Outsourcing is going to get even bigger as balance sheets need to get lighter. Here's a checklist for directors to take to the next board meeting.

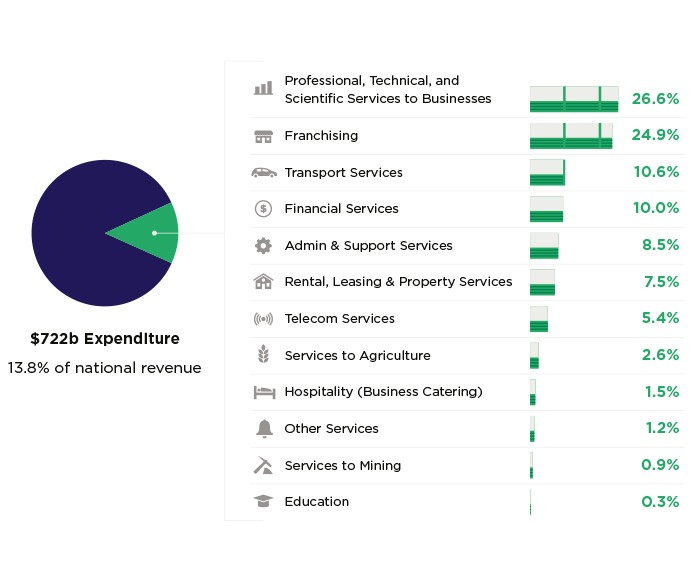

As businesses have become more complex in the post-industrial “infotronics age” over the past half-century, so outsourcing non-core activities has become de rigueur. In the fiscal year, outsourcing is estimated to be $722 billion in costs (plus revenue to the supplying specialists). This is nearly 13 per cent of the national revenue this year, and is around 37 per cent of the expected GDP of almost $2 trillion in 2018–19, although that share tends to exaggerate the importance of outsourcing by comparing revenue with value-added dollars (on which GDP is based).

The biggest category is professional, technical and scientific services, at almost 27 per cent of the total and now Australia’s third-largest employing industry division after health and community services, and construction. It includes legal, accounting, engineering, consulting and a host of other services. Franchising comes in second, at a quarter of the total, and represents the total outsourcing of operations except for intellectual property (IP) and know-how and support activities.

Transport was one of the earliest non-core activities to be outsourced, in the mid-1960s. That led to the rise of new corporate giants such as TNT and Mayne Nickless, now displaced by even bigger giants such as Toll in recent years. Transport now accounts for more than 10 per cent of total outsourcing. Administration and support services, now nudging nine per cent, has enjoyed extraordinary growth this century via personnel consulting and staff-hire services, payroll, call centre, cleaning, gardening and other activities once done in-house. Businesses will spend over $61b on this category in 2018–19. Mining companies will spend almost $20b on contract mining and other services. The ultimate capacity for business outsourcing could see it close to $2 trillion as we enter the 2030s.

There are two common misconceptions about the reason for business outsourcing. Firstly, it is different to subcontracting. Secondly, it is not primarily about cost saving as much as the need of simplifying operations and the span-of-control dilemma. Subcontracting involves getting another supplier to do something you cannot do yourself. Outsourcing is something done in the past, but now deemed non-core, so someone else can do it.

This leads to two factors intrinsic to effective outsourcing. One is that a non-core activity should only be outsourced as an efficiently run activity, otherwise the cost of the new supplier in fixing/modernising it becomes high, and the executive in charge of it is ill-equipped to deal with that supplier or potential suppliers in the future. The second factor is that chasing the lowest cost should not be the prime objective; it is far more important to have smoothly eliminated an activity that distracts from the main game of the business and reduces the span-of-control complexity.

The end game is to create a more “virtual” corporation. This term originated in the early 1990s. The concept recognises that the three most vital elements of a successful modern business are: unique IP, a unique organisational culture and first-class leadership.

Passive assets such as property, stock and debtors have no place on a modern balance sheet. It is impossible to achieve world’s best practice profitability with such passive assets. And non-core activities are a massive distraction from the vital elements mentioned above. Outsourcing is not only here to stay, it is a condition of survival for future business.

Outsourcing checklist

- Do you own any property, equipment, stock or debtors on your balance sheet that could be rented, leased or factored off, creating cash for expansion and more uniqueness in the form of IP?

- Do you have support activities, non-core to the business’ success, which involve capital equipment that could be cashed in by outsourcing these activities?

- Is your business sufficiently unique and capable of franchising where you then earn income and support service fees without needing property and/or stock (now the responsibility of the franchisee)?

Latest news

Already a member?

Login to view this content