On 2 November 2023, the government issued its long-awaited Sustainable Finance Strategy for consultation. The strategy aims to promote private sector decarbonisation, mobilise investment in climate and sustainability opportunities, and bolster financial system resilience to sustainability risks.

What is being proposed under the Sustainable Finance Strategy?

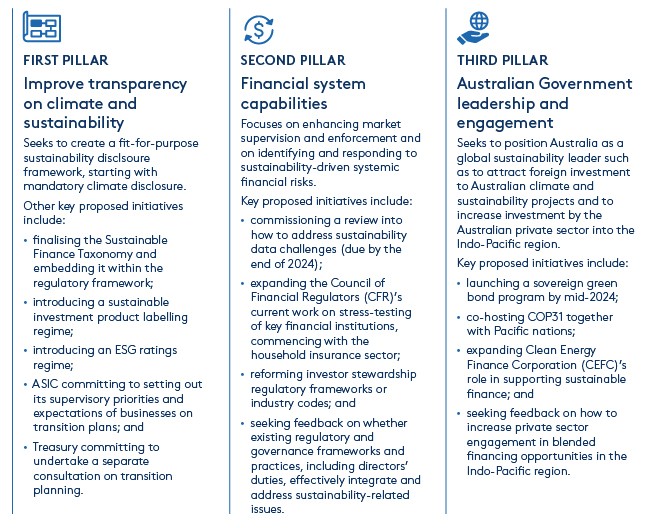

The Sustainable Finance Strategy is structured around three pillars and 12 key priorities and initiatives, and is intended to bring together all the separate components of sustainability and climate policy under a single umbrella. See extracted snapshot below:

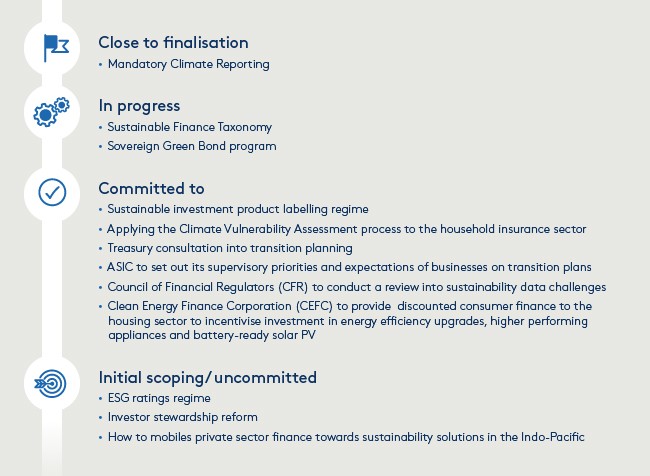

These strategies vary in their progress – some are far progressed and are close to being brought into law, while others are being proposed for the first time. The below provides an overview of where the key proposals sit.

What is the AICD’s position?

The AICD made a submission to the consultation which closed 1 December 2023, with key points including:

a. We support the Strategy’s “climate-first” approach, noting that organisations and boards are grappling with the significant upskilling required to meet mandatory climate reporting. However, we agree that sustainability frameworks should be suitably flexible to allow for reporting on other sustainability issues.

b. The existing regulatory framework, including directors’ duties and laws relating to greenwashing, is adequate to address sustainability issues. The heightened liability exposure faced by Australian organisations and directors is reflected by the fact that Australia has the second highest number of climate litigation cases in the world (second only to the US).

c. The government needs a specific strategy to attract and increase the supply of experts with the capacity to implement the Sustainable Finance Strategy.

d. Data gaps and challenges exist in respect of emissions data and climate impact data. The government has a leading role to play in resolving these issues.

e. To improve business certainty and curb greenwashing, ASIC needs to clearly set out its expectations of corporations and its supervisory and enforcement approach.

Implications for directors

The strategy highlights how various sustainable finance initiatives come together, while underscoring the range of different policies that are set to be rolled out over coming years. Although much of the detail remains subject to further consultation, what is clear is that the policy environment will continue to evolve and create stricter guardrails for organisations to operate within.

Notably, the draft strategy flags that further reporting in emerging sustainability areas such as nature may be mandated over time. It also states that, in Treasury’s view, company directors’ duties to act in the best interests of the company enable, and in many circumstances require, directors to actively integrate sustainability considerations into corporate decision-making and governance

Nature features prominently in the draft strategy with climate change identified as a key driver of nature and biodiversity loss and recognition that capital must be “urgently mobilised towards nature-positive investment” (see AICD/Minter Ellison director resource on nature here).

The most imminent regulatory development is the introduction of mandatory climate reporting, which is proposed to commence for the largest entities from 1 July 2024.

To assist directors prepare, the AICD, in partnership with its Climate Governance Initiative (CGI) Australia partners Deloitte and MinterEllison, has produced A Director’s Guide to Mandatory Climate Reporting (Guide).

The guide outlines the proposed reporting framework, sets out the key legal obligations for directors, and provides practical steps for directors to take in preparation.

We have also produced a concise snapshot of the guide and supporting fact sheets on key topics such as scope 3 emissions and the potential application of US and EU reporting requirements which can be accessed here.

These resources have already been downloaded around 15,000 times, indicating the scale of the reform ahead.

What’s next?

We are expecting Treasury to release its final position on Climate Reporting, and enabling draft legislation shortly. The AICD will review any draft legislation closely and provide a submission. We will also be updating the Guide to reflect this development.

Latest news

Already a member?

Login to view this content