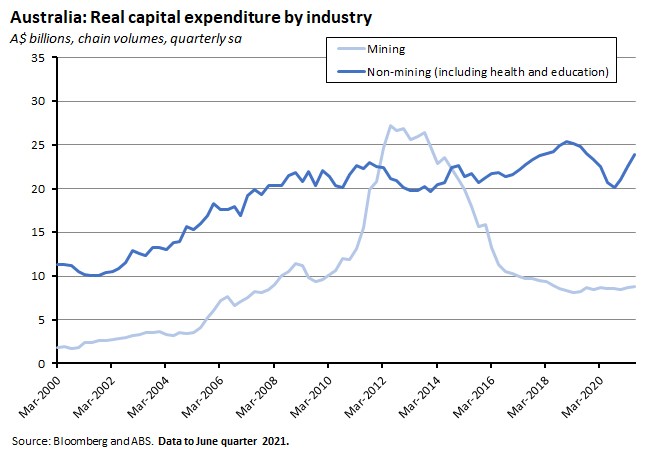

By industry, capital expenditure in mining rose 0.4 per cent over the quarter and 2.2 per cent over the year, while non-mining capex was up six per cent over the quarter and 15.3 per cent over the year. Within the latter group, quarterly growth was in double digits in arts and recreation services (up 21.1 per cent), other services (up 16.8 per cent), rental, hiring and real estate (15.9 per cent), information, media and telecommunications (up 14.5 per cent), retail trade (up 13.9 per cent) and electricity, gas, water and waste (up 10.5 per cent). There was a sharp drop (down 10.5 per cent) in total capex in the accommodation and food services industry.

The data on expected expenditure included Estimate 3 for 2021-22 which was $127.7 billion. That was up 12.5 per cent from Estimate 2 and more than 17 per cent higher than the corresponding estimate last year. By industry, non-mining firms’ capex plans (up 15.4 per between Estimates 2 and 3) look stronger than those of mining firms (up 6.5 per cent).

Why it matters:

The consensus prediction for private capex in the June quarter this year was for a 2.6 per cent rise, so the 4.4 per cent actual outcome was comfortably above that. Capital expenditure was driven by strong growth in non-mining investment, suggesting that government investment incentives (and low interest rates) continued to support business investment through the first half of this year.

At the same time, the ABS survey of expected capex reported an increase of about 12.5 per cent for spending plans for 2021-22. Given that the survey was conducted during July and August this year, and therefore captures the impact of the Greater Sydney and other lockdowns, that shows an encouraging degree of resilience in business investment intentions in the face of the Delta variant. Remember, however, that estimates generally increase over the course of the year anyway, as investment intentions firm up. Over the previous seven years from 2014-15, the average increase between the second and third estimate has been 13.3 per cent, so this year’s increase was a little below that average.

What I’ve been reading . . .

- The latest ANZ Stateometer reports that economic growth was strong across Australia’s states and territories in the three months to June this year, indicating a healthy degree of momentum before Delta and lockdowns started to change the picture.

- The ABS said that the number of actively trading businesses in the Australian economy rose by 3.8 per cent (or 87,806) in 2020-21. The business entry rate in 2020-21 rose to 15.8 per cent from 14.8 per cent in 2019-20 while the exit rate fell to 12 per cent from 12.8 per cent. Growth in the number of businesses was strongest in other services (up 7.4 per cent), health care and social assistance services (up 7.2 per cent) and retail trade (up 6.3 per cent) while the two industries to see declines in business numbers were transport, postal and warehousing services (down 2.8 per cent) and public administration and safety services (down 1.4 per cent).

- Peter Martin explains some of the shortcomings of official ABS data on wages.

- Adam Triggs is sceptical about the COVID-19 mergers and acquisitions (M&A) boom, arguing that the benefits (economies of scale and economies of scope) could be more than offset by the costs (lower competition).

- James Laurenceson argues that Australia got lucky in handling Chinese trade coercion. Mainly because Beijing ‘found it impossible to instruct Chinese steel makers to import iron ore from sources other than Australia – viable alternatives were simply unavailable [and] Developments outside China’s control, like natural disasters in Brazil, then set mineral prices to record highs.’ Australian exporters also benefited from switching to third markets and ‘grey market’ entry into China (e.g. lobsters via Hong Kong).

- A poll of Australian economists finds strong support for vaccine passports for higher risk settings and mandatory vaccinations for higher risk occupations but less confidence in cash incentives for vaccination.

- A new Grattan report on policies to reduce industrial emissions (the source of 30 per cent of Australia’s carbon emissions). The first-best policy would comprise ‘a single, economy-wide emissions price coupled with well-targeted support for technology development’ but with that ruled out by politics, second-best, sector-specific policies are required instead. In the case of industry, Grattan argues for expanding and modifying existing policies such as the Safeguard Mechanism and energy savings schemes along with the establishment of an Industrial Transformation Future Fund to help share financial and technological risk between sectors.

- Related, assessing public support for carbon taxes in Australia.

- Bloomberg Businessweek offers up a field guide to the crypto faithful including Bitcoiners, Ethereans and Doge Soldiers.

- South Korea becomes one of the first major economies to hike policy rates during the pandemic era and the first major Asian economy to do so (Mexico, another OECD member, hiked rates in June and August this year and New Zealand had been widely expected to increase rates last week before Delta changed the RBNZ’s plans).

- A WSJ long read on how Fed Chair Powell is negotiating the US inflation debate against the backdrop of an economy thrown into further turmoil by the Delta variant.

- Related, the Economist magazine on the Powell Doctrine (according to the piece, the Fed’s current chair has led ‘a landmark shift in the way it thinks about interest rates’ with the shift to a new framework for US monetary policy that has introduced average inflation targeting along with an increased focus on full employment).

- Also from the Economist, an interesting piece on attempts by the authorities in China and South Korea to de-escalate the education arms-race in those countries.

- This FT weekend essay from SF author Kim Stanley Robinson on climate change imagines a big role for ‘carbon quantitative easing.’

- Also from the FT, a Big Read on the uncertain lessons of COVID for preparing for the next pandemic. Governments are increasingly focused on building domestic vaccine capacity, but challenges include: the fact that it is very ‘complicated to create manufacturing facilities that can respond quickly and safely to a previously unknown disease;’ how to keep people and facilities ‘semi-switched on’ during ‘inter-pandemic periods;’ how to manage the complexity of global supply chains; the need to manage the risk of backing the wrong (or outdated) technology; how to lock in supplies of basic medicines when a ‘race to the bottom’ means that many of the most important are barely profitable for the firms that make them; and how to manage intellectual property and international inequality in vaccine access.

- The Peterson Institute has published a new Policy Brief which argues that policymakers need to start preparing for a challenging transition to carbon neutrality. Author Jean Pisani-Ferry reckons that the combination of the scale of the transition required and the speed at which it will take place means that there will be ‘serious, immediate economic implications’ with decarbonisation acting as a major adverse supply shock. That doesn’t necessarily mean that growth will fall – since there is the potential for offsetting developments in the form of new spending on research and infrastructure as well as other new investment and renovation efforts – but either way the transition will involve substantial adjustments in the composition of growth (less consumption, more investment), in the state of public finances (more debt and deficits), in the distribution of jobs, and in the value of much of the existing capital stock.

- Bryson and Blanchflower make a case for the ’economics of walking about’. That is, trying to get a real-time picture of what’s happening from economic actors on the ground including workers, consumers, producers and agents via tapping into a range of qualitative surveys including PMIs and business and consumer surveys.

- Michael Spence is gloomy about the global outlook, citing the rapid spread of the Delta variant, the failure of the vaccine supply chain to deliver for the developing world, disrupted global supply chains more generally, and an increase in the ‘frequency, severity and global scope of extreme weather’ that means climate change is ‘becoming a noticeable factor in macroeconomic performance.’

- Noah Smith investigates why (in his view) the gig economy has been a disappointment.

- Does Behavioural Economics have a replication crisis?

- A piece from Branko Milanovic from earlier this year on what he views as the magical thinking of the degrowth movement.

- The global shock to tourism from the pandemic, and a look at implications for the Eurozone.

- An Econtalk podcast on ownership and property rights.

Latest news

Already a member?

Login to view this content