Board of directors should consider reviewing their governance, strategy, risk management and metrics as climate risk integration becomes mainstream.

Climate change has evolved from a “non-financial, ethical, environmental” issue to one that presents financial risks (and opportunities) within mainstream investment horizons. Mainstream investors and corporate regulators are beginning to demand a step up in climate risk fluency from directors and more meaningful disclosures in annual reports, particularly for listed entities and those with material exposure to climate risk.

In its February 2018 Regulation of Corporate Finance report, the Australian Securities and Investments Commission (ASIC) asserted that “environmental and other sustainability risks (including climate risk) generally require a proactive approach to strategy and risk management”. ASIC Commissioner John Price has flagged the authority would review this year’s annual reports to monitor how companies across the ASX 300 index were disclosing information on the matter.

The Australian Prudential Regulatory Authority (APRA) has signalled it is paying attention to the issue in its supervision of APRA-regulated entities.

Recommendation 7.4 of the ASX Corporate Governance Principles, concerning sustainability disclosures, refers to “environmental and social risks” and proposes that listed entities with material exposure to climate change risk be encouraged to consider implementing the recommendations of the Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosures (TCFD). The FSB brings together senior policymakers from the G20, plus Hong Kong, Singapore, Spain and Switzerland to strengthen financial systems and increase the stability of international financial markets.

In March, the federal government welcomed the final report of the TCFD as a framework consistent with the existing disclosure requirements in the Corporations Act 2001 (Cth) for investors and companies to assess and price climate-related risk and opportunities. It’s an approach that is particularly relevant for large listed entities with material climate risk exposures.

Leading market stakeholders have begun to recognise that issues associated with climate change present significant economic and financial risks (and opportunities) over long- and shorter-term investment horizons. Such risks and opportunities arise not only from the physical or ecological impacts of climate change, but associated economic transition risks such as capital market dynamics, including technological developments, and shifting investor, insurer and customer views, and litigation exposures (regulatory and private).

Paris accord

The primary catalyst for this evolution in mainstream market concern is the UN Paris Agreement on 12 December 2015. It represents a commitment by the governments of 197 signatory countries to a goal of limiting the “increase in the global average temperature to well below 2°C above pre-industrial levels” and to pursue “efforts to limit the temperature increase to 1.5°C above pre-industrial levels” — and, perhaps most significantly, to shift the global economy to “net zero emissions in the second half of this century”.

In order to meet the Paris goals, each country will need to significantly reduce its “business as usual” emissions, while the global economy, which has been heavily reliant on fossil fuel combustion since the industrial revolution, will need to transform, at scale and with speed. The impacts are likely to be felt across all asset classes and industrial sectors, in particular by carbon-intensive industries.

Taskforce recommendations

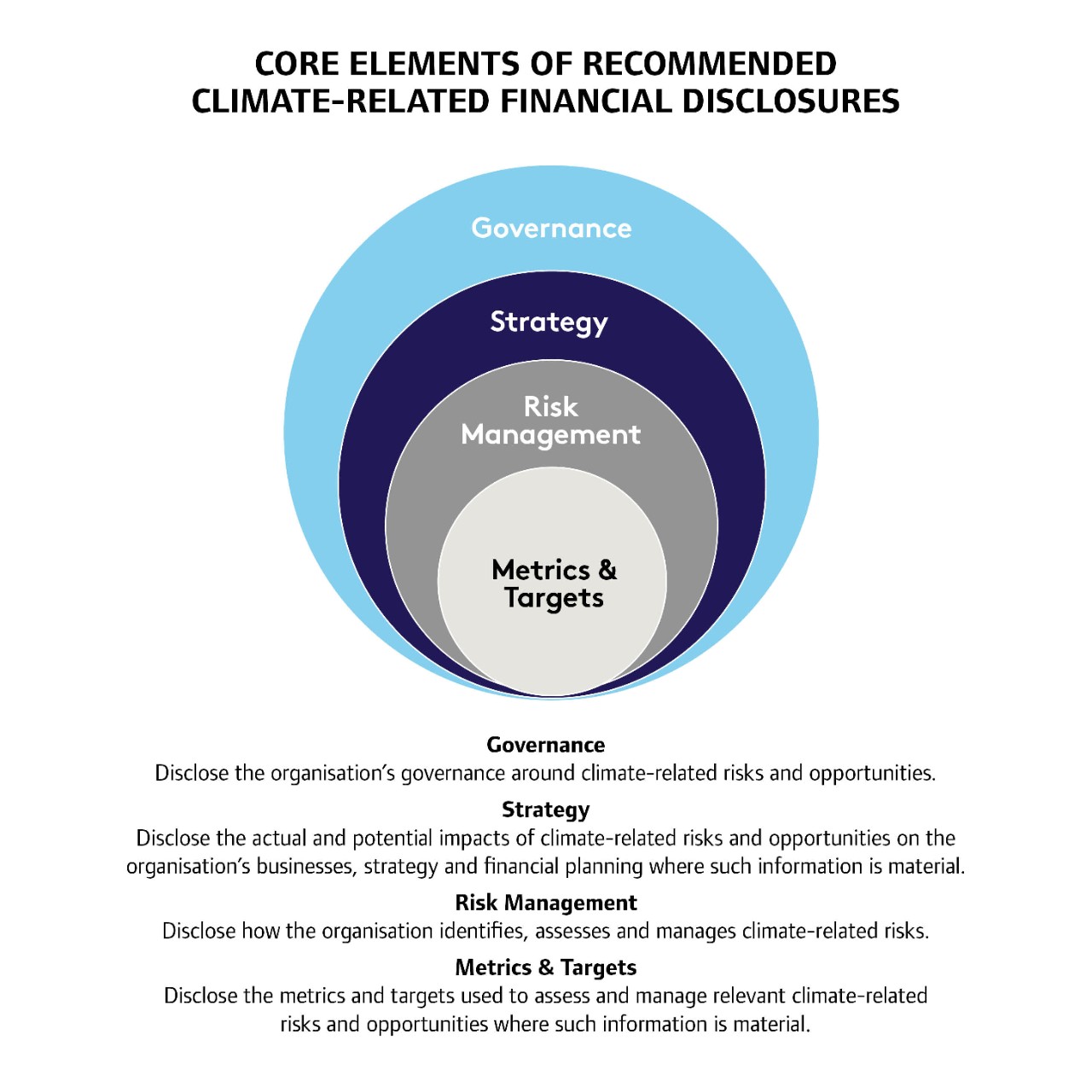

In June 2017, the FSB released the recommended framework of the TCFD for climate risk governance, strategy, risk management and disclosure by financial sector participants and the corporations they invest in. The TCFD was charged with the development of “voluntary, consistent climate-related financial disclosures” that would be “useful to investors, lenders and insurance underwriters in understanding material risks”.

Its recommendations purport to provide guidance on those forms of financial analysis and disclosure likely to be necessary for corporations to present a true and fair view of a company’s financial position in terms of performance and prospects. They place specific emphasis on forward-looking disclosures and the impact of climate change on corporate strategy, recognising climate change presents prospective issues “without historical precedent”. Accordingly, they emphasise the importance of scenario planning in corporate strategy and planning — including for the Paris Agreement’s goals.

What Australian regulators say

In October 2016, the Centre for Policy Development and Future Business Council published an opinion by Australian Bar Association President Noel Hutley SC. He concluded that, as a matter of Australian law, directors must actively engage with the impacts of climate change-related risks on their operations and strategy in order to satisfy their duty of due care and diligence under section 180 of the Corporations Act 2001 (Cth). In the past 12 months, corporate regulators have echoed his conclusion that climate change should be integrated into Australian directors’ governance and disclosure agendas, approaching climate change through a financial risk (and opportunity) lens.

What directors should do

The scale of the shift in thinking, the scope of the issue and the inherent uncertainty involved in stress testing and scenario planning can be daunting for corporations unaccustomed to considering climate change through a financial risk and opportunity lens. Although each case will be determined on its merits, many investors and regulators want assurance that boards understand the relevant risks and are actively considering their implications for strategy and financial planning, even if only at an early stage. Suggested first steps include:

- Mechanisms for board oversight

- Risks management

- Implications for strategy

- Scenario testing

The board, C-Suite and finance team should be briefed on the contemporary climate risk landscape, and ensure a mechanism is in place for board oversight — as with any other financial risk.

Consider how climate change presents risks and opportunities for companies in your sector. Guidance from the TCFD and the Sustainability Accounting Standards Board can be useful here.

Consider how those risks manifest for the unique business, and their implications for current strategy and risk management.

Stress test business plans against a plausible range of climate futures. At a basic level, your board and executive team should ask: “How will our business thrive across a range of potential climate futures in the short, medium and long term?” What is your strategy re strong near-term action (which accelerates economic transition risks) vs business as usual (which accelerates physical impact risks, delaying sharper transition)?

Climate change cannot be consigned to a corporate compliance, public relations or social interest silo. Its impact on balance sheet items and forward-looking risk strategy must be reconsidered in an integrated manner in the light of contemporary economic realities. This is critical for directors who sign off on financial accounts and narrative managerial statements, as well as accounting and risk advisors. Failure to do so may place significant shareholder value at risk.

Latest news

Already a member?

Login to view this content