Company directors must ensure they are protecting personal liability against financial loss with reliable D&O insurance cover. Tricia Hobson outlines the basics for directors.

The risk landscape for directors right now is complex and, it seems, ever increasing. I have never quite understood why so many directors I’ve advised over the years don’t better understand how directors and officers liability (D&O) insurance works. Many directors have taken the view that as long as they have their company indemnity and know the policy is in place, then this is comfort enough.

If you have a company of real means to support you, this may be OK. If you don’t, this policy can be a director’s personal lifeline in times of real need. It’s one of the true personal assets you have for protection in challenging and often unforeseen times.

Challenging risk times they certainly are. The impact of securities class actions is well known. Most of them are brought against the company directly, although occasionally, and perhaps increasingly (particularly as Side C entity cover gets harder to obtain), against the directors themselves as accessories to the “crime”. Either way, the D&O policy is called upon — and the D&O insurance market has been hit heavily.

This might explain the recent premium increases for larger ASX-listed companies, but what about the others? They have been less impacted, but insurers may still seek more modest increased premiums to make up for overall losses. And it’s not just the securities class actions impacting.

The Hayne and other Royal Commissions are an obvious factor. Personal exposure for directors is also on the rise with controversy around #MeToo, cyber and ESG (environmental, social and governance) issues including climate change litigation. Regulatory actions and investigations are also likely to rise.

The Corporations Act 2001 (Cth) duties remain essentially the same, but given the arguably seismic shift in the landscape in which directors are now acting, combined with the Australian Securities and Investments Commission’s (ASIC) own why not litigate approach, a fresh round of cases — both by the regulators and a now far more sophisticated plaintiffs’ bar backed by the funding market juggernaut — will likely see the duty boundaries tested extensively once again. Whether we like it or not, we have a litigious culture in Australia, second only to the US.

The financial damage these potential actions and investigations can wreak can be considerable — and swift. Defence costs for a securities class action are typically in the order of $10m to $20m. Investigations can easily and quickly incur legal costs of more than $1m for each director. Is your company financially sound enough to withstand this cost? Is the indemnity it gave you enough protection?

AICD calls for independent inquiry

In its final report on class actions and ligation funders, released in January, the Australian Law Reform Commission recommended the government commission a review of the legal and economic impact of the operation, enforcement and effects of continuous disclosure obligations and those relating to misleading and deceptive conduct.

The AICD advocated for the inclusion of this recommendation, arguing that continuous disclosure obligations play an important role in promoting market integrity and investor confidence, and that a review would present a timely opportunity to consider whether the laws and their interaction with the class actions regime are operating as intended and serving the interests of justice.

Here to help

D&O Insurance is there to help in most of these situations. There are some risks the policy legally cannot cover given prohibitions under the Corporations Act — mainly relating to acting wilfully and in bad faith. But the general nature of the cover is wide. Yes, the D&O insurance market is now under strain and premium prices are increasing, but if there is any question raised about actually taking out or renewing the cover, think long and hard about the consequences for you and the company if your decision is no.

Not all policies are created equal and it is important to understand what cover you have — and, if it’s not best in class, what you can do to get better terms at an acceptable price in this challenged market.

Standalone D&O policies are common for bigger companies and generally provide broad cover. The trend over the past few years, for medium to smaller companies, is for their D&O cover to be included in a management liability policy — which packages different types of cover together. We’re starting to see some real variations in what is offered by different insurers in this class. Your broker can help you navigate your cover but, based on experience, here are a few specific fundamentals to look out for — the list is by no means exhaustive:

Advancement of defence costs

You want a “final adjudication clause” — so insurers must advance your defence costs (with the right to ultimately recoup if necessary) if allegations, such as dishonesty, are made that would otherwise mean they can deny cover. It means the insurer cannot act as both judge and jury.

Who controls the decision-making?

Even if the insurer appoints and pays for a lawyer for you, they are appointed to act for you, not the company or the insurer. Make sure their letter of engagement is clear about this. Check your policy wording about who has final say on specific matters such as settlement. Get your broker to negotiate as much control as possible.

How much cover do I really have access to?

You may share your limits with multiple directors and even the company, so they can erode quickly. Check whether the policy prioritises payments to individuals in the company — you want it to. Also, be aware that different limits and sub-limits may apply for different types of cover.

Are investigations, fines and penalties covered?

With the rise in the use and monetary value of civil penalties, check you have cover. If prohibited by statute, you won’t get cover, but you’ll likely get it for penalties for inadvertent conduct. This may change as the nature and use of penalties evolves, particularly post-Hayne.

How can I get the best cover at the best price?

Big companies get good face time with underwriters. Financial soundness has been underwriters’ main focus and, of course, it is still very important. However, conversations will go beyond this to address the new risks emerging from the current non-financial risk and cultural focus.

Can I choose my own lawyers?

For bigger companies, most likely. However, many policies dictate that the insurer has the ability to choose a lawyer for you from a panel. Quality and experience varies greatly, so get involved in the decision.

Courting the underwriters

Bigger listed companies have the largest threat of securities class actions so, in this market, underwriters are wary. But bigger risks mean bigger premiums, so underwriters will still want to write some, being careful to pick the ones they see as less likely to get hit by actions. They will ask questions about how you handle difficult situations to test your risk and cultural attitudes.

They will want to hear about your non-financial risk framework, your response to the current remuneration focus, and will try to test that you walk the walk, not just talk it. Underwriters will tend to walk away from companies they consider “smell bad” culturally.

The reality is, there is less scope for such engagement for smaller companies. These directors should get more involved with the placement and renewal processes. Make sure proper care is taken over the proposal form — that it is not just a box-ticking exercise — and provide as much relevant supporting information as you can as to why your company is financially sound, a good corporate citizen and therefore a good risk.

The overall message is to sell your good work as a director to the insurers. Always keep in mind these insurers are struggling, just as you are, to work out how to measure culture. One thing is certain — they know the companies with the best culture are the best risks to write.

Tricia Hobson is immediate past global chair of Norton Rose Fulbright and head of Insurance Australia and Asia Pacific/co-head of Cyber and Incident Response Practice. Not all policies are created equal and it is important to understand what cover you have — and, if it’s not best in class, what you can do to get better terms at an acceptable price.

D&O challenge

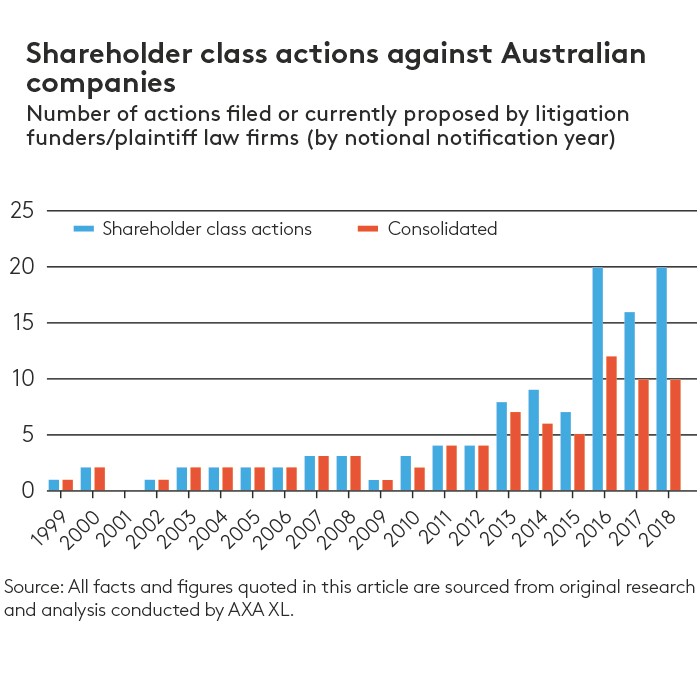

The growth in shareholder class actions has increased Directors & Officers Liability insurance claims, writes Ewen McKay, product leader management liability Australia for AXA XL.Shareholder class actions against Australian companies

It would be apparent even to the most casual observer that the Australian Directors and Officers Liability (D&O) insurance market has seen significant changes during the past two years. In insurance parlance, this is a “hardening” phase of the insurance cycle characterised by increasing premiums and reduced underwriting capacity

This is particularly the case for D&O policies, which, in addition to the usual coverage provided to the board of directors, extend cover to the company itself for securities claims (often referred to as “Side C” cover). Most of Australia’s larger listed companies carry Side C cover, as do many medium and small market cap companies. Initial signs of an impending hard market became apparent in early 2017, with changes accelerating during the intervening period. Year-on-year premium increases of more than 50 per cent have become common for this type of insurance, some reaching 400 per cent or more. This has been coupled with the majority of D&O insurers reducing underwriting capacity — that is, reducing the amount of cover (policy limit) they are prepared to offer, or in some cases withdrawing from perceived “high-risk” industry sectors.

Of the four major D&O insurers active in 2016, one large global insurer has completely withdrawn from the Side C D&O market in Australia, another has all but exited the market, while a third has significantly reduced its risk appetite, offering lower policy limits while significantly increasing premiums and retentions, as well as withdrawing from some industry sectors.

How did it come to this? Since 2004, D&O premium rates have been reducing at a steady pace, except for a short period of modest recovery post-GFC. This “soft” market was driven by an increasing supply of optimistic underwriting capacity, leading to an intensely competitive D&O insurance market. By 2016, D&O premium rates were at an all-time low. As is inevitably the case with the “insurance cycle”, reality eventually struck in the form of unanticipated claims — a growing wave of shareholder class actions from 2011 onwards — which has seen this type of claim become the single most significant cause of D&O claims against listed companies in Australia.

The consolidated numbers shown in the chart (above) are adjusted for competing class actions, where there is more than one claim in respect of the same cause.

As the chart illustrates, prior to 2011 there was an average of two shareholder class actions a year against Australian companies. From 2011, the average is more than seven and in the past few years it has grown to 10 claims a year.

There are two defining factors to the historical shareholder class action claims experienced in Australia that amplify the significance of this surge in frequency. Firstly, nine out of 10 shareholder class actions are finalised by a settlement between the parties. Only about one in 10 has been withdrawn or “struck out” by the court at an early stage. Secondly, historical average settlements have been just under $50m, ranging from a few million dollars to $200m. Defence costs can amount to an additional $10m to $20m on currently litigated matters.

Total historical settlements for shareholder class actions against Australian companies now total more than $1.8b, with D&O insurers estimated to have contributed more than $1.1b to these settlements, plus defence costs.

The evidence points to continuing deterioration of the D&O insurance market. It has taken 20 years of shareholder class actions in Australia to reach this point. However, about 45 per cent of all such actions ever commenced are in the litigation “pipeline” awaiting resolution.

These unresolved claims are yet to be fully quantified and recognised in the D&O market’s underwriting results. As these settlements ultimately flow through to D&O insurers, their impact is likely to be felt over a relatively concentrated period of three to four years resulting in probably the worst ever year-on-year underwriting losses for the Australian D&O market.

It is therefore difficult to see much prospect of imminent relief for D&O insurance premiums.

Latest news

Already a member?

Login to view this content