The 2014 NFP Governance and Performance Study examines the evolving nature of governance in the not-for-profit sector. Angela Faherty reports.

Only 12 per cent of survey respondents believe things have remained the same, while a minimal two per cent consider things to have worsened during this time, according to the Australian Institute of Company Directors’ 2014 NFP Governance and Performance Study.

The study, sponsored by the Commonwealth Bank of Australia, examined the views of 2,700 NFP directors across a number of organisations ranging from small rural community groups to national organisations with a turnover above $100 million.

“The 2014 NFP Governance and Performance Study, completed by Baxter Lawley on Company Directors’ behalf, is the largest and most comprehensive source of information on the governance of NFP organisations in Australia,” says John Colvin FAICD, CEO and managing director at Company Directors.

“It answers questions about the quality of governance of our NFPs, if this is changing and how boards can improve further. It examines the complex issues of mergers and collaboration, performance measurement and the payment of directors, and identifies the key issues governments should address in supporting the sector.”

Governance performance

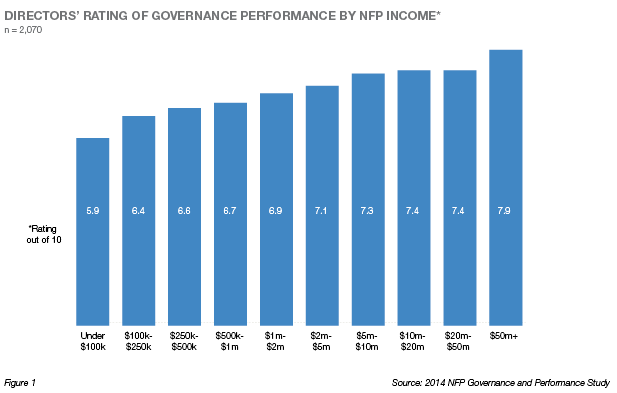

Findings from the study show that directors’ ratings of governance performance varies according to the size of the organisation, with very large organisations — those with a turnover of $50 million or more — averaging a score of 7.9 out of 10, while the average score of the smallest NFPs — those with a turnover of less than $100,000 — was 5.9 out of 10, indicating that governance standards are still meeting basic expectations.

Across different sectors, directors’ ratings of governance performance show only minor variation, with the highest ratings for organisations operating in the aged care or international sectors. The lowest were for those in culture and recreation, religion and business and professional associations.

These results may reflect variations in the complexity and risk of operations but also the average size of NFPs, which differs considerably, the report says. For example, the average annual income of aged-care organisations was $23 million compared with $8.6 million for religious organisations and $7.1 million for those in culture and recreation.

When it came to allocation of time, the survey found that the NEDs responding to the survey divided their time between strategy (22 per cent), managing funding (16 per cent), reviewing performance (14 per cent), risk oversight (13 per cent) and compliance (12 per cent).

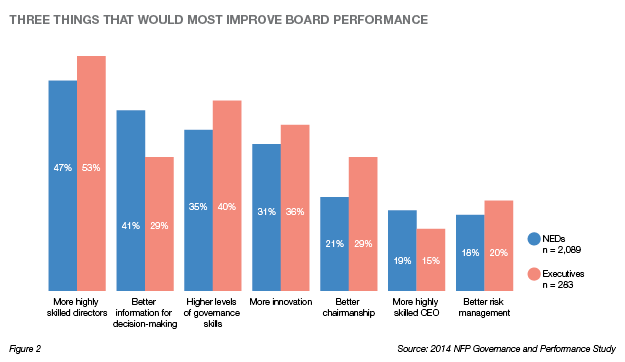

When questioned on how to improve governance, half of all NEDs and executives believe their boards should focus on attracting more highly skilled directors, while 40 per cent of executives want improvement in governance skills.

One in five NEDs and 29 per cent of executives want better chairmanship, highlighting both the high expectations of this role and the need for some chairs to further improve their skills or performance. One in five NEDs believe their governance would be improved with a more highly skilled CEO.

About a third of both NEDs and executives believe their board should be more innovative and one in five believe it should better manage risk. Both innovation and risk were seen as strongly related among those questioned.

The largest difference between NEDs’ and executives’ views on priorities for improvement was related to board information. Forty per cent of NEDs believe their board’s performance would be improved with better information, whereas this was raised by only 29 per cent of executives.

Business evolution

The study also shows the extent to which governance structures of NFPs are evolving. Approximately one third of boards are planning revisions to their organisation’s constitution (or equivalent document, such as statement of purpose, rules, or articles of association) in the next 12 months.

In most cases, this is driven by a need to revise outdated procedures; improve organisational agility; change mission or purpose in response to changing client needs; or in response to changing legal obligations.

Nearly half of those implementing changes will be amending their board structure, for example, changing from a representative model to a skills-based or independent board, while 17 per cent of boards are seeking to change their legal structure.

The study also found that boards are continuing to invest in formal professional development with nearly three quarters of NFP NEDs reporting that their boards had undertaken one or more forms of formal professional development in the last year. Thirty-seven per cent reported individual directors had undertaken external training; 35 per cent reported that their board undertook an internal assessment and 25 per cent said that they had in-house training. Only 15 per cent had external whole-of-board training. The study also found that medium and large NFPs struggle the most to provide professional development.

Collaboration and mergers are also becoming more commonplace in the NFP sector, the study found, with two-thirds of directors stating their NFP works with others to advocate for their sector or to service beneficiaries, while 38 per cent have an agreement or memorandum of understanding to refer or service clients. This trend is highest among NFPs in the health, education and social services sectors.

Mergers are also being discussed by 30 per cent of boards, most commonly, in larger NFPs, with the main reasons cited as a way to improve existing services, efficiency or to broaden the range of services to existing service users. Twenty per cent said mergers were considered in order to make the business more attractive to funders and 18 per cent said it was in response to encouragement by the government.

With the overall performance of an NFP determined by how well it achieves its mission or purpose, it is interesting to note that only 50 per cent of directors believe their organisation measures this effectively. Approximately 60 per cent of directors want more measures of achievement of their mission and half want more non-financial performance measures in general. About forty per cent want more information about risk, data on the sector and information on achievement of financial benchmarks.

Latest news

Already a member?

Login to view this content