With capitalism being tested as a viable long-term socio-economic template, there is debate about practical — and palatable — alternatives, writes economist and director, Carol Austin.

American civil rights activist Martin Luther King once said, “The arc of the moral universe is long, but it bends towards justice.” It’s not an original quote, dating back to the early 19th century. but as we approached the 21st century, many embraced this view of history.

By the year 2000, the number of democracies in the world had trebled from 39 in the mid-1970s to 120. Growth had been strong and global trade had outpaced global growth by a wide margin. Overall, there had been a significant increase in living standards and a large reduction in levels of extreme poverty during this period.

By any measure, the postwar period was one of increasing prosperity and liberal progress. Globalisation, capital policies, the spread of democracy and the adoption of the free market all played an important part in this remarkable progress.

The security umbrella provided by the US, in addition to its strong financial support for international institutions — the rules-based international order — were also important contributing factors. Within societies, rising prosperity allowed the emphasis to shift from social justice to identity politics. Two decades on from 2000, the story is very different. The reversal of important trends reflects a complex intermingling of political, economic and social factors.

At a fundamental level, we have witnessed an erosion of commitment to common purpose. As memories of World War II and the Cold War have faded, security concerns that bind citizens together have weakened. The progress in eliminating extreme poverty reduced inequality between nations, but it also contributed to increasing inequality within nations — particularly in developed Western countries.

At the same time, social and economic liberalism has shifted the balance between individual freedoms and society. In combination, there has been a decline in “collective purpose”. The resultant fragmentation into a mosaic of smaller groups shaped by ethnic, religious, regional or gender links has eroded the sense of common identity, and with it, commitment to policies that advance the common good.

Economic drivers

Economic factors also played a key role. The global financial crisis in 2007–08 (GFC) exposed fault lines in the market-based capitalist system. For the first time since the end of the Cold War, the supremacy of the capitalist model has been called into question. The crisis had devastating consequences for individuals and businesses, but it also undermined the moral authority of liberal democratic governments. There has been considerable soul searching in the aftermath of the GFC.

Long periods of stability often lead to complacency, hubris and overreach. Some argue that capitalism has succumbed to this malaise while others believe there are inherent problems with the capitalist system itself. There is now a lively debate about ways to increase competition, particularly in tech industries — currently dominated by Big Tech firms Apple, Google, Facebook and Amazon — with the aim of revitalising capitalism. Separately, economic research is clustering around key themes, particularly the role of capitalism in generating income and wealth inequality as well as the propensity for capitalism to sacrifice the future in pursuit of short-term gains.

A wave of new data-based research is analysing inequality from an efficiency and political interference perspective rather than through the lens of social justice. They argue that if inequality causes individuals to perform below their potential, then it undermines productivity and the overall growth potential of the nation. Links between excessive concentrations of wealth and undue political influence are also being researched.

New economic thinkers are applying advanced analytical techniques to newly available big data sets. French economist Thomas Piketty, author of Capital in the Twenty-First Century and Capital and Ideology, was among the first to popularise these ideas.

Heather Boushey is CEO and co-founder of the Washington Center for Equitable Growth, and her new book, Unbound: How Economic Inequality Constricts Our Economy and What We Can Do About It, summarises the endeavours of a number of young economists working in this field. Walter Scheidel strikes a significantly more sombre note in The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century.

At a more basic level, economists have long known that reforms will only increase national prosperity if they generate net positive benefits after compensating the losers. Full compensation has not been the norm so it is not surprising that workers displaced by globalisation have been among some of the most vocal opponents of open international trade.

All of these problems were exacerbated by the GFC, but opinion remains deeply divided on its root cause. We are also no closer to understanding why the recovery has been so weak, why wages growth has been so feeble and why investment spending is so low despite the massive amount of monetary stimulus and interest rates being low. Perhaps it is time to start exploring new approaches.

Why is it so?

The pervasive nature of the problems suggests the underlying causes are structural. One area attracting some attention is demographics. In particular, the role of the baby boomer generation. In the early part of their working lives, baby boomers were big spenders rather than savers. This contributed to the surge in inflation during the 1970s and ’80s. As they have started to move into retirement, changes in their spending and savings patterns are depressing growth rates and contributing to the surge in asset prices. This cohort is also changing the dynamics of the labour market. Despite solid population growth, the size of Australia’s working-age population is now declining as the number of retirees exceeds new entrants. Similar trends are evident across most OECD countries.

We do not fully understand the implications of the baby boomer generation ageing, but experience from Japan provides salutatory lessons. The Japanese working-age population peaked more than two decades ago. They have experimented with a wide range of unconventional policies — including spending on the construction of bridges to nowhere — but have still struggled with low or negative growth, inflation and interest rates. Demographics add to the challenges facing liberal democracies. These are indeed difficult times.

Debates have become more polarised — rural vs urban, cosmopolitan vs traditionalists, young vs old, and environmentalists vs climate deniers. Populist leaders have sought to exploit these divisions.

More broadly, a toxic mix of failed economic policies, inaction on climate change, anxiety about rapid social changes and uncertainty about the geopolitical order have fuelled political upheaval and contributed to the rise of anti-establishment leaders, which, in turn, is challenging the fundamentals that underpin liberal democracy.

Across the globe, the forward momentum of democratic trends has reversed. According to advocacy agency Freedom House, from 2006 to 2017, the number of countries experiencing decline in freedom outnumbered those experiencing increases, with 113 nations experiencing a net decline in freedom.

Many of these factors are global and beyond Australia’s control, but there is much we can do for ourselves. We need to take a fresh look at many of the norms and institutions we have taken for granted, including global security, the rules-based international order and how the capitalist system operates.

We also need to recognise that many of these problems are too important to be left to government alone.

With declining relative power, US support for global security and international institutions is waning. At a time when the global economy is mired in slow growth, the world’s leading economic power is becoming increasingly isolationist and more protectionist.

The shift from a unipolar to a multipolar world will usher in a period of greater global instability. It will embolden autocratic leaders to test boundaries and will favour the powerful over the just. Hal Brands and Charles Edel explore these themes in The Lessons of Tragedy: Statecraft and the World Order.

On the home front

As a small, globally connected nation, Australia will need to allocate greater resources to defence and to supporting the multilateral institutions that champion a rules-based international order. Civil society helps to create the glue that binds us together as a nation. By strengthening links with communities, business can help to buttress our society against illiberal populist forces.

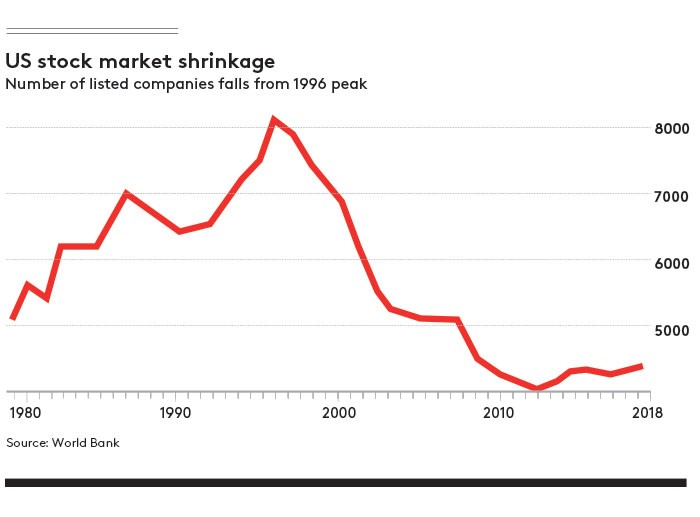

In 2019, more than 180 US CEOs of major corporations signed the US Business Roundtable Statement on the Purpose of a Corporation, formally committing their organisations to broader objectives beyond the pursuit of shareholder value. While these developments are positive, listings on major stock exchanges are declining as companies are being taken private or are remaining private for longer periods (see graph). This partly reflects the short-term focus of equity markets. However, the increasingly onerous nature of regulatory compliance is also playing a role. The most constructive way forward is for business, regulators and government to work together to maximise the contribution of business to the nation’s growth and wellbeing. Of course, this is easier said than done.

With the easy gains from past reforms behind us, we need to develop a new ambitious agenda. The Australian Productivity Commission’s 2017 report, Shifting the Dial, argued that the service sector offers the greatest opportunities for future productivity gains.

The services sector comprises more than 70 per cent of the Australian economy. Productivity enhancement opportunities are huge, particularly in areas such as health, education and aged care. As these sectors are either highly regulated or operated by government, much greater attention needs to be paid to understanding the drivers of productivity in government and the regulated sectors.

Fiscal policy

The throwaway line, “government should just get out of the way”, is unhelpful. Regulation and government ownership are important parts of our mixed economy. It is in the interests of the business community to support multidisciplinary research into effective regulation. Trade is vitally important to Australia. We were once a world leader in trade theory; we should aspire to achieve similar pre-eminence in the field of effective regulation. If we don’t know what “good” looks like, then how can we effectively assess performance?

These issues should be tackled with a sense of urgency. Recessions are a normal part of the business cycle. In all likelihood, there will be global recession sometime in the next five years. With the potency of global monetary policy almost exhausted, we are in uncharted waters. Australia cannot influence the course of global events, but enhancing productivity growth is an important way of increasing resilience.

It is widely accepted that fiscal policy will need to play a much bigger role in dealing with the next recession. Now is the time to start thinking about the preferred shape of future counter-recessionary fiscal programs. Should we provide cash handouts or should we invest more money in infrastructure? Aggressive monetary policy during and after the GFC has driven up asset prices and turbocharged wealth accumulation by the rich. In weighing up alternative fiscal strategies, we need to take into account a broader range of considerations than simply economic efficiency.

British economic historian and emeritus professor of political economy at Warwick University in the UK, Robert Skidelsky, in his latest book, Money and Governance: A Challenge to Mainstream Economics, and Binyamin Appelbaum, author of The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society, both argue that economics needs to return to its political economy roots if it is to address the challenges facing societies.

The youth of today are frustrated by the high cost of housing, inadequate action on climate change and the rising cost of supporting an ageing population. Their priorities in framing a stimulus package will be vastly different to those of ageing baby boomers. The next recession will force us to think more clearly about who owes what to who.

Australia has much to be proud of. We need to rise above the issues that divide us and work towards ensuring our liberal democratic system delivers inclusive growth for our society and, in doing so, helps bend the arc of the moral universe towards justice.

Carol Austin FAICD is a non-executive director of HSBC Bank Australia, State Super and the Grattan Institute, chair of the ACT Investment Advisory Board, and a commissioner with the Independent Planning Commission.

Latest news

Already a member?

Login to view this content