In what is being called the most significant budget since World War II, the AICD summarises the key economic and policy initiatives that directors need to be across.

The 2020-21 budget will be significant for many organisations as the nation recovers from COVID-19. The AICD Chief Economist Mark Thirlwell has summarised the key economic numbers and initiatives, while the AICD policy team rounds up the major announcements directly relevant to governance.

AICD Chief Economist analysis

Key points

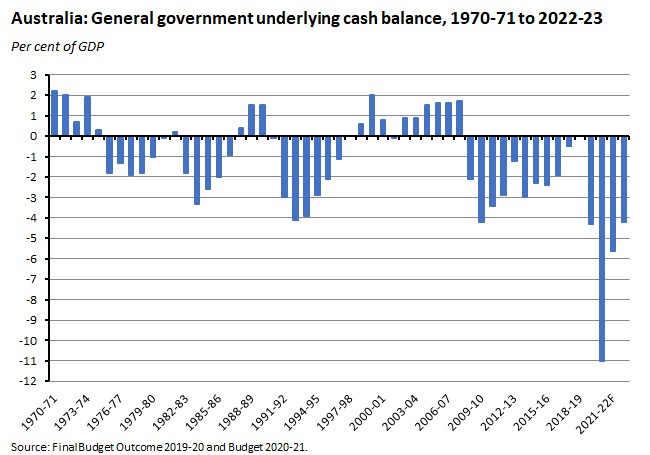

Budget 2020-21 heralds the start of a new fiscal era. An era of more government spending, bigger deficits, and more government debt. It is also an era where fiscal policy has replaced monetary policy as the key macro lever in the economy, and where the budget has been assigned a specific goal in terms of the unemployment rate.

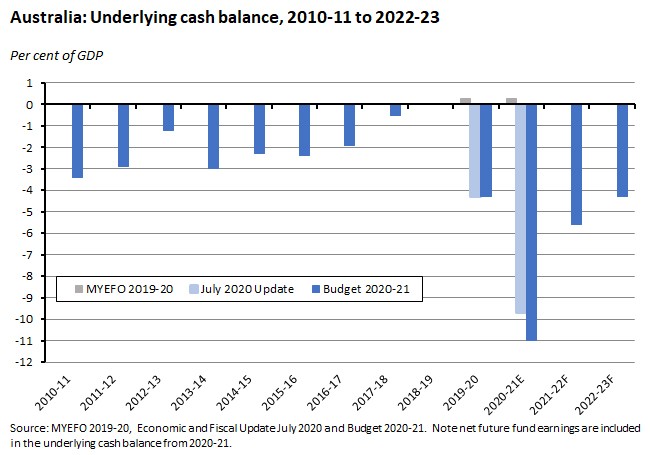

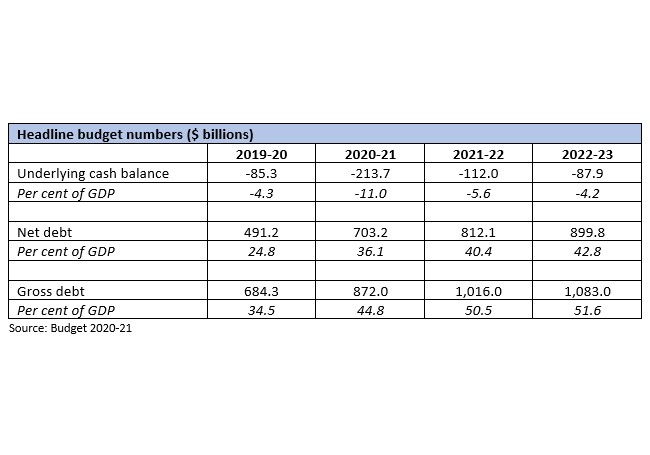

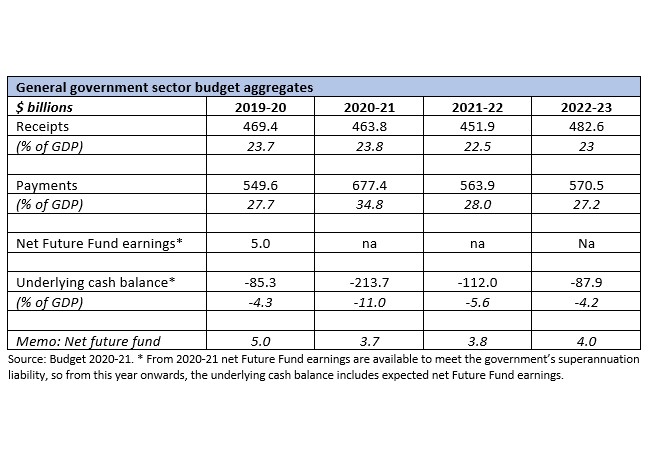

- Budget 2020-21 estimates a deficit of $213.7 billion (11% per cent of GDP) in the underlying cash balance this year, a pandemic-driven outcome that is a long, long way from the modest surplus forecast in the 2019-20 MYEFO. That deficit is expected to fall to a still-sizeable shortfall of $112 billion (5.6 per cent of GDP) in 2021-22 with further deficits predicted out through 2023-24, by when the deficit is expected to have fallen to three per cent of GDP.

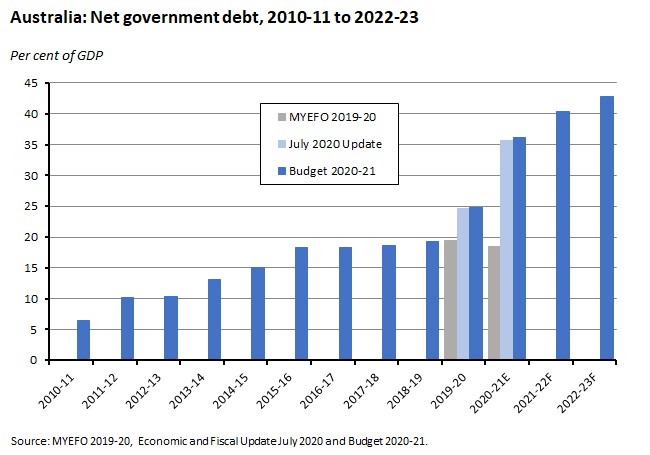

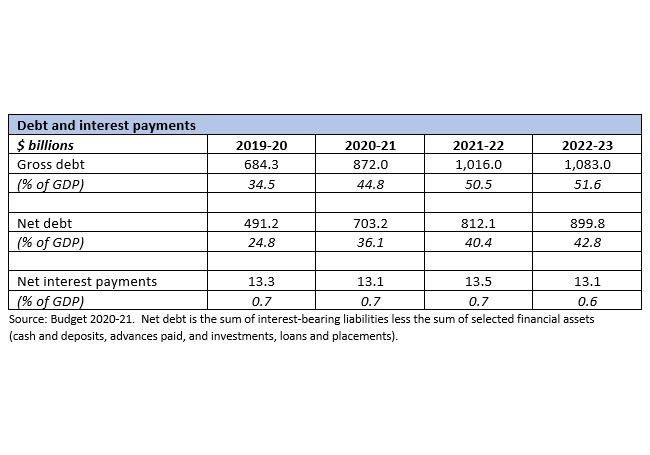

- Gross government debt is forecast to rise to $872 billion (44.8% of GDP) by the end of 2020-21, and to continue to rise to $1,016 billion (50.5 per cent of GDP) by 2022-23. Net debt as a share of GDP is forecast to rise to 36.1 per cent by the end of the current financial year. Gross debt is forecast to stabilise as a share of GDP at 55 per cent in the medium term while net debt is forecast to peak at less than 44 per cent of GDP in 2023-24 and then gradually decline over the medium term to less than 40 per cent of GDP by 2030-31.

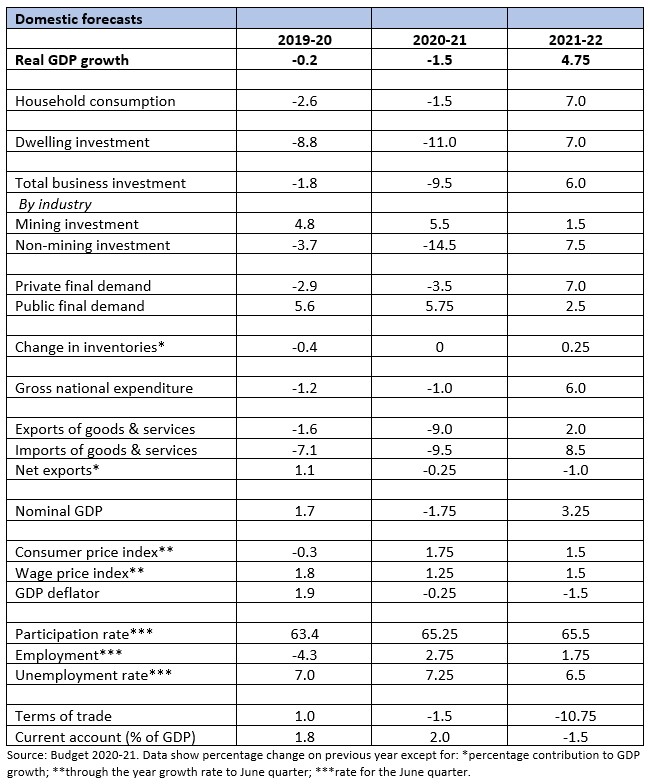

- Treasury predicts that the economy will shrink by 1.5 per cent in 2020-21 and grow by 4.75 per cent in 2021-22.

- Unemployment is forecast to rise to 7.25 per cent in the June quarter of 2020-21 per cent before falling to 6.5 per cent in 2021-22, six per cent in 2022-23 and 5.5 per cent in 2023-24.

- The budget delivers substantial tax relief. That includes $17.8 billion in additional personal tax relief over the forward estimates, including $12.5 billion over the next 12 months. This will be achieved by bringing forward stage two of the already-legislated personal income tax plan from 2022-23 to 2020-21 – so backdated to this year - along with a one-off additional benefit from the low and middle income tax offset (LMITO - the LMITO had been due to be removed at the same time as the stage two tax plan was implemented). Household incomes will be further boosted by two $250 payments to pensioners and other eligible recipients, worth an estimated $2.6 billion.

- For businesses, the tax relief is even larger. The budget introduces both temporary full expensing and temporary loss carry-back measures for businesses with turnover of up to $5 billion. Combined, these two measures are estimated to deliver $31.6 billion in tax relief to businesses over the forward estimates, by bringing forward tax deductions or the utilisation of losses from future years.

- The government will also increase its infrastructure pipeline by $10 billion to $110 billion over the next ten years.

- There are substantial funds to encourage hiring, including $1.2 billion to support Australian businesses to employ 100,000 new apprentices or trainees and a $4 billion JobMaker hiring credit to provide businesses incentives to take on additional employees aged between 16 and 35 years.

- There is also increased funding for research and development (R&D) including $2 billion in new incentives, $1 billion in new research funding for universities and more money for the CSIRO.

Funding the war on COVID and shaping the post-War reconstruction

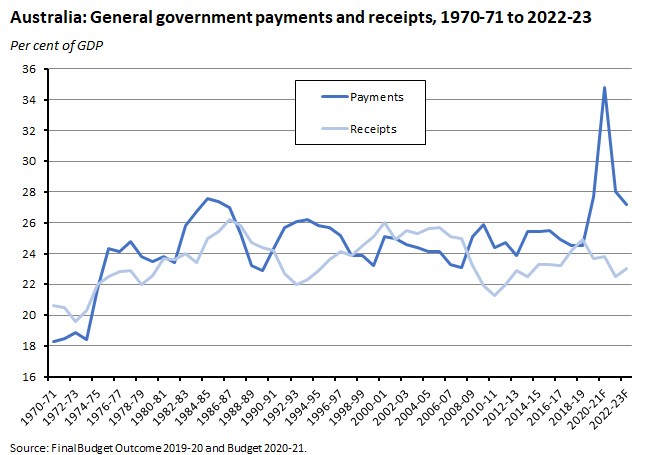

In last week’s budget preview, we said that when the Prime Minister described Budget 2020-21 as ‘arguably one of the most important, if not the most important since the end of the Second World War,’ not only was he making a fair point, but he’d got the historical comparison right, too. Budget 2020-21 delivers a huge, multi-billion-dollar deficit on a scale not seen since the end of that global conflict, with the deficit on the underlying cash balance forecast to rise to $213.7 billion or 11 per cent of GDP this financial year. The budget is then forecast to remain in deficit across the forward estimates, falling from 5.6 per cent of GDP in 2021-22 to 4.2 per cent of GDP in 2022-23 to three per cent of GDP in 2023-24.

Remember, as recently as the 2019-20 MYEFO, the government was predicting an underlying cash balance in surplus to the tune of $6.1 billion (0.3 per cent of GDP) in 2021-22. COVID-19 has completely transformed the story of Australia’s government finances.

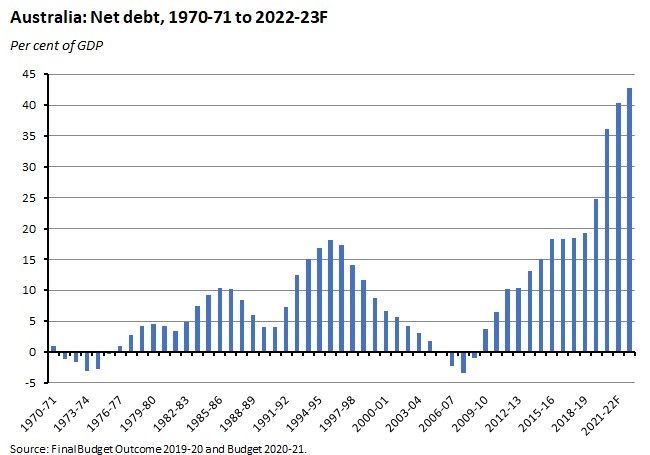

That tide of red ink will be accompanied by an expansion in the public debt burden as a share of GDP to levels we haven’t witnessed in Australia in much more than half a century. Gross debt is forecast to rise to more than $1000 billion dollars in 2022-23.

It seems reasonable to characterise this dramatic shift in the fiscal profile and the government’s forced replacement of its previous ‘back in the black’ ambitions with the prospect of ‘remaining in the red’ for years to come as the start of a new fiscal era.

Again, as we noted last week, this is an historic budget in other ways too, taking place as it does against the backdrop of Australia’s first recession in almost three decades, during its deepest downturn in the post-war period, and amidst a global slump worse than any suffered since the 1930s. Treasury now thinks that the economy will shrink by 1.5 per cent in 2020-21. And as the RBA reminded us in today’s monetary policy statement, the ‘national recovery is likely to be bumpy and uneven and it will be some time before the level of output returns to its end 2019 level.’

This week’s budget also arrives in the context of the government’s new, two-stage fiscal strategy ‘that emphasises jobs and growth.’ The second stage of the new strategy is old-school in its focus, with a traditional-sounding pledge to rebuild Australia’s fiscal buffers and stabilise the debt burden. But the government will not rush to austerity. Instead, the immediate focus is on a first phase that will see Canberra (1) continue to ‘allow the automatic stabilisers to work freely to support the economy’; (2) maintain the provision of ‘temporary, proportionate and targeted fiscal support, including through tax measures, to leverage private sector jobs and investment’; and (3) ‘push ahead with structural reforms that position the economy for the jobs of the future and which improve the ease of doing business.’ The Treasurer has promised that this first phase ‘will remain in place until unemployment is on a clear path back to pre-crisis levels’ which likely means ‘until the unemployment rate is comfortably back under 6 per cent.’ On this budget's forecast, that will not be achieved until 2023-24

Granted, much of this new strategy simply reflects the unavoidable consequences of the way that the pandemic has transformed the state of our public finances. But it also comes at a time when the lessons of premature austerity following the global financial crisis, the near-exhaustion of conventional monetary policy, and the prevalence of extremely low interest rates have combined to prompt much of the economics profession to rethink old orthodoxies around fiscal policy and debt sustainability. In this sense, too, Budget 2020-21 marks the start of a new era for fiscal policy.

In our budget preview, we argued that this week’s budget needed to accomplish three key tasks, with the first the most important:

First, it needed to continue the government’s impressive work in supporting the economy and offsetting the large, negative demand shock that crushed economic activity and drove up unemployment earlier this year. With a significant amount of existing financial support due to wind down as the year draws to a close, more income support was required.

Here, the government has responded by delivering a substantial amount of additional stimulus in the form of large doses of personal and business tax relief and a further cash injection to some households. There is also significant support for new hiring. Missing was any news on the future of JobSeeker.

Second, the budget had to demonstrate that the government was also thinking beyond the immediate need to support demand and activity by offering measures designed not only to help the economy adapt to the significant relative shifts in performance and short- and longer-term prospects across industries, regions and individuals triggered by the way in which the pandemic has played out but also address the challenge that economic performance pre-COVID was fairly lacklustre, marked by disappointing productivity growth and low rates of (non-mining) business investment.

In this context, Budget 2020-21 offers some important down payments on the required productivity repair job in terms of improved incentives for investment, increased support for hiring, some additional R&D support, some additional funding for infrastructure and support for manufacturing. But with the government concentrating on its mantra of making much of its COVID-related spending ‘timely, temporary and targeted’, the measures here are – perhaps inevitably – much more limited in scope when set against the huge stimulus effort.

Third, the budget had to build on the government’s announced new fiscal strategy to provide a guide to the medium-term state of the government accounts.

Here, to the extent that the government is bound by its new fiscal strategy, the budget outlook is in part conditional on delivering its targeted decline in the unemployment rate. As noted above, the budget forecasts suggest that it will achieve this, but only by 2023-24.

In summary, then, the main focus of Budget 2020-21 is on the immediate priority of continuing to fund the war against COVID-19 with the key objectives being supporting growth and employment. It does that through a combination of substantial tax cuts for business and households and some additional commitments. The budget also makes a more modest down payment on what we might think of as the post-war reconstruction process, delivering support for investment, including infrastructure, and training along with a series of smaller measures also aimed at boosting the supply side of the economy via tax tweaks and digital initiative along with some targeted sectoral support. Finally, the new fiscal strategy means a re-ordering of fiscal priorities, with any sustained shift in the policy focus to fiscal repair now conditional on a recovery in the labour market.

One final point before digging into the detail. As we noted in the initial response to last year’s offering back in May 2019, all budgets are hostage to the future. Back then, we certainly didn’t foresee the dramatic damage to Budget 2019-20 that would be caused by COVID-19 and its aftermath. This year, we should be uncomfortably aware just how uncertain the outlook is, and therefore the substantial risks around this latest set of fiscal projections.

Economic outlook and forecasts

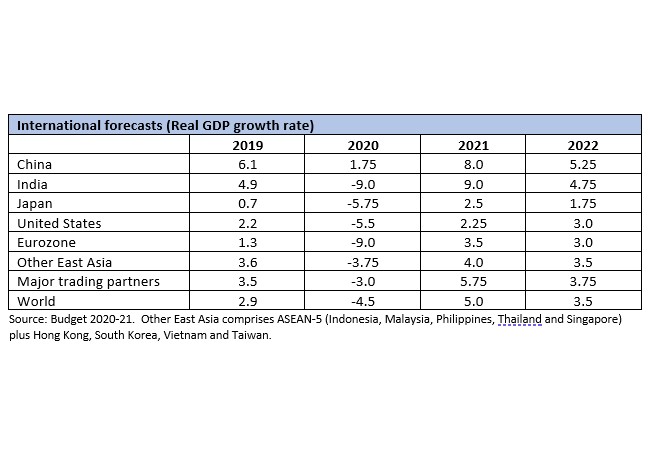

Back in July, the key international assumption underpinning the budget was that after growing by 2.9 per cent in 2019, the world economy would contract by 4.75 per cent this year before recovering to grow at five per cent in 2021. Major trading partner growth was expected to do better than this, with growth ‘only’ falling by three per cent in 2020 and rising by 5.5 per cent in 2021. The new projections in Budget 2020-21 show that Treasury has become slightly more optimistic on the global outlook for the remainder of this year. World GDP is still forecast to plummet in 2020, but by a slightly smaller 4.5 per cent. There is some payback in terms of slightly slower forecast world growth for 2021 of five per cent. The anticipated decline in major trading partner growth for 2020 is unchanged from the JEFU at three per cent while expectations for 2021 have been nudged up slightly to 5.75 per cent. The Chinese economy is forecast to grow 1.75 per cent this year and eight per cent in 2021.

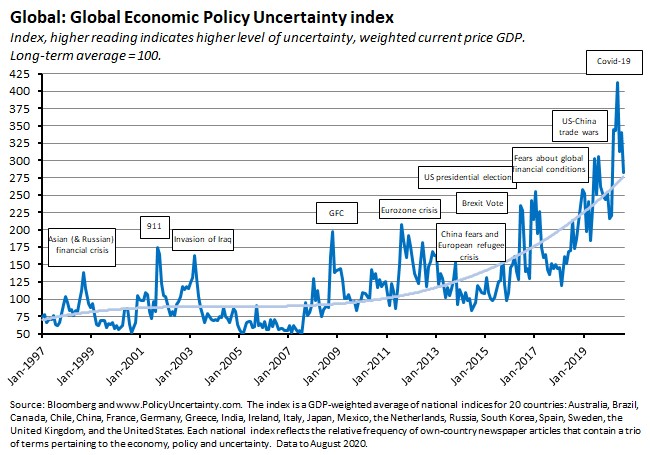

Of course, there is a substantial level of uncertainty associated with these projections. Most obviously, prospects for the international economy remain hostage to the future trajectory of the pandemic, the changing nature of the public health response and the prospects for a vaccine. But the world economic outlook is also vulnerable to uncertainties beyond COVID-19, including next month’s potentially volatile US Presidential election and the intensifying geo-strategic competition between the US and China. As a result, measures of global economic policy uncertainty remain elevated, albeit down from the highs of earlier this year.

Turning to the outlook for the domestic economy, July’s Economic and Financial Update had predicted that real GDP would shrink 2.5 per cent in 2020-21 in what would be the worst result suffered since the 1940s. Nominal GDP growth – particularly important for the budget as it sets the size of the tax base – was predicted to contract by 4.75 per cent in 2020-21.

Under the new forecasts presented in Budget 2020-21, the fall in real GDP has been pared back to 1.5 per cent for the current fiscal year, while nominal GDP is expected to contract by 1.75 per cent. Critical to these forecasts are the assumptions about public health, with virus expected to be effectively contained in Australia across the forecast period, with only localised outbreaks of COVID-19 occurring which are largely contained. The forecast also assume that a population-wide Australian COVID-19 vaccination program is fully in place by late 2021. General social distancing restrictions are assumed to continue until a vaccine is fully available. In addition, a gradual return of international students and permanent migrants is assumed through the latter part of 2021, while inbound and outbound international travel is expected to remain low through the latter part of 2021, after which a gradual recovery in international tourism is also assumed to occur.

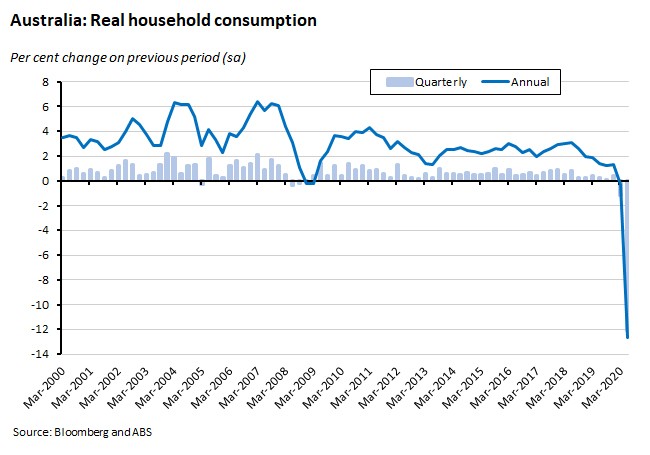

Household consumption will play a critical role in driving near-term economic prospects. Real consumption spending fell sharply in the second quarter, while as a share of nominal GDP consumption slid to less than 52 per cent.

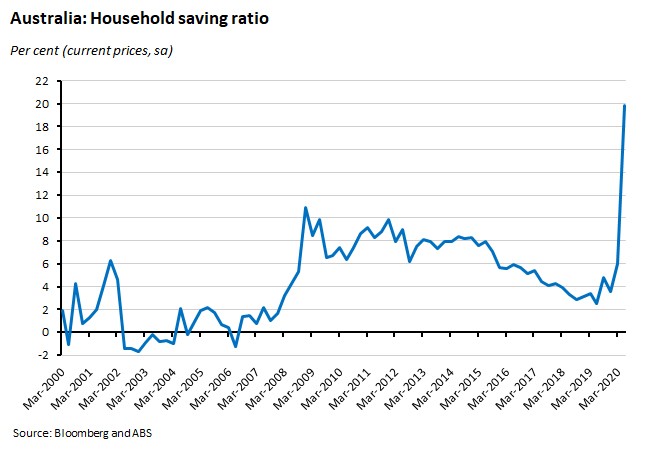

To date, households have responded to the pandemic-driven rise in uncertainty by sharply increasing their saving rate, with the household saving ratio approaching 20 per cent in the June quarter.

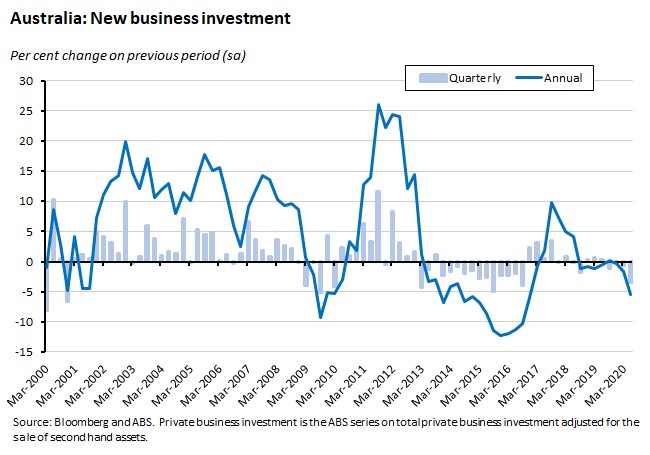

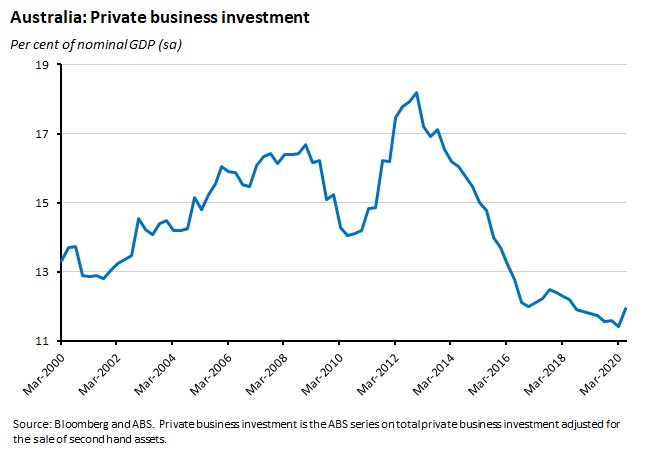

According to the Budget papers, Treasury thinks that household consumption will fall 1.4 per cent this FY before rising by seven per cent in 2021-22. Private business investment is another critical component of near-term demand and – because of its impact on the future capital stock – a driver of medium-term growth prospects as well. Again, the high levels of uncertainty brought by COVID-19 saw capital expenditure fall in the second quarter of this year.

But it’s also the case that our investment performance was disappointing even before the pandemic. Measured as a share of nominal GDP, private business investment had slumped to a multi-decade low by the first quarter of this year, and even after a small rise in the June quarter, is still at low levels. In part that’s been the story of the end of the earlier mining investment boom and there have been some positive signs that mining capex is recovering. But non-mining investment has also been weak, held down by slow national growth and the uncertain pre-pandemic global environment that was characterised by trade wars, rising populism and technological change and disruption.

The forecasts in Budget 2020-21 see private business investment falling 9.5 per cent in 2020-21 with a 14.5 per cent slump in non-mining investment. By 2021-22 investment is forecast to grow six per cent with non-mining investment up 7.5 per cent.

The projected unemployment rate is an even more important variable to track than usual. Not only is it a critical measure of economic and (therefore) political success and a key driver of fiscal expenditure, but under the government’s new fiscal strategy, the Treasurer has introduced a form of fiscal forward guidance, promising that supportive fiscal measures ‘will remain in place until unemployment is on a clear path back to pre-crisis levels’ which likely means ‘until the unemployment rate is comfortably back under 6 per cent.’ The budget forecasts see the unemployment rate peaking at eight per cent in the December quarter of this year before falling to 6.5 per cent by the June quarter of 2022 and to 5.5 per cent by the June quarter of 2024, but the forecasts also concedes that the outlook for the labour market is ‘unusually uncertain’.

One key transmission channel for the international economic impact of COVID-19 has been through net overseas migration, which since 2017 has contributed to more than 60 per cent of total population growth. In the JEFU, Treasury had estimated that lower net overseas migration would contribute to a marked slowdown in the rate of population growth, predicting a decline from 1.5 per cent in 2018-19 to 1.2 per cent in 2019-20 and just 0.6 per cent in 2020-21, marking the weakest pace of growth since 1916-17. Budget 2020-21 sees net overseas migration falling from around 154,000 in 2019-20 to minus 72,000 in 2020-21 before rising to around 201,000 in 2023-24. That in turn sees population growth fall from 1.2 per cent in 2019-20 to just 0.2 per cent in 2020-21 to 0.4 per cent in 2021-22.

A second key international transmission channel has been the price of iron ore, which in recent years has surprised to the upside and delivered some welcome support to the fiscal accounts. At the time of the JEFU, the forecast was for the iron ore price fall to US$55/tonne by the end of the December quarter. To date, the price has proved much more resilient, starting October at well above the US$100/tonne mark. Budget 2020-21 assumes that the iron ore price will fall to US$55/tonne by the end of the second quarter of 2021.

Back at the time of Budget 2019-20, Treasury estimated that the potential growth rate of the Australian economy was around 2.75 per cent, which set the parameters for the likely medium-term growth performance. The current budget notes that potential growth in the near-term is estimated to have been cut to below two per cent, mainly due to the projected decline in population growth noted above but also reflecting a decline in the participation rate.

Fiscal Projections

Back at the time of the July 2020 Economic and Fiscal Update (JEFU), Treasury was expecting that 2020-21 would bring an underlying cash deficit of around $184.5 billion or about 9.7 per cent of GDP. Government gross debt was forecast to surge to $851.9 billion (45 per cent of GDP) and net dent to rise to $677.1 billion (35.7 per cent of GDP).

According to the new budget estimates, the deficit will be $213.7 billion (11 per cent of GDP). Most of the action here is in terms of government payments, which are forecast to rise to 34.8 per cent of GDP in the current FY before easing back to 28 per cent of GDP in 2021-22.

The implications for government debt

The sharp increase in deficits in response to the pandemic has produced a significant increase in the current and forecast level of government debt, although importantly this increase comes on top of what was a relatively comfortable debt position by international standards. Gross debt is forecast to rise to $870 billion this FY and to exceed $1,000 billion in 2021-22, while net debt is forecast to rise from 24.8 per cent of GDP In 2019-20 to 36.1 per cent in 2020-21 and to 42.8 per cent of GDP by 2022-23.

By way of contrast, the 2019-20 MYEFO had predicted that net government debt would peak at 19.5 per cent of GDP in 2019-20 before edging down to 18.4 per cent of GDP in the current FY and then sliding to 16 per cent of GDP by 2022-23. Again, we’re travelled a long way from that old fiscal world.

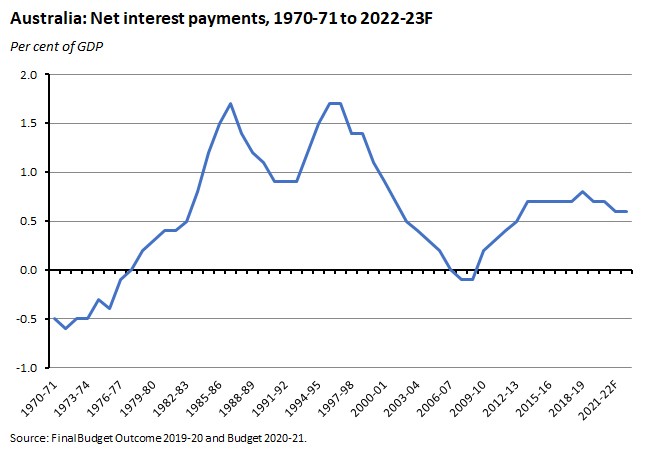

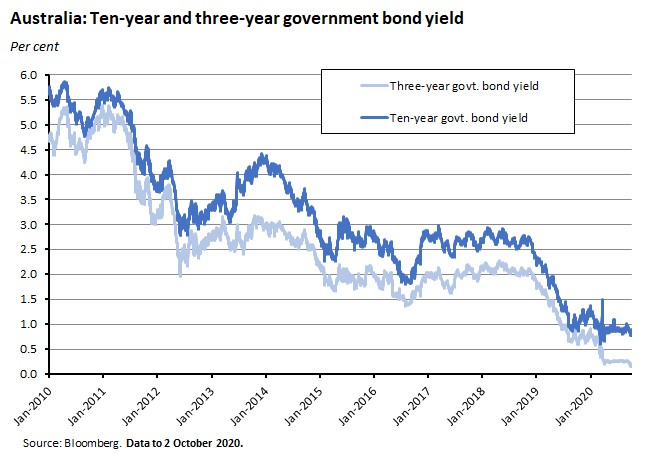

The impact on the debt service burden of this marked increase in the debt stock has been substantially offset by the fall in official interest rates. The cost of government borrowing is at record lows, with the RBA pegging the three-year government bond yield at around 0.25 per cent in line with the cash rate as part of its yield curve control (YCC) policy while the government is also able to borrow for ten years at less than one per cent. As a result, net interest payments are forecast to remain relatively flat over the next few years, both in dollar terms and as a share of GDP, despite the marked growth in the debt stock.

Selected major policy initiatives

The government has announced a range of taxation and spending measures, several of which were flagged in advance of budget night.

Tax measures

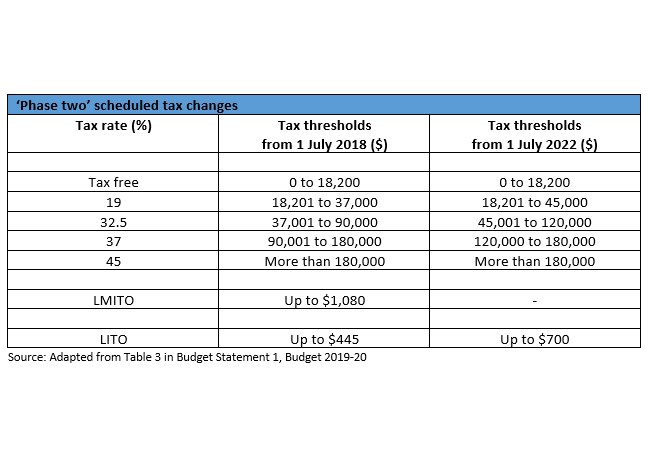

As had been expected, Budget 2020-21 has brought forward already-planned income tax cuts. Phase two was scheduled to take effect from 1 July 2022 and brings together measures from both the 2018-19 and 2019-20 budgets:

- An increase in the top threshold of the 19 per cent tax bracket to $45,000;

- An increase in the top threshold of the 32.5 per cent tax band to $120,000;

- An increase in the low income tax offset (LITO) to $700.

Note that the combination of changes to the top threshold of the 19 per cent bracket and the expansion of the LITO were also designed to lock in the previous benefits from the Low and Middle Income Tax Offset (LMITO).

Budget 2020-21 delivers $17.8 billion in additional tax relief over the forward estimates, including $12.5 billion over the next 12 months. This is achieved by bringing forward - and backdating - stage two of the already-legislated personal income tax plan from 2022-23 to 2020-21 along with a one-off additional benefit from the low and middle income tax offset (LMITO), instead of removing the LMITO at the same time as the stage two tax plan was implemented.

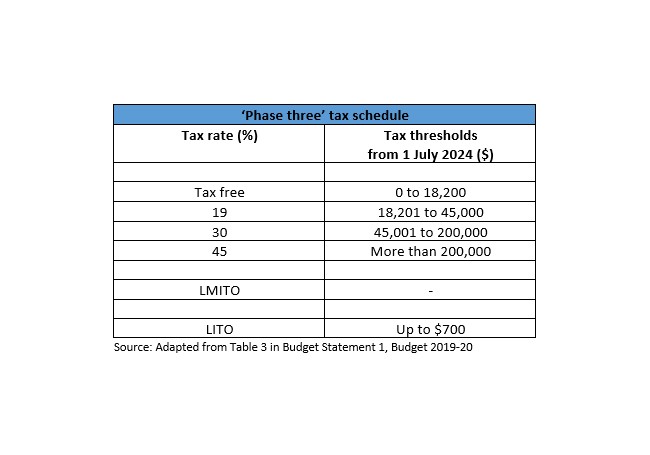

Phase three of the tax changes is still scheduled to take effect from 1 July 2024 and again combined changes introduced in Budget 2018-19 and Budget 2019-20. These comprised:

- The abolition of the 37 per cent tax bracket

- The reduction of the 32.5 per cent tax rate to create a new 30 per cent tax band running from $45,001 to $200,000

- Increase the top band for this new middle tax rate to $200,000.

The completion of the stage three tax reforms will leave Australia with a much cleaner and simpler tax structure with just three tax brackets.

Budget 2020-21 also introduced major new incentives for investment. The government is introducing temporary full expensing of depreciable assets for businesses with turnover below $5 billion, with no limit on the value of assets eligible for full expensing. The budget papers estimate that around 3.5 million businesses — over 99 per cent of businesses — employing around 11.5 million workers will be eligible for the measure, which builds upon the enhanced $150,000 instant asset write-off and the Backing Business Investment measures introduced in March. The measure will apply to eligible assets purchased from 6 October 2020 and first used or installed by 30 June 2022. The measure is expected to be worth around $26.7 billion.

In addition, the budget also allows companies with turnover of up to $5 billion to temporarily offset tax losses against previous profits and tax paid. This temporary loss carry back measure allows businesses to access their losses earlier, by way of a cash refund, to provide a cash flow boost to keep businesses running. Companies with turnover up to $5 billion can apply tax losses incurred during the 2019-20, 2020-21 and/or 2021-22 income years to offset tax paid in 2018-19 or later income years. The tax refund will be available for eligible businesses when they lodge their 2020-21 and 2021-22 tax returns.

Combined, the temporary full expensing and temporary loss carry-back measures are estimated to deliver $31.6 billion in tax relief to businesses over the forward estimates, by bringing forward tax deductions or the utilisation of losses from future years.

The government will also now invest an additional $2 billion through the Research and Development Tax Incentive to help innovative businesses that invest in research and development. And the budget also promises $1 billion in new research funding to the university sector in 2020-21, to safeguard Australian researcher effort.

Before the budget, the government had indicated it was looking at tax measures related to training, including an exemption from Fringe Benefits Tax (FBT) for retraining and reskilling workers. The government also said that it would consult on changes to rules around tax deductions for the cost of training.

There are some modest tax breaks for small business start-ups, including certain start-up expenses and certain prepaid expenditure, exemptions from the 47 per cent fringe benefits tax on car parking and multiple work-related portable electronic devices, such as phones or laptops, provided to employees.

Spending measures

To supplement the income support to households from the tax cuts noted above, the government will also inject $2.6 billion of support in the form of two additional Economic Support Payments of $250 each to pensioners and other eligible recipients.

Yesterday, the government had announced that it would invest an additional $1.2 billion to support Australian businesses to employ 100,000 new apprentices or trainees. Starting from 5 October 2020, businesses who take on a new Australian apprentice will be eligible for a 50 per cent wage subsidy, for the period up to 30 September 2021, up to $7,000 per quarter.

The Budget significantly expands on the idea of hiring subsidies by introducing a $4 billion JobMaker hiring credit to provide businesses incentives to take on additional employees aged between 16 and 35 years.

The government also announced that it would support $7.5 billion of new investment in national transport infrastructure.

In the run-up to the budget, the government had said it would provide $1.5 billion in grants to support advanced manufacturing across six ‘National Manufacturing Priorities’ comprising: resources technology and critical minerals processing; Food and beverage manufacturing; Medical products; Clean energy and recycling; Defence industry; and the space industry.

And the government has already pledged almost $800 million for a Digital Business Plan and a further $4.5 billion for upgrades to the NBN, although that will be financed through NBN Co borrowing from private debt markets.

The government will also extend its First Home Loan Deposit Scheme to cover an additional 10,000 first home buyers and will also increase the caps on the price of homes that can be purchased under the scheme.

There will be $1.6 billion for 23,000 additional home care packages.

AICD policy team analysis of key governance initiatives

This year’s budget saw few governance-related policy announcements, with a number of major steps having already been taken by the government over recent months in response to the pandemic including: an extended moratorium on director liability for insolvent trading; modifications to continuous disclosure laws; extended financial reporting deadlines; and facilitation of virtual AGMs and electronic execution of documents.

In a welcome move, the budget has however seen the government announce that it will permanently legislate for virtual AGMs and electronic execution of documents -- thereby going a step further than its recent decision to commence a public consultation on reform.

For trustees of superannuation funds, the government has also outlined (yet) another set of measures aimed at lifting transparency and accountability in the sector. In an apparent response to controversy surrounding charitable fundraising during last summer’s bushfires, the ACNC has been provided with special funding for a field-based compliance review of charities deemed to be at high risk of failing to meet the ACNC’s Governance Standards.

Moving from the compliance to the performance aspect of governance, as part of its Digital Business Plan aimed at lifting the nation’s capacity as a digital economy, the government has also committed funding for a Digital Directors training package to address identified skills gaps at the board level.

The nation is now contemplating a path to economic recovery, in the shadow of COVID-19 and an uncertain global economy. Australia needs a regulatory environment and policy settings that can adjust from crisis mode to a re-set for growth and resilience.

We take a closer look at the key governance and policy priorities highlighted in the budget below.

Virtual AGMs and electronic execution: government commits to permanent reform

In an important step towards the modernisation of Australia’s ageing corporations law framework, the government has committed to making permanent the temporary COVID-19 reforms which allow companies to hold virtual AGMs and execute documents electronically. In doing so, they have gone further than their recent announcements to conduct a public consultation. (It is worth noting that the budget policy measures paper refers only to a consultation while the more detailed factsheet, released in tandem with the budget papers, contains an explicit government commitment).

This announcement will be applauded by stakeholders, including the AICD, who have seen real efficiency and participation dividends from the COVID-19 experience, and pushed for the temporary reforms to be made permanent.

Digital Business Plan: funding for a Digital Directors training package

The government has unveiled a new Digital Business Plan, investing $796.5 million over four years, to further drive progress towards Australia becoming a leading digital economy by 2030 and to improve productivity, income growth and jobs by supporting the adoption of digital technologies by Australia businesses.

Key elements of the Digital Business Plan include:

- A further $419.9 million to enable the full implementation of the Modernising Business Registers (MBR) program (providing the infrastructure for the new Director Identification Number regime commencing in 2021), allowing businesses to quickly view, update and maintain their business registry data in one location;

- $3.0 million over four years from 2020-21 to develop a Digital Readiness Assessment tool to help businesses self-assess their digital maturity, and to support leaders of Australian organisations to improve their digital literacy and decision-making (from earlier government announcements it is clear that the digital literacy measure will be targeted at the board-level);

- $2.5 million in 2020-21 to support an industry-led Digital Skills Finder Platform to enable Australian workers and small to medium enterprises to easily find digital skills training courses for reskilling and upskilling in digital literacy.

The Digital Business Plan measure builds on the objectives of the 2020 Cyber Security Strategy announced in August. The government will invest an additional $201.5 million to deliver a number of initiatives ranging from enhancing law enforcement agencies’ capabilities to combat cyber crime (including through improved coordination across the States and Territories), support for industry and academia to develop innovative approaches to lift cyber security skills and long-term workforce planning as well as improving cyber security resilience of SMEs.

ACNC to subject charities to greater compliance scrutiny

In an apparent response to last summer’s bushfires, the government will provide $2.9 million over three years from 2020-21 to implement a program of field-based compliance reviews to intervene early where charities are at high risk of breaching the Australian Charities and Not-for-profits Commission (ACNC) Governance Standards.

The funding is aimed at strengthening the ACNC’s ability “to provide greater assurance to government and the public that charities have appropriate governance structures in place and are using their income for charitable purposes, including when responding to natural disasters”.

Given the limited information provided, we will await further detail from the ACNC regarding the nature and scope of its review program.

Superannuation – higher expectations on trustees

This year’s budget has seen the government outline a further set of reforms for the superannuation sector aimed at increasing trustee accountability by strengthening their obligations to ensure trustees only act in the best financial interests of members (see press release here).

The government will also require superannuation funds to provide “better information regarding how they manage and spend members’ money” in advance of Annual Members’ Meetings.

We look forward to seeing more detail on the proposed reforms --- the latest government step to address perceived governance weaknesses in the sector.

R&D tax incentive: further changes

The government has also revealed refinements to its R&D tax incentive program, effective from 1 July 2021, aimed at supporting businesses through the pandemic recovery phase.

For companies with aggregated annual turnover of less than $20 million, the refundable R&D tax offset will be set at 18.5 percentage points above the claimant’s company tax rate, and the proposed $4 million cap on annual cash refunds will no longer proceed.

For larger companies with aggregated annual turnover of $20 million or more, the government will reduce the number of R&D intensity tiers from three to two -- the marginal R&D premium will be the claimant’s company tax rate plus: 8.5 percentage points above the claimant’s company tax rate for R&D expenditure between 0 per cent and 2 per cent R&D intensity; and 16.5 percentage points above the claimant’s company tax rate for R&D expenditure above 2 per cent R&D intensity.

Other aspects of the government’s previously announced proposals to refine the R&D program remain including the increase to the R&D expenditure threshold from $100 million to $150 million per annum.

Insolvency reforms to support small business

In September, the government announced significant reforms to Australia’s insolvency regime for small business, coming on the back of the COVID-19 moratorium on insolvent trading for directors.

The reforms, which draw on key features from Chapter 11 of the Bankruptcy Code in the United States, are intended to help more small businesses restructure and survive the economic impact of COVID-19. Where a restructure is not possible, the reforms propose providing access to a simplified winding-up process to enable greater returns for creditors and employees.

The government has outlined further detail and practical guidance on these changes (commencing 1 January 2021) in a budget fact sheet available here. Notably, this includes reference to a proposed consultation on permanently increasing the minimum threshold at which creditors can issue a statutory demand on a company (under emergency COVID-19 relief measures, this threshold has been temporarily raised from $2,000 to $20,000 until 31 December 2020).

The AICD and other industry stakeholders will continue to consider what further insolvency reforms (not confined to small business) may be necessary to kick-start the nation’s economic recovery. Addressing Australia’s onerous director liability settings must be part of that conversation.

Latest news

Already a member?

Login to view this content