In recent months, the AICD made submissions on the Government’s proposed mandatory climate disclosure framework and the content of reporting standards, with the regime proposed to commence as early as 1 July 2024.

Summary:

- The AICD supports a mandatory climate-related financial disclosure regime that is internationally aligned and meets the policy objectives of high-quality, comparable, and useful climate disclosures. However, we are concerned that key aspects of the proposal do not meet these objectives.

- Most notably, the omission of forward-looking disclosures from the limited immunity three-year regulator-only enforcement period (including transition plans) will leave companies vulnerable to private litigation in a disclosure area marred by significant uncertainty and litigation risk.

- The AICD has strongly advocated for the limited immunity to cover all forward-looking disclosures required under the Sustainability Standards, including transition plan disclosures. A failure to do so may lead to generalised and unhelpful disclosures.

- Directors cannot make unreserved statements of compliance with the Sustainability Standards. Directors should only be required to state that they have ‘reasonable grounds to believe that’ the climate disclosures are in accordance with the Sustainability Standards and Corporations Act.

- The scope of entities covered by the proposed regime needs to be narrowed and explicitly exclude NFPS.

What is the Government proposing?

The Government’s proposal, as set out in the Draft Legislation issued for consultation on 12 January 2024, is summarised in this article, and also below:

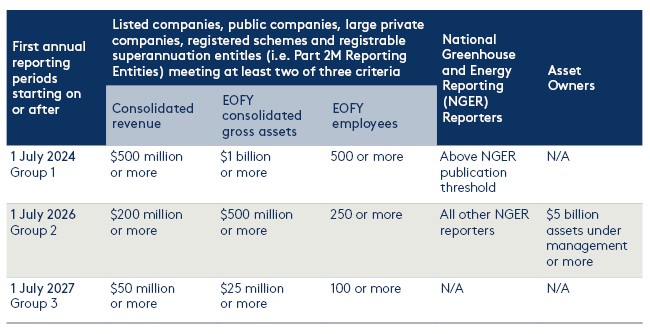

- WHO must report and WHEN: A three-tiered approach is proposed based on organisational size (see table below), with Group 1 entities reporting from the reporting period commencing 1 July 2024. While charities registered with the Australian Charities and Not-for-Profits Commission (ACNC) are excluded, not-for-profit (NFP) entities not registered with the ACNC that meet the relevant thresholds are captured. However, it is proposed that only those Group 3 entities facing material climate-related risks or opportunities are required to disclose under the regime. Those that conclude that they do not have material climate-related risks and opportunities will have to disclose this fact, and explain their rationale in reaching this conclusion.

- WHERE will the disclosures be set out? Disclosures are to be made annually in a separate Sustainability Report which sits within the Annual Report (the other ‘parts’ of the Annual Report being the Financial Report, Directors’ Report and Audit Report).

- WHAT DISCLOSURES will be required: Entities must disclose under the Australian Sustainability Reporting Standards. The Sustainability Standards have taken the International Sustainability Standards Board (ISSB) Standards (IFRS S1 and S2) and adapted them for the Australian context by the Australian Accounting Standards Board (AASB). The content of the Sustainability Standards have yet to be finalised, with a consultation period recently closing (see discussion and AICD position below). Directors will be required to state whether, in their opinion, the disclosures are in accordance with the Sustainability Standards and Corporations Act.

- WHAT ASSURANCE will be required: Assurance is mandatory but will be phased in, starting with limited assurance over Scope 1 and 2 emissions for those disclosing from 1 July 2024 (assurance start state), and ending with all climate disclosures subject to mandatory assurance from 1 July 2030 (assurance end state). The Auditing and Assurance Standards Board (AUASB) has been tasked with setting an ‘assurance roadmap’ for the phase-in of mandatory assurance requirements between the assurance start state and assurance end state.

- WHAT are the consequences for not complying/poor compliance? The failure to keep and retain sustainability records and make the Sustainability Report publicly available after lodgement with ASIC will attract civil penalties or even gaol time. These are among the over 15 new or modified offences created by the new regime. It is proposed that a fixed three-year regulator-only enforcement period (with limited immunity) will apply to scope 3 emissions and scenario analysis statements made in any Sustainability Report for a financial year commencing between 1 July 2024 and 30 June 2027. Critically, and in a departure from what Treasury previously proposed, the limited immunity does not currently extend to transition plan disclosures.

What are the Sustainability Standards that entities will need to comply with?

The draft Sustainability Standards largely mirror the ISSB Standards, with some Australian-specific modifications to address legal and practical nuances and to reflect the Government’s proposal for mandatory climate reporting – see this article for a summary of the main deviations.

There has been some criticism that the cumulative effect of the deviations may jeopardise international alignment and comparability, causing confusion for investors and regulatory complexity for reporting entities.

What is the AICD’s position?

The AICD’s starting position is to strongly support a mandatory climate-related financial disclosure regime that is internationally aligned and meets the policy objectives of high-quality, comparable and useful climate disclosures. Ensuring that the legal settings are appropriately framed is key to achieving the regime’s policy objectives.

We are concerned that aspects of the proposed regime do not align with the regime’s objectives and policy intent. In particular:

- Limited immunity: The omission of forward-looking representations, including transition plans from limited immunity is of utmost concern as it will leave companies vulnerable to private litigation in a disclosure area marred by significant uncertainty. The AICD has strongly advocated that the limited immunity must cover all-forward-looking disclosures required under the Sustainability Standards, including transition plans. The limited immunity should also cover substantially similar disclosures made outside of the Sustainability Report that were originally made in the Sustainability Report and to any legally required updates (such as those required under continuous disclosure laws).

- Director declaration: Given the nascent and inherently uncertain nature of climate-related disclosures and that consideration that reasonable assurance over all disclosures is not required until 1 July 2030, director declarations should be suitably qualified. At a minimum, directors should only be required to opine that they have ‘reasonable grounds to believe that’ the climate disclosures are in accordance with the Sustainability Standards and Corporations Act. Unreserved statements of compliance in the absence of assurance cannot be provided.

- Assurance: The phase-in of reasonable assurance (currently proposed for 1 July 2030) should be accelerated to support market confidence in the accuracy of reporting and mitigate liability risks for entities and directors.

- Group 3: The thresholds for Group 3 entities are too low and should be increased to 100 million (for consolidated revenue) and $50 million (for consolidated gross assets). The proposed ‘additional’ entity-level materiality threshold does not relieve the regulatory burden for Group 3 entities and risks confusing (or even potentially undermining) the application of materiality under the Sustainability Standards.

- NFPs: We are concerned about the inclusion of NFPs in the absence of specific consultation with the sector, noting that charities are proposed to be excluded.

The full AICD submission can be found here.

In relation to the content of the Sustainability Standards, the AICD has taken these positions:

- International comparability: The AICD supports the principle of international comparability, as far as is reasonably practicable. However, we recognise some disclosure areas may require clarification in their application to the Australian context. We support necessary clarifications to reduce the compliance burden on entities.

- Director Declaration: Entities and directors cannot provide an “explicit and unreserved statement of compliance” as currently proposed under the Draft Sustainability Standards. Any director or entity sign-off must be qualified and mirror what is required under the climate reporting legislation (see above).

- Group 3 and Not-for-Profit (NFP) entities: If covered (noting our views above), these entities should be subject to simplified reporting standards, with scope 3, scenario analysis and forward-looking financial impact disclosures removed or simplified.

- Industry metrics: Industry-based metrics should be initially voluntary to allow entities time to upskill and focus on the cross-industry metrics.

- Further support: Guidance is needed on the application of materiality (particularly given the “Group 3 materiality threshold”) and the “reasonable and supportable information available to the entity at the reporting date without undue cost or effort” test contained in the ISSB standard (and proposed to be replicated domestically).

The full submission can be found here.

What happens next?

The Government is considering stakeholder submissions on its Exposure Draft and will then introduce a bill into Parliament. At the same time, the AASB needs to issue the final Sustainability Standards. Concurrently, the AUASB will be working on Australian sustainability assurance standards, as adapted from international standards issued by the International Auditing and Assurance Standards Board (IAASB) (although the IAASB is not due to finalise the international standards until September 2024).

There is significant doubt as to whether any bill could be legislated prior to 1 July 2024, particularly given the likelihood that any bill would be referred to a parliamentary inquiry. A January or July 2025 commencement date seems increasingly likely.

For more practical steps that directors can take, including key questions to ask of management, see the Climate Governance Imitative (CGI) Australia’s Director’s Guide to Mandatory Climate Reporting. A revised version of the guide will be issued after the bill has been introduced into Parliament. However, its core recommendations remain relevant for directors looking to prepare for the regime.

Latest news

Already a member?

Login to view this content